- Category Finance

- Version5.30

- Downloads 0.10B

- Content Rating Everyone

Cash App: Simplifying Financial Transactions with a Touch of Innovation

Imagine managing your money as effortlessly as sending a message—Cash App stands out as a user-friendly mobile platform that blends convenience, security, and cutting-edge features to revolutionize personal finance management.

About the App: Who, What, and Why?

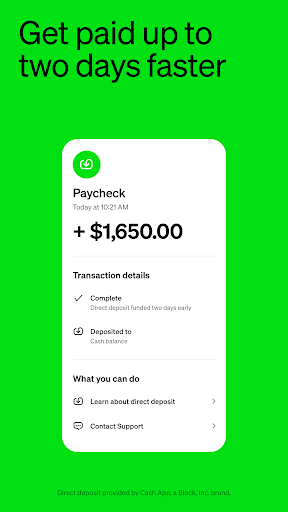

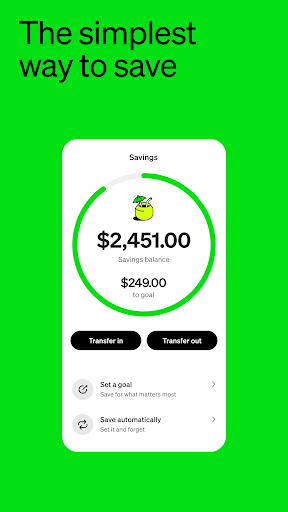

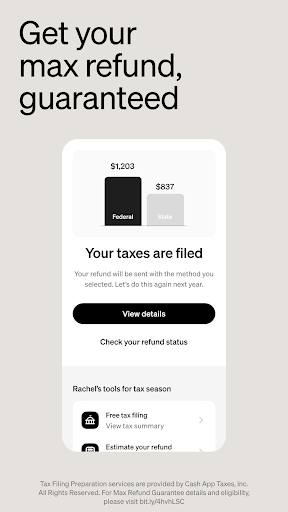

Cash App is a versatile financial application developed by Block, Inc. (formerly Square Inc.), designed to facilitate seamless peer-to-peer payments, instant access to funds, and a range of financial services—all packed into a sleek mobile interface. Its primary strengths lie in intuitive transfers, integrated investing options, and robust security protocols. Geared toward young professionals, tech-savvy users, and those seeking quick financial solutions, Cash App aims to bridge the gap between traditional banking and modern digital lifestyles.

Spice Up Your Financial Life: An Exciting Overview

Using Cash App feels like having a friendly financial assistant right in your pocket—imagine swiftly splitting dinner bills with friends, or investing spare change with a few taps, all without the usual hassle of banking queues or complex interfaces. Its design invites users into a universe where managing money feels less like a chore and more like a daily convenience or even a mini adventure.

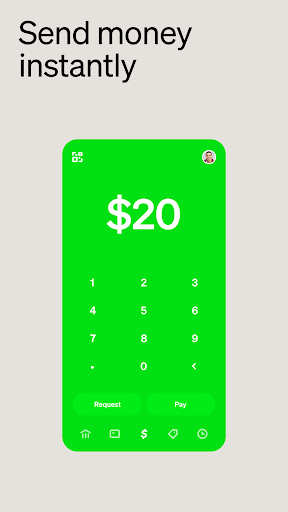

Simplified Payments and Transfers: The Core of Cash App

At its heart, Cash App excels at making money transfers straightforward and lightning-fast. With just a few taps, you can send or receive cash from friends and family, regardless of your location—think of it as passing a note in class, but digital and instant. The app supports payment requests, scheduled transfers, and even enables users to request money seamlessly, mimicking the casual spontaneity of exchanging small bills but in a secure, digital format. The experience is remarkably smooth, thanks to a clean interface that guides you effortlessly from start to finish.

What makes this standout? Unlike traditional bank transfers that can take hours or even days, Cash App offers near-instantaneous transactions. Plus, it incorporates a handy feedback system—notifications that confirm your money has arrived, making every transaction feel like a shared secret between friends rather than a financial chore.

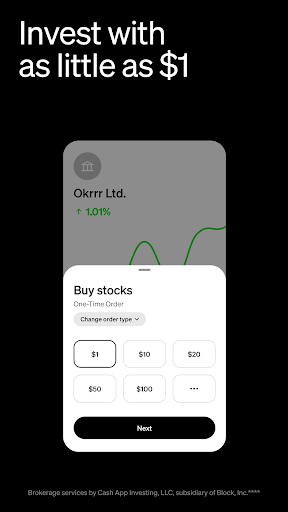

Investing Made Easy: Your Pocket-Sized Trading Desk

One of Cash App's most compelling features is its integrated investing platform. Think of it as your mini Wall Street, embedded right into your phone. You can buy and sell fractional shares of popular companies, allowing even beginners with modest funds to participate in the stock market. The interface simplifies complex investment concepts into digestible steps, turning what used to be a daunting process into an approachable activity—like trading virtual cards when you were a kid, but with real financial stakes.

This differentiation from conventional banking apps shines brightest when it comes to its user-centric approach: no hefty brokerage fees, easy account setup, and educational prompts that guide you through your investment journey. The app's security measures further enhance confidence, with multiple layers of encryption and fraud detection ensuring your investments are safe.

Security and User Experience: Building Trust in Every Tap

Cash App emphasizes security almost as much as it does ease of use. With features like two-factor authentication, multi-layer encryption, and fraud monitoring, users can rest assured that their money and data are protected. Compared to other finance apps, Cash App's focus on transparent security protocols, combined with its user-friendly design, sets it apart—it's like having a high-security vault that's also friendly enough to give you a reassuring smile every time you use it.

From an experience perspective, the app boasts a minimalist yet engaging interface, with intuitive navigation that reduces the learning curve to almost zero. Whether you're a first-timer or a seasoned user, the flow from opening the app to completing your transaction feels natural, like flipping through the pages of a well-designed book.

Final Verdict: Worth a Spot in Your Digital Wallet?

Overall, Cash App stands out as a practical, well-rounded financial tool. Its most unique aspects—instant transaction capabilities and accessible investing—offer real value that set it apart from many traditional or other digital finance solutions. For those looking for a reliable, straightforward app to manage daily transactions or dip into investing without fuss, Cash App is highly recommended.

Personally, I see it as a digital financial Swiss Army knife—ready to handle your basic money needs while offering a few smart features that make managing your finances feel less like a chore and more like part of your daily routine. However, users should always remain cautious with investments and ensure they understand the risks involved.

In conclusion, if you're comfortable with digital payments and want a secure, easy-to-navigate platform with innovative features, Cash App deserves a prominent place in your financial toolkit. It's not just a payment app; it's a step toward smarter, simpler personal finance management.

Similar to This App

Pros

User-friendly interface

Cash App offers an intuitive design that makes transactions simple for users of all experience levels.

Fast and secure transactions

Funds are transferred almost instantly with robust security measures to protect user data.

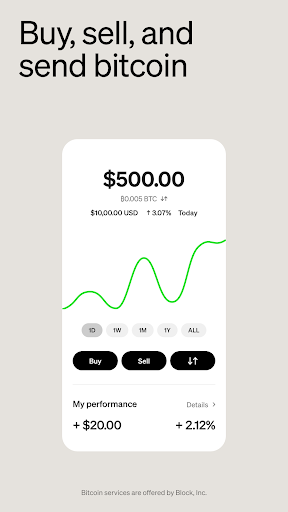

Multiple features including Investing and Bitcoin trading

Users can buy stocks or cryptocurrencies directly within the app, adding versatility.

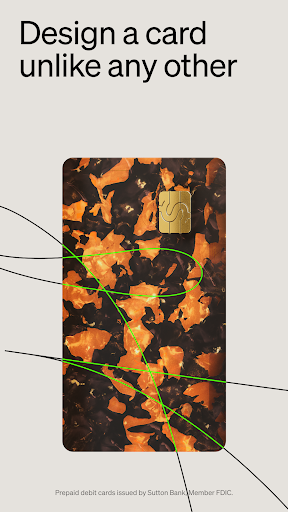

Availability of a virtual debit card

The Cash Card allows users to spend funds instantly and customize their card design.

Free basic services

Sending money and receiving funds are generally free, making it cost-effective for everyday use.

Cons

Limited international support (impact: high)

Cash App is mainly available in the US and UK, restricting access for users in other countries.

Customer service response times (impact: medium)

Support can be slow during peak times, which may delay issue resolution.

Absence of bill payment options (impact: low)

Currently, Cash App does not support direct bill payments, but the company plans to add this feature in future updates.

Limited account recovery options (impact: medium)

Users have reported challenges in recovering access after account lockouts, though official support offers guidance.

Some features require upgrading to paid tiers (impact: low)

Advanced features like instant deposits may incur fees, which could be avoided with manual transfers.

Frequently Asked Questions

How do I set up my Cash App account for the first time?

Download the app, tap Sign Up, enter your details, verify your identity, and link your bank account through Settings > Banking to start using Cash App.

Can I send money to someone without a Cash App account?

No, both sender and receiver need a Cash App account. You can send money via phone number, email, or $Cashtag within the app is required.

How do I link my bank account to Cash App?

Go to Settings > Banking > Link a Bank, select your bank, and follow the prompts to connect your account securely.

What features are available for investing in stocks and Bitcoin?

You can buy and sell stocks, ETFs, and Bitcoin within the app. Access real-time market data and set up auto-invest through the Investing section.

How do I enable the Cash App custom debit card?

Navigate to the Card tab, select 'Get a Free Cash Card,' customize your card, and follow the prompts to order it for virtual or physical use.

Are there any fees for using Cash App's premium services or investments?

Most basic payments are free. However, some features like instant deposits or ATM withdrawals may have fees. Check Settings for specific charges.

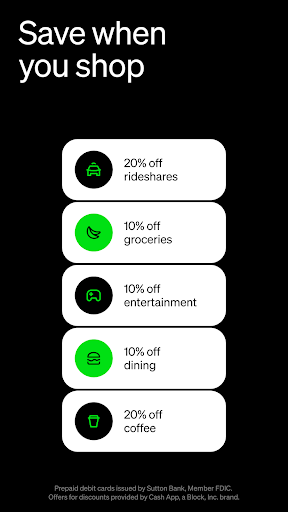

How can I subscribe to Cash App's premium features or discounts?

Open Settings > Personal > Promotions or Discounts to view available offers or upgrade your account to access special deals and cashback options.

How do I troubleshoot if my transactions are not going through?

Check your internet connection, verify sufficient funds, ensure your account is verified, and contact Support if the issue persists.

Is my money safe on Cash App?

Yes, Cash App uses encryption, fraud monitoring, and security protocols to protect your funds and personal information.

Can I withdraw money from Cash App to my bank account?

Yes, go to Banking > Cash Out, choose an amount, and select Instant or Standard transfer to your linked bank account.