- Category Finance

- Version7.26.0.796

- Downloads 5.00M

- Content Rating Everyone

Empower: Advance & Credit — A Fresh Take on Personal Finance Management

Empower: Advance & Credit offers a modern approach to managing credit and financial growth, designed for users seeking intuitive tools backed by robust security. Developed by a dedicated team committed to transparency and user empowerment, this app integrates seamless financial tracking with innovative credit features. With its focus on security, user experience, and tailored credit options, Empower stands out as a promising companion for those aiming to take control of their financial journey.

Introducing Empower: Your Personal Finance Ally

Imagine having a personal finance expert in your pocket, guiding you smoothly through the sometimes choppy waters of credit management and financial growth. That's exactly what Empower aims to be. Built by a team of financial technology enthusiasts, this app combines a sleek interface with powerful features crafted to demystify credit scoring and improve financial health. Whether you're a young professional establishing credit for the first time or an experienced user fine-tuning your financial strategies, Empower offers a tailored experience designed with clarity and security at its core.

Core Features That Shine Bright

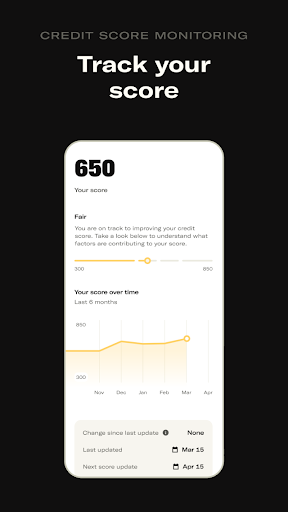

Unified Credit Profile and Score Monitoring

This feature acts like a financial cockpit, allowing users to view their credit score in real-time along with detailed insights into contributing factors. Unlike many apps that only display a score, Empower provides a breakdown of what actions influence your credit, empowering you to make informed decisions. Additionally, the app aggregates data from multiple credit bureaus for a comprehensive view, reducing guesswork and increasing confidence in your financial standing.

Personalized Credit Building and Optimization Tools

Empower doesn't just show your current credit status; it actively guides you on how to improve it. The app offers customized suggestions — such as optimal payment strategies, suggested credit utilization ratios, and tailored loan options — based on your unique profile. Like a digital coach, it encourages healthy credit habits, helping users build or repair credit efficiently over time.

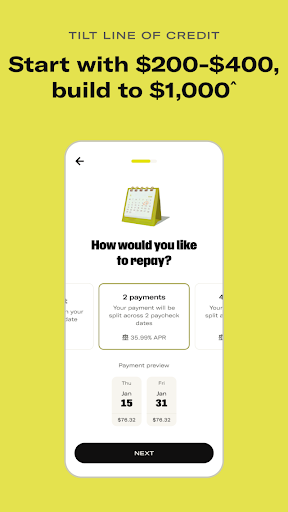

Secure and Transparent Transaction Experience

Security is woven into the fabric of Empower's design. It employs bank-grade encryption to protect sensitive data and offers straightforward, transparent transaction processes. Users can perform loan repayments, credit transfers, or set up automated payments with confidence, thanks to clear instructions and real-time confirmation. This focus on security and clarity distinguishes Empower from many competitors, ensuring peace of mind at every step.

Intuitive User Experience and Design

Empower's interface feels like a well-organized dashboard — clean, inviting, and intuitive. The onboarding process gently guides new users, reducing the initial learning curve. Navigating through account summaries, insights, or recommendations is as smooth as gliding on ice, thanks to responsive design and logical layout. Even users unfamiliar with complex financial jargon find the app approachable, turning what could be daunting into an engaging, user-friendly experience.

What Makes Empower a Standout in the Field?

While many financial apps excel at tracking transactions or providing general credit scores, Empower's true innovation lies in its emphasis on security and tailored credit optimization. Its multi-source credit data aggregation ensures accuracy and completeness, helping users understand their full credit picture. Most notably, its personalized guidance system acts like a financial GPS, steering users toward better credit health with actionable steps. Compared to apps that simply show numbers, Empower offers a proactive, transparent approach that equips users with practical knowledge and confidence to improve their financial standing.

Final Thoughts: Should You Give it a Try?

Overall, Empower: Advance & Credit is a well-rounded tool for anyone serious about their credit journey. Its balanced focus on security, user experience, and personalized advice makes it a reliable choice for both beginners and experienced users. If you value a clear, transparent, and secure environment to monitor and build your credit, this app is worth considering. However, if you prefer a more comprehensive suite with investment tracking or budgeting features, you might explore additional options. For those seeking a straightforward, trustworthy credit management companion — Empower offers a compelling and accessible solution.

Similar to This App

Pros

User-Friendly Interface

The app offers an intuitive layout that simplifies navigation for all users.

Comprehensive Credit Management Tools

Provides detailed credit score monitoring and personalized insights to improve financial health.

Fast Processing Speed

Quick updates and transaction processing ensure real-time credit information.

Secure Data Encryption

Uses advanced encryption methods to protect user data and maintain privacy.

Customizable Notifications

Allows users to set alerts for credit changes, payment deadlines, and promotional offers.

Cons

Limited Currency Support (impact: Medium)

Currently only supports credit in specific regions, which may inconvenience international users.

Occasional App Crashes (impact: Low)

Users have reported occasional crashes during data synchronization; updating to the latest version often resolves this.

Basic Analytics Features (impact: Low)

Advanced analytics for credit trend prediction are limited; future updates may include more detailed insights.

Customer Support Response Time (impact: Medium)

Support response may take up to 24 hours; improvements are anticipated in upcoming releases.

Offline Accessibility (impact: Medium)

Most features require internet; offline mode is planned for future updates to enhance usability during limited connectivity.

Frequently Asked Questions

How do I sign up and start using Empower?

Download the app from your app store, create an account with your email or phone, and follow the onboarding instructions to set up your profile.

Is my personal information safe on Empower?

Yes, Empower uses bank-level encryption and does not store your login details, ensuring your data remains secure and private.

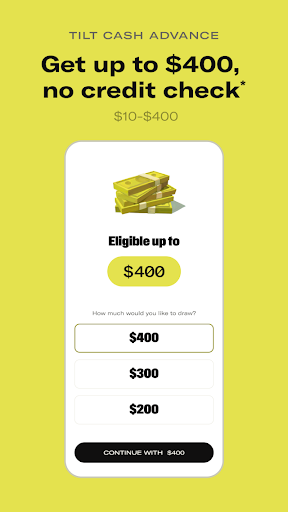

How can I request a cash advance?

Open the app, navigate to 'Cash Advances,' enter the amount ($10–$400), and submit your request. Funds are typically transferred quickly.

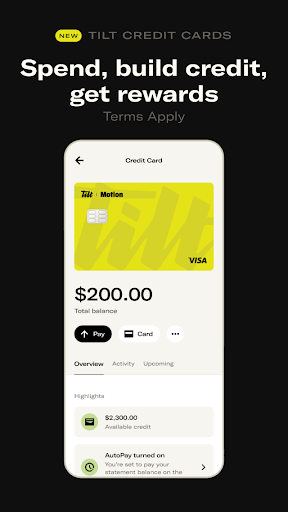

What features help me build my credit score?

Use Empower's credit cards, make responsible payments on the line of credit, and monitor your score in the app for personalized tips.

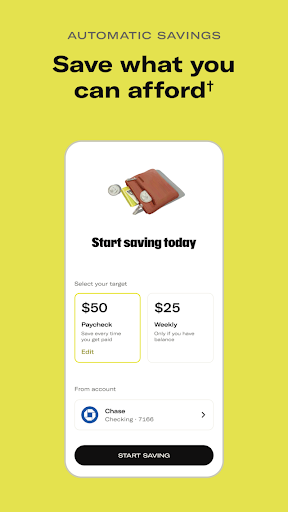

How do automatic savings work?

Go to 'Savings,' set your goals and schedule, and enable 'Auto-Save.' The app will transfer funds automatically based on your preferences.

Are there any fees for cash advances or credit features?

Fees may apply for instant cash advances—check the in-app details. The app states clearly if additional charges are involved before completing requests.

Do I need a good credit score to use Empower's features?

No, Empower's credit tools are accessible regardless of your current score, making it suitable for all users to build credit over time.

Can I upgrade or cancel my subscription easily?

Yes, go to Settings > Account > Subscriptions to manage or cancel your plan at any time without hassle.

What should I do if the app is not loading or having technical issues?

Try restarting your device, check your internet, and ensure app updates are installed. For further help, contact Empower support via the app's chat or email.