- Category Shopping

- Version3.402.1

- Downloads 0.01B

- Content Rating Everyone

Introducing Affirm: Buy Now, Pay Over Time – A Smarter Way to Shop

Affirm is a financial technology app designed to redefine the way consumers approach online shopping, offering transparent and flexible payment options that make big purchases more manageable.

Who's Behind the App?

Developed by Affirm, Inc., a well-established leader in point-of-sale financing, this app aims to provide consumers with buy now, pay later solutions that are straightforward, transparent, and user-friendly. Backed by a team of financial experts and technologists, Affirm's mission is to promote responsible spending while expanding shopping flexibility.

Key Features That Stand Out

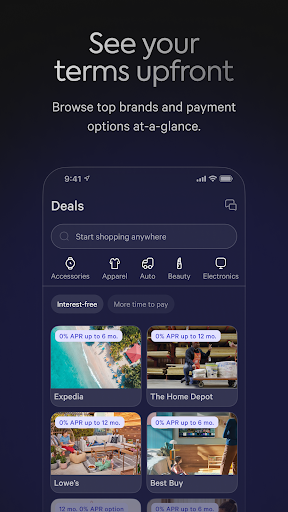

- Transparent Financing Plans: Clear, upfront details about interest rates, repayment schedules, and total costs, eliminating surprises.

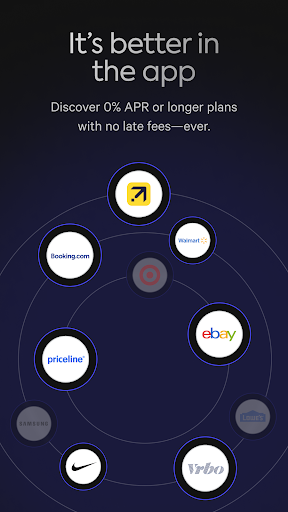

- Seamless Integration with Retailers: Easily connects with popular e-commerce platforms, allowing instant approval and checkout without switching apps.

- Flexible Payment Options: Allows users to customize repayment periods—from several weeks to months—tailored to their financial situation.

- Easy Application Process: Quick credit checks and instant decisions mean less waiting and more shopping.

Vivid Shopping Partnering: The App's Entrance & Ease of Use

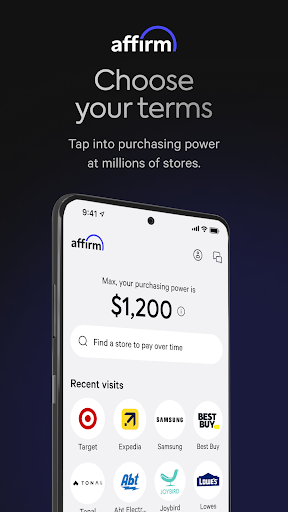

Imagine walking into a bustling marketplace where every stall is neatly labeled, prices are transparent, and the staff guides you effortlessly to what suits your budget. Affirm's app offers a similar experience—friendly, intuitive, and designed to simplify complex financial decisions. Upon launching, users are met with a clean, organized interface that guides them through the process as if chatting with a knowledgeable friend. No overwhelming menus or confusing jargon—just straightforward options and visual cues that make understanding your payment plan as easy as a pleasant walk in the park.

Smooth Operations & User Experience

The app boasts a smooth and responsive operation—swiping through offers, selecting preferred repayment periods, and confirming purchases happen seamlessly. The interface features crisp visuals, familiar icons, and minimal clutter, ensuring even first-time users can navigate without frustration. The learning curve is gentle; most users can grasp all functionalities within minutes, thanks to guided prompts and clear terminology. It's like having a friendly financial advisor sitting by your side—encouraging yet informative, helping you make smarter shopping choices without feeling overwhelmed.

The Highlighted – Most Unique Features of Affirm

While many buy now, pay later services focus solely on quick approvals or limited repayment options, Affirm elevates the experience with nuanced, customer-centric features. Its commitment to transparency—showing exactly how much you'll pay in total upfront—is a game-changer illuminating the true cost of your purchase—no hidden fees or confusing interest calculations. Furthermore, the flexible repayment plans tailor-fit to individual budgets empower users to choose what suits their financial rhythm best.

Stand-Out from the Crowd: What Sets Affirm Apart

Compared to other shopping apps and BNPL solutions, Affirm's approach is akin to choosing a crystal-clear lake over muddy waters—transparent, clean, and trustworthy. Its detailed categorization of diverse product options combined with comprehensive installment plans gives consumers confidence long before they hit checkout. Plus, the pricing transparency isn't just about honesty; it's about empowerment—allowing users to see exactly what they will pay, fostering responsible borrowing and long-term financial health.

Should You Give It a Shot?

Overall, Affirm stands out as a reliable, user-friendly, and transparent buy now, pay later platform. If you often find yourself hesitating at checkout because of uncertain costs or complex installment plans, this app could be a valuable companion—especially for larger purchases where flexibility makes a real difference. It's particularly suitable for shoppers who value clarity and control over their spending without sacrificing convenience.

Final Thoughts

In the world of digital shopping, Affirm acts like a dependable financial buddy who helps you spread costs wisely, maintaining your fiscal peace of mind. Its thoughtful features, emphasis on transparency, and intuitive design make it a notable tool for modern consumers. Whether you're splurging on a new gadget or upgrading your wardrobe, this app offers a smarter, more responsible way to shop—worthy of a friendly recommendation to those seeking more control and clarity in their expenses.

Similar to This App

Pros

Flexible payment options

Allows users to spread payments over time, making large purchases more manageable.

Instant approval process

Quick authorization facilitates a seamless shopping experience.

Wide merchant acceptance

Supported by many retailers, increasing shopping flexibility.

Interest-free periods

Offers promotional periods without interest, saving users money.

User-friendly app interface

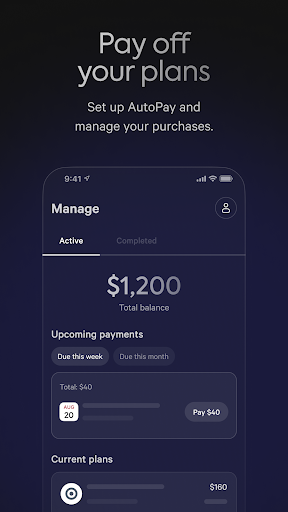

Simple navigation helps users easily manage their payments and account.

Cons

Limited application in some regions (impact: medium)

Availability varies, potentially restricting users in certain areas.

Potential impact on credit score (impact: high)

Late payments may negatively affect user credit ratings, so timely repayment is essential.

Fees for missed payments (impact: medium)

Late or missed payments may incur fees; users should set reminders to avoid extra costs.

Limited options for longer-term financing (impact: low)

Mostly short-term plans; users seeking extended payment plans might need alternatives.

Customer service response times can vary (impact: low)

Support may be slow during peak hours; official updates aim to improve response efficiency.

Frequently Asked Questions

How do I get started with the Affirm app and apply for the Affirm Card?

Download the Affirm app from your app store, create an account, and follow the onboarding process. To request the Affirm Card™, apply within the app under 'Cards' after confirming eligibility.

Is there a credit check when I use Affirm for a purchase?

Many Affirm purchases do not involve a credit impact, but some plans may require a soft credit check. Approval is quick, and you can see your eligibility upfront during checkout.

How can I view my available purchasing power in the app?

Open the Affirm app, go to your dashboard, and your estimated purchasing power is displayed prominently to help plan your spending.

How do I choose a payment plan for my purchase?

During checkout, select Affirm as your payment method, then choose from available plans like 0% APR or installment options, which are shown before confirming.

What is the process to make early or one-time payments?

In the Affirm app, go to your account, find your active payment plans, and select 'Make a Payment' for early or one-time payments with clear details.

How does the Affirm Card™ work for in-store purchases?

Apply for the Affirm Card™ via the app, activate it, and use it anywhere VisaⓇ is accepted. You can request payment plans before or after shopping in the app.

What are the interest rates and fees associated with Affirm plans?

Interest rates vary from 0% to 36% APR depending on the plan and purchase. There are no annual or card fees; always review details during checkout.

Can I get a discount or promotion for using Affirm?

Some retailers offer promos like 0% APR or discounts when paying with Affirm. Check the retailer's site and the Affirm app for current offers before purchasing.

What should I do if I experience technical issues with the app?

Try restarting the app, checking your internet connection, or reinstalling. For persistent problems, contact Affirm customer support via the app's help section.

Are there any hidden fees or charges when using Affirm?

No, Affirm is transparent. However, ensure you understand your selected plan's interest rate and repayment terms before confirming a purchase to avoid surprises.