- Category Finance

- Version7.0.4

- Downloads 5.00M

- Content Rating Everyone

Introducing Classic Netspend: A User-Friendly Prepaid Card Management App

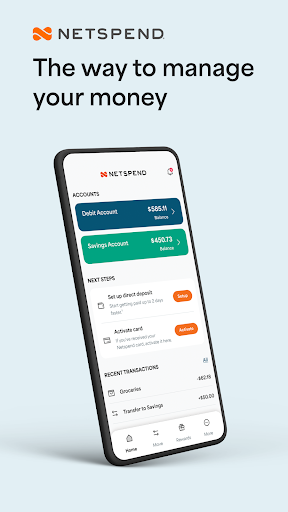

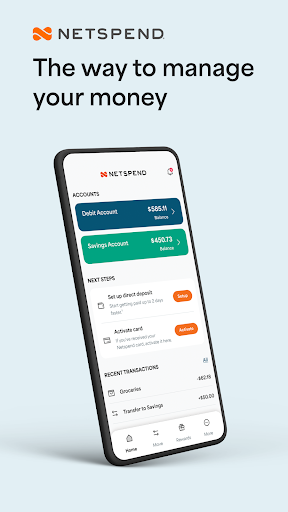

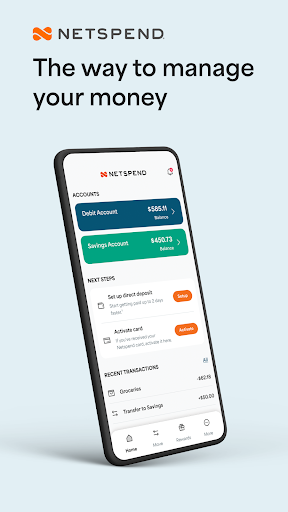

Classic Netspend is a comprehensive application designed to help users easily manage their prepaid debit cards, offering a suite of features focused on security, convenience, and financial insight. Developed by the innovative team behind Netspend, this app aims to simplify everyday banking tasks for a diverse user base.

Who's Behind It?

Developed by Netspend Corporation, a well-established player in the prepaid financial services industry, the app benefits from years of experience in secure and user-centric financial technology solutions.

Key Highlights & Main Features

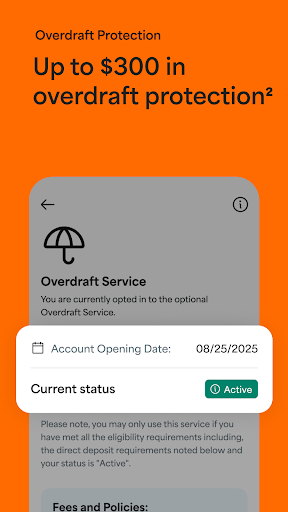

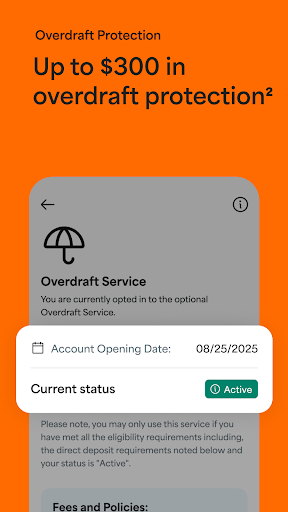

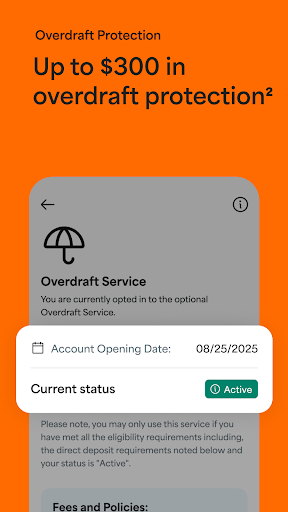

- Enhanced Account and Fund Security: Advanced security measures, including multi-factor authentication and real-time monitoring, ensure users' funds are protected.

- Streamlined Transaction Management: Users can easily view transaction histories, categorize expenses, and set alerts for suspicious activity, making money management straightforward.

- Intuitive User Interface with Seamless Navigation: Designed with usability in mind, the app's clean layout and straightforward workflows enable both tech-savvy individuals and beginners to navigate efficiently.

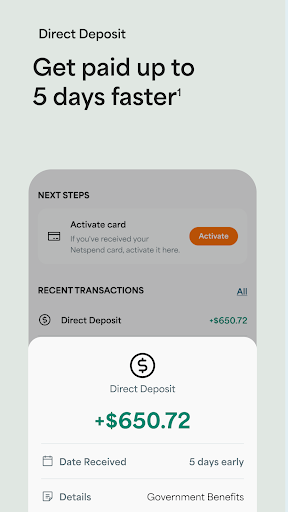

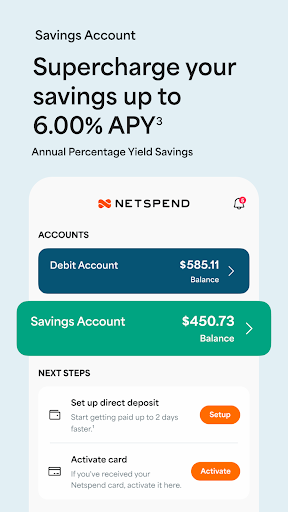

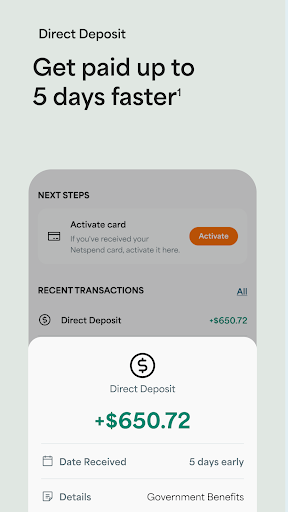

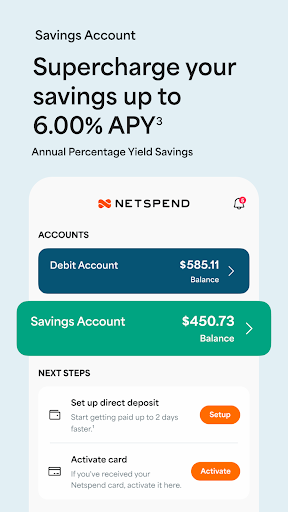

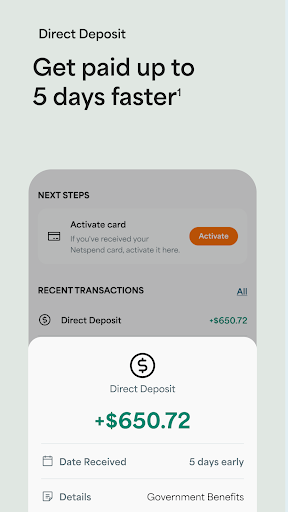

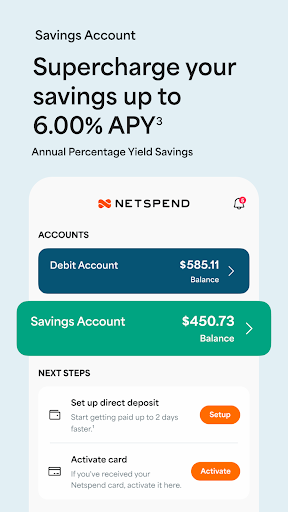

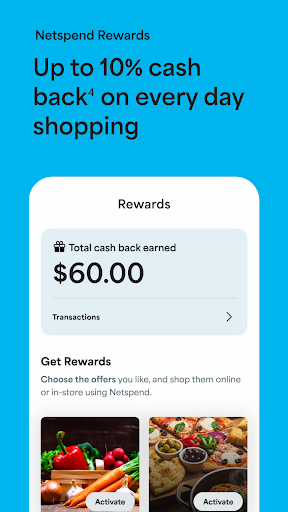

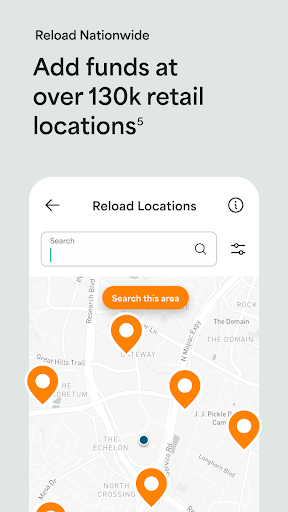

- Additional Perks: Features like direct deposit, reload options, and budgeting tools cater to a wide range of financial needs.

Deep Dive into Core Functionalities

Security First: Safeguarding Your Money and Data

Security is paramount when it comes to financial apps, and Classic Netspend sets itself apart with robust safeguards. The app employs multi-factor authentication (MFA) to verify user identities, reducing the risk of unauthorized access. Additionally, real-time alerts notify users of any suspicious transactions, acting as an early warning system. The app's encryption standards align with industry best practices, ensuring that sensitive information like account details and transaction data remains confidential. For users wary of digital fraud, these features provide an essential peace of mind, making managing prepaid cards feel safe and reliable.

Smooth and Intuitive Transaction Experience

Performing transactions with Classic Netspend is as easy as swiping a card at an outdoor market—you get everything done swiftly and without hassle. The home screen displays recent activity along with quick options to add funds, transfer money, or pay bills. The process flows logically, minimizing step counts and cognitive load. Categorization of expenses and interactive charts help users analyze their spending patterns effortlessly. Unlike some apps where navigation feels like navigating a maze, here it's more akin to strolling along a well-paved path, encouraging extended usage without frustration.

Design, Usability, and Learning Curve

The app sports a sleek, modern interface with vibrant icons and a clean layout, making it visually appealing and easy to scan at a glance. The onboarding process is straightforward, featuring guided tutorials for first-time users. Most actions, from checking balances to setting up direct deposit, require just a few taps. Even beginners can quickly get comfortable, thanks to clear labels and logical structuring. Transitioning from traditional bank apps might take a slight adjustment, but overall, users will find the learning curve gentle—almost like learning to ride a bike with training wheels.

What Sets Classic Netspend Apart?

While many financial apps focus solely on transaction tracking or simple card management, Classic Netspend introduces notable differentiators, particularly in account and fund security, coupled with a pleasurable transaction experience. Its cutting-edge security measures make it a trustworthy companion for managing disposable income, underpinning confidence in a gamified, streamlined interface. The real-time alerts and multi-layered security features create a fortress around your funds, a vital edge in an era of digital threats.

Moreover, its emphasis on user experience — from minimal onboarding to visually engaging dashboards — offers a higher level of satisfaction compared to more utilitarian counterparts. These elements combined position Classic Netspend not just as a functional tool but as a reliable financial partner that works quietly in the background, empowering users to stay in control of their money with ease.

Final Verdict and Recommendations

Overall, I'd recommend Classic Netspend to anyone seeking a secure, easy-to-use prepaid card management app. Its strongest points—the security architecture and intuitive transaction flow—address common user pain points effectively. Perfect for students, gig workers, or anyone seeking a straightforward way to manage their funds without fuss.

For those already using prepaid cards or seeking an alternative to traditional banking apps, Classic Netspend provides a compelling blend of safety and simplicity. Just keep in mind that while it excels in core features, those looking for complex investment tools or advanced financial planning may need additional solutions. But if your priority is dependable card management with peace of mind, this app deserves a spot on your device.

Similar to This App

Pros

User-Friendly Interface

The app offers an intuitive layout, making it easy for users to navigate and manage their accounts efficiently.

Comprehensive Spending Tracking

Provides detailed transaction histories and spending insights, helping users monitor their finances effectively.

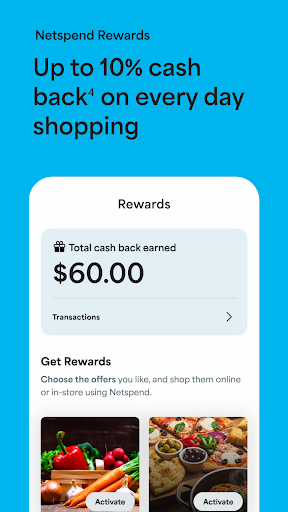

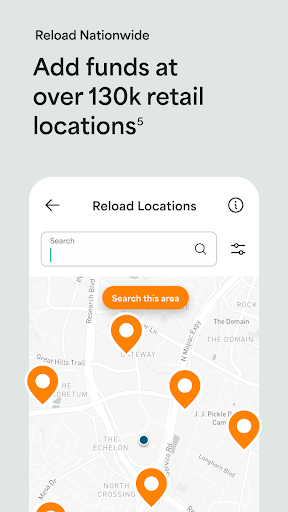

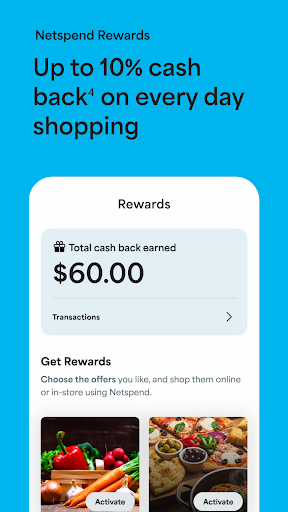

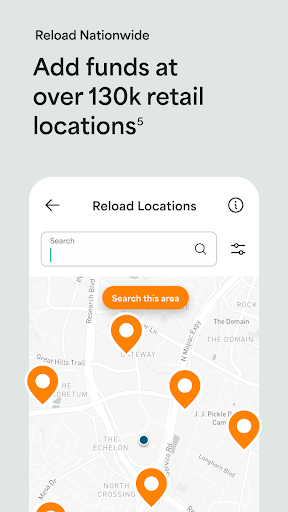

Quick Reload Options

Allows instant fund reloading via bank transfers, cash reloads, or partner locations, enhancing convenience.

Security Features

Includes fraud protection and enabling users to set alerts, ensuring account safety.

Offline Card Usage Details

Displays recent transactions even without internet connectivity, useful for immediate financial overview.

Cons

Limited Budgeting Tools (impact: Medium)

The app lacks advanced budgeting features, which might affect users seeking detailed financial planning solutions.

Occasional App Crashes (impact: Medium)

Some users experience app crashes during high traffic periods; restarting the app often resolves the issue.

Delayed Customer Support Response (impact: Low)

Customer service response times can be slow, but improvements are expected with upcoming updates.

Restricted International Use (impact: Low)

The app is primarily designed for domestic use; international transactions may have limitations or delays.

Minimal Investment Features (impact: Low)

Currently, the app does not support investment options, but future updates may include such features.

Frequently Asked Questions

How do I get started with creating an account on Classic Netspend?

Download the app for Android or iOS, then open it and follow the on-screen instructions to register by entering your basic details and linking your bank account.

Is the Classic Netspend app available for both Android and iOS devices?

Yes, the app is available for download on both Google Play Store and Apple App Store, ensuring compatibility across devices.

How can I check my account balance and recent transactions easily?

Open the app, and on the main dashboard, you'll see your balance and a transaction history tab for quick access.

What features does Classic Netspend offer to help manage my budget?

The app provides budgeting tools like spending limits and expense tracking to help you monitor and control your finances in real time.

How does the app support international transactions?

Go to Payments > Send Money, then select international transfer options to manage transactions while abroad easily.

Can I receive my direct deposit payments earlier with Classic Netspend?

Yes, the app supports faster funding by allowing you to receive direct deposits up to two days earlier than traditional banks.

How secure is my personal and financial information on the app?

The app uses biometric login options and provides instant alerts on suspicious activity to keep your data safe and secure.

Are there any subscription fees for using Classic Netspend?

Check Settings > Account > Subscriptions to view current plans; some features may have fees, but basic usage is often free.

What should I do if I forget my login credentials?

On the login screen, tap ‘Forgot Password' and follow the prompts to reset your password via email or phone verification.

How do I contact customer support if I encounter a problem?

Navigate to Settings > Help > Contact Support within the app to get assistance from the customer service team quickly.