- Category Finance

- Version10.0.23

- Downloads 5.00M

- Content Rating Everyone

Introducing Albert: Budgeting and Banking — Your Smart Financial Companion

Albert: Budgeting and Banking is a comprehensive financial app designed to streamline personal finance management by combining budgeting tools with banking features, tailored for users seeking both simplicity and security in their financial lives.

Who's Behind It? An Insight into the Creators

Developed by a dedicated team of financial technology innovators, Albert's team focuses on integrating user-centered design with robust financial security measures. Their goal is to empower users to take control of their money without the confusion often associated with traditional banking and budgeting apps.

What Makes Albert Stand Out? Key Features in Focus

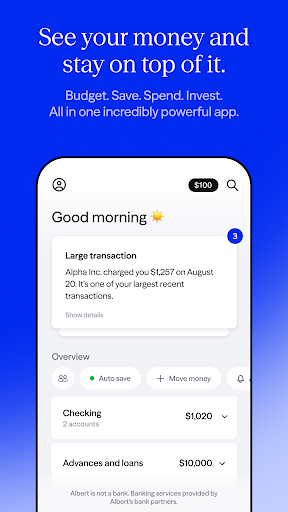

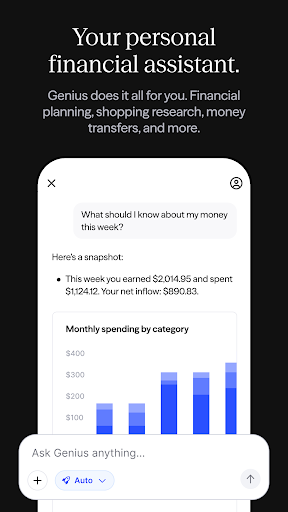

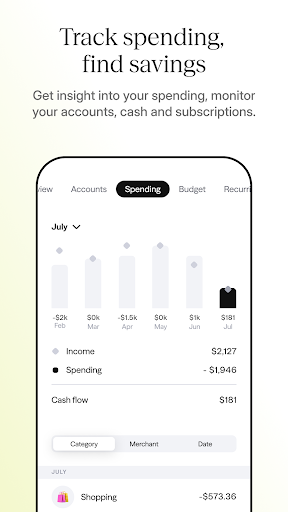

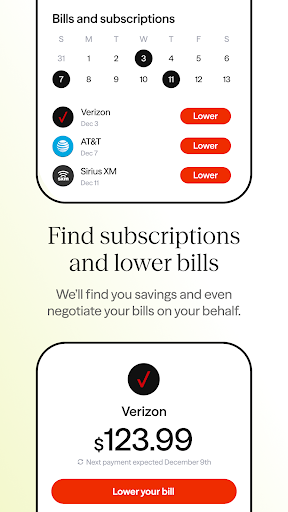

- Automatic Spending Tracking and Budgeting: Leveraging AI-driven algorithms, Albert tracks your expenses seamlessly and suggests personalized budget plans, helping you stay on top of your financial goals with minimal effort.

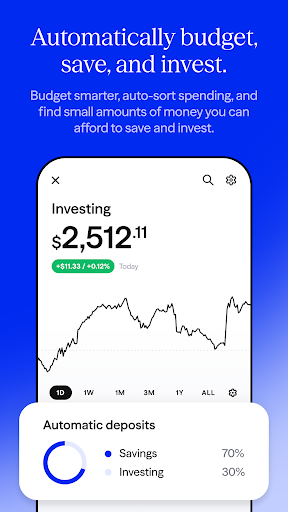

- Integrated Banking and Investment Options: Instead of juggling multiple apps, Albert consolidates your bank accounts, credit cards, and investment accounts—offering a unified view of your financial landscape.

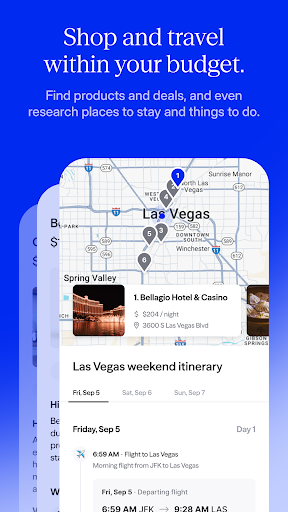

- Exclusive Savings Goals and Smart Savings Tools: The app intelligently identifies opportunities to save, automatically moving funds toward specific goals like emergencies, travel, or major purchases.

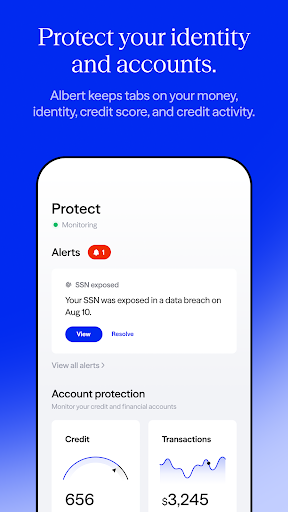

- Real-Time Notifications and Security: Users receive instant alerts for transactions and account activities, ensuring peace of mind while maintaining industry-standard security protocols.

Getting Under the Hood: A Deep Dive into the User Experience

Design and Interface – Navigating with Ease and Style

Imagine walking into a well-lit room where every element seems intuitively placed—this is how Albert's interface feels. The app features a clean, modern design with vibrant yet professional color schemes, making navigation feel like a stroll through a well-organized digital neighborhood. Clear icons and minimal clutter help users find functionalities effortlessly, whether they're checking their balances or setting new savings goals.

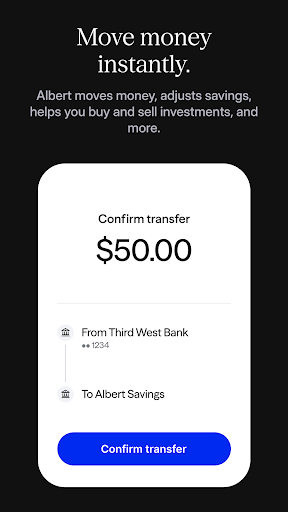

Performance and Smoothness – Transactions as Smooth as a Well-Oiled Machine

From syncing accounts to executing transfers, Albert operates with a fluidity that impresses. Transitions are seamless, and loading times are minimal, which means users spend less time waiting and more time managing their finances. The app's responsiveness creates a feeling of reliability, akin to having a dependable financial assistant right in your pocket.

Learning Curve and Usability – Friendly to Beginners, Valuable for Pros

Whether you're new to budgeting or a seasoned financial pro, Albert's onboarding process gently guides you through setup, with helpful tips and prompts. Its user interface strikes a balance—sophisticated enough to satisfy experts, yet welcoming enough for novices. This approachable design reduces the intimidation often associated with financial apps, making financial mastery attainable for all.

Unique Selling Points: What Sets Albert Apart?

Unlike many competitors, Albert's standout feature is its integration of banking and budgeting within a single platform, paired with intelligent savings capabilities. Its AI-driven insights are crafted to adapt to individual user habits, offering personalized advice rather than generic recommendations. This adaptive intelligence results in a more tailored financial experience, unlike tools that provide only static data or manual tracking.

Another notable aspect is its focus on security—using bank-level encryption and real-time transaction alerts ensures that your financial data remains protected, addressing the growing concern over account security in digital banking apps. This focus on security paired with smooth transaction experiences gives users a confident feel, akin to having a secure vault combined with an easy-to-use cashier.

Recommendations and Final Thoughts

For anyone looking for a friendly yet powerful financial companion, Albert is a reliable choice. Its blend of automation, security, and user-centered design makes managing money less daunting and more engaging. Particularly, its automated savings features and integrated banking make it a notable contender in the crowded personal finance space. We recommend Albert for users who want a cohesive, secure, and intelligent approach to managing their finances without feeling overwhelmed.

Similar to This App

Pros

Intuitive User Interface

The app offers a clean, easy-to-navigate layout that simplifies budgeting for users.

Comprehensive Budget Tracking

It categorizes expenses effectively, helping users monitor spending habits in detail.

Secure Banking Integration

Supports secure connections with multiple bank accounts, ensuring data safety.

Personalized Budget Recommendations

Provides tailored advice based on user spending patterns to improve financial health.

Multi-Platform Support

Available on both smartphones and tablets, allowing flexible access anytime.

Cons

Limited Export Options (impact: medium)

Currently only supports basic CSV exports; more formats like PDF would be helpful.

Occasional Sync Delays (impact: medium)

Bank account synchronization can sometimes take several minutes or require manual refresh.

Lack of Investment Management Features (impact: low)

The app focuses mainly on budgeting and does not support investment tracking or planning.

Limited Customization Options (impact: low)

Custom category icons or flexible budget adjustment options are somewhat basic.

Offline Mode Constraints (impact: low)

Some features may not be fully accessible without an internet connection, which could be inconvenient.

Frequently Asked Questions

How do I get started with Albert and link my bank accounts?

Download the app, create an account, and navigate to Settings > Bank Accounts to securely link your banking accounts for personalized management.

Is Albert free to use or are there any fees involved?

Albert offers a free cash account with basic features; premium services like Albert Genius require a subscription, which can be managed in Settings > Subscriptions.

How can I set up my monthly budget using Albert?

Link your bank accounts, then go to Budget > Create Budget to input your income and expenses, and Albert will help analyze and set your spending plan.

Can Albert help me save automatically?

Yes, enable the Automatic Savings feature in Settings > Savings, and Albert will intelligently transfer small amounts to your savings account.

What investing options does Albert provide and how do I start investing?

Go to the Invest tab, choose stocks, ETFs, or portfolios, and follow the prompts to open an investment account and start building your portfolio.

How do I access my rewards or cashback benefits with Albert?

Use your linked debit card for eligible purchases, and cashback will be automatically credited; check rewards details in the Rewards section via Settings.

What should I do if I encounter technical issues or errors?

Try restarting the app, check your internet connection, and contact Albert Support through Settings > Help & Support for further assistance.

How can I cancel or change my Albert Genius subscription?

Go to Settings > Subscriptions, select Albert Genius, and choose to cancel or modify your plan; changes take effect at your next billing cycle.

Are my funds and personal information safe when using Albert?

Yes, Albert uses bank-backed FDIC-insured accounts, secure encryption, and real-time fraud alerts to protect your data and funds.

Can I link multiple bank accounts to Albert?

Yes, you can link multiple bank accounts via Settings > Bank Accounts for a comprehensive view of your finances and easier management.