- Category Finance

- Version7.0.14

- Downloads 0.50M

- Content Rating Everyone

Unlocking Your Credit Potential: A Detailed Look at Dovly's Credit Score Growth App

In today's digital age, maintaining and improving your credit score can sometimes feel like navigating a complex maze. Dovly's app aims to simplify this journey, providing users with intuitive tools to grow their credit profiles confidently. Developed by a dedicated team committed to financial empowerment, this application stands out with its personalized guidance and secure transaction environment—making the path to better credit more accessible than ever.

What Makes Dovly Unique? An Overview of Its Core Strengths

At its core, Dovly is more than just a credit improvement app; it's a comprehensive partner in your financial growth. Its main features include proactive credit monitoring, tailored dispute management, and personalized credit-building recommendations. The app's innovative approach combines real-time updates with actionable insights, helping users understand their credit health and take tangible steps forward. Designed for individuals who are serious about elevating their financial standing, Dovly caters to a broad audience—from young professionals starting their credit journeys to seasoned savers aiming to optimize their scores.

Engaging and Intuitive User Experience

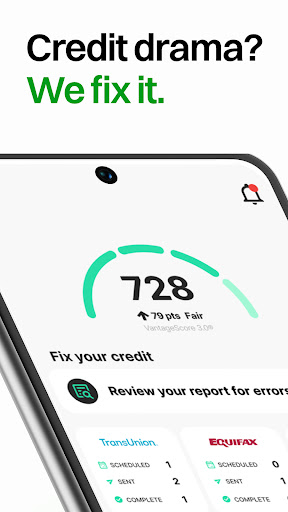

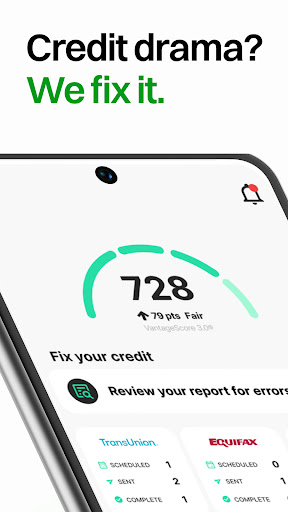

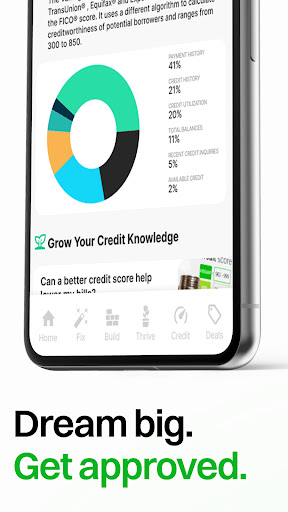

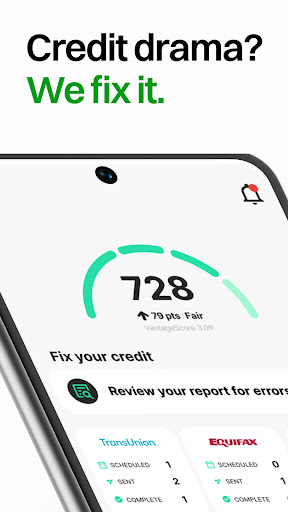

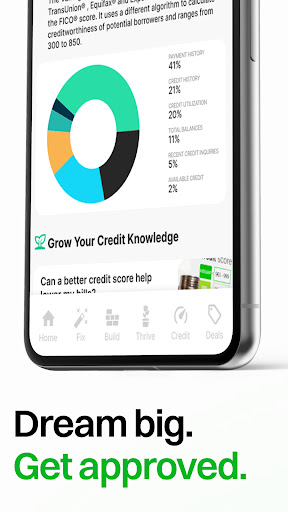

Once you dive into Dovly, the interface greets you like a trusted adviser—clean, organized, and easy to navigate. The onboarding process is smooth, guiding users through essential setup steps with visual cues and straightforward language, making it friendly even for first-time credit app users. The core dashboard displays your credit score trend and key metrics at a glance, akin to a dashboard in a high-performance vehicle—immediately giving you a sense of control and awareness.

Operationally, the app feels responsive; transitions are seamless, and data loads swiftly, ensuring that users spend more time on actionable insights than waiting. The learning curve is gentle—thanks to in-app tutorials and contextual tips—allowing users to gradually master features like dispute resolution or credit report analysis without feeling overwhelmed. This thoughtful design ensures that users of varying financial literacy levels can benefit equally, turning the app into an accessible yet powerful resource.

Standing Out in the Crowded Fintech Arena

While many finance apps tend to focus narrowly on budget tracking or limited credit score access, Dovly's standout feature is its personalized dispute management system combined with proactive credit coaching. Unlike traditional credit monitoring tools that simply alert you to changes, Dovly actively guides you through the process of correcting errors or disputing inaccuracies—empowering users to take control of their credit report in a way that feels like having a personal credit counselor in your pocket.

Another distinctive aspect is its emphasis on security and transaction experience. Dovly employs bank-level encryption protocols, ensuring that your sensitive data remains safe. The app streamlines interactions with credit bureaus and financial institutions, transforming what used to be a tedious process into a straightforward, user-friendly experience—much like having a dedicated financial concierge. This focus on security and ease of transaction sets Dovly apart from many competitors, who often overlook the user experience during sensitive operations.

Final Verdict and Recommendations

Overall, Dovly presents a balanced combination of user-friendly design, actionable insights, and security-conscious features. Its most remarkable strengths—particularly its proactive dispute resolution and personalized coaching—make it a compelling choice for anyone looking to actively improve their credit score without getting lost in technical complexities.

For those committed to taking meaningful steps towards better credit health, I highly recommend giving Dovly a try. It's especially suitable for users who value security and personalized guidance over generic alerts. Newcomers will appreciate the gentle learning curve, while seasoned users will find the dispute management features a valuable addition to their financial toolkit.

In conclusion, Dovly is more than just an app—it's your personal partner in credit growth. With its thoughtful design and innovative features, it stands out in the crowded fintech space and offers a trustworthy, empowering experience for anyone eager to grow their credit score responsibly and confidently.

Similar to This App

Pros

User-friendly interface

The app's intuitive design makes it easy for users to navigate and understand their credit reports.

Effective credit monitoring

Provides real-time updates on credit score changes, helping users stay informed promptly.

Personalized credit improvement tips

Offers tailored advice that can help users strategically boost their credit scores.

Clear growth tracking

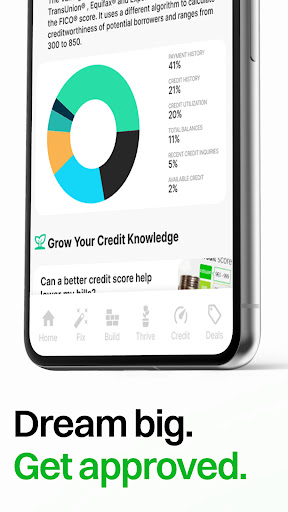

Visual charts and progress reports make it easy to see credit score improvements over time.

Free basic features

Allows users to access essential credit information without any subscription costs.

Cons

Limited credit bureaus coverage (impact: Medium)

Currently, the app mainly covers one or two bureaus, which may not provide a full credit report.

Occasional data delays (impact: Medium)

Some users report delayed updates of their credit scores, which could temporarily misrepresent their credit status.

Basic features may need upgrade (impact: Low)

Advanced insights and detailed reports may require a paid subscription, which could deter some users.

Limited educational content (impact: Low)

The app offers minimal explanations about credit factors, which might benefit from more comprehensive resources.

Occasional app crashes (impact: Low)

Some users experience minor stability issues; updates are expected to improve reliability soon.

Frequently Asked Questions

How do I start using Dovly to improve my credit score?

Download the app, create an account, and connect your credit report source. Dovly will automatically begin monitoring and providing personalized guidance.

Is Dovly free to use, and do I need to pay for any features?

Yes, Dovly is completely free with no credit card required. All core features, including credit monitoring and dispute tools, are available at no cost.

How often can I check my credit score on Dovly?

You can access your monthly TransUnion credit score and report at any time within the app, ensuring you stay updated on your credit health.

How does Dovly help me dispute errors on my credit report?

Dovly uses AI-powered dispute tools accessible via Settings > Dispute Resolution. The app guides you through challenging inaccuracies quickly and efficiently.

What personalized tips does Dovly provide for credit building?

Navigate to the Advice section in the app to receive tailored recommendations based on your financial profile, helping you boost your credit score steadily.

Can I lock my credit or protect against fraud with Dovly?

Yes, Dovly offers credit lock features under Settings > Fraud Protection to help prevent unauthorized access and safeguard your credit profile.

Are there any subscription plans or premium features I should know about?

Dovly is free; there are no subscriptions or in-app purchases. All core tools are included without additional costs.

What should I do if the app isn't updating my credit score properly?

Try closing and reopening the app, or check your device's internet connection. If issues persist, contact Dovly support via Settings > Help for assistance.

How can I maximize my credit score improvement with Dovly?

Regularly review your credit report, follow personalized tips, dispute inaccuracies, and maintain responsible financial habits for best results.

Is Dovly suitable for users with poor or no credit history?

Yes, Dovly is designed for all users, including those with little or no credit, providing guidance to build and improve credit over time.