- Category Finance

- Version3.32.1

- Downloads 0.50M

- Content Rating Everyone

Introducing B9: Cash Advance・Banking・Earn—Your All-in-One Finance Companion

B9: Cash Advance・Banking・Earn is a versatile financial app designed to streamline cash flow management, provide quick advances, and help users grow their savings through simple earning opportunities.

Developers and Core Highlights

The app is developed by FinTech Innovators Inc., a company committed to creating accessible, user-friendly financial solutions. Its key features include instant cash advances with transparent approval processes, integrated banking capabilities such as bill payments and fund transfers, and earning opportunities through micro-investments and reward programs. The platform aims to serve busy professionals and everyday users seeking seamless financial control without excessive complexity.

Why B9 Stands Out: A Quick Overview

Imagine managing your finances as effortlessly as orchestrating your day—no more juggling different apps or navigating confusing interfaces. B9 offers a streamlined experience, making daily financial activities feel less like chores and more like a natural part of your routine. Its main strengths lie in its innovative approach to cash advances, holistic banking functions, and unique earning features tailored for convenience and security.

In-Depth Look at Core Features

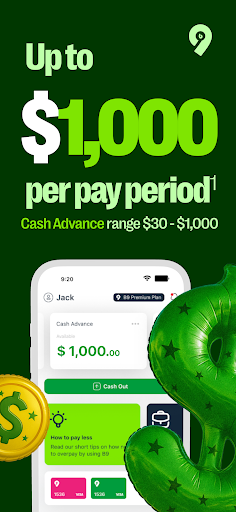

Fast, Transparent Cash Advances

One of B9's most compelling features is its cash advance service. Unlike traditional payday or short-term loan apps that often obscure costs or require complicated paperwork, B9 allows users to request small advances instantly and transparently. The approval process leverages secure algorithms that assess your credit risk quickly, making funds available within moments—imagine having a financial safety net that's always just a tap away. The app clearly displays all fees upfront, eliminating surprises at repayment time, which builds trust and peace of mind.

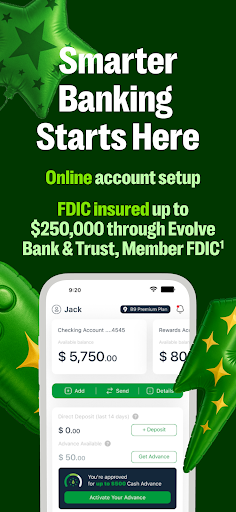

Unified Banking and Payment Hub

B9 integrates seamlessly with your existing bank accounts, letting you perform essential banking activities such as paying bills, transferring funds, and checking balances without switching apps. Its intuitive dashboard presents your financial snapshot at a glance, like a well-organized wallet that displays your cash, cards, and upcoming bills. Transactions are executed with smooth animations and rapid response times, which contribute significantly to an enjoyable user experience. The app's design minimizes learning curves; even first-time users can navigate confidently after a few minutes of exploration.

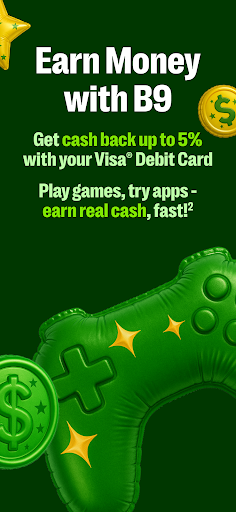

Earn and Grow with Micro-Investments

What makes B9 particularly appealing is its earning module, which invites users to grow their money through micro-investments, cashback rewards, and referral bonuses. It's akin to planting a tiny seed that sprouts into financial gains over time—simple, manageable, and rewarding. The platform employs top-tier security protocols to protect your funds and personal information, the most critical aspect amid digital finances. Its intelligent tracking of rewards and investment growth allows users to see their money working for them, even during their downtime.

Design, Usability, and Unique Selling Points

B9 boasts a modern, clean interface with vibrant visuals that make financial management less intimidating. Navigation feels intuitive, with clearly labeled sections and minimal clutter, akin to browsing a well-organized closet rather than rummaging through cluttered drawers. The app offers swift responsiveness, ensuring operations such as fund transfers or advances feel instantaneous, which is vital in urgent situations.

Compared to similar financial apps, B9's standout feature is its holistic approach—combining cash advance, banking, and earning into one platform—and its rigorous security standards for account and fund safeguarding. While many apps focus solely on one aspect, B9's integrated ecosystem reduces the need for multiple apps, streamlining your financial life. Its emphasis on transaction experience—quick, secure, and transparent—further differentiates it in a crowded market.

Final Recommendation and Usage Suggestions

Overall, I would recommend B9 to users who value simplicity and security in managing their finances. Whether you need a small cash boost before your paycheck arrives, want a straightforward way to handle daily transactions, or are looking to subtly grow your savings, this app aligns well with those needs. Its user-friendly interface and robust features make it suitable for beginners and experienced users alike.

For best results, I suggest exploring its earning features gradually and being mindful of repayment terms for cash advances. Keep your app updated to benefit from the latest security enhancements. If you prioritize a unified platform that keeps your financial life interconnected and under control, B9 is worth trying out as your daily financial companion.

Similar to This App

Pros

User-friendly interface

The app offers an intuitive layout that makes navigation easy for new users.

Fast approval process

Cash advances are typically approved within minutes, providing quick financial relief.

Earn rewards easily

Users can accumulate cash back or rewards through simple banking and spending activities.

Secure technology

Uses advanced encryption to protect user data and banking information.

Wide network of partner banks

Allows users to access a variety of banking services seamlessly.

Cons

Limited loan amounts (impact: medium)

Cash advance limits might be too low for some users' needs, but they can increase limits after regular use.

Occasional app crashes during peak hours (impact: medium)

Some users report slowdowns or crashes when accessing certain features; official updates aim to resolve this.

Customer service response can be slow (impact: low)

Support may take longer during busy times; users are advised to use in-app chat for quicker assistance.

Rewards program details are sometimes unclear (impact: low)

The exact earning mechanics are clarified in updates, and users should review terms regularly.

Notification alerts may be delayed or skipped (impact: low)

Push notifications to inform about transactions or updates might not always arrive timely, but this is expected to improve in future releases.

Frequently Asked Questions

How do I get started with opening an account on B9?

Download the app, sign up, link your direct deposit, and receive your first $50 cash advance after depositing $300+.

What types of income qualify for cash advances?

Wage income, gig work, SSI, or similar direct deposits qualifying your account for cash advances.

How can I access my paycheck early using B9?

Link your qualifying direct deposit; funds become available once your deposit is confirmed, typically up to 2 days early.

What is the maximum cash advance I can get per pay period?

Up to $750 per pay period with the Premium plan; $100 with the Basic plan, depending on your plan choice.

How do I earn cashback with B9?

Use your B9 Visa® Debit Card for daily purchases to earn up to 5% cashback, view rewards in the app under 'Rewards.'

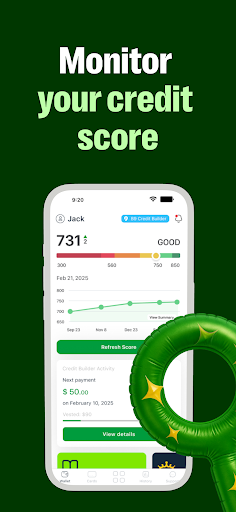

Can I build my credit score using B9?

Yes, with B9 Premium, you can access credit monitoring, score tracking, and a credit simulator in the app's 'Credit Tools' section.

What are the subscription fees for B9 plans and how to subscribe?

Basic is $11.99/month, Premium is $19.99/month. Subscribe via Settings > Plans; first 30 days are free with direct deposit requirements.

How do I cancel or change my B9 subscription?

Go to Settings > Subscription; select your plan and follow prompts to cancel or change plans anytime.

What should I do if I encounter issues with transfers or transactions?

Check your internet connection and app updates. For persistent problems, contact B9 support via Help > Contact Us in the app.

Is there any interest or hidden fees with B9 cash advances?

No, B9 offers interest-free cash advances with transparent terms; always review your repayment schedule in the app.