- Category Finance

- Version41.0.0

- Downloads 1.00M

- Content Rating Everyone

DailyPay On-Demand Pay: Your Flexible Payday Companion

In today's fast-paced world where financial flexibility is king, DailyPay On-Demand Pay stands out as a sophisticated yet user-friendly solution designed to give employees quick access to their earned wages. Developed by DailyPay Inc., this app embodies the shift towards instant financial relief, blending technological innovation with a commitment to financial well-being. Whether you're a gig worker, frontline employee, or someone seeking greater control over your paycheck, DailyPay offers features tailored to your needs.

Core Features That Make a Difference

Real-Time Access to Earned Wages

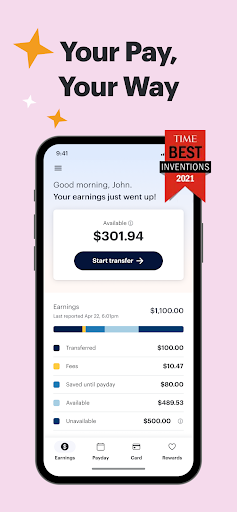

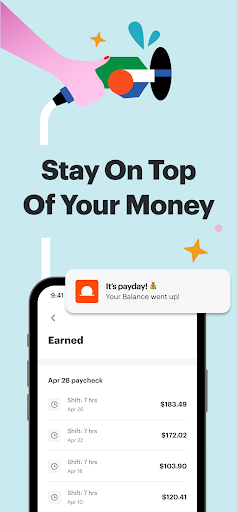

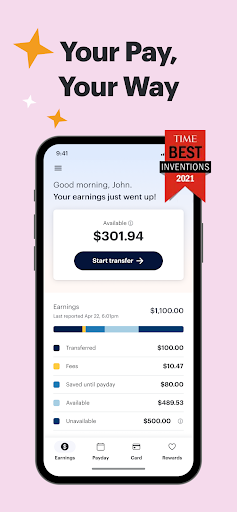

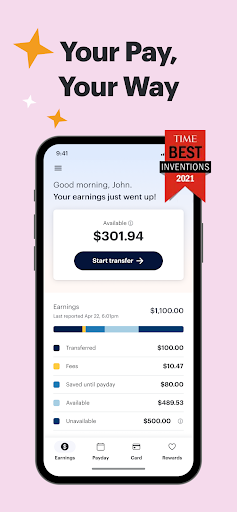

The hallmark of DailyPay is its ability to let users access a portion of their earned wages before the traditional payday. Imagine having your paycheck on a flexible leash—no more waiting for the bank to clear or the next pay period to arrive. This feature acts like a financial safety valve, helping users manage unexpected expenses or avoid costly payday loans. The process is straightforward: after completing work, employees can transfer a part of their earned income instantly or within a few hours, directly into their linked bank account or digital wallet.

Seamless Integration with Payroll Systems

One standout aspect of DailyPay is its ability to integrate smoothly with existing payroll infrastructures. For employers, this means minimal disruption—simply connect the platform, and wage data flows securely and automatically. For employees, this translates to accurate, up-to-date wage information without manual input. The real-time synchronization ensures nobody is left guessing about their current earnings, creating transparency and trust in the payroll cycle.

Robust Security and User Control

Security is at the core of DailyPay's design philosophy. The app employs industry-standard encryption and multi-factor authentication to safeguard sensitive financial data. Moreover, users have control over how much of their wages they draw upon, with customizable limits allowing tailored financial support. Compared to many peer apps, DailyPay emphasizes safe transactions, preventing unauthorized access and ensuring peace of mind for users concerned about fund security.

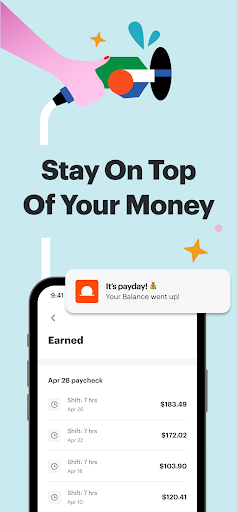

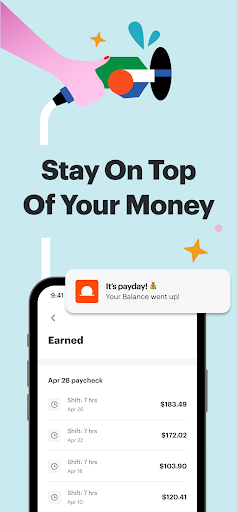

Investing in User Experience: Design and Usability

The app's interface resembles a crisp, organized dashboard—like a well-arranged workspace that invites you to navigate effortlessly. Bright, intuitive icons lead users through features, and real-time notifications keep them updated on transaction statuses, reducing uncertainty. The operation flow is fluid, with minimal steps required to view wages, request advances, or transfer funds. The learning curve is gentle; even newcomers adjusting to digital payroll solutions will find the app accessible. It's akin to adopting a familiar new gadget—once you start, it feels natural.

Standing Out from the Crowd: Unique Selling Points

Enhanced Account and Fund Security

Unlike many competing apps that operate on less transparent platforms, DailyPay's emphasis on rigorous security protocols sets it apart. Its encryption standards and authentication methods ensure that user funds and personal data are shielded from cyber threats. This focus on safety turns the app into a trustworthy partner, especially vital given its handling of sensitive financial information.

Superior Transaction Experience

DailyPay's real-time fund transfer capability offers a smoother, more immediate experience than traditional payroll methods or even some other on-demand pay apps. Users are not just requesting money—they're gaining a financial lifeline that can be accessed instantly or within hours, making day-to-day cash flow management far more manageable. This immediacy reduces stress and enhances financial resilience.

Final Thoughts: Is It Worth Your Time?

Considering its robust features, security-first approach, and user-centric design, DailyPay On-Demand Pay is highly recommended for employees seeking greater control over their earnings. It's particularly well-suited for gig workers, hourly employees, and anyone who appreciates having their financial options expanded beyond the traditional pay cycle. While no app is perfect, its focus on safety, transparency, and ease of use make it stand out in the on-demand payroll landscape. I'd suggest giving it a try if your work circumstances lend themselves to flexible wage access—after all, financial agility can be a genuine game-changer.

Similar to This App

Pros

Instant paycheck access

Allows employees to access their earned wages anytime before payday, improving financial flexibility.

User-friendly interface

The app features an intuitive design that makes it easy for users to navigate and request funds quickly.

No traditional banking requirements

Supports users without bank accounts by offering alternative payout methods like prepaid cards or digital wallets.

Transparent fee structure

Clear disclosure of fees for on-demand payouts helps users make informed financial decisions.

Integration with payroll systems

Seamless sync with employer systems ensures accurate wages calculation and quick updates.

Cons

Limited free access options (impact: medium)

Users may incur fees after a certain number of free transactions per month; a premium plan could mitigate this.

Availability may vary by location (impact: high)

Some regions might not support all features due to regulatory or partnership limitations; checking location eligibility is advised.

Potential overdraft risks (impact: medium)

Easy access to funds might encourage overuse, leading to overdraft or fee accumulation; offering budgeting tools could help.

Limited financial planning tools (impact: low)

The app primarily focuses on on-demand pay without extensive budgeting or savings features; future updates may include these enhancements.

Customer support response times vary (impact: low)

Some users report delays in support response; improved live chat or dedicated support lines could enhance experience.

Frequently Asked Questions

How do I sign up and get started with DailyPay?

Download the app, create an account, connect your employer, and verify your details to start accessing your earned wages.

Is there a limit to how much I can withdraw using DailyPay?

Your withdrawal limit depends on your earned Pay Balance; you can withdraw up to your available balance at any time.

How can I check my Pay Balance daily?

Open the DailyPay app and navigate to the main dashboard to view your real-time Pay Balance and transaction history.

How does the instant withdrawal option work?

Tap ‘Withdraw Instantly' in the app to transfer funds immediately to your linked account, available 24/7, including weekends and holidays.

What payment methods can I transfer my wages to?

You can transfer your Pay Balance to bank accounts, debit cards, prepaid cards, or pay cards via the app's transfer options.

How are my transactions secured on DailyPay?

DailyPay uses 256-bit encryption and complies with PCI standards and SOC II, ensuring your data and transactions are protected.

Is there a subscription fee for using DailyPay?

No, DailyPay itself does not charge a subscription fee. Check with your employer if they have pricing arrangements.

Are there any charges for instant transfers?

Yes, instant transfers may include a small fee; please review the specific fee details within the app before confirming.

What should I do if the app is not working properly?

Try restarting the app, check internet connection, and update to the latest version; contact customer support for further assistance.

Can I use DailyPay without linking my bank account?

No, linking a bank or eligible card is necessary to transfer and access your wages through the app.