- Category Finance

- Version4.174.0

- Downloads 0.01B

- Content Rating Everyone

Acorns: Invest For Your Future — A Smart, User-Friendly Micro-Investing App

Acorns is a beginner-friendly investment platform designed to make saving and investing seamless for everyday users, especially those new to finance or looking for automated solutions to grow their wealth over time.

About the App: Simplifying Investing for All

Developed by Acorns Grow Inc., a company rooted in making investment accessible and effortless, Acorns stands out as an intuitive micro-investing app that automatically rounds up your everyday purchases to invest spare change. Its primary appeal lies in turning small, consistent savings into meaningful investments without requiring users to have prior financial expertise.

- Main Features: Automatic round-ups, diversified portfolio options, educational insights, and retirement account integration.

- Target users: Young professionals, new investors, busy individuals seeking passive income growth, and anyone cautious about making large initial investments.

Introduction: Turning Spare Change into Future Wealth

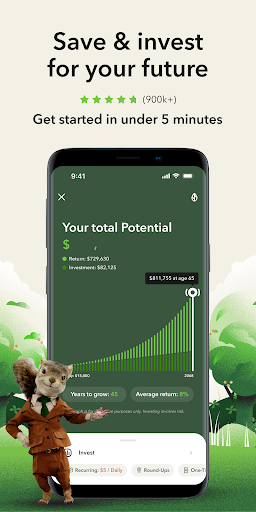

Imagine this: each coffee run, grocery shop, or online purchase magically transforms into a stepping stone toward your financial future. Acorns takes this day-to-day routine and weaves it into a clever investment strategy, turning what might otherwise be small change into a powerful growth engine. It feels like having a financial assistant that quietly works in the background, enabling even the most hesitant savers to start building wealth without feeling overwhelmed by complex processes or intimidating jargon. Whether you're just dipping your toes into investing or looking for a smart way to automate your savings, Acorns presents a compelling service wrapped in a friendly interface.

Core Features: Powering Your Investment Journey

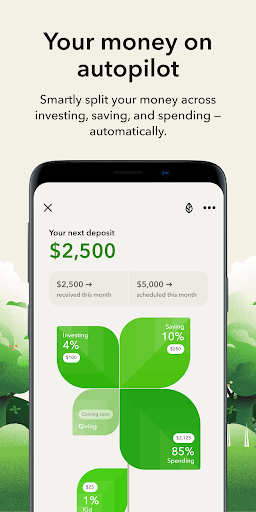

1. Automatic Round-Ups — Turning Small Change into Big Potential

The standout feature of Acorns is its automatic round-up function. Each purchase you make is rounded to the nearest dollar, with the difference automatically transferred into your investment account. For example, buying a coffee for $3.75 triggers a $0.25 deposit, which then gets invested. Over time, these tiny increments accumulate, making the investment journey feel like planting countless seeds—silent, steady, and ultimately fruitful. This feature removes the psychological barrier of saving large sums and instead emphasizes continuous, effortless contribution, similar to watering a small sapling daily to foster a mighty oak later.

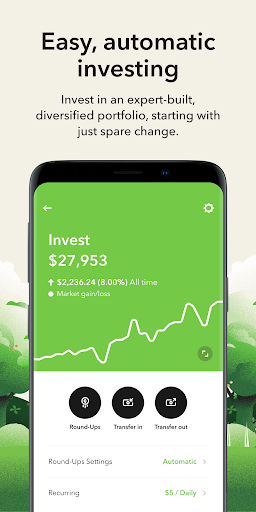

2. Diversified Portfolio Management with Ease

Acorns offers pre-designed, diversified portfolios based on your risk appetite, ranging from conservative to aggressive. These portfolios include a mixture of ETFs across asset classes, intelligently balanced to optimize growth and stability. The platform handles the rebalancing automatically, meaning users don't have to worry about constant adjustments or market fluctuations. This setup is akin to having a professional gardener tending your investment landscape, ensuring each plant grows harmoniously without the need for your constant oversight. It's especially appealing for novice investors who want professional-grade management with minimal effort.

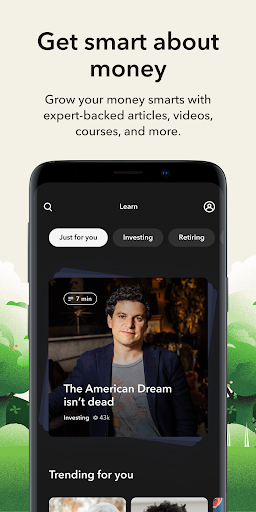

3. Learning Tools & Additional Investment Options

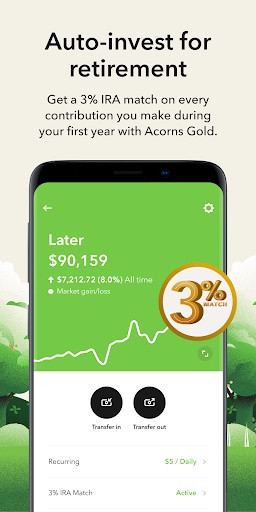

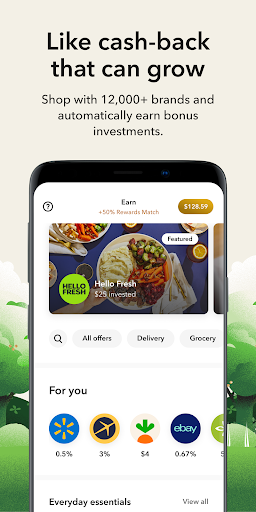

Beyond automation, Acorns delivers bite-sized educational content and insights tailored to your investing profile, helping users understand their financial behaviors and investment principles. The app also provides options for retirement accounts (Acorns Later), checking accounts (Acorns Spend), and even round-up investment “Found Money” offers when shopping with partner brands. These features turn the app into a comprehensive financial toolkit. Think of it as having a friendly finance mentor guiding your journey while offering practical tools to enhance your financial health.

User Experience & Differentiation: Friendly Interface Meets Robust Security

Acorns scores high on usability, thanks to its clean, intuitive interface that feels more like navigating a well-organized digital wallet than a complex banking portal. The onboarding process is straightforward, guiding users through risk assessments and setting up investment preferences in minutes. The app responds smoothly, with effortless transitions between sections, making the investment process feel like a casual conversation rather than a daunting chore.

Security-wise, Acorns employs bank-level encryption, two-factor authentication, and FDIC-insured banking partners for its custodian accounts. This focus on security and privacy is critical, especially when compared with other finance apps that may lack comprehensive safeguards. In particular, Acorns' automated rebalancing and round-up features set it apart, providing a uniquely seamless experience that marries simplicity with security—like having a vigilant guardian watching over your financial seeds.

Final Verdict: A Practical Choice for Building Wealth Passively

For anyone looking to start their investment journey without the complexity and intimidation often associated with finance, Acorns stands out as a friendly, reliable companion. Its most unique strength lies in automating the often-overlooked tiny savings via round-ups, transforming everyday expenditures into long-term wealth. While it's perfectly suitable for beginners and those seeking a low-effort approach, experienced investors can still appreciate its diversified portfolios and educational resources.

Overall, I'd recommend Acorns to those who want a straightforward, secure, and subtly effective way to grow their savings over time. Whether saving for a big goal, retirement, or simply establishing good financial habits, this app offers a practical, non-intrusive path to your financial future. Just set it and forget it—your spare change is quietly working toward a brighter tomorrow.

Similar to This App

Pros

User-Friendly Interface

The app is intuitive and easy to navigate, making investing accessible for beginners.

Round-Up Investing Feature

Automatically invests spare change from everyday purchases, which encourages consistent saving.

Educational Content

Includes helpful resources and tips to improve users' understanding of investing concepts.

Low Minimum Investment

Allows users to start investing with as little as $5, reducing entry barriers.

Automatic Portfolio Rebalancing

Maintains an optimal asset allocation without user intervention, enhancing portfolio management.

Cons

Limited Investment Options (impact: Medium)

Currently, the app primarily offers diversified ETFs, which may limit customization for advanced investors.

Higher Fees for Some Accounts (impact: Medium)

Management fees can be relatively high for smaller account balances, but promotional periods are often available.

Lack of Retirement Planning Features (impact: Low)

The app does not currently integrate comprehensive retirement-specific tools, but future updates are expected.

Occasional App Glitches (impact: Low)

Users have noted occasional lag or crashes, though these are usually resolved with updates.

Limited Custodial Options (impact: Low)

Funds are managed primarily through affiliated brokers, which might restrict certain account types, but official support is expanding.

Frequently Asked Questions

How do I get started with Acorns quickly?

Download the app, create an account, link your bank, and enable Round-Ups or set recurring investments via Settings > Investment Preferences.

What is the minimum amount I need to start investing?

You can start with as little as $5 through recurring investments or Round-Ups, making it easy to begin with small amounts.

How does the Round-Ups feature work?

Shop normally, and Round-Ups automatically rounds your purchases to the nearest dollar, investing the spare change into your portfolio; enable via Settings > Round-Ups.

Can I customize my investment portfolio?

Yes, during setup or later in Settings > Portfolio, you can select ETFs, add individual stocks, or allocate funds to Bitcoin-linked ETFs as per your preference.

How does Acorns help with retirement savings?

Open an Acorns Later account in Settings > Retirement, and choose your plan; start saving with minimal effort and monitor progress in your dashboard.

What features are available with the Gold subscription plan?

Gold offers investment accounts for kids, IRA matches, a debit card for youth, personal stocks, life insurance, and a free Will—set via Settings > Subscription.

Are there any fees for using Acorns?

Yes, plans cost $3, $6, or $12/month depending on your choice. Check your plan details in Settings > Subscription for full transparency.

How do I upgrade or change my subscription plan?

Go to Settings > Subscription, select your current plan, and choose to upgrade or modify your plan according to your financial goals.

What should I do if I experience login issues?

Try resetting your password or reinstalling the app. If issues persist, contact Acorns support via Settings > Help & Support for assistance.

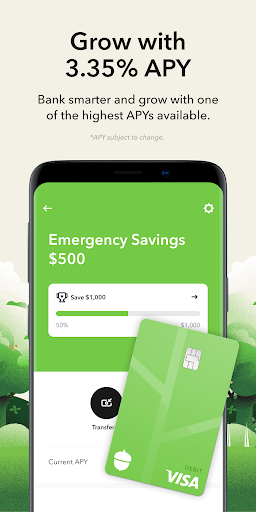

Is my money safe with Acorns?

Yes, your investments are protected by SIPC insurance up to $500, and FDIC-insured checking accounts up to $250, with industry-leading security protocols.