- Category Finance

- Version25.24.0

- Downloads 1.00M

- Content Rating Everyone

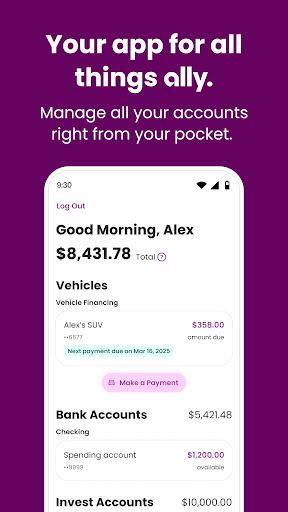

Introducing Ally: Bank, Auto & Invest — Your All-in-One Financial Companion

Ally: Bank, Auto & Invest is a comprehensive digital financial app designed to streamline banking, auto, and investment needs within a single user-friendly platform, making managing your finances more intuitive and efficient.

Powered by Innovation: Who's Behind Ally?

This application is developed by Ally Financial Inc., a well-established leader in digital banking and financial services. With a reputation for customer-centric solutions and innovative technology, Ally's team focuses on creating seamless financial experiences that cater to a diverse range of users, from tech-savvy millennials to seasoned investors.

Highlighting the Key Features: What Sets Ally Apart?

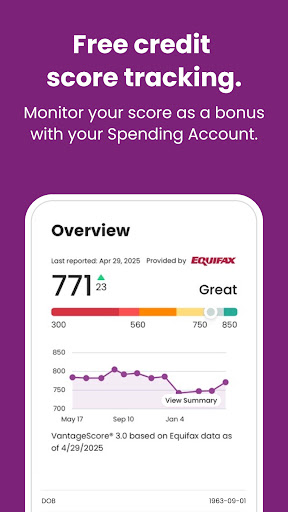

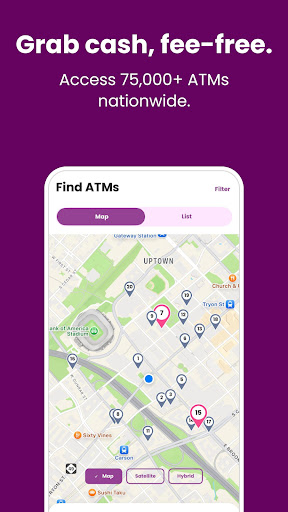

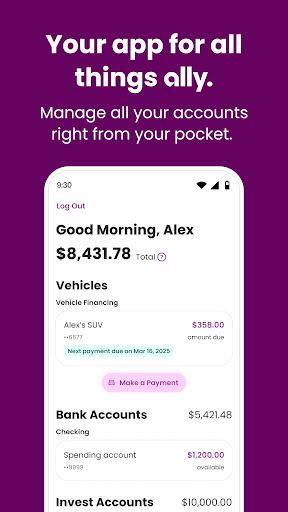

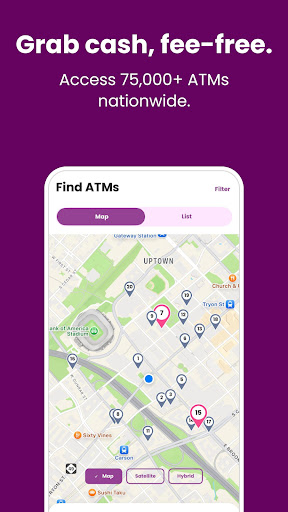

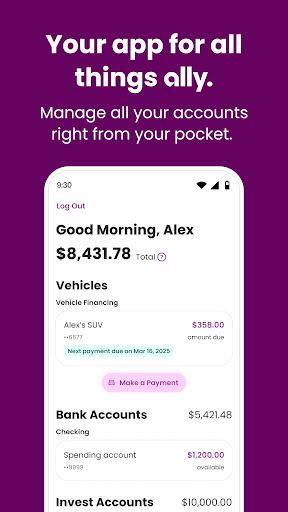

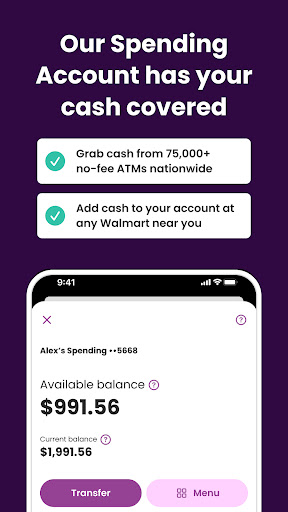

- Unified Dashboard for Banking, Auto, and Investments: Users can access all financial services in one place, providing a clear overview of their accounts, auto financing options, and investment portfolios.

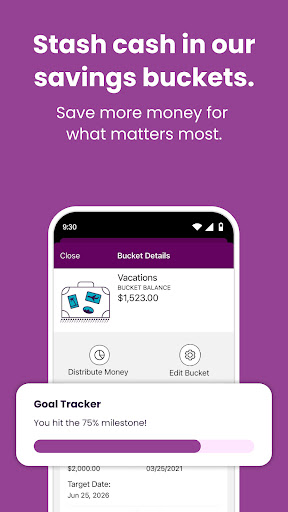

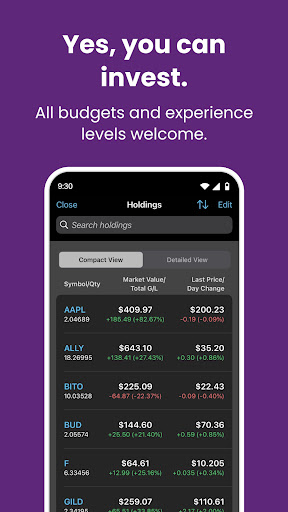

- Automated Investment Strategies: The app offers robo-advisory features that tailor investment plans based on user goals and risk appetite, making wealth-building accessible without needing a financial advisor.

- Robust Security Measures: Ally employs bank-grade security protocols, including multi-factor authentication and end-to-end encryption, ensuring transaction safety and account confidentiality.

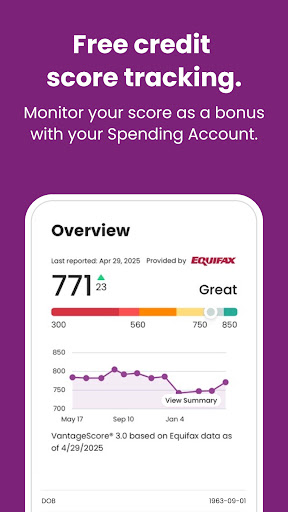

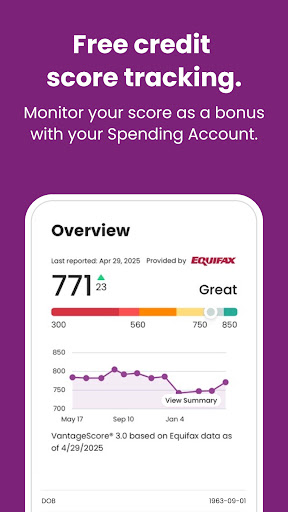

- Intuitive User Interface with Smart Insights: Designed with cleanliness and ease-of-use in mind, the app provides actionable insights and personalized suggestions, enhancing user engagement and financial literacy.

A Deep Dive into Ally's Core Functionalities

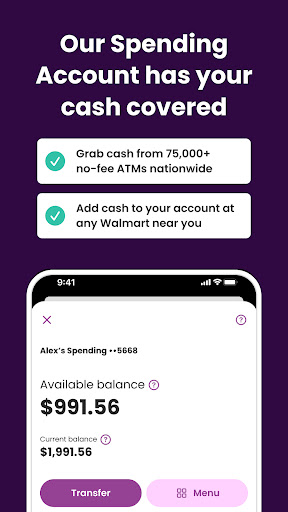

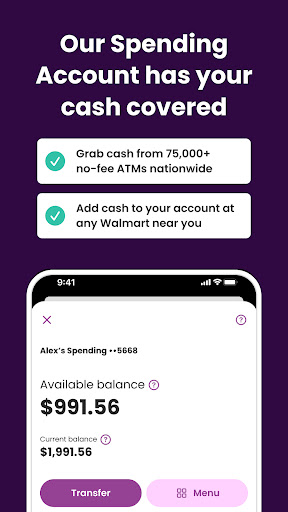

Seamless Banking Experience at Your Fingertips

Once inside, you'll be greeted by a sleek, uncluttered dashboard that feels like a well-organized drawer — everything you need is just a tap away. Transferring money, paying bills, or viewing transaction histories is remarkably straightforward, thanks to a smooth, fluid interface reminiscent of gliding on a well-paved road. The app's responsiveness is impressive, with minimal lag, making routine banking feel almost effortless even during busy moments.

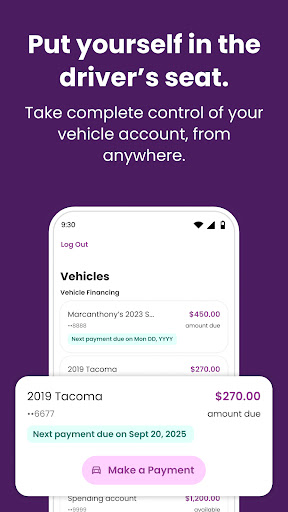

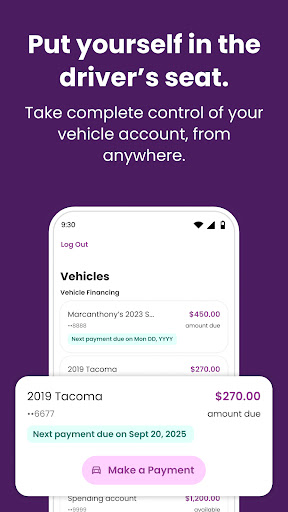

Your Auto and Investment Management Made Simple

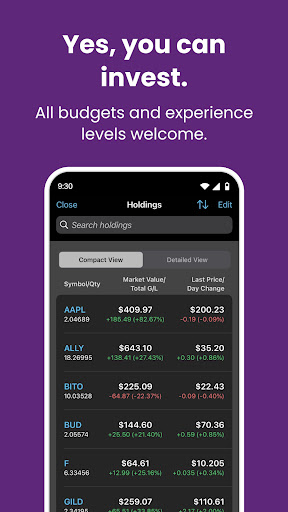

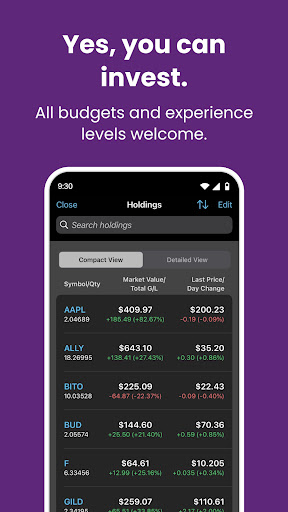

Ally truly shines in managing auto-related finances and investments. If you're shopping for a car loan, the app offers instant pre-qualification and comparison tools, turning what used to be a tedious process into a quick, stress-free experience — imagine having a friendly car broker in your pocket. Meanwhile, the robo-advisor guides you through building an investment portfolio tailored to your aspirations. The AI-driven recommendations are transparent and easy to understand, demystifying investment strategies often shrouded in jargon. Watching your assets grow through this combined auto and investment interface feels like having a smart, attentive financial coach by your side.

Unique Selling Points and User Experience

Compared to traditional finance apps, Ally's standout feature is its integrated platform that consolidates banking, auto financing, and investing under one roof — a true all-in-one powerhouse. Its security architecture rivals that of top-tier banks, ensuring your transaction experience is both safe and smooth. The app's design prioritizes clarity and ease, turning complex tasks into simple actions, much like having a savvy friend guide you through your finances.

Furthermore, where many competitors focus solely on one aspect of finance, Ally's holistic approach—especially in auto loans integrated with investment tools—offers a unique advantage, making it compelling for users looking for a comprehensive financial management solution.

Final Verdict: A Recommended Choice for Holistic Financial Management

If you're seeking an app that combines ease of use, security, and comprehensive features, Ally: Bank, Auto & Invest is definitely worth trying. It suits users who prefer a central hub for all their financial needs, especially if you appreciate automation and clear insights. While seasoned investors might want more advanced tools, for everyday banking, auto loans, and beginner-friendly investing, this app hits the sweet spot.

In summary, Ally provides a balanced, reliable, and user-friendly experience that stands out in the crowded field of finance apps—consider it your digital financial assistant that truly understands your entire money journey.

Similar to This App

Pros

Unified Financial Management

Ally consolidates banking, auto, and investment services into a single platform for ease of use.

Intuitive User Interface

The app offers a clean and user-friendly design, making navigation straightforward for users.

Competitive Auto & Personal Loans

Provides flexible auto loan options with competitive interest rates and quick approvals.

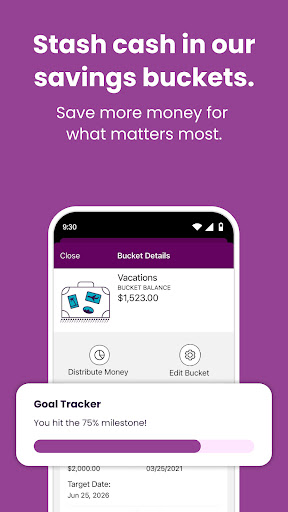

Robust Investment Tools

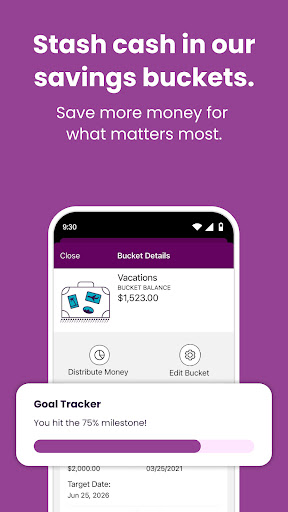

Features including robo-advisors and goal tracking help users optimize their investments.

Strong Security Measures

Employs advanced encryption and fraud detection to protect user data and accounts.

Cons

Limited International Support (impact: medium)

Currently, the app primarily supports users within the US, which may limit international users.

Occasional App Freezes (impact: medium)

Some users report app crashes during high traffic times; official updates aim to improve stability.

Limited Investment Options (impact: low)

Compared to dedicated investment platforms, Ally's investment features are somewhat basic.

Customer Service Response Time (impact: low)

Customer support can sometimes be slow; Ally plans to enhance live chat support later this year.

Basic Budgeting Tools (impact: low)

Budgeting features are relatively simple and may lack advanced expense tracking; expect possible feature upgrades.

Frequently Asked Questions

How do I create a new account on the Ally app?

Download the app, open it, and tap 'Sign Up.' Follow the prompts to enter your details and set up your login credentials.

Can I link my existing bank accounts to Ally app?

Yes, go to 'Settings' > 'Accounts' > 'Link Account' and follow the instructions to securely connect your bank accounts.

What are the main features of the Ally app?

The app offers banking, auto loans management, and investing tools, all accessible via an easy-to-use interface for comprehensive financial control.

How do I deposit checks using the Ally mobile app?

Navigate to 'Deposit Checks,' select your account, and snap a photo of the check following the on-screen instructions.

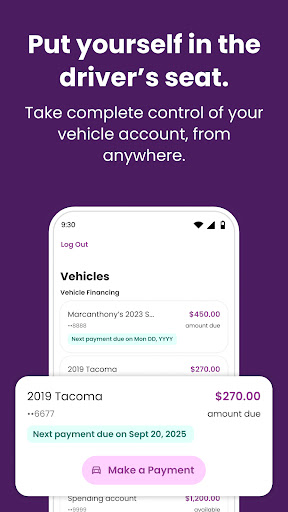

How can I set up auto payments for my auto loan?

Go to 'Auto & Loans,' select your loan, then set up payments under 'Make a Payment' or 'Auto Pay' for recurring payments.

How do I buy or sell stocks and ETFs on Ally?

Access the 'Invest' section, choose your securities, and follow the prompts to place buy or sell orders, commission-free on eligible securities.

Are there any fees for using the Ally app's investment services?

Some portfolios may have advisory fees; check each option under 'Investing' > 'Personal Advice' to understand specific costs.

Is there a subscription fee for premium features in the Ally app?

Most basic features are free. Premium investment advice services may incur fees, which you can review in 'Settings' > 'Subscriptions.'

How do I troubleshoot login issues on the Ally app?

Try resetting your password via 'Sign In' > 'Forgot Password' or contact customer support via 'Help' for assistance.