- Category Finance

- Version9.90.1

- Downloads 0.01B

- Content Rating Everyone

Introduction: A Modern, Reliable Companion for Your Banking Needs

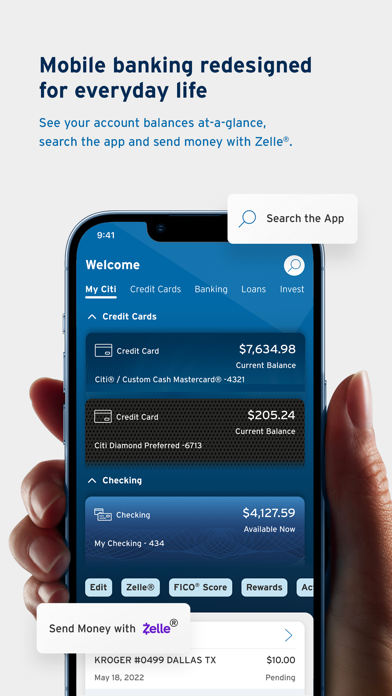

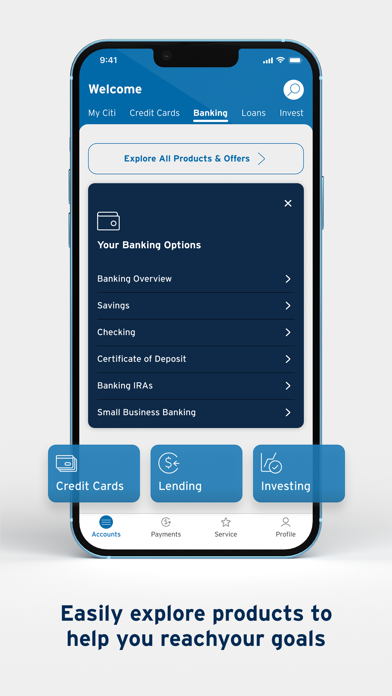

Citi Mobile® is a thoughtfully crafted mobile banking application designed to bring the bank's services directly into your palm with ease and security. Developed by Citibank's dedicated mobile team, this app aims to provide a seamless banking experience tailored for today's busy and tech-savvy users. Whether you're managing daily expenses, transferring funds, or checking investments, Citi Mobile® positions itself as a comprehensive digital financial partner. Its main highlights include robust security features, intuitive transaction processes, and personalized financial insights, making it ideal for urban professionals, frequent travelers, and tech-minded individuals seeking a trustworthy banking solution on the go.

Intuitive Interface and User Experience: Banking Made Simple

Upon launching Citi Mobile®, users are greeted with a sleek, modern interface that feels both welcoming and professional. The design emphasizes clarity—think of it as a well-organized dashboard in your favorite dashboard car, where every switch and display has its place. Navigation flows smoothly like a gentle river, thanks to thoughtful touch responses and minimal clutter.

The app's learning curve is gentle; most users report feeling comfortable within minutes. Features are accessible through straightforward tabs, and even first-time users quickly grasp how to perform common tasks such as checking balances or initiating transfers. The app's responsiveness enhances user experience, ensuring transitions between screens are instantaneous, which is particularly critical when managing time-sensitive transactions.

Core Functionalities: Power and Precision in Your Hands

Secure Transactions with Advanced Account Safety

Security is at the heart of Citi Mobile®. The app employs multiple layers of protection, from biometric authentication—such as fingerprint and face recognition—to one-time passcodes sent via secure channels. These measures work behind the scenes like a vigilant security guard, ensuring that unauthorized access is virtually impossible. Unique to Citi Mobile® is its proactive fraud alert system, which monitors suspicious activities and notifies users immediately, adding an extra layer of reassurance. This focus on security stands out from many peers that often rely solely on password protection, positioning Citi Mobile® as a trustworthy guardian of your financial assets.

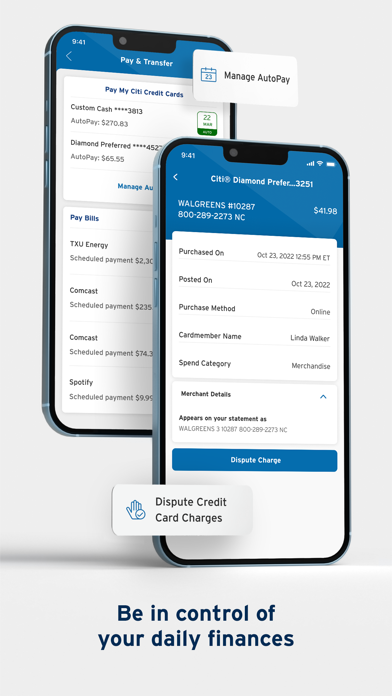

Streamlined Transaction Experience

Executing bank transfers or bill payments within Citi Mobile® feels as effortless as messaging a friend. The app structures transaction steps logically, minimizing effort and reducing errors. Smart prompts guide users through each phase, while real-time confirmation screens assure that your money is headed precisely where intended. Notably, the app offers quick-access options for recurring payments and template creation, transforming repetitive tasks into tap-and-go actions. This efficiency makes everyday banking feel less like a chore and more like a swift conversation.

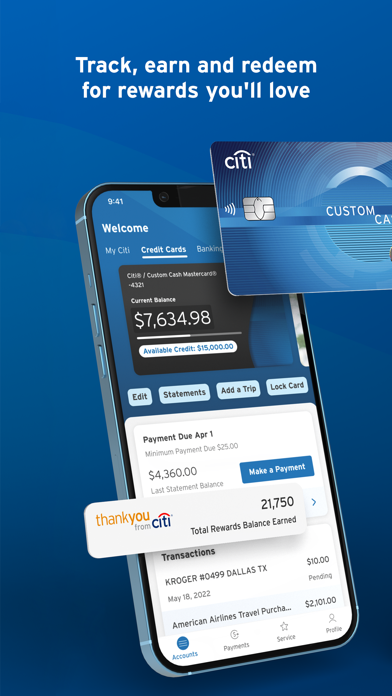

Personal Financial Management and Insights

One of Citi Mobile®'s standout features is its ability to provide personalized insights into your spending habits and financial health. Using colorful visualizations and tailored recommendations, the app helps you understand where your money goes and suggests ways to optimize your budget. Imagine having a friendly financial advisor within your pocket, guiding you towards smarter financial decisions with clear, digestible data. This proactive approach helps users stay on top of their finances without feeling overwhelmed, setting Citi Mobile® apart from more basic banking apps that merely display account balances.

Final Thoughts and Recommendations

Overall, Citi Mobile® offers a compelling blend of security, ease of use, and insightful features that cater to modern banking needs. Its focus on transaction security and smart insights are particularly noteworthy, providing users with peace of mind and actionable information. The app's polished design and responsive experience make daily banking tasks straightforward, transforming what could be mundane into an intuitive process.

If you prioritize a secure platform that doesn't compromise on usability and value tailored financial insights, Citi Mobile® is highly recommended. It's especially suited for users who travel frequently or handle complex financial portfolios, as its security measures are robust and its transaction experience smooth. For those seeking a dependable, user-friendly mobile banking app that feels almost like having a personal financial assistant by your side, Citi Mobile® is an excellent choice to incorporate into your digital lifestyle.

Similar to This App

Pros

User-Friendly Interface

Simple and intuitive design makes navigation easy for users of all ages.

Robust Security Features

Multiple layers of encryption and biometric login ensure account safety.

Real-Time Transaction Updates

Users receive instant notifications for transactions, improving financial awareness.

Comprehensive Account Management

Supports multiple account types, including checking, savings, and credit cards.

Excellent Customer Support Integration

Built-in messaging and helpline options provide quick assistance when needed.

Cons

Limited Investment Options (impact: medium)

Currently, investment features are minimal; expanding options could be beneficial.

Occasional App Freezes (impact: low)

Some users report temporary freezes during high-traffic periods; restarting the app can mitigate this.

Slow Loading Times on Older Devices (impact: medium)

The app may take longer to load on older smartphones; updating device or app will help.

Limited Customization Options (impact: low)

Personalization features are basic; future updates may include more themes and layout options.

Occasional Synchronization Delays (impact: medium)

Some users experience slight delays syncing data across devices; official updates are expected to improve this.

Frequently Asked Questions

How do I set up Citi Mobile® for the first time?

Download the app from your app store, open it, and follow the on-screen instructions to securely log in or register your account.

Can I open a new bank account through the app?

Yes, you can open checking or savings accounts directly via Citi Mobile® under the 'Account Services' or 'Open New Account' menu.

How do I deposit a check using the app?

Use the 'Deposit Checks' feature by taking photos of your check within the app, following the prompts under 'Transfers & Payments.'

What are the main features of Citi Mobile®?

It offers account management, quick payments, card lock/unlock, transaction tracking, bill payments, financial insights, and credit score monitoring.

How can I lock or unlock my Citi card if it's lost?

Navigate to 'Manage Cards' > 'Secure Citi® Quick Lock' to instantly lock or unlock your card from the app.

How do I enable biometric login for secure access?

Go to Settings > Security > Enable Biometric Authentication to use fingerprint or facial recognition for login.

Are there any subscription fees for using Citi Mobile®?

Citi Mobile® is free to download and use; however, charges may apply for certain transactions or services, depending on your account type.

How do I view my FICO® Score in the app?

Access 'Credit & Scores' from the main menu to view your free FICO® Score, available to Citi credit cardholders.

What should I do if I encounter a technical issue with the app?

Try restarting your device, check for app updates, or contact Citi Mobile® in-app support via chat for assistance.

Can I customize the app's dashboard to fit my needs?

Yes, personalize your dashboard by rearranging features and setting shortcuts in the app's 'Settings' menu for quick access.