- Category Finance

- Version8.5.9

- Downloads 1.00M

- Content Rating Everyone

Introduction: A New Level of Financial Management

Imagine managing your finances with the ease of a seasoned banker, seamlessly navigating through your accounts and investments—all from the palm of your hand. Barclays US's mobile application promises just that by offering a comprehensive, secure, and user-friendly banking experience tailored for today's fast-paced digital world.

Basic Information: The Core of the App

Developed by Barclays Bank PLC's US-based digital innovation team, this app aims to bridge the traditional banking experience with cutting-edge technology. It stands out as a versatile financial tool built for everyday banking, investment tracking, and secure transaction management.

Main Features Include:

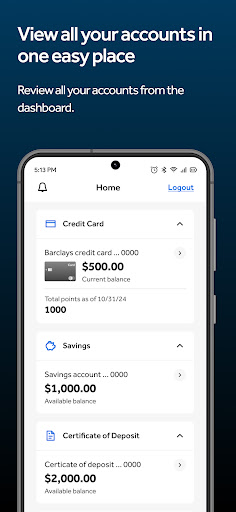

- Real-Time Account Monitoring and Fund Transfers — Stay updated and move money instantly, anytime and anywhere.

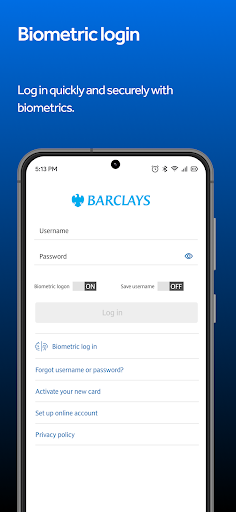

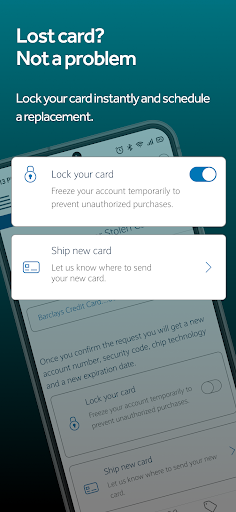

- Enhanced Security Protocols — Multiple layers of authentication, biometric login, and real-time fraud alerts ensure your money's safety.

- Personalized Financial Insights — Custom reports, budgeting tools, and tailored recommendations help users optimize their finances.

- Investments and Wealth Management — Access to investment portfolios, performance tracking, and market insights within the app.

Target User Group: This app caters primarily to tech-savvy individual investors, small business owners, and professionals seeking a consolidated digital banking solution that combines banking functionalities with investment and security features.

Vivid Appraisal: Navigating the Digital Bank Vault

Stepping into the Barclays US app feels akin to entering a sleek, modern bank branch — digital yet intuitively familiar. From the moment you log in, the interface's clarity and responsiveness make you feel like you've been handed a premium financial toolkit designed with both experts and everyday users in mind. Let's unpack its core strengths, starting with its key functionalities.

Streamlined Transactions and Account Management

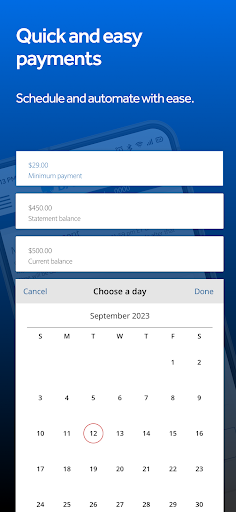

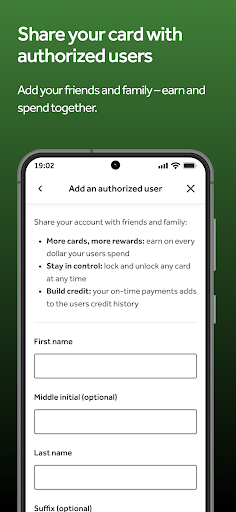

The app's transaction experience is smooth, almost like sliding a well-oiled door open — swift and satisfying. Transferring funds to friends, paying bills, or even setting up recurring payments is effortless. The app supports multiple account types (checking, savings, loans) with consolidated views, helping users grasp their financial standing at a glance. The real-time nature of updates ensures no surprises—just like having a financial dashboard at your fingertips. Its operation flow is intuitive, requiring minimal learning curve even for first-time users, thanks to clear icons and guided prompts.

Top-Tier Security with a Personal Touch

One of the standout features is how Barclays US elevates security beyond standard protocols. It employs biometric logins—facial recognition and fingerprint authentication—that feel as natural as unlocking your smartphone. The app's security doesn't just stop at login; it offers real-time fraud alerts, enabling immediate action if suspicious activity is detected. Compared to other financial apps, Barclays US shines by integrating these protective measures seamlessly into the user experience, making account security feel like a reassuring conversation rather than an obstacle.

Investment and Wealth Management: Money Goes Beyond Banking

This app transforms banking into a more dynamic process. Its investment tools allow users to view and manage portfolios directly within the platform. Visualized graphs, market insights, and tailored recommendations turn complex data into digestible information—much like having a dedicated financial advisor in your pocket. The inclusion of educational resources makes it especially appealing for users looking to grow their financial literacy alongside their assets. Unlike many competitors that treat investments as a separate service, Barclays US integrates them into the daily banking environment, offering a holistic view of your financial health.

User Experience and Differentiating Factors

The interface design strikes a perfect balance—it's modern without being overwhelming. The visual hierarchy guides users effortlessly from account summaries to transactions or investment insights, which enhances usability. Performance-wise, the app reacts instantly, with minimal loading times, providing a fluid experience akin to flipping through a well-designed magazine.

Compared to other finance apps, Barclays US distinguishes itself notably through its focus on security and transaction convenience. The biometric authentication and real-time fraud detection are like having a vigilant financial bodyguard always on duty. Conversely, many similar apps rely solely on password protections or less integrated security measures. Furthermore, the app's investment features are robust yet user-friendly, making wealth growth accessible for users who may not be professional traders but wish to stay engaged.

Final Recommendations and Usage Tips

All in all, Barclays US's mobile app is a solid choice for users seeking a secure, intuitive, and comprehensive financial platform. I would recommend it especially to those already banking with Barclays or those looking for an integrated suite of financial tools in a single app. For best results, spend some time exploring its investment features and security settings—these are the two areas where the app truly shines and can add significant value to your financial journey.

If you value a trustworthy, smooth, and multi-functional digital banking experience, this app merits a strong recommendation. Its most distinctive advantage—the seamless integration of security, transactions, and investments—makes it stand out as a serious contender in the digital finance landscape. For users ready to embrace a modern, secure, and user-centric financial app, Barclays US delivers a thoughtfully crafted solution that balances sophistication with ease of use.

Similar to This App

Pros

User-Friendly Interface

The app has an intuitive design that makes navigation simple for users of all experience levels.

Real-Time Account Monitoring

Provides instant access to balances, transactions, and alerts, enhancing financial oversight.

Smooth Fund Transfers

Enables quick and secure transfers between accounts with minimal steps involved.

Robust Security Features

Includes multi-factor authentication and biometric login to protect user data.

Comprehensive Bill Payment Options

Supports bill scheduling and reminders, improving payment management for users.

Cons

Limited Investment Tools (impact: medium)

The app does not currently offer advanced investment features or portfolio management, which may inconvenience active investors.

Occasional Login Errors (impact: low)

Some users experience brief login issues which are expected to be addressed in upcoming updates.

Slow Customer Support Response (impact: medium)

Customer service response times can be longer during peak hours; official improvements are planned.

Limited Customization Options (impact: low)

Personalization features are basic, and users cannot customize dashboard layouts extensively.

Offline Functionality is Restricted (impact: low)

Some features require internet access, but offline transaction viewing is limited; official app updates may enhance this aspect.

Frequently Asked Questions

How do I set up my Barclays US mobile banking app for the first time?

Download the app from your app store, open it, and follow the setup prompts to create your account using your existing banking details or new credentials.

Is there a way to access my account if I forget my login details?

Yes, tap 'Forgot Password' or 'Forgot User ID' on the login page and follow the instructions to reset your credentials securely.

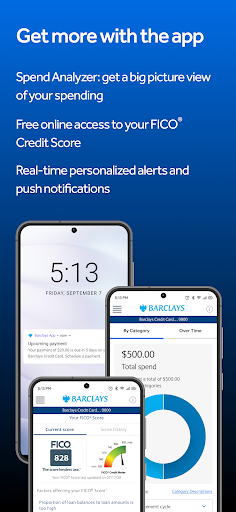

What core features does the Barclays US app offer for managing my finances?

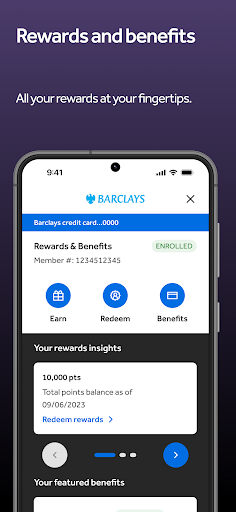

It allows funds transfers, bill payments, online deposits, rewards viewing, spending analysis, and credit score monitoring for financial oversight.

How can I enable biometric login for quick access?

Go to Settings > Security > Enable Biometric Login, then follow prompts to register your fingerprint or face ID.

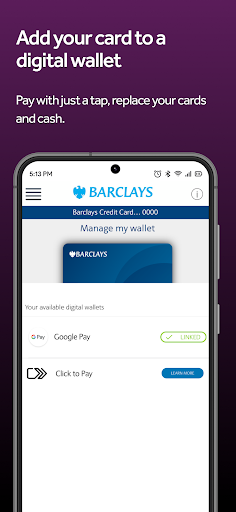

How do I add my Barclays card to Google Pay or Samsung Pay?

Navigate to the Payments section, select 'Add Card to Wallet,' and follow the instructions to link your card to your preferred digital wallet.

Can I set up automatic payments or direct deposits through the app?

Yes, go to Transfers > Setup Regular Payments or Direct Deposit, and follow the steps to establish automatic transactions.

How do I check my FICO credit score using the Barclays US app?

Visit the 'Credit Score' section from the main menu to view your free FICO score and get insights into your credit health.

Are there any subscription fees or premium features I should be aware of?

The basic app is free; check your account type for specific services as some premium features may incur charges, which you can verify in Settings > Subscriptions.

How do I update or manage my account notifications?

Go to Settings > Notifications, then customize alerts for account activity, payments, or security updates as per your preference.

What should I do if I experience glitches or the app crashes?

Try restarting your device, updating the app to the latest version, or reinstalling it. If issues persist, contact Barclays customer support for assistance.