- Category Finance

- Version26.1.90

- Downloads 1.00M

- Content Rating Everyone

Introducing BMO Digital Banking: A Fresh Take on Mobile Financial Management

Imagine managing all your banking needs as effortlessly as flipping through the pages of your favorite book—that's precisely what BMO Digital Banking aims to offer. Developed by the Bank of Montreal's innovative tech team, this app strives to blend security, convenience, and a user-friendly experience into a seamless digital banking solution. With features tailored for both busy professionals and everyday banking users, it's positioned to redefine how you handle your finances on the go.

Core Features That Make BMO Digital Banking Stand Out

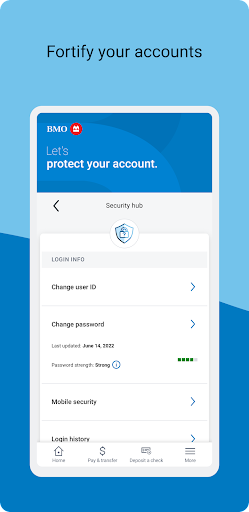

Secure and Invulnerable Account Management

At the heart of BMO Digital Banking lies a robust security framework. Utilizing multi-layered authentication, biometric logins, and AI-powered fraud detection, the app promises your financial data remains under lock and key. This emphasis on security isn't just a selling point but a core pillar that reassures users that their money and personal info are safeguarded against emerging threats.

Effortless Transaction Experience with Smart Automation

Make the usual financial chores feel almost magical—schedule payments, transfer funds with a tap, or even set up recurring transactions—all with a sleek, intuitive interface. BMO's intelligent transaction system recognizes your most common activities and suggests shortcuts, turning what once was a chore into a smooth, frictionless process. This “smart automation” reduces clicks and mental load, making your banking feel less like work and more like a breeze.

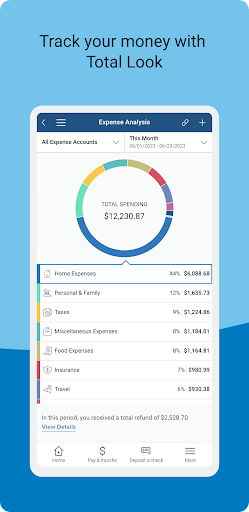

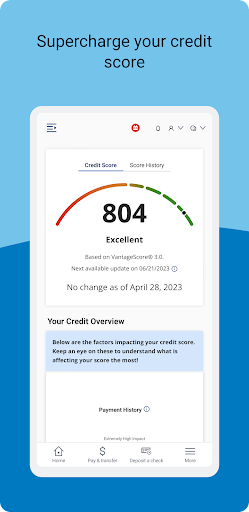

Personalized Financial Insights and Budgeting Tools

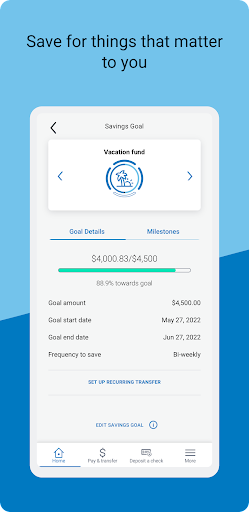

Imagine having a financial buddy in your pocket—helping you track expenses, analyze spending patterns, and set savings goals. BMO's app leverages data-driven insights to offer personalized recommendations, guiding you toward smarter money management. Whether you are trying to save for a trip or cut unnecessary expenses, the app's adaptive dashboard makes these goals approachable and straightforward.

Immersive User Experience and Design — Friendly Meets Functional

Navigation in BMO Digital Banking is akin to wandering through a well-organized, friendly neighborhood. The interface employs a clean, modern aesthetic with intuitive icons and logical flow, making it accessible even for first-time users. The layout strikes a balance—vivid enough to engage but subtle enough to prioritize clarity. Operation feels fluid, with minimal lag or sluggishness, reflecting thoughtful optimization under the hood.

Learning curve? Think of it like riding a bike—initially a bit unsteady, but once you get the hang of it, it becomes second nature. The onboarding process introduces features step-by-step, and contextual tips help new users to master functionalities without feeling overwhelmed.

How BMO Digital Banking Differentiates Itself

While many financial apps focus on basic account management, BMO's standout advantage lies in its layered security combined with a highly personalized user experience. Its advanced fraud detection system acts like a vigilant guardian, quietly working in the background for peace of mind. Additionally, its transaction automation and tailored insights set it apart from peers, transforming routine banking from a mundane task into an engaging, informative process.

Compared to other apps, BMO's approach to integrating security and usability feels like upgrading from a standard sedan to a high-performance vehicle—more control, smoother ride, and a sense of trust that your journey is secure at every turn.

Final Verdict: Is It Worth Your Time?

Absolutely. BMO Digital Banking combines sensible, robust security with features that genuinely enhance daily financial routines. If you value a straightforward yet sophisticated app that makes banking safer and smarter, this one deserves a spot on your device. Whether you're a tech-savvy user or someone just starting to embrace digital finance, it's a reliable choice worth exploring. For those seeking a seamless mix of security, innovation, and user-friendly design, BMO Digital Banking offers an experience akin to having a reliable financial companion in your pocket.

Similar to This App

Pros

User-friendly interface

The app offers an intuitive and clean layout, making navigation effortless for users.

Robust security features

BMO Digital Banking employs multi-factor authentication and real-time fraud alerts to protect users' accounts.

Comprehensive bill pay and transfer options

Users can easily pay bills and transfer money between accounts within the app, enhancing convenience.

Real-time transaction notifications

Instant alerts keep users informed about their account activity, enhancing financial awareness.

Integrated budgeting tools

Built-in features help users track expenses and set savings goals effectively.

Cons

Limited investment options (impact: low)

Currently, the app only offers basic savings and checking accounts, lacking advanced investment services, but future updates may expand this feature.

Occasional app crashes during high traffic (impact: medium)

Some users report brief crashes during peak usage times; reinstalling or updating the app can mitigate this issue temporarily.

Delays in customer support response (impact: low)

Support inquiries sometimes take longer than expected; using live chat can provide quicker assistance in the meantime.

Limited customization options for notifications (impact: low)

Users cannot currently customize notification preferences extensively, but a future update is planned to address this.

Offline banking features are minimal (impact: low)

Most functionalities require an internet connection; offline access for viewing balances is not available, which is common in digital banking apps.

Frequently Asked Questions

How do I set up the BMO Digital Banking app for the first time?

Download the app from Google Play or App Store, open it, and log in with your existing banking credentials. No additional setup is required.

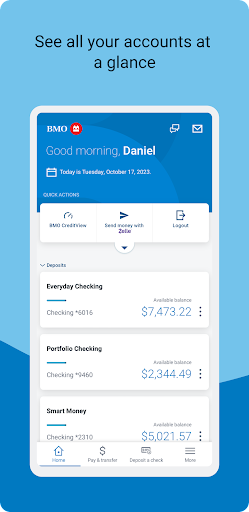

Can I access all my BMO accounts in one view?

Yes, after logging in, all your checking, savings, and credit card accounts are displayed on your dashboard for easy management.

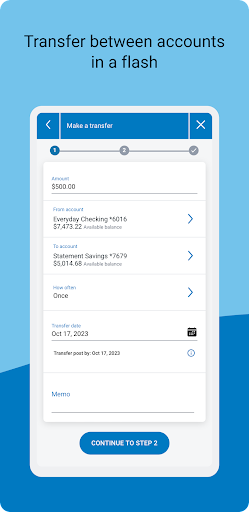

How do I transfer money between my accounts?

Navigate to 'Transfers' in the app, select your accounts, enter the amount, and confirm the transfer for quick, secure transactions.

How can I pay my bills using the app?

Go to 'Bill Pay', add payees if needed, schedule or pay bills directly within the app for convenience.

How do I send money to friends via Zelle®?

Select 'Send Money' > 'Zelle®', choose your contact, enter the amount, and confirm the transfer instantly.

How secure is the BMO Digital Banking app?

The app uses multi-factor authentication, real-time alerts, and allows you to turn cards on/off to protect your accounts.

What should I do if I forget my login credentials?

On the login screen, click 'Forgot Password' or 'Forgot Username' and follow the prompts to recover or reset your credentials.

Are there any costs or subscription fees for using the app?

The app is generally free to download and use. Check your bank account terms for any applicable service fees.

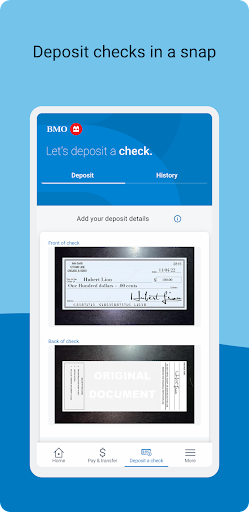

Can I deposit checks using the app?

Yes, select 'Deposit Checks', snap a picture of your check following on-screen instructions, and submit for deposit.

What should I do if the app crashes or isn't working properly?

Try updating the app, restart your device, or reinstall the app. Contact BMO customer support if issues persist.