- Category Finance

- Version26.1.0

- Downloads 1.00M

- Content Rating Everyone

Citizens Bank Mobile Banking: A Modern Approach to Managing Your Finances

Citizens Bank Mobile Banking stands out as a reliable and user-friendly app designed to streamline everyday banking tasks while emphasizing security and a seamless user experience. Crafted by Citizens Bank's dedicated development team, this app caters to customers seeking convenient access to their accounts anytime, anywhere.

Key Features That Make a Difference

With an emphasis on simplicity paired with powerful functionality, Citizens Bank Mobile Banking offers core features such as account management, secure fund transfers, and personalized financial insights. Notably, the app integrates advanced security protocols and an intuitive interface, making banking feel less like a chore and more like a trusted companion in your financial journey.

A Friendly Introduction to Digital Banking Ease

Imagine waking up on a busy morning, coffee in hand, checking your account with a swipe. Citizens Bank Mobile Banking transforms this everyday scene into a smooth, almost soothing experience. It's like having your bank branch in your pocket—ready to assist, inform, and protect your assets at your fingertips. Whether you're managing bills, reviewing transaction history, or making quick transfers, this app aims to make those tasks effortless and stress-free.

Core Functionality Deep Dive

Streamlined Account Management and Monitoring

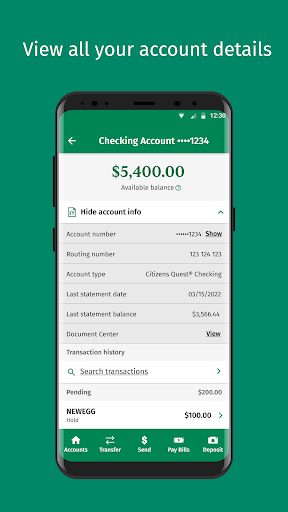

The app provides a clear dashboard that consolidates all your accounts—including checking, savings, and loans—into one accessible view. It's akin to having a financial cockpit, with real-time balances, recent transactions, and alerts readily available. The intuitive layout ensures that even financial novices can navigate with ease, reducing the typical learning curve associated with digital banking. The responsive design adapts smoothly across devices, making account monitoring a quick task during coffee breaks or commutes.

Secure and Effortless Transactions

One of the standout features is its robust security measures combined with flexible transfer options. Citizens Bank employs multi-layered security protocols, including biometric authentication and encryption, to safeguard your funds. Transferring money between your accounts, paying bills, or even depositing checks through photo capture is designed to be straightforward. The transaction experience feels both secure and immediate, akin to handing off cash—except with the added confidence that your digital key is well-guarded. This dual emphasis on security and simplicity distinguishes it from many competitors, focusing on protecting your assets without sacrificing convenience.

Evaluating User Experience and Unique Strengths

The interface of Citizens Bank Mobile Banking strikes a balance between modern aesthetic and functional clarity. With its clean lines, logical navigation, and snappy response times, users often find themselves slipping into a familiar rhythm—like chronically revisiting an old favorite book that still offers surprises. The app's learning curve is gentle, welcoming newcomers without overwhelming them with features, yet packed enough for seasoned users to appreciate nuanced functionalities.

Compared with other finance apps, Citizens Bank's app notably advances the standards of account and fund security—utilizing state-of-the-art encryption and biometric authentication. It elevates transaction experience by combining speed with reassurance, ensuring that every interaction feels both immediate and protected. Its commitment to security doesn't come at the expense of ease; rather, it enhances user confidence in digital transactions.

Final Verdict: A Solid Choice for Secure, Everyday Banking

If you're seeking a banking app that doesn't just look good but performs reliably with top-tier security, Citizens Bank Mobile Banking is worth considering. Its most distinctive features—advanced security coupled with a fluid transaction experience—make it particularly appealing for users who prioritize safety without sacrificing speed and simplicity. While it might not replace more comprehensive financial management apps for complex needs, it's an excellent choice for everyday banking essentials. I'd recommend it to anyone who values ease, security, and a friendly digital interface for managing their finances on the go.

Similar to This App

Pros

User-Friendly Interface

The app offers a clean and intuitive layout, making navigation straightforward for all users.

Fast Transaction Processing

Transfers and bill payments are quick, often completing within seconds, enhancing user efficiency.

Robust Security Measures

Features like multi-factor authentication provide secure access to sensitive banking information.

Comprehensive Account Management

Users can easily view account details, transaction history, and manage multiple accounts seamlessly.

Excellent Customer Support Access

In-app chat and help options facilitate quick resolution of user issues.

Cons

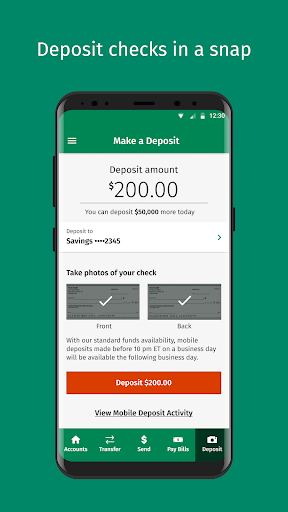

Limited Mobile Check Deposit Limits (impact: medium)

Deposit limits can be restrictive; users may need multiple deposits for larger checks, but official updates are promised.

Occasional App Crashes During Peak Hours (impact: medium)

Users have reported crashes during intense usage, which may temporarily disrupt banking activities.

Delayed Notifications for New Transactions (impact: low)

Push notifications can sometimes be delayed, leading to possible confusion about recent account activity.

Limited Budgeting Tools (impact: low)

The app lacks advanced budgeting features, though Citizens Bank is considering future updates.

Some Features Not Available on Older Devices

Compatibility issues may limit certain functionalities on outdated smartphones, but official support plans are expected to address this.

Frequently Asked Questions

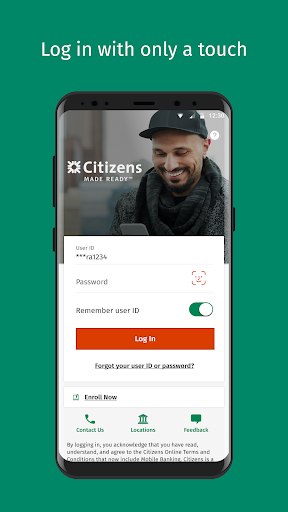

How do I get started with Citizens Bank Mobile Banking app?

Download the app from the App Store or Google Play, then log in with your existing online banking credentials to access your accounts and features.

Is there a way to quickly set up mobile deposits?

Yes, open the app, select 'Deposit Checks,' take clear photos of your check, and submit before 10 pm ET for same-day credit.

How do I view my account balances and transactions?

Log into the app, and your account balances and recent transactions will be displayed on the dashboard for easy monitoring.

Can I transfer money between my Citizens Bank accounts?

Yes, go to 'Transfer,' select your accounts, enter the amount, and confirm to transfer funds seamlessly within your accounts.

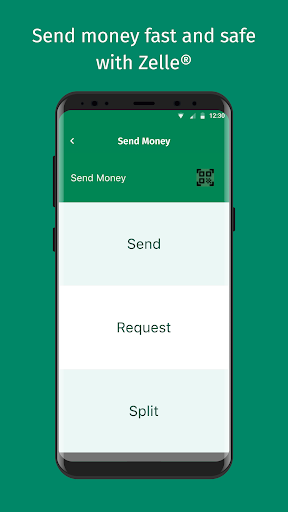

How do I send money to someone using Zelle®?

Navigate to 'Send Money,' choose Zelle®, enter the recipient's email or phone number, and follow prompts to complete the payment securely.

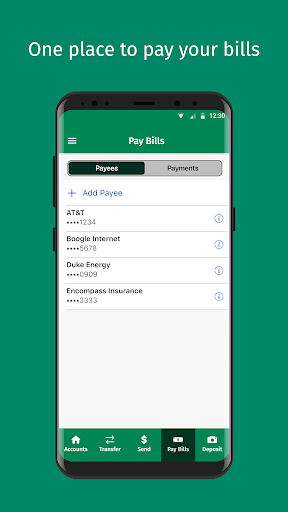

How do I pay my bills through the app?

Access 'Bill Pay,' add payees, schedule payments, or set up automatic payments to manage your bills easily from the app.

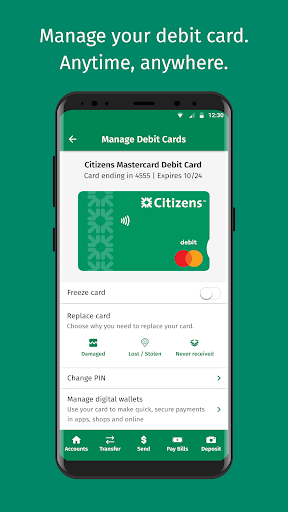

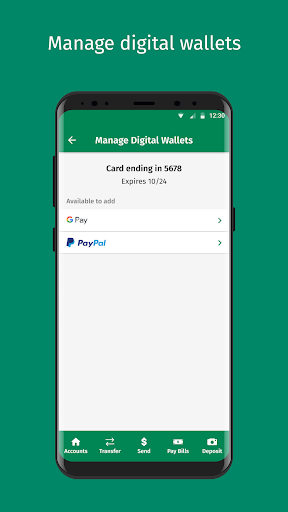

Are there any security features to protect my account?

Yes, the app uses encryption, and you can lock your card instantly in settings under 'Manage Cards' if lost or stolen.

What should I do if I forget my login credentials?

Use the 'Forgot Password' or 'Forgot Username' option on the login page and follow instructions to recover or reset your credentials.

Is there a fee for using the Citizens Bank Mobile Banking app?

The app is generally free to download and use; however, standard banking fees may apply for certain transactions—check your account terms.

What do I do if the app crashes or encounters an error?

Try updating the app, restart your device, or reinstall the app. If issues persist, contact Citizens Bank customer support for assistance.