- Category Finance

- Version3.89.0

- Downloads 0.01B

- Content Rating Everyone

Introduction: A New Player in Digital Banking

Dave - Fast Cash & Banking is a modern financial app designed to simplify your money management, offering quick access to cash, secure banking features, and insightful financial tools—all wrapped into an intuitive interface. Developed by a dedicated team of fintech innovators, this app aims to serve busy individuals seeking a streamlined digital banking experience. With features that blend security, convenience, and functionality, Dave stands out as a compelling choice in the crowded fintech landscape.

A Closer Look at the Core Features

Rapid Cash Access with Ease

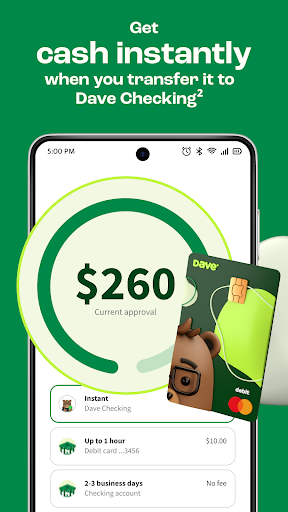

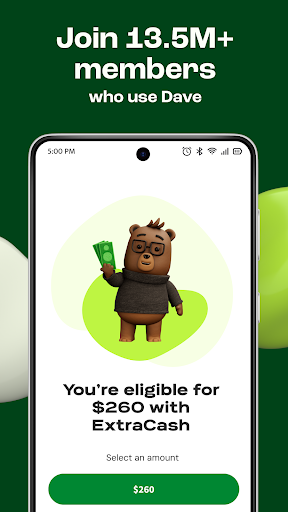

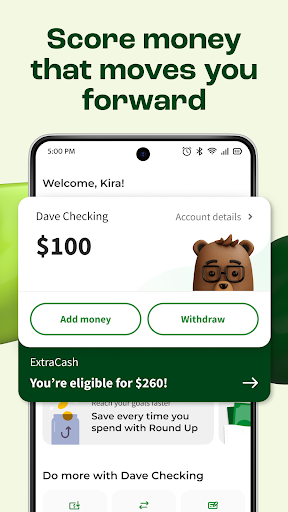

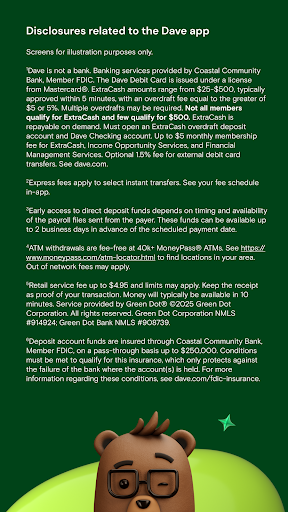

The app's standout feature is its ability to provide instant micro-loans or cash advances, tailored to your needs. Whether you're faced with an unexpected expense or need quick liquidity before your paycheck, Dave allows you to access funds seamlessly. The process is as straightforward as a few taps—no lengthy approval processes or complex paperwork, making it ideal for users who value speed and simplicity. This feature is akin to having a financial safety net that's always within reach, much like a trusted friend ready to lend a hand whenever needed.

Secure and Smart Banking Solutions

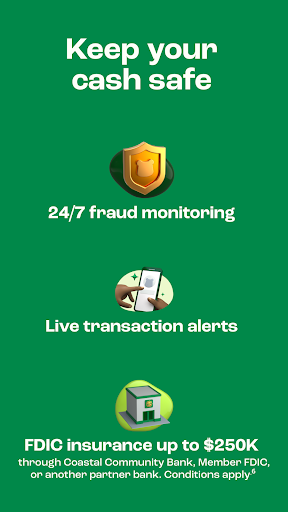

Safety is paramount in financial transactions, and Dave excels here with its robust security protocols. Using multi-layered encryption and biometric authentication, it ensures your funds and personal data remain protected. Beyond security, the app offers smart budgeting tools, expenditure tracking, and tailored financial advice, helping users understand their spending habits and plan better. Imagine having a personal financial advisor right in your pocket—friendly, accessible, and most importantly, trustworthy.

User Experience: Seamless, Intuitive, and User-Friendly

The design of Dave emphasizes clarity and ease of use. The interface features a clean layout with vibrant icons and straightforward navigation, making it accessible even for first-time users. Swiping through balances, making transfers, or requesting a cash advance feels natural, akin to flipping through a well-organized digital wallet. Responsiveness is impressive; the app loads quickly and operates smoothly across various devices. The learning curve is gentle, with guided tutorials and helpful prompts simplifying complex financial concepts for users of all ages.

What Sets Dave Apart from Its Peers?

The app's unique emphasis on transaction experience and security distinguishes it within the financial app landscape. Unlike traditional banking apps, Dave prioritizes transparency and user control, offering real-time updates and instant notifications for every transaction—think of it as having a vigilant watchdog that keeps your financial environment transparent and secure. Its proprietary security measures include biometric login and real-time fraud alerts, which set a high bar for account and fund security. Additionally, the app's quick cash feature not only provides immediate funds but also offers flexible repayment options, making financial assistance less stressful and more manageable.

Final Verdict and Usage Recommendations

Overall, I'd rate Dave as a highly practical tool for individuals seeking a comprehensive yet lightweight digital banking solution. Its strongest points—particularly the instant cash access and advanced security—make it a compelling option for those who need both speed and peace of mind. For users comfortable with smartphone-based banking who value simplicity without sacrificing security, Dave is a highly recommended choice. However, it may not be the best fit for those looking for extensive investment options or complex financial planning tools. If quick cash, straightforward banking, and top-tier security sound appealing, give Dave a try—you might find it becomes your trusted financial companion.

Similar to This App

Pros

User-friendly interface

The app features an intuitive design that makes navigation easy for users of all experience levels.

Fast cash transactions

Users can quickly transfer or withdraw funds, often within seconds, enhancing convenience.

Comprehensive banking features

Includes savings, checking, and loan options, providing all-in-one financial management.

Secure with multi-layer protection

Employs advanced encryption and authentication methods to safeguard user data.

Excellent customer support

Provides responsive assistance through chat, email, and phone, resolving issues promptly.

Cons

Occasional app crashes during high traffic times (impact: medium)

The app may become temporarily unresponsive during peak hours, but restarting often resolves the issue.

Limited functionality in certain regions (impact: medium)

Some features may not be available in all countries, though official updates are expected to expand coverage.

Small learning curve for new users (impact: low)

First-time users might need some time to familiarize themselves with all features, but tutorials are provided.

Occasional delays in transaction processing (impact: low)

A few users report delays, which can usually be resolved by updating the app or reattempting later.

Limited customization options on notifications (impact: low)

Preferences for alerts are basic, but future updates are planned to improve notification controls.

Frequently Asked Questions

How do I set up my account to start using Dave?

Download the app, register with your email or phone, link your bank account via Settings > Bank Accounts, and complete the verification process to get started.

How can I access my cash advance quickly?

Apply for ExtraCash™ in the app, and if approved, you can receive up to $500 within 5 minutes, with no fees or credit check involved.

What are the main features of the Dave app?

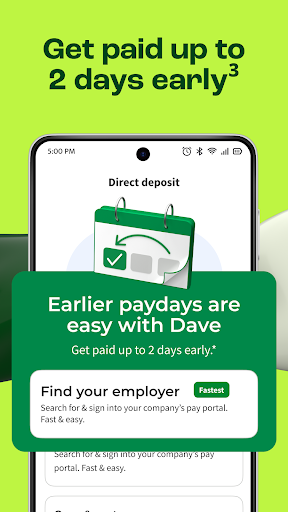

The app offers cash advances, high-yield savings, budget management, early paycheck access, and a Side Hustle board for earning extra income.

How does the app help me save money?

Set savings goals, enable Auto Savings, and enjoy a 4.00% APY on your Goals account by navigating to the Savings tab in the app.

Can I use Dave without paying any fees?

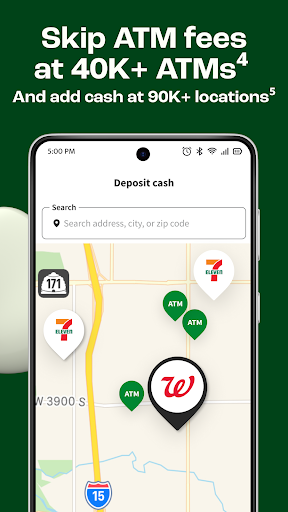

Yes, you can avoid ATM fees at MoneyPass locations and manage your budget without hidden costs, though a small monthly fee applies for membership.

How do I subscribe to the Dave membership?

Go to Settings > Membership, choose your plan, and subscribe via the app. The monthly fee covers all features, including cash advances and savings tools.

What is the cost of using Dave's services?

The app charges a small monthly subscription fee for full feature access, but cash advances (ExtraCash™) are interest-free and have no late fees.

How do I cancel my membership if I no longer want it?

Navigate to Settings > Membership, select Cancel Membership, and confirm your choice. Cancellation stops future payments, but features remain until billing period ends.

What should I do if the app is not loading properly?

Try restarting your device, updating the app to the latest version, or reinstalling it. Contact support via Settings > Help if issues persist.

Is my personal data secure on the Dave app?

Yes, Dave uses encryption and secure protocols to protect your data. Regular updates also ensure compliance with industry security standards.