- Category Finance

- Version3.0.8

- Downloads 0.50M

- Content Rating Everyone

Concora Credit: A Modern Companion for Smarter Financial Management

Concora Credit is a sleek and intuitive app designed to simplify and enhance your financial life, combining advanced security with seamless transaction experiences. Developed by a dedicated team passionate about fintech innovation, it aims to appeal to individuals seeking a secure and user-friendly platform for managing their credit and financial activities. Its standout features include real-time credit monitoring, personalized financial insights, and robust transaction security, making it a compelling choice for modern consumers.

First Impressions: A Fresh Breeze in Fintech

Stepping into the world of Concora Credit feels like entering a well-designed cockpit—everything is where it should be, and each feature invites exploration. The interface exudes clarity, with a balance of minimalistic elegance and functional accessibility. Launching the app, you're greeted with a clean dashboard that highlights your current credit score, recent transactions, and personalized notifications. It's like having a trusted financial advisor in your pocket—friendly, informative, and always right there when you need guidance.

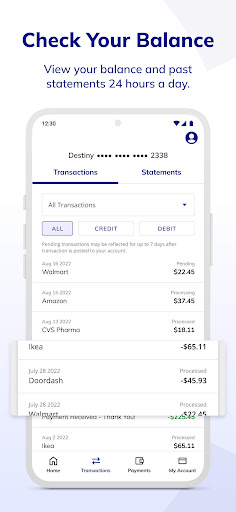

Core Functionality 1: Real-Time Credit Monitoring and Alerts

At the heart of Concora Credit lies its ability to provide real-time updates on your credit status. By securely connecting to major credit bureaus, the app offers instantaneous insights whenever there's a change—like a new inquiry or a balance update. Picture this feature as a vigilant guardian, quietly keeping watch and alerting you immediately if anything unusual occurs. This proactive approach empowers users to address potential issues before they snowball, making credit management less stressful and more controlled. Setting personalized thresholds and receiving instant alerts ensures you're always in the know without being overwhelmed.

Core Functionality 2: Secure Transactions with Smart Verification

One of the standout features of Concora Credit is its emphasis on transaction security. Using advanced encryption and multi-factor authentication, the app guarantees that your financial actions are safeguarded at every step. Imagine your transactions as meticulously guarded vaults—accessible only to you through strong, yet user-friendly, verification channels. Furthermore, the app offers smart transaction verification using biometric confirmation, making payments not just secure but also lightning-fast. This layer of sophistication reassures users that their sensitive operations are protected from fraud without sacrificing convenience.

Core Functionality 3: Personalized Financial Insights and Planning

Beyond just tracking numbers, Concora Credit endeavors to educate and guide its users. By analyzing spending habits and credit trends, the app generates tailored recommendations—whether it's optimizing credit utilization or suggesting savings strategies. Think of it as a friendly financial coach sitting in your pocket, providing insights in real-time that turn complex data into actionable steps. Its intuitive visualizations and clear summaries make understanding your financial health simple and motivating, encouraging smarter decisions over time.

User Experience: Elegant Simplicity Meets Responsive Performance

Using Concora Credit feels akin to navigating a well-organized workspace—everything is where you'd expect it to be, and the journey from login to action is fluid. The interface design champions simplicity, avoiding clutter while delivering rich functionality through well-thought-out menus and icons. The app responds swiftly to user inputs, with negligible lag even when loading detailed reports or updating security settings. Its learning curve is gentle; newcomers find it easy to get started thanks to clear onboarding and helpful tooltips. Seasoned users appreciate the depth of customization available to tailor their experience.

Unique Strengths: Standing Out in the Crowd

While many financial apps focus solely on tracking or transactions, Concora Credit's most exceptional feature lies in its combined emphasis on security and personalized insights. Its advanced credit monitoring, backed by real-time alerts, acts like a trusted watchdog—giving peace of mind that your credit score remains under constant surveillance. Meanwhile, its smart verification system streamlines secure transactions without sacrificing usability—something not all competitors achieve with such finesse. Compared to other finance apps, Concora Credit stands out by prioritizing the safety of your account and transaction data with an innovative approach that blends security seamlessly into everyday usage.

Final Recommendation: A Solid, Trustworthy Partner in Your Financial Journey

If you're someone who values a balance between robust security features and user-friendly experience, Concora Credit is worth considering. Its standout security measures and real-time credit updates make it especially suitable for users who prioritize peace of mind and proactive financial management. Beginners will find its gentle learning curve and clear insights encouraging, while seasoned users will appreciate its depth and customization options. Overall, I'd recommend it as a reliable, well-rounded tool that keeps your financial health front and center—consider it your trusted co-pilot in navigating the complex skies of personal finance.

Similar to This App

Pros

User-Friendly Interface

Concora Credit has an intuitive design that allows users to navigate effortlessly, even beginners.

Comprehensive Credit Assessment

The app offers detailed credit scoring tools, helping users make informed financial decisions.

Real-Time Updates

Users receive instant credit report updates, ensuring they have current information at all times.

Secure Data Encryption

Concora Credit employs advanced encryption protocols to protect user data and privacy.

Custom Financial Tips

The app provides personalized advice to improve credit health based on user profiles.

Cons

Limited International Coverage (impact: medium)

Currently, the app predominantly supports users in certain regions, which may restrict global users.

Occasional App Delays (impact: low)

Some users experience slight delays in fetching credit reports, which may improve with future updates.

Free Version Offers Basic Features Only (impact: medium)

Advanced analytics require a subscription, which might be a barrier for budget-conscious users.

Limited Customer Support Options (impact: low)

Support primarily through chat or email, with longer response times during peak hours, but official improvements are expected.

Some Features Require Upgraded Account (impact: low)

Certain useful tools are only accessible after upgrading, which may inconvenience casual users.

Frequently Asked Questions

How do I get started with Concora Credit app after download?

Open the app, create an account, verify your identity, and link your credit or retail accounts through the setup process on the home screen.

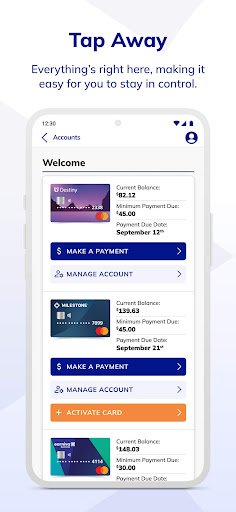

Can I manage multiple credit and retail accounts in one app?

Yes, the app supports viewing and managing multiple accounts like Mastercard, jewelry, and furniture store accounts with a single login.

How do I activate my new credit card in the app?

Navigate to Accounts > Select your card > Tap 'Activate' and follow on-screen instructions to activate your card quickly.

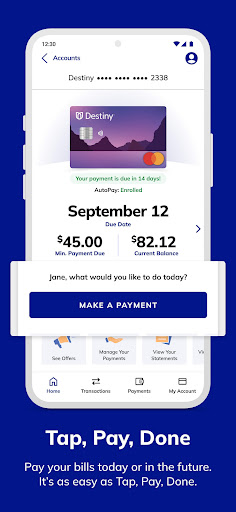

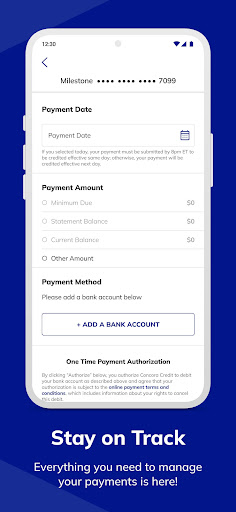

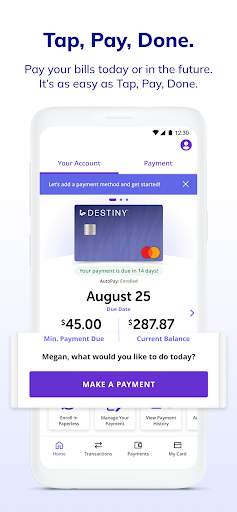

How can I make a payment through Concora Credit?

Go to the Payments tab, select your account, enter payment details, and confirm to complete your payment securely from anywhere.

How do I apply for a quick line of credit using the app?

Go to the Credit Application section, fill in your details, submit, and wait for the swift creditworthiness assessment and decision.

What options do I have for flexible repayment plans?

In your account settings, select 'Repayment Options' to view and choose a plan that fits your budget and financial situation.

Are my financial data safe in Concora Credit?

Yes, the app uses strong encryption protocols and security measures to protect your personal and financial information.

How can I adjust notification preferences?

Go to Settings > Notifications to customize alert frequency and types, including due date reminders and promotional offers.

Are there any costs or subscriptions required to use Concora Credit?

The app is free to download and use for account management; however, certain services like credit access may involve fees or interest, depending on your account.

What should I do if I encounter a technical issue with the app?

Contact Concora Credit customer support via the app's Help section or Settings > Support for assistance with technical problems.