- Category Finance

- Version7.23

- Downloads 5.00M

- Content Rating Everyone

Unlock Your Financial Potential with Credit Sesame: Grow Your Score

In the landscape of personal finance management, Credit Sesame stands out as a trusted companion for those eager to understand and improve their credit scores. Created by the innovative team at Credit Sesame, this app offers a suite of features designed to demystify credit scores, help users track their financial health, and unlock opportunities for better credit management. Whether you're a first-time borrower or someone looking to fine-tune your financial profile, Credit Sesame aims to be your go-to partner.

Core Features that Make Credit Sesame Shine

Personalized Credit Monitoring and Score Tracking

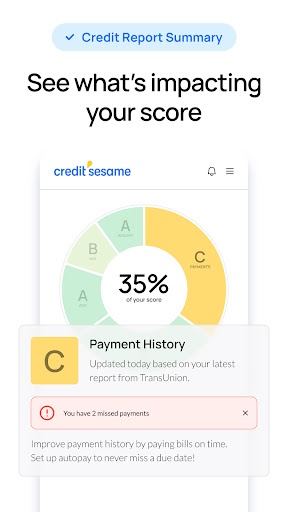

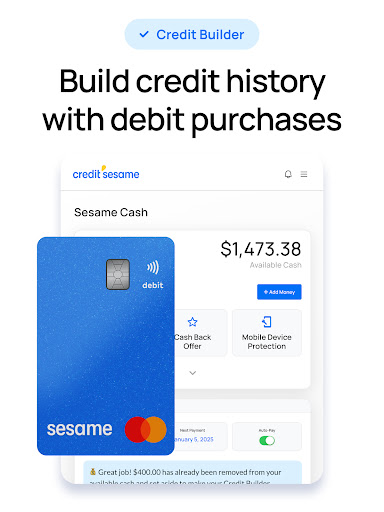

At the heart of Credit Sesame is its real-time credit monitoring system. Unlike some apps that only give periodic updates, this platform provides continuous insights into your credit score, reflecting changes almost instantaneously. What makes this feature compelling is its tailored advice — based on your unique financial habits, the app suggests actionable steps to improve your score. This personalized guidance turns abstract numbers into a clear road map toward better creditworthiness, helping users stay motivated and informed.

Comprehensive Financial Dashboard

The app boasts a sleek, intuitive dashboard that consolidates your credit score, loan accounts, credit utilization, and new credit inquiries all in one place. Imagine it as your financial command center, where every vital piece of your financial puzzle is laid out clearly. Visual graphs and easy-to-understand metrics make complex data accessible, helping users grasp their credit health at a glance. This holistic view not only boosts confidence but also encourages proactive financial decisions.

Smart Recommendations & Credit Education

Credit Sesame doesn't just display data; it also empowers users with tailored recommendations. Whether it's suggesting ways to reduce debt, advising on optimal credit card usage, or alerting you to potential identity theft risk, the app's insights are practical and relevant. Additionally, its resource section offers bite-sized educational articles and tips, perfect for those new to credit management or seasoned users wanting to deepen their understanding. This educational aspect transforms the app from a mere tracker into a personal coach for financial literacy.

Delivering a User-Friendly Experience

The interface of Credit Sesame is refreshingly clean and inviting — think of it as a well-organized workspace that invites you to explore. Navigating through the app feels like flipping through a well-illustrated magazine; everything is logically structured, with key features just a tap away. The design balances visual appeal with functionality, making complex credit data accessible to users of all levels.

Operation is smooth and responsive, with minimal lag even when syncing with external credit bureaus or updating information. The learning curve is gentle, thanks to guided onboarding and clear labels. First-time users will quickly get the hang of tracking their scores and interpreting the graphs, while seasoned users will appreciate the depth of insights offered.

Unique Advantages: Standing Out from Other Finance Apps

While many apps in the personal finance sphere focus on budgeting or investment tracking, Credit Sesame's standout feature lies in its dedicated credit score growth toolkit combined with robust security measures. One of its most distinctive aspects is the emphasis on Account and Fund Security, with advanced encryption and proactive monitoring to detect suspicious activity. This focus provides an added layer of peace of mind, especially vital when managing sensitive financial data online.

Another key differentiator is the seamless Transaction Experience. The app's ability to integrate data from multiple sources, update scores in real-time, and provide instant feedback delivers a fluid user experience. Unlike more static platforms, Credit Sesame continuously adapts to your financial behavior, making your journey toward credit improvement feel natural and engaging.

Final Recommendations and Usage Tips

Overall, I'd recommend Credit Sesame to anyone eager to take control of their credit health without the hassle of excessive complexity. Its user-centric design, personalized guidance, and security-focused approach make it a solid companion. For best results, regularly check your dashboard, heed its personalized advice, and stay proactive about your credit habits. Whether you're aiming to buy a home, refinance, or simply want a better understanding of your financial profile, Credit Sesame offers a reliable, insightful platform to support your goals.

Similar to This App

Pros

Comprehensive credit score tracking

Provides an overall credit score and detailed reports to monitor changes over time.

Free and user-friendly interface

Offers free access without subscription fees, with an intuitive design suitable for all users.

Personalized financial tips

Gives tailored advice to help users improve their credit scores effectively.

Credit monitoring alerts

Sends notifications about significant changes or suspicious activities related to your credit profile.

Integration with multiple accounts

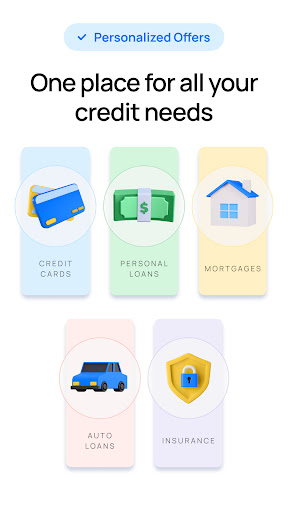

Allows tracking of various financial accounts in one place for a holistic view.

Cons

Limited credit bureau data (impact: medium)

Currently only provides scores based on one credit bureau, which may not reflect the full picture.

Scheduled updates can be delayed (impact: low)

Credit score updates may lag behind actual changes, but the app is expected to improve synchronization.

Some advanced features require premium subscription (impact: low)

Access to additional insights or advice may need payment, but basic features are free.

Limited educational content (impact: low)

Could expand on more comprehensive credit education to help users better understand factors affecting scores.

Mobile app occasional stability issues (impact: medium)

Some users experience app crashes, but updates are regularly released to improve stability.

Frequently Asked Questions

How do I get started with Credit Sesame for free?

Download the app from your app store, sign up with basic info, and immediately access your free credit score and report summary without complicated steps.

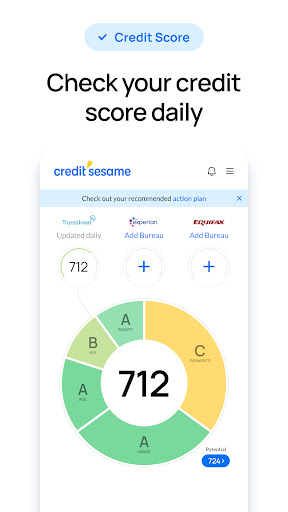

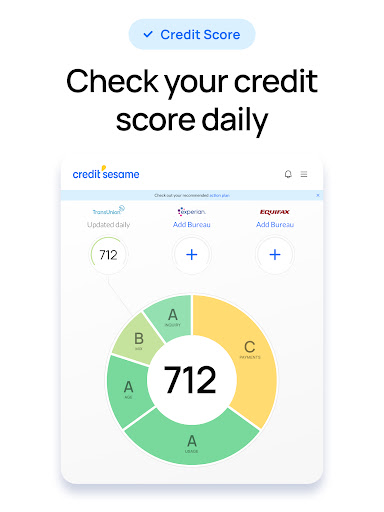

Can I check my credit score daily?

Yes, Credit Sesame allows you to refresh your credit score daily via the app to track your progress in real-time.

What are the core features available to help improve my credit?

Key features include credit score monitoring, report summaries, credit tips, alerts, and tools like score potential analysis, all accessible from the main dashboard.

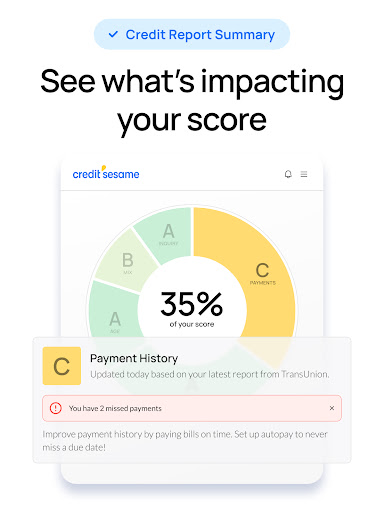

How does the Credit Report Summary & Sesame Grade work?

Weekly, the app provides a simplified report with a letter grade highlighting factors affecting your credit, accessible via the 'Credit Report' section.

What benefits come with a Credit Sesame Premium subscription?

Premium offers access to 3-bureau scores, dispute support, score simulators, rent reporting, and personalized credit offers, available through the 'Upgrade' section.

How do I upgrade to Credit Sesame Premium?

Go to 'Settings' > 'Subscriptions' > 'Upgrade to Premium' within the app, then follow prompts to select your plan and complete payment.

Are there any costs associated with the free credit monitoring service?

No, credit monitoring and alerts are free features provided to all users, helping you stay informed about changes to your credit report.

How can I dispute errors found on my credit report?

Use the 'Dispute' feature in the Premium section to identify inaccuracies and submit disputes directly through the app for review.

What should I do if the app isn't refreshing my credit score?

Ensure your internet connection is stable, restart the app, and try refreshing again. If issues persist, contact Support via 'Help' in Settings.

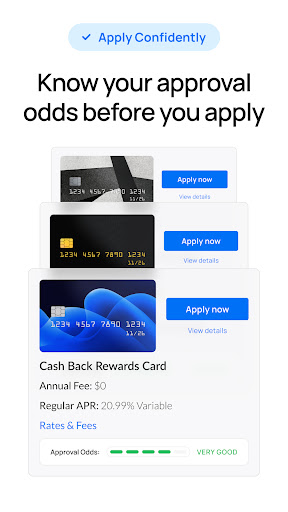

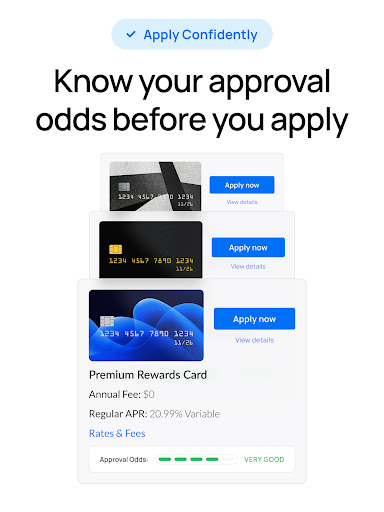

How do I view personalized loan or credit card offers?

Access 'Instant Offers' from the dashboard or notification alerts to see tailored lending options with high approval likelihood.