- Category Finance

- Version3.36.0

- Downloads 5.00M

- Content Rating Teen

Introducing Cleo AI: A Smart Companion for Your Financial Flexibility

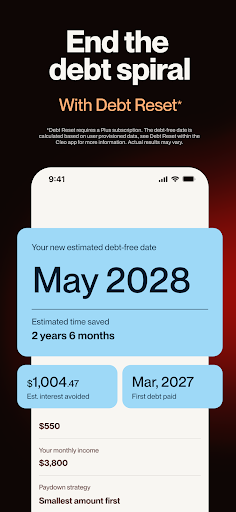

Cleo AI is a user-friendly mobile application designed to provide quick cash advances and credit management, helping users navigate their financial lives with confidence and ease. It's not just about borrowing; it's about making borrowing smarter and more transparent.

Developed by a Forward-Thinking Team with a Focus on User Empowerment

Created by the innovative team at Cleo Finance Labs, this app combines cutting-edge technology with an intuitive interface. The development team focuses on delivering reliable financial tools that are accessible to everyday users, emphasizing transparency, security, and ease of use.

Key Features That Make Cleo Stand Out

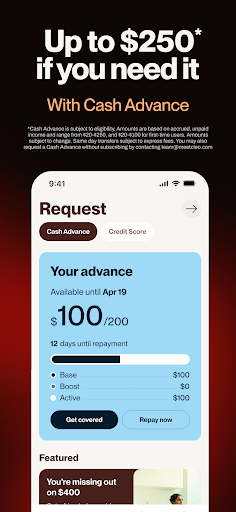

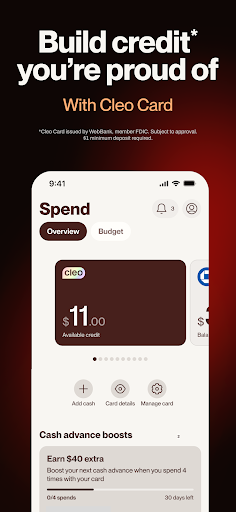

- Instant Cash Advances: Access short-term funds rapidly without lengthy approval processes, ideal for urgent expenses.

- Personalized Credit Insights: Get tailored recommendations and insights to optimize your credit score and borrowing habits.

- Secure Transaction Environment: State-of-the-art security protocols ensure your financial data remains protected at all times.

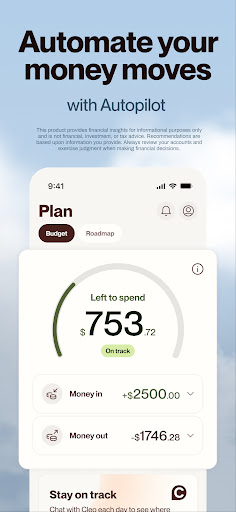

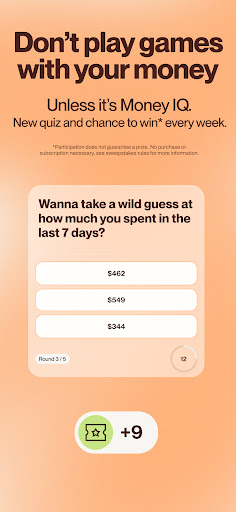

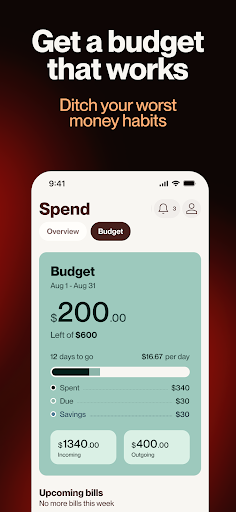

- Financial Literacy & Budgeting Tools: Interactive features help users understand their spending and planning for future financial goals.

Bringing Finance to Life: A User-Friendly Experience

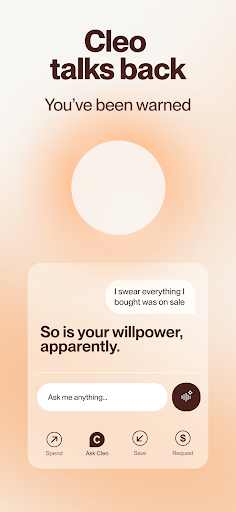

Jumping into a new financial app can sometimes feel like learning a new language—full of charts, numbers, and complex jargon. But Cleo AI simplifies this with its lively, engaging interface that feels more like chatting with a knowledgeable friend. Its design is clean and inviting, with colorful icons and straightforward navigation that make even the most nuanced functions feel accessible.

Core Functionality Deep Dive: Speed, Security, and Smarts

The standout feature of Cleo is undoubtedly its instant cash advance capability. Imagine a scenario where sudden medical expenses or car repairs hit you out of nowhere—Cleo acts as a financial quick-escaper, offering small, short-term loans with minimal hassle. The process is streamlined: input your amount, confirm in a few taps, and funds are transferred swiftly. Unlike many competitors, Cleo emphasizes transparency by clearly presenting repayment terms upfront, avoiding hidden fees or surprises.

Another core aspect is its credit insight engine. Cleo doesn't just lend money; it helps you understand and improve your credit profile through personalized tips. Think of it as your financial GPS, guiding you around potential pitfalls and toward better borrowing habits. Its recommendations are easy to grasp and tailored to your unique situation, enabling smarter financial choices over time.

Security is another pillar supporting Cleo's reputation—it's built with advanced encryption standards and multi-factor authentication, ensuring your data remains locked tight. Compared to many other apps, Cleo makes the safety of your information a priority without compromising usability, giving a sense of trust that's crucial when dealing with sensitive financial data.

Experience Factors – Design, Usability, and Differentiation

The app's interface is akin to a well-organized toolbox—everything you need is within easy reach, and the learning curve is gentle. Even first-time users find themselves navigating without frustration, thanks to thoughtful onboarding and helpful prompts. The reaction speed is smooth, with transitions and responses feeling seamless, creating a gratifying experience that keeps users engaged rather than confused.

What sets Cleo apart from other finance apps is its genuine focus on user empowerment coupled with its security. While many competitors emphasize just lending or debt tracking, Cleo combines these with a proactive approach to financial education and security—making it a comprehensive companion. Its unique emphasis on transparent, rapid cash solutions combined with personalized credit insights creates a compelling edge in the crowded fintech marketplace.

Should You Give Cleo a Try? Our Recommendation

If you're someone who occasionally needs quick cash or wants a smarter way to understand and improve your credit, Cleo is definitely worth considering. Its balance of ease of use, security, and educational features makes it suitable for users across various financial literacy levels. However, if you're seeking extensive investment or long-term savings tools, this app might fall short of your needs. For quick, secure, and insightful financial assistance, Cleo shines brightly.

Overall, I'd rate Cleo AI as a highly recommendable app for those seeking reliable short-term financial support with a friendly user experience. It's like having a digital financial assistant right in your pocket—ready to lend a hand and help you grow more confident in managing your money.

Similar to This App

Pros

User-friendly interface

The app features a clean and intuitive design, making it easy for users to navigate and access features quickly.

Fast cash advances

Cleo AI offers quick approval processes, often enabling users to receive funds within minutes.

Clear fee structure

The app provides upfront information on fees and interest rates, helping users make informed decisions.

Financial insights and budgeting tools

Cleo AI offers personalized financial advice and expense tracking to improve user financial health.

No collateral required

Users can access cash advances without putting up collateral, reducing barriers to borrowing.

Cons

Limited credit reporting options (impact: medium)

Currently, Cleo AI may not report all loan repayments to major credit bureaus, which can affect credit building.

Interest rates can be relatively high (impact: high)

Some users might encounter higher-than-average interest rates, especially if repayment is delayed.

Limited availability in certain regions (impact: medium)

The app is not accessible in all countries, restricting potential users outside specific areas.

App notifications could be more customizable (impact: low)

Users may experience generic alerts; however, official updates are expected to improve notification settings.

Customer support response times may vary (impact: low)

Support responses can sometimes be delayed, but increased staffing or automated help options could alleviate this.

Frequently Asked Questions

How do I link my bank account to Cleo for budgeting?

Download and open Cleo, go to Settings > Bank Accounts > Add Account, and securely connect your bank using Plaid.

How can I request a cash advance on Cleo?

Open the app, navigate to the Cash Advance feature, choose the amount (up to $250), and follow prompts to request your advance easily.

What is the process to build my credit with Cleo?

Use the cash advance feature with a small deposit (minimum $1), and access credit coaching via Settings > Credit Builder to improve your score.

How do I set a savings goal in Cleo?

Go to the Savings section, tap 'Set Goals,' enter your target amount, and start saving through Cleo's high-yield savings account.

Can I access my paycheck earlier with Cleo?

Yes, set up direct deposit in your bank account settings, and Cleo will allow access up to 2 days before your scheduled payday.

What are the subscription options available on Cleo?

Navigate to Settings > Subscriptions to explore options like Cleo Grow, Cleo Plus, and Cleo Credit Builder for additional features.

Is there a fee for requesting a cash advance?

No, Cleo's cash advances have no interest, fees, or credit checks. You repay exactly the amount you borrowed.

How do I upgrade my subscription to access more features?

Go to Settings > Subscriptions, choose your preferred plan (e.g., Cleo Plus), and follow the prompts to upgrade.

What should I do if I can't connect my bank account?

Ensure your bank supports Plaid, verify login info, and try reconnecting. If issues persist, contact Cleo support for assistance.

How is my data protected on Cleo?

Cleo uses secure encryption and follows privacy policies. For details, visit meetcleo.com/page/privacy-policy.