- Category Finance

- Version6.36.2

- Downloads 0.05B

- Content Rating Everyone

Unveiling the Power of Capital One Mobile: A Smooth Sailing Financial Companion

Imagine having a friendly, reliable friend by your side whenever you need to manage your finances, with a knack for making complex tasks simple and secure—that's what Capital One Mobile aims to be. This app isn't just another banking tool; it's a thoughtfully crafted digital partner designed to streamline your financial life with ease and confidence.

About the App: Who, What, and Why

Capital One Mobile is a comprehensive banking application developed by Capital One Financial Corporation, a renowned leader in financial services. The app's primary mission is to offer users a convenient, secure, and feature-rich platform to manage their accounts on the go.

- Key Features Highlights:

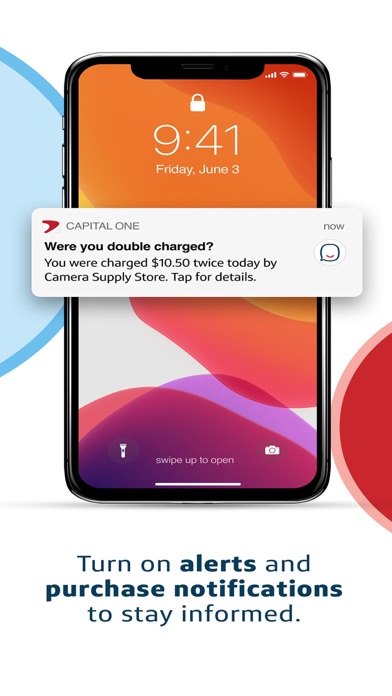

- Real-time account monitoring and transaction alerts, keeping you informed 24/7

- Seamless fund transfers and bill payments with an intuitive flow

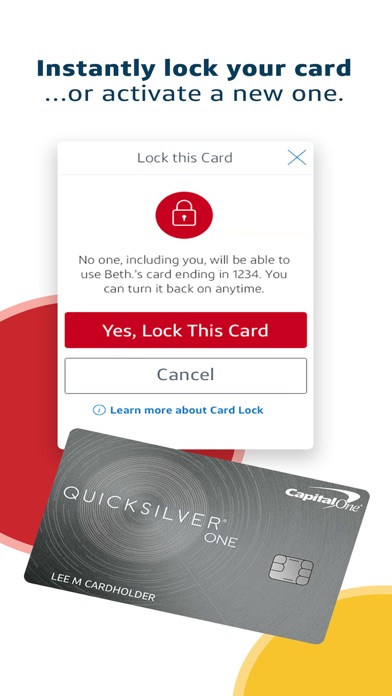

- Advanced security measures like instant card freezes and fraud alerts

- Personalized financial tools, including customized spending insights

Targeted at a broad spectrum of users—ranging from tech-savvy millennials to busy professionals and seasoned savers—the app aims to simplify financial management for anyone seeking a trustworthy digital banking experience.

Engaging the User: Is This App a Game-Changer?

You might think all banking apps are created equal, but Capital One Mobile stands out like a lighthouse amidst a fog of digital clutter. Navigating through multiple accounts, checking transactions, or paying bills feels almost like chatting with a knowledgeable friend—smooth, quick, and reassuring. But what truly makes it shine?

Streamlined Core Functionalities: Power at Your Fingertips

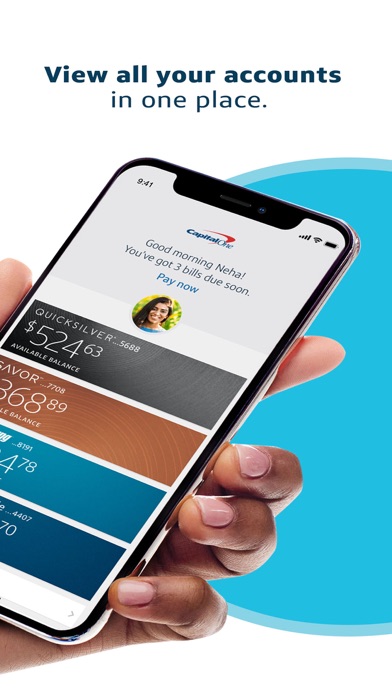

First and foremost, the app's dashboard acts as a control tower, prioritized with clarity. Your account balances, recent transactions, and upcoming payments are displayed in a clean, digestible layout. It's akin to having a quick glance at your financial health while on the move—no unnecessary clutter, just the essentials beautifully arranged.

Secondly, the transaction experience within the app is remarkably fluid. Initiating a transfer or paying a bill involves straightforward steps—select the recipient, input the amount, and confirm. The process feels natural, almost like handing over a note to a trusted friend. The app supports instant transfers between Capital One accounts and allows scheduled payments, eliminating the usual banking hassle.

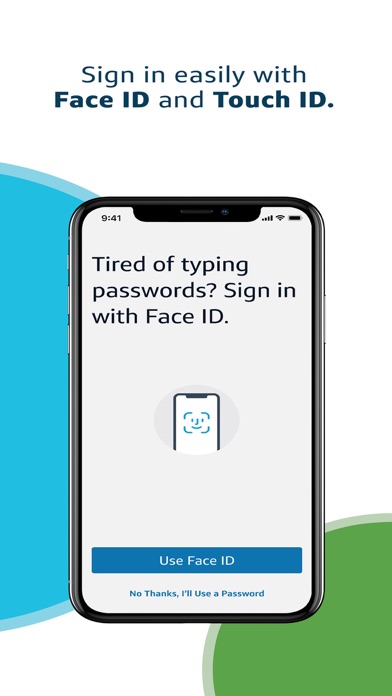

Thirdly, security isn't an afterthought; it's woven into the fabric of the app. Features like instant card freezing, customizable fraud alerts, and biometric authentication give users complete control and peace of mind. Compared to many finance apps—where security might just be a checkbox—Capital One Mobile's proactive approach offers a significant advantage, especially for users who prioritize safeguarding their assets.

User Experience: Ease, Aesthetics, and Learning Curve

The interface design is sleek yet approachable—purple accents against clean white backgrounds guide your eyes naturally. Navigation feels intuitive, with tabs and menus logically arranged, reducing the learning curve even for first-time users. The responsiveness of the app is impressive, with pages loading swiftly and interactions feeling ‘buttery smooth'. Even users unfamiliar with mobile banking will find it easy to get started after a brief exploration, making it accessible for all ages and tech competencies.

The Differentiator: Standing Out in a Crowd

While many banking apps emphasize basic functionalities, Capital One Mobile excels with its focus on security and transaction experience. The app's instant card freeze feature is a particularly notable highlight—if your card gets lost or stolen, you can disable it immediately with a single tap, preventing unauthorized use. This is a step ahead compared to traditional methods requiring customer support calls.

Moreover, its transaction flow feels personalized and efficient, with clear prompts and minimal friction. For users juggling multiple accounts or managing investments, the app provides a unified view—no need to open multiple apps or logins, reducing cognitive overload. The integration of financial insights based on your spending habits adds value without being intrusive, fostering smarter financial decisions.

My Take: To Use or Not to Use?

If you're seeking a digital banking app that combines straightforward usability, robust security, and a touch of personalization, Capital One Mobile deserves your attention. It's particularly well-suited for those who value control and swift access to their financial details. However, if you need extensive investment features or complex financial planning tools, you might find it somewhat basic—though for everyday banking, it's a solid choice.

The Bottom Line: A Friendly, Secure, and Efficient Banking App

All in all, Capital One Mobile stands out as a highly reliable and user-centered financial app. Its most special features—like instant card freeze and seamless transaction experience—place it ahead of many counterparts. As a digital handshake—friendly, efficient, secure—this app is recommended for anyone wanting confidence and simplicity in managing their money on their terms. Whether you're a first-time smartphone banker or a seasoned user, it's worth giving a try, especially if security and clarity are your top priorities.

Similar to This App

Pros

User-Friendly Interface

The app has an intuitive layout that makes navigation seamless for all users.

Robust Security Features

It incorporates multi-factor authentication to safeguard users' financial information.

Real-Time Account Monitoring

Users can easily track their transactions and account balances instantly.

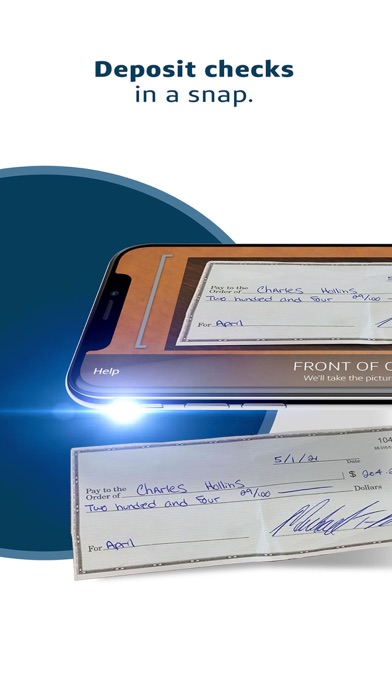

Convenient Mobile Check Deposit

The app allows secure remote deposit, saving time for users.

Personalized Financial Insights

Capital One Mobile provides tailored insights to help users manage their finances better.

Cons

Occasional App Crashes (impact: medium)

Some users experience crashes during high traffic periods; updating the app to the latest version may help mitigate this issue.

Delayed Notifications (impact: low)

Push notifications for transactions can sometimes be delayed; reinstalling the app or checking notification settings could improve this.

Limited Budgeting Tools (impact: low)

The app offers basic insights but lacks advanced budgeting features; Capital One plans to enhance this in future updates.

Encountering Login Issues on Certain Devices (impact: medium)

Some Android devices report login difficulties; clearing cache or reinstalling the app can temporarily resolve this.

Slow Customer Support Response (impact: low)

Customer service responses via the app may be slower than expected; users can try using live chat or calling directly for quicker assistance.

Frequently Asked Questions

How do I set up my Capital One Mobile app for the first time?

Download the app, open it, and follow the on-screen prompts to securely log in or register using your banking details or personal information.

What are the basic functions I can perform with the app?

You can view your account balances, transaction history, and manage bill payments easily from the app's main dashboard.

How can I view my account statements on the app?

Navigate to Accounts > Select your account > Export statements to view or download your account statements.

How do I pay bills using the app?

Go to Payments > Bill Pay, select your payee, enter payment details, and confirm to complete your bill payment.

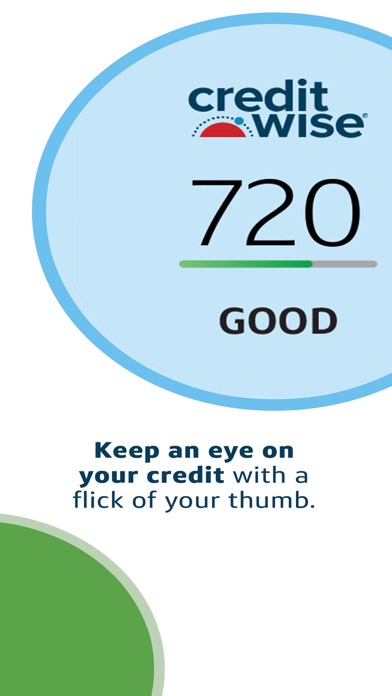

Can I monitor my credit score on the app?

Yes, enable CreditWise in the app under the Credit Monitoring section to check your credit score and receive alerts.

How do I activate or lock my card through the app?

Navigate to Cards > Select your card > Activate or Lock Card options to securely activate or temporarily lock your card.

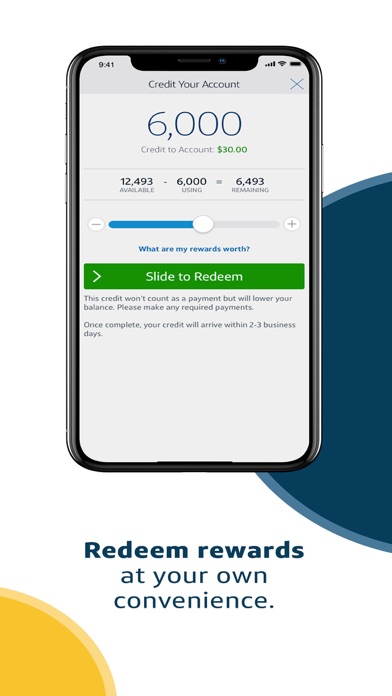

How do I redeem rewards or cashback on the app?

Go to Rewards > Redeem, choose your rewards options, and follow the prompts to claim your cashback or rewards points.

How can I send or receive money using the app?

Use the Zelle® feature in the app, select Send/Receive Money, enter recipient details, and confirm the transaction.

How do I set up travel notifications in the app?

Go to Settings > Travel Notifications, add your travel details, and enable notifications to prevent card declines while traveling.

What should I do if the app crashes or I can't log in?

Try updating your app, clearing cache, or reinstalling. If issues persist, contact customer support through the app or website for assistance.