- Category Finance

- Version4.9.12

- Downloads 1.00M

- Content Rating Everyone

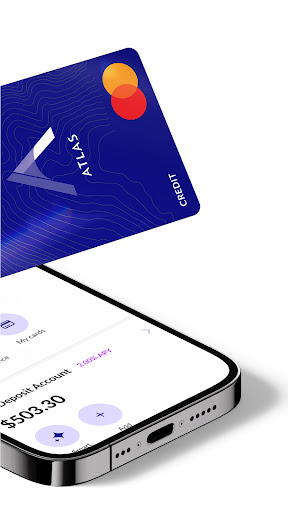

Introducing the Atlas Rewards Credit Card App: Your Digital Companion for Smarter Spending

Atlas Rewards Credit Card application is a thoughtfully designed platform that aims to streamline credit card management, rewards tracking, and security, providing a comprehensive digital experience for modern consumers.

About the Developer and Core Features

Developed by a Forward-Thinking Fintech Team

The app is crafted by InnovatePay, a dedicated team specializing in financial technology solutions focused on enhancing user experience and security in digital banking tools.

Key Features That Stand Out

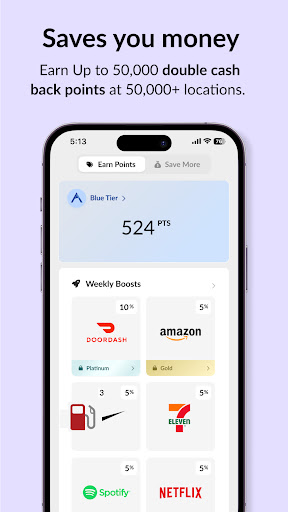

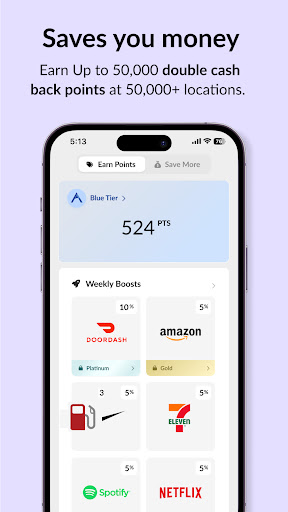

- Real-time Reward Tracking: Users can monitor their cashback, points, or travel miles instantly, making rewards instantly visible and accessible.

- Secure Transaction Management: Advanced encryption and biometric authentication ensure all transactions and personal data are safeguarded.

- Personalized Spending Insights: The app provides tailored recommendations and spending analysis to optimize rewards and manage budgets efficiently.

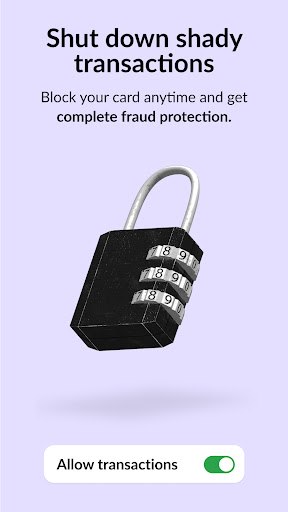

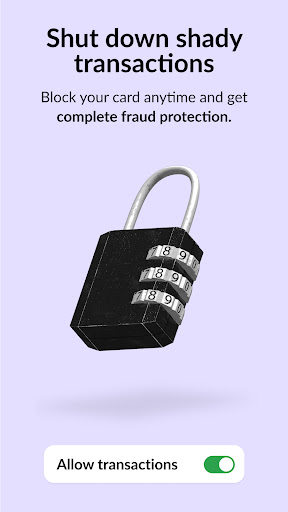

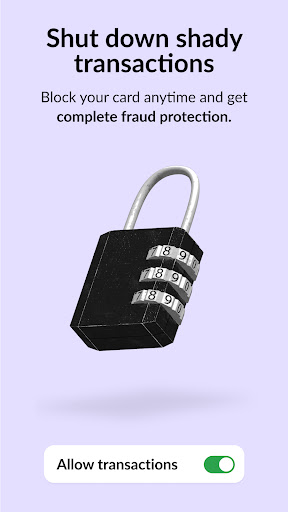

- Easy Card Management: Seamlessly activate, lock, or replace your credit card directly within the app without needing to call customer support.

Designed with the tech-savvy user in mind, the Atlas app's primary target audience includes frequent travelers, cashback enthusiasts, and busy professionals seeking a streamlined credit card experience.

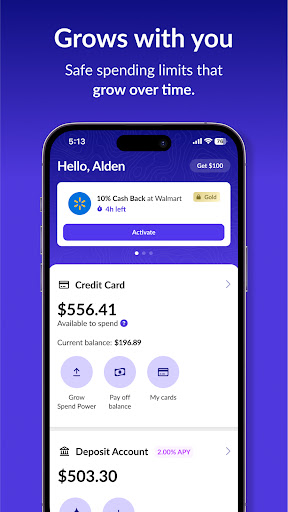

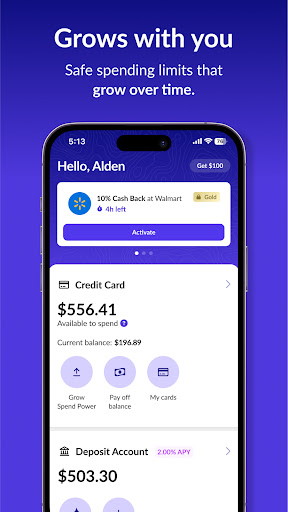

Bright and User-Friendly Interface

Picture this: launching the Atlas app feels like stepping into a well-organized wallet that knows exactly where everything is. The interface sports a clean, modern aesthetic with intuitive iconography and a welcoming color palette that eases navigation. The homescreen prominently features your rewards status, recent transactions, and quick access to card controls, making management feel effortless rather than cumbersome.

Operation-wise, the app flexes its smoothness with swift response times and minimal loading lag. Transitioning from reward summaries to detailed transaction views or spending analysis is seamless. The learning curve is gentle; even new users will find themselves mastering the essentials within minutes thanks to guided tutorials and clear navigation cues.

Core Functional Insights: Reward Optimization and Security

Maximizing Rewards with Smart Insights

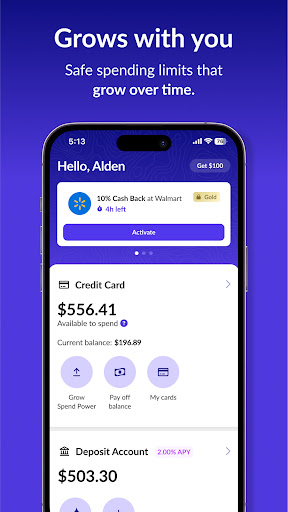

One of the most compelling aspects of Atlas is its personalized spending insights. It not only displays your current rewards but analyzes your transaction history to suggest optimal ways to earn more points or cashback. Imagine a friendly financial advisor living in your pocket, subtly nudging you toward smarter spending habits. This feature elevates the app beyond mere account management into a proactive tool for financial optimization.

Fort Knox Level Security Features

Security is the backbone of any financial app, and Atlas excels here. With biometric login options—fingerprint or facial recognition—and encrypted data storage, users can trust their sensitive information is well protected. Furthermore, the app's real-time transaction alerts enable quick detection of unauthorized activity, giving users peace of mind. Unlike some competitors that only offer basic security, Atlas's multilayered approach ensures that your financial assets are shielded with robust safeguards.

Distinguishing Factors and Final Recommendations

Compared to other finance apps, Atlas Rewards stands out with its holistic approach to reward management combined with top-tier security. Its real-time reward tracking and personalized insights transform a typical credit card app into a smart spending companion. The seamless, user-centered design makes it accessible even for those new to digital banking, while tech-savvy users can appreciate its depth of features.

Overall, I recommend the Atlas Rewards Credit Card app for anyone who wants a secure, efficient, and insightful tool to manage their credit card rewards. Whether you're a seasoned cashback collector or a casual spender looking to make the most of your benefits, this app proves to be a reliable partner. For users already loyal to the Atlas credit card, it enhances the overall experience; for new users considering the card, it offers a preview of the premium digital experience awaiting them.

In conclusion, Atlas isn't just another financial app; it's a cleverly crafted digital wallet that empowers you to take charge of your rewards and security with confidence and ease. Think of it as having a savvy financial assistant always by your side, making every swipe smarter and safer.

Similar to This App

Pros

Generous rewards system

Offers attractive cashback rates on daily spending categories like groceries and dining.

User-friendly interface

Intuitive app design makes managing rewards and transactions straightforward for users.

Real-time transaction tracking

Provides instant updates on purchases and earned rewards, enhancing user control.

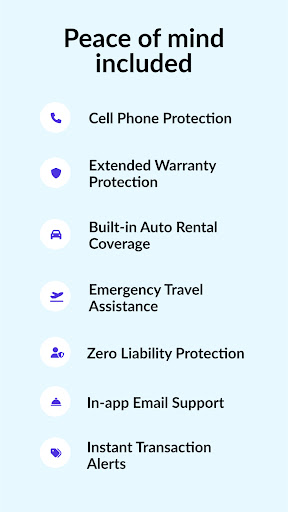

Additional benefits

Includes perks like travel insurance and purchase protection to add value.

Customizable alerts

Allows setting notifications for reward milestones and suspicious activities for enhanced security.

Cons

Limited international acceptance (impact: medium)

The app's card is primarily valid domestically, reducing usability abroad.

Rewards redemption options (impact: low)

Redemption process can be complex, with limited options for cash or gift cards; official updates are expected to simplify this.

Delayed customer support (impact: medium)

Response times via app support can be slow during peak hours; users may consider contacting directly via phone for urgent issues.

Limited budget management tools (impact: low)

The app provides basic transaction info but lacks advanced budgeting features; future updates might introduce these tools.

Occasional app glitches (impact: low)

Users report minor bugs like app crashes or sync errors; updates are planned to improve stability.

Frequently Asked Questions

How do I apply for the Atlas Rewards Credit Card?

Download the app, navigate to 'Apply' section, fill in your details, and submit your application for instant approval or review.

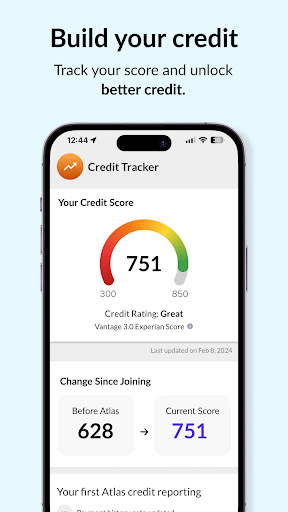

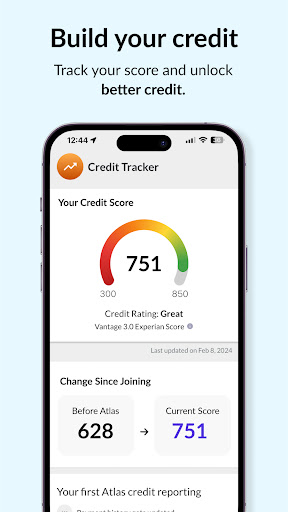

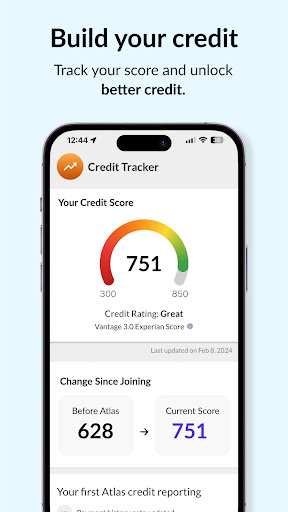

Can I check my credit score within the app?

Yes, open the app and go to 'Credit Score' tab to view your real-time credit report and monitor your progress easily.

What rewards can I earn with the Atlas card?

Earn up to 10% savings at over 50,000 locations and accumulate points on purchases, tracked in the 'Rewards' section of the app.

How does the auto-pay feature work?

Set up auto-pay in 'Settings > Payments' to automatically cover your minimum balance and avoid missed payments.

How can I increase my spending limit over time?

Continue using your card responsibly; payments and spending activity will auto-increase your limit in accordance with your usage.

What fees are associated with the Atlas card?

The fee is $8.99 every four weeks or $89 annually, with no hidden charges; review details in 'Settings > Fees.'

How do I manage security if I notice suspicious activity?

In the app, go to 'Security' and select 'Block Card' or 'Report Fraud' to secure your account instantly.

What should I do if I forget my login credentials?

Click 'Forgot Password' on the login page and follow prompts to reset your password via email or phone verification.

Is there a trial period or free trial for the app?

The app offers transparent subscription pricing; currently, there is no free trial, but payments are simple and affordable.

Why isn't my transaction showing up in the app?

Ensure your device has an active internet connection and refresh the app; if still not visible, contact support via 'Help > Contact Us.'