- Category Finance

- Version1076.0

- Downloads 5.00M

- Content Rating Everyone

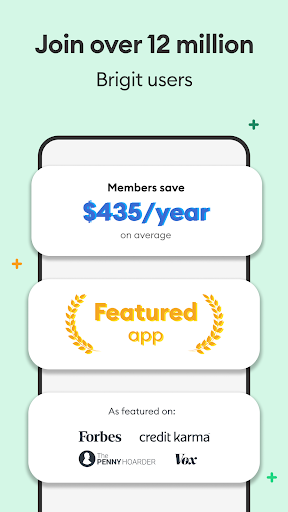

Introducing Brigit: Your Friendly Financial Sidekick

Brigit: Cash Advance & Credit is a user-centric financial app designed to help everyday consumers manage cash flow more smoothly, offering small advances and credit insights with simplicity and security in mind.

About the Developers and Core Features

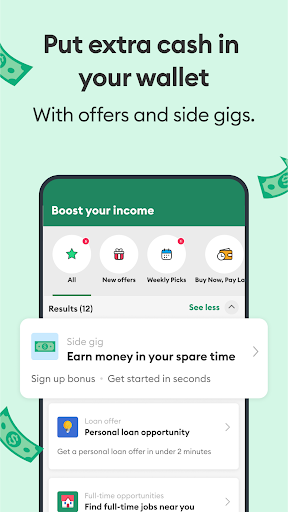

Developed by the innovative team at Brigit, Inc., this application embodies a craft that combines real-time financial guidance with accessible cash solutions. The core strengths of Brigit lie in its ability to provide instant cash advances, personalized budgeting tips, and credit-building tools—all wrapped in an intuitive interface aimed at users who seek proactive financial management. Its primary functionalities include flexible cash advances, automatic financial tracking, and dedicated credit building features. Targeted at individuals who frequently experience temporary cash shortfalls or want to improve their credit scores, Brigit strives to be a trustworthy companion for responsible financial decision-making.

A Friendly & Fun Introduction to Brigit's Core Offerings

Imagine a financial assistant that doesn't just sit there quietly but actively helps you navigate the sometimes turbulent waters of personal finance. From the moment you open Brigit, its approachable design and thoughtful features make managing money feel less daunting and more like a helpful chat with a savvy friend. Now, let's peel back the layers and see what makes Brigit stand out in the crowded forest of personal finance apps.

Cash Advances Made Easy & Trustworthy

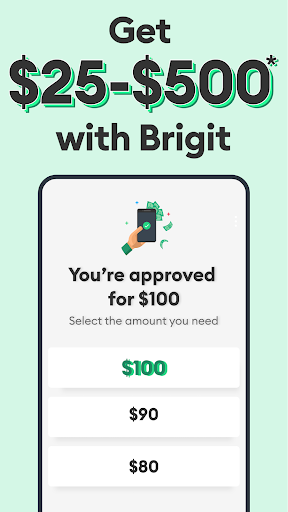

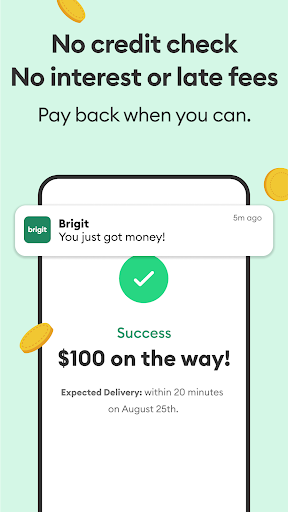

One of Brigit's crown jewels is its ability to provide small cash advances with minimal fuss. Unlike traditional payday loans or complicated banking overdrafts, Brigit allows users to request advance funds to tide over urgent expenses directly within the app. What sets it apart is its "predictive" system that analyzes your income patterns and spending behaviors to suggest whether an advance is appropriate, thereby reducing impulsive borrowing. Transactions are transparent, with clear fee structures and repayment reminders, making it a tool you can trust rather than fear. The process is remarkably seamless—think of it as having a financial safety net fold itself neatly into your pocket, ready whenever you need a quick boost.

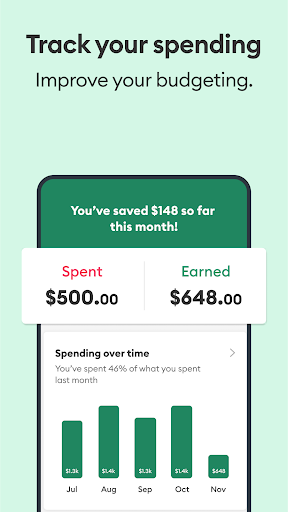

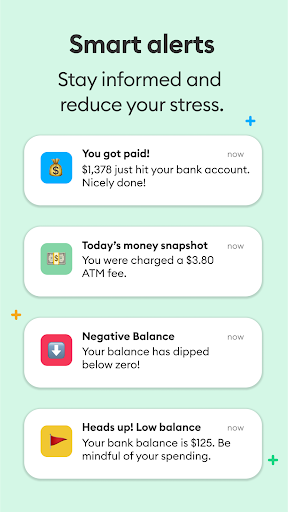

Financial Monitoring & Personalized Tips

Beyond immediate cash needs, Brigit acts like a friendly financial coach. Its automatic tracking features monitor your income, expenses, and spending habits, gently alerting you to potential issues before they snowball. The app offers tailored insights—such as low-balance alerts or suggestions to reduce unnecessary subscriptions—that help you make smarter choices day-to-day. This proactive approach helps demystify the complicated world of personal finance, turning chaos into clarity with each tap.

Building Your Credit Step-by-Step

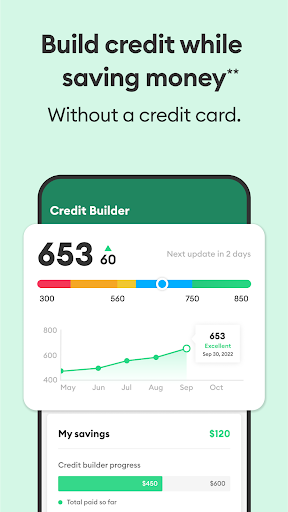

Developing or repairing credit can feel like trying to assemble a puzzle in the dark. Brigit shines a light on this process with straightforward tools that help users understand what impacts their credit scores and how to improve them. With features like secured credit-building and easy-to-understand reporting, the app encourages responsible finance habits. It's like having a coach guiding your journey towards financial independence, one small step at a time.

The User Experience: Friendly, Smooth, and Intuitive

From a design perspective, Brigit scores highly with its clean, approachable interface—the kind that feels like a well-organized workspace rather than a cluttered dashboard. Navigating between cash advances, spending insights, and credit tips is a breeze thanks to logical menus and clear labels. Transactions appear promptly, and the app's responsiveness mirrors that of a well-oiled machine—no lag, no hiccups. Beginners will find the learning curve gentle, as helpful tips and onboarding tutorials gently guide new users through each feature, transforming financial unfamiliarity into familiarity without overwhelming. The overall user experience resembles a friendly chat rather than a complicated transaction portal, making it appealing for both tech-savvy users and those just starting to manage their finances.

What Makes Brigit Special? Security & Transaction Experience

In the realm of financial apps, security is paramount, and Brigit takes this seriously. It employs advanced encryption methods, two-factor authentication, and bank-level security standards to safeguard your sensitive information. What truly sets it apart, however, is its transparent approach to transactions—clear fee disclosures and real-time notifications keep you informed at every step, cultivating trust and peace of mind. Unlike some apps that hide hidden fees or obscure terms, Brigit emphasizes openness, ensuring users feel confident in their choices. Furthermore, its seamless integration with bank accounts means that transactions feel instantaneous and natural, mirroring the fluidity of handling cash in the real world but with the added security of digital safeguards.

Final Thoughts — Is Brigit Worth Your Time?

Overall, I'd recommend Brigit quite confidently for folks seeking an honest, user-friendly tool to help manage cash flow and build credit responsibly. Its standout feature—providing small, low-commitment cash advances backed by predictive analysis—is like having a financial guardian angel whispering advice and help when you need it most. Paired with its transparent and secure transaction environment, Brigit offers a balanced mix of practicality and reassurance. For those who want a compassionate yet reliable ally in their financial journey, this app is definitely worth exploring.

Similar to This App

Pros

User-Friendly Interface

The app features a clean and intuitive design that makes navigation straightforward for users.

Early Access to Funds

Allows users to access small cash advances quickly, helping in urgent financial situations.

Transparency in Fees

Provides clear information about charges and repayment terms, building trust with users.

Credit Building Potential

Timely repayments can positively influence credit scores over time.

Account Integration

Easily connects with bank accounts for seamless transactions and fund management.

Cons

Limited Loan Amounts (impact: low)

The maximum cash advance is relatively small, which may not meet larger financial needs.

High Fees for Small Advances (impact: medium)

Fees can add up quickly on small amounts, making it expensive to use frequently.

Limited Availability in Some Regions (impact: medium)

The app may not be accessible in all states or countries, restricting user access.

No Savings or Investment Features (impact: low)

The app focuses solely on cash advances and credit, lacking tools for financial planning.

Potential Impact on Credit if Misused (impact: high)

Late repayments could negatively affect credit scores; users are advised to manage borrowing responsibly.

Frequently Asked Questions

How do I start using Brigit for the first time?

Download the app, sign up for free, connect your bank account via Settings > Bank Accounts, and explore the main features to get started.

Can I use Brigit without linking my bank account?

No, connecting your bank account is required to access features like cash advances, budgeting, and credit building.

What is the process to request a cash advance?

Connect your bank account, navigate to Cash Advances, select the amount ($25–$250), and submit your request; funds are deposited instantly.

How does Brigit help me build my credit?

Activate Credit Builder in Settings, make on-time payments, and Brigit reports these to credit bureaus to improve your score over time.

Are there any fees for using the cash advance feature?

No, Brigit offers interest-free cash advances with no hidden fees. Repayments are flexible and automatic when you get paid.

What is the difference between the Basic and paid plans?

The Basic plan offers free alerts and insights, while paid plans ($8.99–$14.99/month) include features like cash advances and credit building tools.

How do I upgrade or cancel my subscription?

Go to Settings > Membership or Subscription to upgrade, downgrade, or cancel anytime. Changes take effect immediately.

Can I access all features on the free plan?

The free plan provides alerts and insights, but features like cash advances and credit building require a paid subscription.

What should I do if I experience errors or app crashes?

Try reinstalling the app or updating to the latest version. If issues persist, contact Brigit support via Settings > Help & Support.

Is my financial data secure with Brigit?

Yes, Brigit uses encryption and secure protocols to protect your data, and offers features like bank balance alerts and identity theft protection.