- Category Finance

- Version4.5

- Downloads 0.50M

- Content Rating Everyone

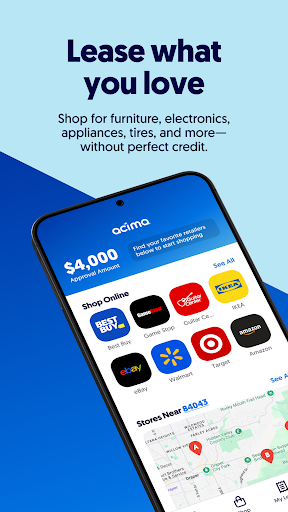

Introducing Acima Leasing: Your Flexible Lease Solution

Acima Leasing is a streamlined leasing platform that empowers consumers and businesses to acquire goods effortlessly through innovative financing options, redefining how we approach purchases and credit.

Who Is Behind Acima and What Makes It Stand Out?

Developed by Acima Credit, Inc., a pioneer in lease-to-own financing solutions, this app integrates cutting-edge technology to simplify leasing procedures. Its core highlights include flexible lease terms tailored to user needs, a seamless digital approval process, and robust security measures protecting users' information. Designed for individuals seeking quick, accessible financing options, Acima appeals to a broad range of consumers—from young adults shopping for electronics to small business owners acquiring equipment.

Catch the Excitement: Why Acima Leasing Is Worth Your Attention

Imagine walking into your favorite electronics store or furniture outlet, knowing that you can take home your desired items today without needing full upfront payment. Acima makes this a reality with just a few taps on your phone. The app's engaging interface invites users into a world of flexible financial solutions, much like a trusted guide accompanying you through a maze of credit options—making the journey easy and reassuring.

Core Feature 1: Flexible Lease Options — Your Customized Financial Pathway

One of Acima's standout features is its flexible leasing plans. Unlike traditional loans or credit cards with rigid terms, Acima offers plans tailored to your pay schedule and budget. Whether you want to lease a smartphone for six months or a piece of furniture for a year, the app dynamically presents options best suited to your financial situation. This adaptive approach turns what might seem like a daunting credit process into an accessible and user-friendly experience, much like choosing your own adventure story with options that fit your unique story.

Core Feature 2: Rapid Digital Approval — No More Waiting in Line

The app's approval process feels like a breath of fresh air. With its intelligent algorithms, users can get instant decisions without submitting piles of paperwork or lengthy waiting times. Imagine the satisfaction of scanning your ID and within seconds seeing approval — it's akin to having a friendly financial assistant sitting in your pocket, ready to help you get what you want instantly. This feature shines particularly when shopping in-store or browsing online, ensuring smooth, frictionless transactions.

Core Feature 3: Top-Tier Security & Transaction Experience — Trust and Ease

Acima places a high premium on security. The app employs advanced encryption and real-time monitoring to safeguard user data and transaction details, much like a digital vault guarding your valuables. Plus, the intuitive UI ensures that even if you're new to leasing apps, navigating through payments, setting up payment methods, or checking lease details feels natural and straightforward. The fluidity of these interactions transforms leasing from a chore into an effortless part of your shopping experience.

How Acima Differs: Security and User-Centric Experiences

Compared to traditional finance apps or credit providers, Acima's focus on lease-specific flexibility and security sets it apart. Its account and fund security protocols ensure your financial data remains private, while its transaction experience emphasizes transparency and control—think of it as having a personal finance concierge who respects your privacy and guides you effortlessly through each step. Unlike some competitors that may hide fees or complicate approval, Acima's approach is straightforward, making it a trustworthy choice for cautious users.

Final Verdict: Should You Give Acima Leasing a Shot?

Overall, Acima Leasing earns a solid recommendation, especially if you value flexibility, quick approvals, and security. Whether you're making a major purchase or need short-term financing solutions, the app's user-friendly interface and tailored options make it worth trying. For those who dislike traditional credit checks or lengthy approval processes, Acima provides a refreshing alternative—like having a helpful friend guiding you into smarter purchasing decisions. Just remember, as with any financial tool, use it responsibly, and keep an eye on your lease commitments to maintain financial health.

Similar to This App

Pros

User-Friendly Interface

The app features an intuitive layout that simplifies the leasing process for new users.

Quick Loan Approvals

Leverages streamlined approval algorithms, often providing instant leasing decisions.

Wide Range of Products

Offers leasing options for various electronics, furniture, and essential household items.

Flexible Payment Plans

Provides customizable installment options tailored to individual financial situations.

Dedicated Customer Support

Accessible support via chat and phone helps resolve issues promptly and enhances user satisfaction.

Cons

Limited Geographic Availability (impact: Medium)

Currently available only in select regions, restricting access for users elsewhere.

Occasional App Crashes (impact: Low)

Some users experience minor crashes or slowdowns, especially during peak usage hours; official updates are expected to address this.

Strict Credit Checks (impact: Medium)

Requires a thorough credit assessment that may disqualify some potential users; savings may be possible by verifying credit beforehand or contacting support for exception options.

Limited Payment Methods (impact: Low)

Supports only a few payment options, which could be inconvenient; future updates may expand payment choices.

Lack of Detailed Leasing Terms (impact: Low)

Some users find the leasing agreement details vague; official documentation improvements are likely to clarify terms in upcoming updates.

Frequently Asked Questions

How do I get started with Acima Leasing?

Download the app from your app store, then sign up with basic details to explore leasing options and connect with retail partners.

Do I need good credit to use Acima Leasing?

No, Acima does not require a credit check; approvals are based on alternative criteria, making leasing accessible for many users.

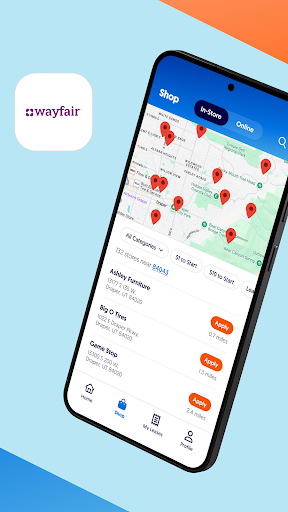

How do I browse available stores and products?

Use the app's store locator feature or visit Acima.com to find retail partners offering products like furniture, electronics, and appliances.

How does the lease-to-own process work?

Select your product, choose a payment plan, and sign your lease agreement within the app to start your lease; you can manage payments easily.

Can I switch stores or locations after starting a lease?

Yes, the app allows you to switch between approved retailers or locations to adapt to your shopping needs.

What's the range of purchase amounts I can lease?

You can lease items ranging from $300 up to $4,000 through the app, providing flexible shopping options.

How do I make payments or manage my lease?

Open the app, go to 'My Leases' or 'Payments,' and follow prompts to view, pay, or modify your lease details easily.

Are there any fees or subscriptions for using Acima Leasing?

There are no subscription fees; some leases may include interest or fees, which are detailed before confirmation during setup.

What should I do if I encounter technical issues?

Contact Acima's customer support through the app's help section for troubleshooting assistance and guidance.

Is there a way to see all my lease agreements in one place?

Yes, you can view and manage all your leases within the app under the 'My Leases' section for easy access.