- Category Finance

- Version1.58.3

- Downloads 1.00M

- Content Rating Everyone

Bright Money - AI Debt Manager: Your Friendly Guide to Smarter Finances

In an era where managing debt can feel like navigating a complex maze, Bright Money offers an innovative AI-powered approach to help users regain control over their financial health with clarity and confidence.

Developers and Core Highlights

Developed by Bright Money Inc., a team dedicated to leveraging artificial intelligence to improve financial well-being, this app stands out in the crowded finance app space. Its main features include personalized debt repayment plans, real-time financial insights, and an intelligent expense tracker—designed to simplify your journey toward debt freedom.

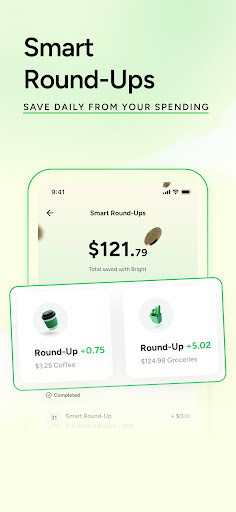

- AI-driven personalized debt repayment strategies tailored to individual financial situations.

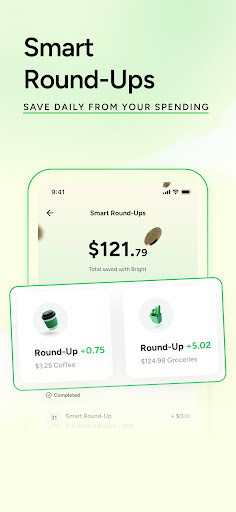

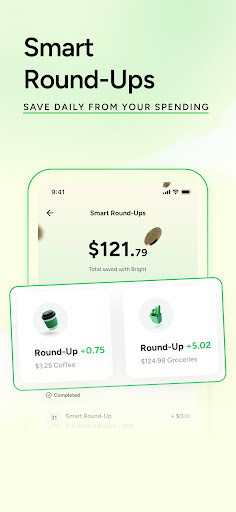

- Real-time insights and proactive alerts to optimize spending and saving behaviors.

- Secure account and fund management emphasizing user security and privacy.

- Seamless transaction experience with intuitive interface design.

The target audience includes young professionals, recent graduates, and anyone striving to pay off debt efficiently while gaining better financial literacy.

A Fresh Spin on Debt Management: Setting the Scene

Imagine having a dedicated financial coach whispering tailored advice in your ear as you navigate the daily ebb and flow of expenses. Bright Money transforms the often daunting task of debt repayment into a manageable, even engaging, process. Its intelligent algorithms decode your financial data, suggesting achievable milestones, and helping you stay motivated without feeling overwhelmed. With a friendly user interface that feels like a trusted companion, this app makes financial discipline approachable and, dare I say, even enjoyable.

The Heart of Bright Money: Core Functionalities

Personalized Debt Repayment Plans

The flagship feature kicks into gear with its AI-driven strategies customized to each user's debt profile. Whether you're juggling multiple credit cards or student loans, Bright Money analyzes your income, expenses, and debt interest rates to craft an optimal payoff path. It breaks down large goals into bite-sized milestones, making the journey less intimidating. Unlike generic debt calculators, this app adapts in real-time, recalibrating plans as your financial situation evolves—kind of like having a savvy financial advisor in your pocket, always adjusting the course for maximum efficiency.

Real-Time Insights and Proactive Alerts

Bright Money keeps you on your toes with timely notifications that act like friendly nudges. Did you overspend this week? An alert highlights areas to cut back. Planning a big expense? It suggests optimal timing to avoid unnecessary interest or fees. These insights help you understand your spending habits better, turning financial discipline into a habit rather than a chore. The app's mood is supportive rather than preachy, encouraging users at every step.

Secure Account and Fund Management

Security is a cornerstone of this application. Bright Money employs bank-level encryption and multi-factor authentication to ensure your data stays private and your funds are protected. Unlike some apps that handle sensitive data with a casual attitude, Bright Money emphasizes transparency about security measures—offering peace of mind for users wary of digital threats. This commitment to security and privacy sets it apart from many competitors who may treat sensitive information as secondary.

User Experience: Intuitive, Seamless, and Friendly

The interface resembles a well-organized dashboard—clean, modern, and inviting—making financial management less stressful. Navigating through features feels like flipping through a well-thought-out magazine—each section logically flowing into the next. Operation is snappy and responsive, with menus and buttons that respond instantaneously, making actions feel natural and fluid. Its learning curve is gentle; even financial novices find it easy to start and gradually explore advanced features. Guided walkthroughs and contextual tips serve as friendly mentors, helping users unlock the app's full potential step by step.

What Makes Bright Money Stand Out?

Among a sea of finance apps, Bright Money shines particularly in its commitment to personalized, adaptive debt strategies through AI. Its ability to recalibrate plans dynamically and communicate with users via proactive insights creates a highly customized experience—almost as if the app knows your financial story intimately and guides you with a gentle hand. Additionally, its robust security measures ensure that users can entrust their sensitive data without hesitation.

Compared to traditional budgeting apps or debt calculators, Bright Money takes a step further by integrating machine learning to not only forecast savings but also adapt to changing circumstances. This level of adaptability ensures that users are never left stranded; instead, they have a reliable partner that evolves with their financial journey.

Final Verdict & Usage Recommendations

Bright Money is highly recommended for individuals committed to tackling debts with a strategic mindset. Its personalized, adaptive approach makes it ideal for those who want clarity and reassurance in their repayment plans. If you value security, intuitive design, and smart insights, this app can become an essential tool for your financial toolbox. Beginners will appreciate the gentle onboarding and guided features, while experienced users will find the adaptive strategies and detailed analytics beneficial.

In summary, Bright Money doesn't just manage your debts; it transforms how you interact with your finances, turning complicated calculations into clear, actionable steps. Whether you're just starting your debt-free journey or looking for a more intelligent way to stay on track, this app offers a compelling mix of innovation and user-centric design that deserves a close look.

Similar to This App

Pros

Intelligent debt prioritization

Bright Money uses AI to identify the most efficient repayment strategies, saving users time and money.

Personalized budgeting advice

The app offers tailored financial tips based on user spending habits, enhancing financial literacy.

Automatic debt payments

Seamless auto-draft features help ensure timely payments, reducing late fees.

Progress tracking & analytics

Users can monitor their debt repayment progress with detailed visual reports.

User-friendly interface

The intuitive design simplifies complex financial data, making debt management accessible.

Cons

Limited debt account integrations (impact: medium)

Currently, it supports only certain banks, which may restrict users with diverse accounts.

Dependence on internet connectivity (impact: low)

Real-time updates require a stable internet connection; offline functionality is limited.

Learning curve for new users (impact: medium)

Some users may need time to understand AI-driven recommendations fully; tutorial improvements are planned.

Basic free version features (impact: low)

Advanced features require subscription, which may deter budget-conscious users; future free tiers might be introduced.

Potential privacy concerns (impact: high)

Sharing sensitive financial data may raise security worries; encryption protocols are continuously enhanced.

Frequently Asked Questions

How do I get started with Bright Money and set up my account?

Download the app, sign up with your email, and follow the onboarding prompts to link your financial accounts and customize your preferences.

Is Bright Money suitable for beginners with no prior financial experience?

Yes, Bright provides user-friendly guidance and educational resources to help beginners improve their financial management skills.

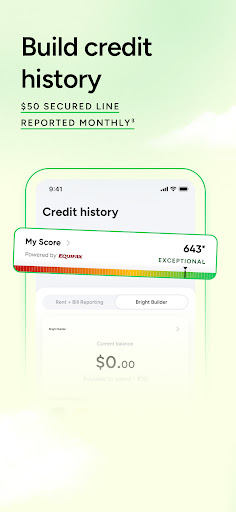

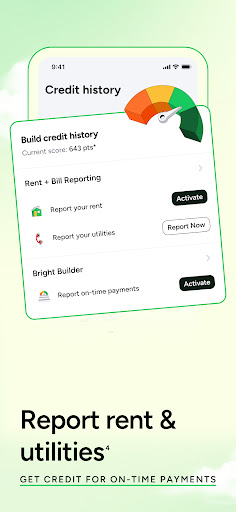

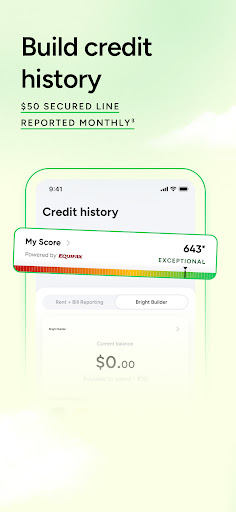

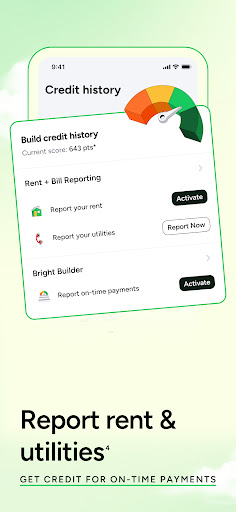

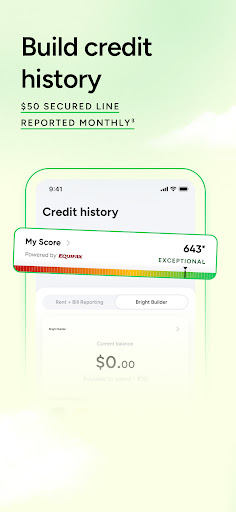

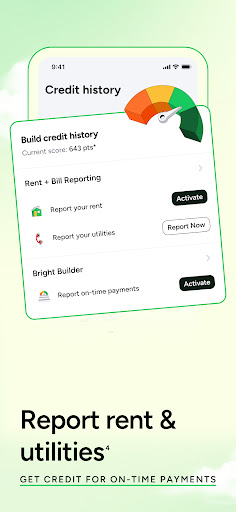

How does Bright Builder report my credit activity?

Navigate to 'Settings > Bright Builder' to set up a secured credit line and enable reporting; make timely payments to build your credit history.

Can I use Bright Money to improve my credit through rent payments?

Yes, enable rent reporting in 'Settings > Rent Payments' to have your rent history reported to major bureaus once linked.

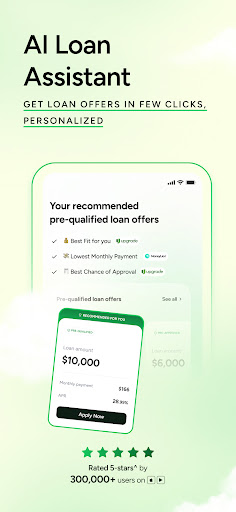

How do I create a personalized debt payoff plan with Bright Plan?

Go to 'Dashboard > Bright Plan', input your debt details and goals, and let AI generate a tailored repayment strategy for you.

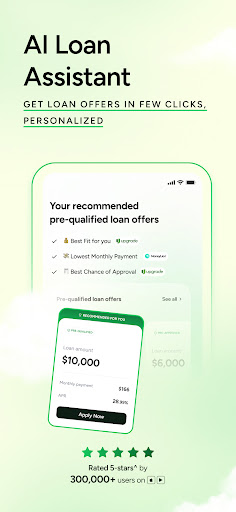

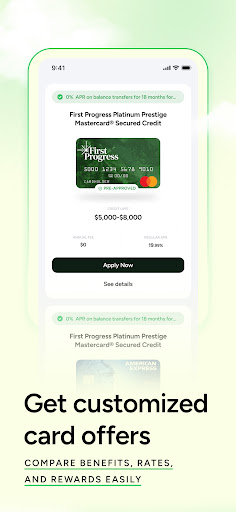

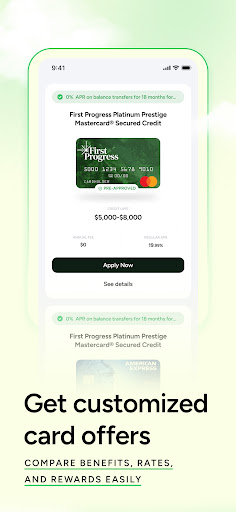

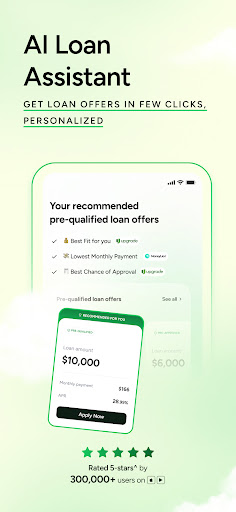

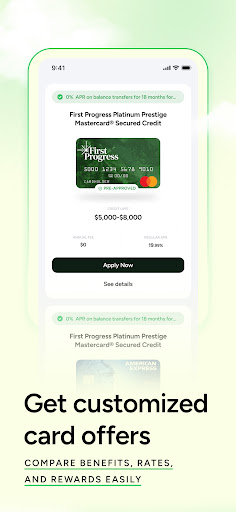

What types of loans does Bright Money offer and how do I apply?

Access available loans via 'Loans > Apply', choose your preferred amount and term, and complete the application with your financial details.

What are the subscription plans and their costs?

Plans include 3-month ($39), 6-month ($68), and 12-month ($97/year) options, which can be managed in 'Settings > Subscription'.

Is there a premium membership, and what additional benefits does it offer?

Yes, a Premium plan unlocks advanced debt strategies and extra resources. You can upgrade in 'Settings > Membership'.

Does Bright Money offer free features or is it primarily paid subscription-based?

Core features like Bright Builder and basic loan options are free; premium insights and extra tools require a subscription in 'Settings > Subscription'.

What should I do if I encounter technical issues while using the app?

Contact 24/7 support via 'Help > Live Chat' in the app or email support for troubleshooting assistance.