- Category Finance

- Version5.305.0

- Downloads 0.01B

- Content Rating Everyone

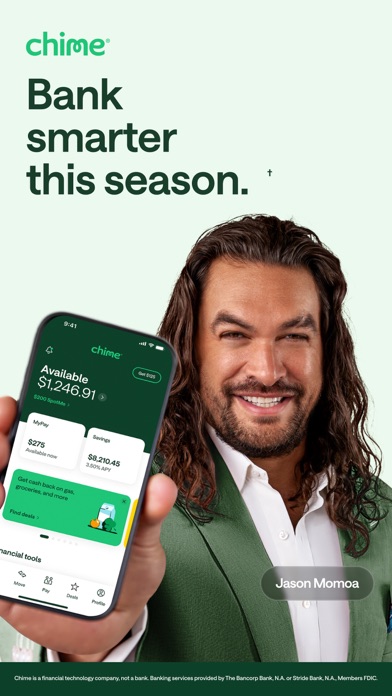

Chime – Mobile Banking: A Fresh Spin on Digital Banking

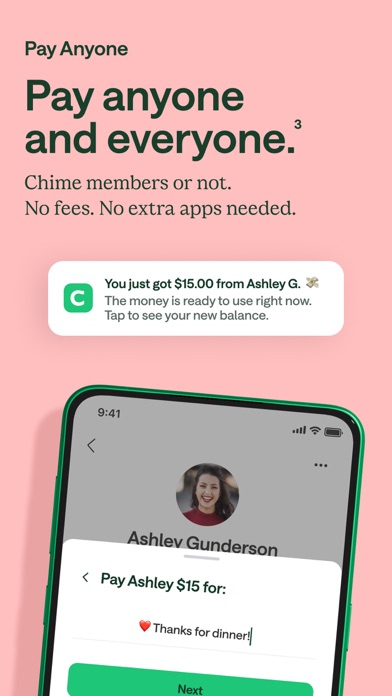

Chime is an innovative mobile banking app designed to simplify financial management while prioritizing security and user convenience. Developed by the well-regarded Chime Financial Inc., this app aims to redefine traditional banking with a sleek interface and thoughtful features. Whether you're a young professional, student, or anyone seeking a seamless banking experience without hefty fees, Chime targets those who value simplicity, speed, and safety in managing their money.

Core Features That Make Chime Stand Out

1. No-Fee Banking with High Accessibility

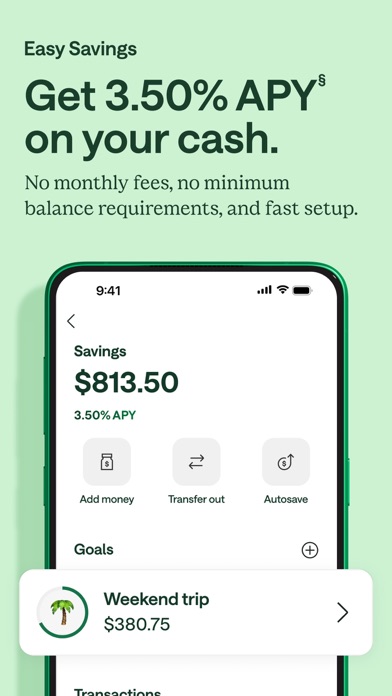

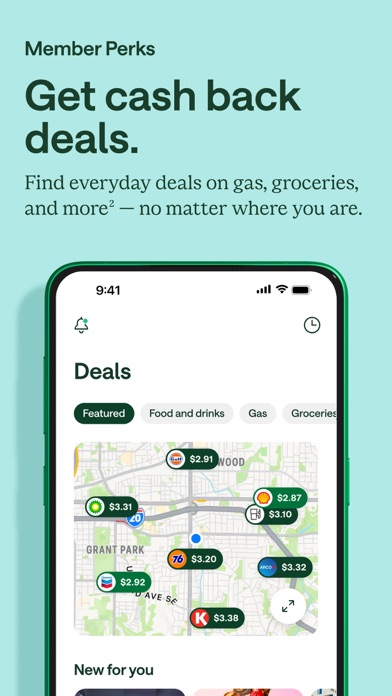

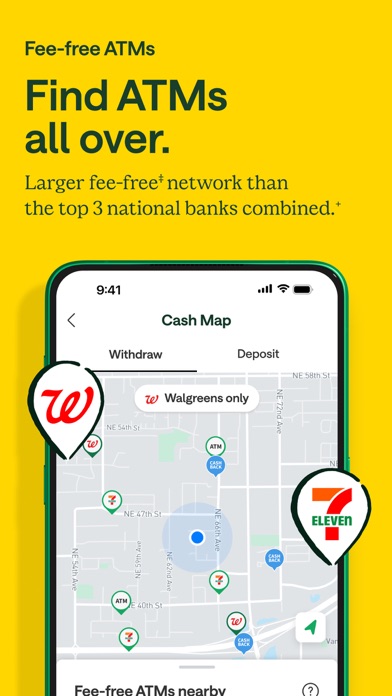

At its heart, Chime provides a checking account and a savings account without monthly maintenance fees or minimum balance requirements. This straightforward approach appeals to users tired of hidden bank charges, offering an accessible pathway into the digital banking world. The app also includes a built-in Visa debit card, enabling users to make purchases or ATM withdrawals free of charge at a vast network of ATM locations.

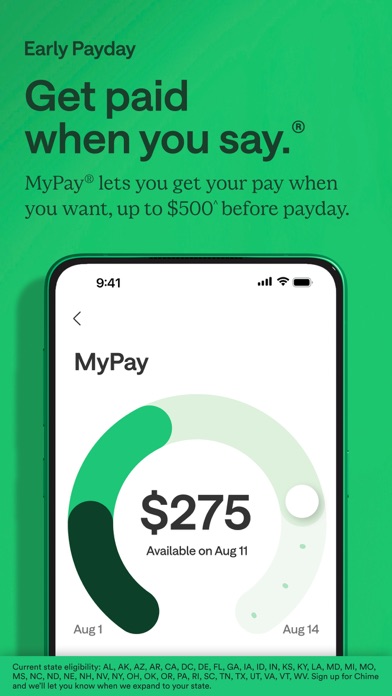

2. Early Direct Deposit for Your Paycheck

One of Chime's flagship features is its ability to post paychecks up to two days early. Imagine waking up on payday and seeing your funds already available — it feels like having a financial concierge working behind the scenes to prioritize your cash flow. This feature is especially attractive for users managing tight schedules or living paycheck-to-paycheck, providing immediate access to earned wages without waiting for traditional banking cycles.

3. Automatic Savings with a Clever Twist

Chime offers an intuitive savings feature that rounds up everyday transactions to the nearest dollar and transfers the difference into your savings account automatically. It's like having a smart piggy bank that quietly siphons spare change whenever you spend. This small but powerful feature encourages consistent saving habits without requiring active effort, helping users build a financial cushion effortlessly.

Experience and User Interface: Friendly, Intuitive, and Smooth

Stepping into the Chime app feels like walking into a well-organized, brightly lit workspace — everything is positioned thoughtfully, with vibrant icons and a clean layout that invites exploration. Navigating between account balances, transaction histories, and savings goals is seamless thanks to the intuitive navigation system. The app opens swiftly, with a responsiveness that feels more akin to chatting with a capable friend rather than wrestling with a complex tool. Even first-time users will find the learning curve gentle, thanks to clear prompts and straightforward process flows.

Unlike some financial apps that try to cram endless details upfront, Chime maintains a minimalist aesthetic that balances functionality and clarity, making financial management less daunting and more engaging.

What Sets Chime Apart: Security and Transaction Experience

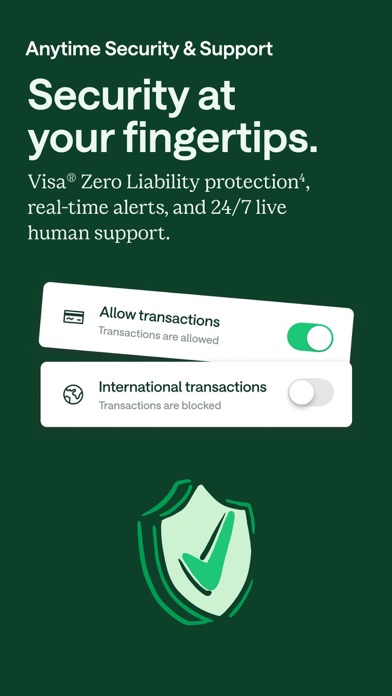

When it comes to financial apps, security is paramount, and Chime doesn't disappoint. Its approach to account and fund security employs robust encryption, real-time fraud monitoring, and instant transaction alerts. These features act like a vigilant security guard, always watching over your hard-earned money and notifying you of any suspicious activity immediately.

Additionally, Chime's transaction experience emphasizes speed and reliability. The app processes deposits, payments, and transfers swiftly, often faster than traditional banks. If you imagine your money as a fleet of delivery drones, Chime ensures they are dispatched quickly and efficiently, providing peace of mind and a sense of control. Its integration with a vast ATM network further improves access, eliminating the frustration of limited withdrawal points that plague other digital banks.

Final Verdict: A Gentle Recommendation for Modern Bankers

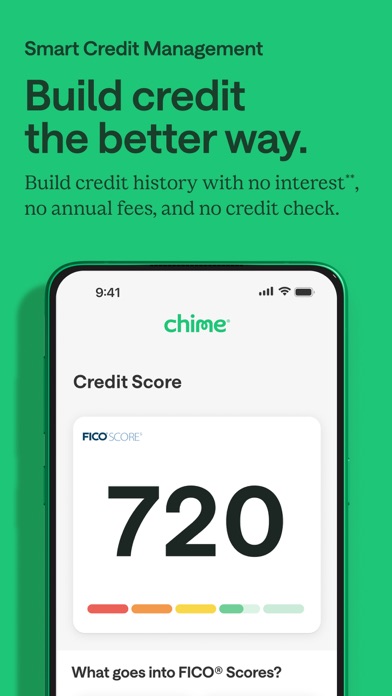

Chime is best suited for users seeking a no-fuss, fee-free banking alternative that emphasizes security, simplicity, and immediate access to funds. It's ideal for those new to digital banking or anyone frustrated by hidden fees and slow transactions in traditional banks. Its standout features, especially early direct deposit and automatic savings, serve as powerful tools for improving financial habits without demanding extra effort.

While it may lack some advanced features found in comprehensive finance apps, its focus on core banking essentials done well makes it a reliable choice. If you're comfortable with a streamlined, user-friendly app that prioritizes your security and convenience, Chime deserves serious consideration. Just think of it as your trusty financial sidekick — always there when you need it, quietly working behind the scenes to keep your money safe and accessible.

Similar to This App

Pros

User-Friendly Interface

Chime offers an intuitive app design that makes banking simple for users of all ages.

No Monthly Fees

The app provides free checking accounts without maintenance fees, saving users money.

Early Direct Deposit Access

Users can access their paycheck funds up to two days early, enhancing cash flow management.

Automatic Savings Features

The app encourages savings through automatic round-ups and scheduled transfers.

Built-in Security Measures

Chime employs robust security measures like instant transaction alerts and account freeze options.

Cons

Limited banking services (impact: low)

Chime mainly offers checking and savings accounts, lacking features like loans or investment products.

Occasional app outages (impact: medium)

Users have reported brief service disruptions; Chime is working to improve system reliability.

No physical branches (impact: low)

All banking is digital, which may inconvenience users who prefer in-person banking; solutions include nearby ATM networks.

Customer service wait times (impact: medium)

Some users experience longer wait times for support; Chime plans to expand its support team.

Limited international access (impact: low)

The app is primarily US-focused; international users cannot access all features outside the US.

Frequently Asked Questions

How do I sign up for Chime and create an account?

Download the app, tap Sign Up, and follow the prompts to provide personal info and verify your identity through the app interface.

Is there a minimum deposit to open a Chime account?

No, Chime has no minimum deposit requirement. Simply fund your account through direct deposit or deposited checks.

How do I set up or change my direct deposit for early paycheck access?

Go to Settings > ACH & Payments > Direct Deposit, then enter your employer's routing and account numbers to set up or update.

How do I enable automatic savings within the app?

Navigate to Settings > Save & Grow > Automatic Savings, then toggle it on and set your preferred savings amount or rules.

How can I access my high-yield savings account?

Open the app, go to the Savings tab, and select your high-yield savings account to view your balance and manage savings.

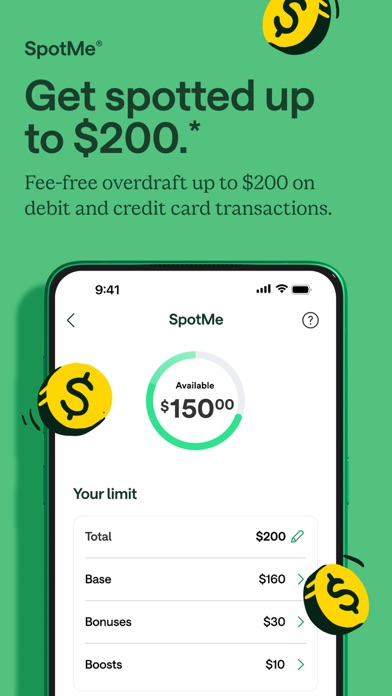

How do I access or activate the SpotMe overdraft feature?

Go to Settings > SpotMe, then follow instructions to enable SpotMe and set your overdraft limit up to $200 within in-network ATMs.

Are there any fees for using Chime's ATM network?

No, Chime offers free in-network ATM withdrawals. Out-of-network ATMs may incur fees, so use the fee-free network whenever possible.

What are the costs or charges associated with Chime?

Chime operates with no monthly fees, no overdraft fees with SpotMe, and free ATM use in-network. Check the app for specific fee policies.

How do I report a problem or suspicious activity on my account?

Tap Support/Help in the app, then select Contact Us to chat with a representative or call 24/7 live customer support for assistance.

Why can't I deposit a check via mobile deposit?

Ensure the check is properly endorsed and well-lit. If issues persist, go to Settings > Support to contact customer service for help.