- Category Finance

- Version8.1.0

- Downloads 5.00M

- Content Rating Everyone

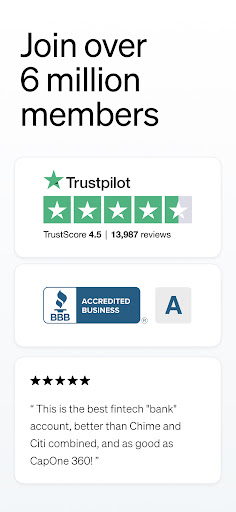

Introducing Current: The Future of Banking

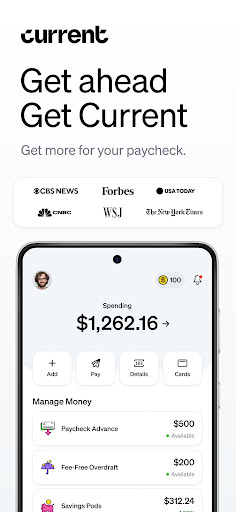

Current is an innovative digital banking app designed to redefine your financial experience with cutting-edge security, seamless transactions, and user-friendly design, all tailored for the modern world. Developed by a dedicated fintech team committed to pushing boundaries, Current's primary goal is to make banking smarter, safer, and more accessible for everyone.

Core Features That Set Current Apart

1. Advanced Account and Fund Security

One of the standout features of Current is its focus on security, employing multi-layered authentication protocols, real-time transaction monitoring, and biometric ID verification. Imagine your finances being safeguarded by an intelligent watchdog that's always alert—keeping your funds safe from fraud and unauthorized access. This robust security framework ensures peace of mind whether you're managing your daily expenses or making a large transfer.

2. Lightning-Fast and Transparent Transaction Experience

Transaction speed is where Current truly excels. Payments process instantly, with users often witnessing funds transfer in real time. The app also provides detailed transaction histories with easy categorization, enabling you to track your spending effortlessly—imagine having a detailed financial map at your fingertips. This transparency and speed make routine banking feel more like a conversation with a trusted friend than a chore.

3. Intuitive and Engaging Interface with Customization Options

Current's interface resembles a sleek dashboard—clean, vibrant, and designed with the user in mind. Navigating through features feels like flipping through a well-organized magazine rather than digging through a cluttered workspace. The app offers personalized themes and settings, allowing users to tailor the experience, which is perfect for those who appreciate both functionality and style. Its smooth operation and logical layout significantly reduce the learning curve, making it accessible to novices and seasoned users alike.

Deep Dive into User Experience and Design

Stepping into Current's interface is akin to entering a modern, well-lit control room—every element placed thoughtfully, guiding users naturally. The design adopts a contemporary aesthetic with energetic colors that convey a sense of vitality and dynamism. Transition animations are smooth, lending a sense of fluidity that makes multitasking seem effortless.

When it comes to operation and responsiveness, Current shines. Navigating between accounts, viewing transaction details, or adjusting settings feels instantaneous—there's no lag to hinder your flow. For users who are new to digital banking, the app's onboarding tutorial simplifies initial setup, reducing apprehension and inviting exploration. veteran users will appreciate the quick access features and customizable options that streamline their routines.

What Makes Current Truly Unique?

While many digital banking apps emphasize convenience, Current's emphasis on security—particularly its multi-layered account protection—is a game-changer. Unlike traditional apps that often treat security as an afterthought, Current integrates it into its core design, ensuring your assets are protected while maintaining simplicity and ease of use.

Another notable distinction is its transaction experience. Real-time processing paired with detailed, categorically organized histories makes managing finances less of a chore and more of an insightful activity. This combination can assist users in better budgeting and financial planning—something that sets Current apart from more basic, transactional-focused apps.

Is Current the Right Choice for You?

Based on its features, security measures, and user-friendly design, I would recommend Current for anyone seeking a modern, reliable banking companion. Whether you're a digital novice or a seasoned tech enthusiast, the app offers a balance of security, speed, and customization that appeals across the board. For those who prioritize transaction transparency and secure fund management, Current is especially worth exploring.

In conclusion, Current stands out not just because of its sleek facade but because of its core commitment to secure, swift, and personalized banking. It's a valuable tool for navigating your financial future with confidence—think of it as having a smart, vigilant financial partner in your pocket.

Similar to This App

Pros

Intuitive User Interface

The app offers a clean and easy-to-navigate design, enhancing user experience.

Comprehensive Financial Tools

Includes budgeting, savings, and investment features suitable for diverse banking needs.

Real-time Transaction Alerts

Provides instant notifications to monitor account activity and prevent fraud.

Robust Security Measures

Employs advanced encryption and biometric login options for data protection.

Personalized Financial Insights

Uses AI to offer tailored advice based on user spending habits.

Cons

Limited International Support (impact: medium)

Currently lacks full multilingual options and international transaction capabilities. This may inconvenience global users.

App Performance on Low-end Devices (impact: medium)

The app sometimes experiences lag or crashes on older smartphones, affecting usability.

Insufficient Customer Support Channels (impact: low)

Customer support primarily relies on chat, with limited phone or email options. A dedicated support line might improve experience.

Feature Rollout Delays (impact: low)

New features are introduced gradually, which may frustrate users expecting faster updates. The company plans to accelerate updates in future releases.

Limited Offline Functionality (impact: low)

Most features require an internet connection; offline access is minimal, which could be inconvenient in low-network areas.

Frequently Asked Questions

How do I create an account on Current?

Download the app, tap Sign Up, enter your details, and follow the on-screen instructions to set up your account quickly and easily.

Can I use Current if I don't have a traditional bank account?

Yes, Current is a digital banking app that provides banking services without needing a traditional bank account; just download and sign up.

How do I access my real-time notifications?

Enable notifications in Settings > Notifications within the app to receive instant updates about transactions and deposits.

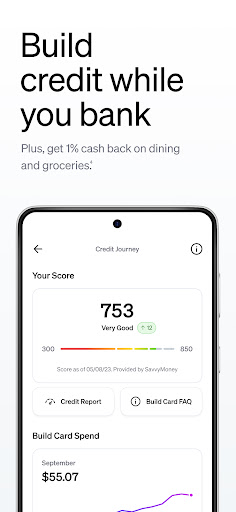

What is the Build Card and how does it help me build credit?

Use the Build Card to build credit without checks; apply via Settings > Build Card, and start managing your credit score effortlessly.

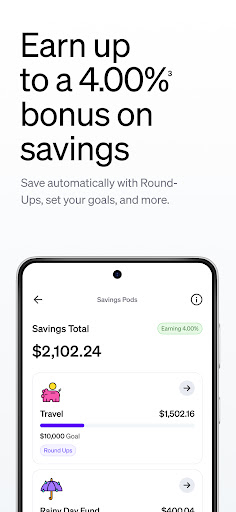

How do Savings Pods work and how can I set them up?

Go to Savings > Pods, choose your goal, set the amount, and start saving. Earn up to 4% annual bonus on your savings with this feature.

What rewards can I earn with the Rewards Program?

Earn points for every dollar spent at grocery stores or restaurants; redeem points for rewards via the Rewards section in the app.

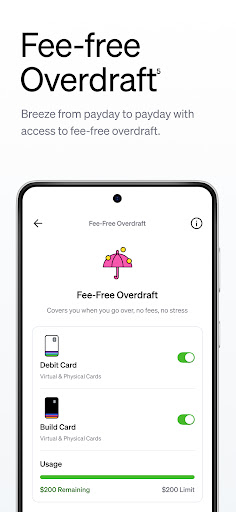

How does the overdraft protection work for fee-free overdraft up to $200?

Activate overdraft protection in Settings > Overdraft; it covers transactions up to $200 without any fees.

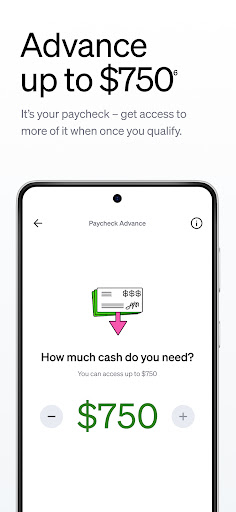

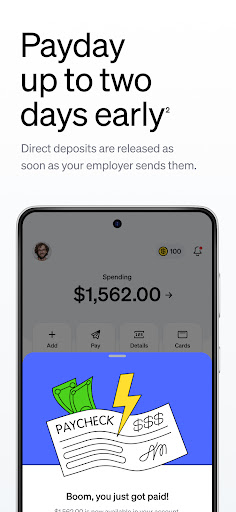

How can I get a paycheck advance through Current?

Qualify for Paycheck Advance in the app under Benefits; you can receive up to $750 before your paycheck arrives, with no fees.

Are there any monthly fees or charges for using Current services?

Current is fee-free for standard banking features; check Settings > Fees for detailed information about optional premium services.

What should I do if I encounter technical issues or errors?

Contact 24/7 support through the app by going to Support > Help; our team will assist you with technical problems promptly.