- Category Finance

- Version3.0.11

- Downloads 1.00M

- Content Rating Everyone

Introducing Credit Genie: A Sleek Solution for Quick Cash Advances

Credit Genie is a user-centric financial app designed to help users access small cash advances seamlessly. Developed by a dedicated team in fintech innovation, it aims to provide a safe, efficient, and transparent avenue for short-term borrowing. Whether you're facing an unexpected expense or just need a financial breather, this app positions itself as a reliable companion in your financial toolkit.

Core Features That Stand Out

- Instant Cash Advances with No Hidden Fees: Quickly request and receive cash advances directly into your bank account without complicated procedures or hidden costs.

- Secure Account and Fund Management: Advanced encryption and biometric authentication ensure your financial data remains private and protected.

- User-Friendly Interface Designed for Simplicity: Easy navigation even for first-time users, with clear instructions and minimal steps to get funds.

- Personalized Loan Limits and Repayment Plans: Tailored options based on your credit profile and repayment history to make borrowing manageable.

A Fresh Take on Short-Term Borrowing

Imagine being caught in a downpour without an umbrella — Credit Genie is like offering you that timely umbrella, but in your pocket, when cash flow gets tight. It's not just another loan app; it's a pragmatic solution crafted to bridge financial gaps swiftly and securely. Its design feels like chatting with a knowledgeable friend rather than wading through complex financial jargon, making the borrowing process less daunting and more reassuring.

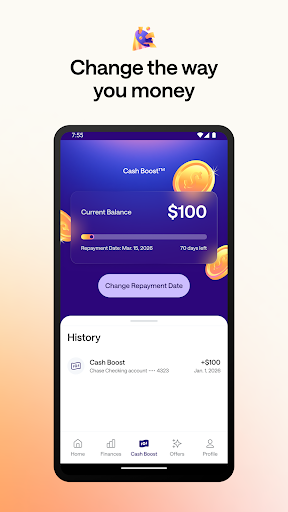

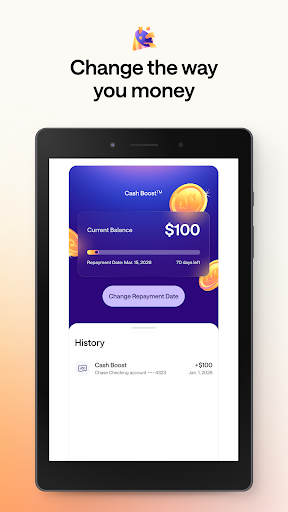

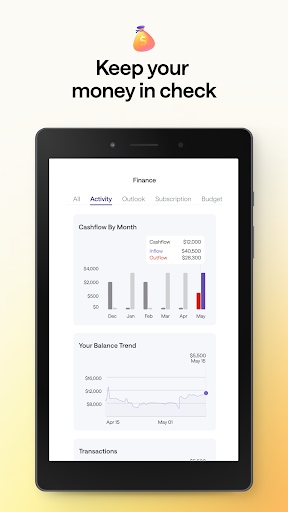

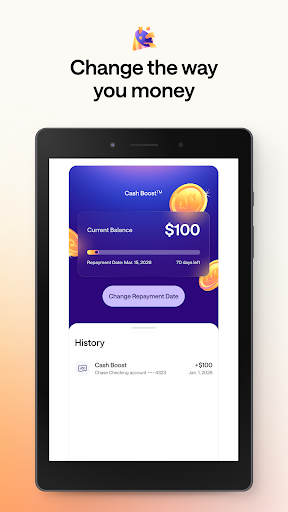

Streamlined Cash Requests and Fast Transfers

The core allure of Credit Genie lies in its ability to deliver funds almost instantaneously. Upon launching the app, users encounter a clean, modern dashboard that clearly displays their available credit and recent activity. Requesting a cash advance involves a few taps: input the amount, review the fee and repayment terms, and confirm. The magic happens in moments — funds are often deposited within minutes — a feature especially valuable when facing urgent expenses. This speed is a stark contrast to traditional payday loans that can take days to process. Additionally, the app's transparency about fees and repayment schedules eliminates the common anxiety surrounding hidden costs.

Security and Trust at Its Heart

Unlike many financial apps that sometimes raise eyebrows over data protection, Credit Genie prioritizes security. It employs bank-grade encryption, ensuring sensitive information remains unassailable. The biometric login options (fingerprint or facial recognition) add an extra layer of assurance, making sure that only you can access your financial data. Furthermore, the app's compliance with financial privacy regulations instills a sense of trust. This steadfast commitment to security isn't merely a feature, but a defining trait that sets Credit Genie apart in the crowded short-term lending sector.

Intuitive Design and User Experience

Ease of use is often the litmus test for financial apps, and Credit Genie passes with flying colors. Its interface is akin to a well-organized digital pocket — straightforward, clutter-free, and inviting. Navigating through borrowing, repayment, and account management feels effortless, even for tech novices. The learning curve is gentle; tutorials and tooltips guide new users smoothly. Transactions are quick and trouble-free, akin to a swift tap on a familiar smartphone app, which makes the entire process less intimidating and more accessible. This thoughtful design fosters confidence and encourages regular use.

What Makes Credit Genie Uniquely Special?

Compared to other finance apps, Credit Genie's most distinctive feature is its unwavering focus on security combined with its lightning-fast delivery of funds. In an ecosystem where data breaches and delayed transactions are common worries, its meticulous encryption and biometric options shine bright as a trust pillar. The seamless transaction experience — turning a small request into cash flow in minutes — makes it not just a tool but a reliable financial partner. Its personalized approach to credit limits ensures users are not overwhelmed, while transparent fee structures preserve trust. These aspects collectively elevate Credit Genie above many of its peers, making it a standout option for those seeking a safe and efficient short-term cash solution.

Final Verdict: A Practical and Trustworthy Financial Companion

If you're looking for a straightforward, secure, and quick way to access small cash advances, Credit Genie deserves serious consideration. Its robust security measures, rapid transaction times, and intuitive interface make it a smart choice, especially if you value transparency and peace of mind. While it's not tailored for large loans or long-term borrowing, its focus on immediate cash needs makes it a dependable tool in your financial arsenal. I recommend giving it a try if you want a responsible, hassle-free way to manage sudden expenses — it's like having a reliable financial buddy in your pocket, ready to step in when you need it most.

Similar to This App

Pros

User-Friendly Interface

The app offers an intuitive and easy-to-navigate design, making it accessible for all users.

Fast Loan Approval

Credit Genie provides quick approval processes, often within minutes, for instant cash access.

Transparent Fees and Terms

Clear communication about fees and repayment conditions helps users make informed decisions.

Low Credit Score Requirements

The app allows access to cash advances even for users with less-than-perfect credit history.

Flexible Repayment Options

Multiple repayment plans enable users to choose what suits their financial situation.

Cons

Limited Loan Amounts (impact: Low)

The maximum advance might be restrictive for some users, typically up to a few hundred dollars.

Interest Rates Could Be High (impact: Medium)

The app's cash advances may come with higher interest or fees compared to traditional lenders, especially if not repaid on time.

Requires Linking Bank Accounts (impact: Low)

Users need to connect their bank details, which may raise security or privacy concerns.

Limited Availability in Some Regions (impact: Low)

The app might not be accessible in all countries or states, restricting potential user base.

Potential Over-reliance on Short-term Borrowing (impact: Medium)

Frequent use of cash advances could lead to reliance on short-term credit, impacting financial health; the app plans to implement debt management tips in future updates.

Frequently Asked Questions

How do I sign up and start using Credit Genie?

Download the app, create your account, and connect your bank account by following onboarding prompts. Approval depends on your banking profile.

What is the maximum cash advance I can get?

You can get up to $150 in cash advances, with amounts typically starting lower for first-time users and increasing with repeat usage.

How long does it take to receive the cash after approval?

Standard delivery may take a few hours, while express delivery typically arrives within 30 minutes after approval.

What are the repayment terms and options?

Repayments are flexible, ranging from 3 to 90 days. You can choose your repayment date through the app or customer support.

Are there any interest charges or hidden fees?

No, Credit Genie offers zero interest (APR) on cash advances. There is a biweekly $4.99 bank connection fee, which you can cancel anytime.

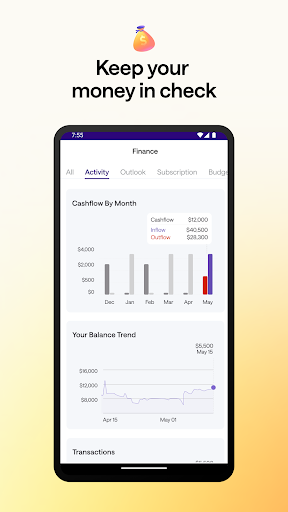

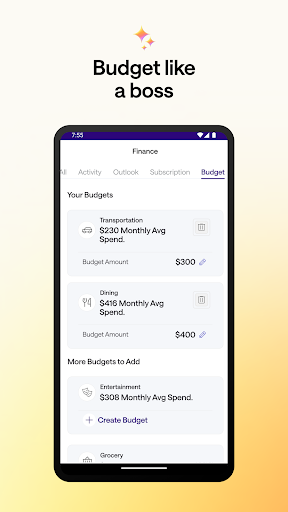

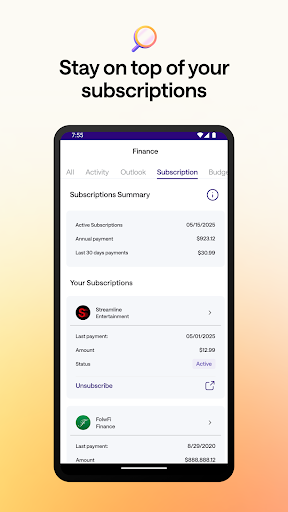

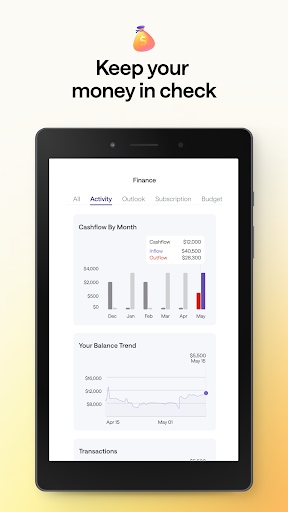

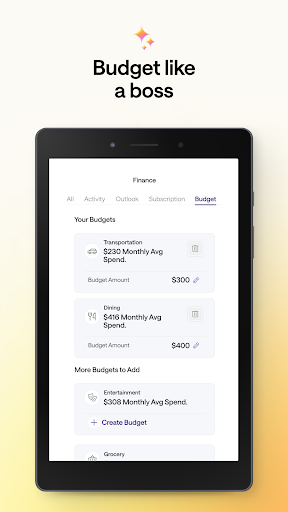

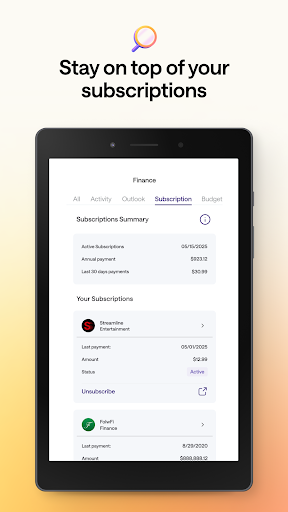

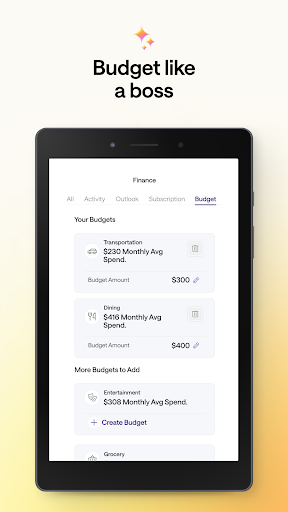

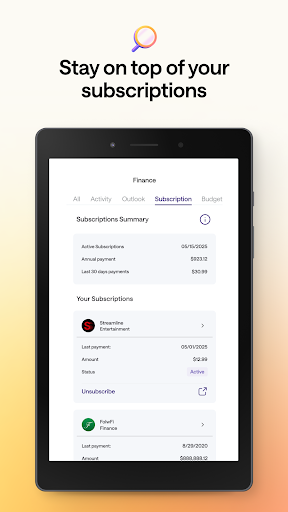

What features help me manage my spending better?

The app provides overdraft alerts and budgeting tools to help you track expenses and avoid overdraft fees.

How do I set up recurring bank connection fees or cancel them?

Go to Settings > Account > Payments to manage or cancel the biweekly $4.99 bank connection fee at any time.

Can I get a larger cash advance if I am a repeat user?

Yes, repeat users may qualify for higher advances up to $150, based on your banking profile and usage history.

Does Credit Genie charge any subscription fees or premium charges?

There are no subscription fees; you pay only the biweekly bank connection fee and repayment costs. You can close your account anytime.

What should I do if I experience issues with app functionality?

Contact Customer Support through the app's Help section for troubleshooting assistance or further help with your account.