- Category Finance

- Version2026.2.20

- Downloads 1.00M

- Content Rating Everyone

Overview: Your Digital Budgeting Companion

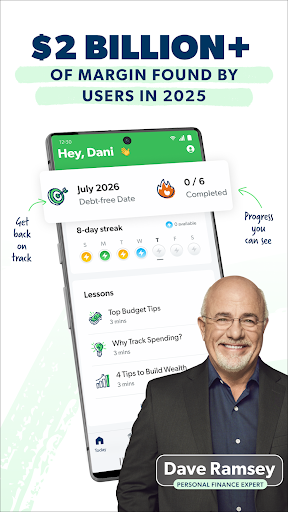

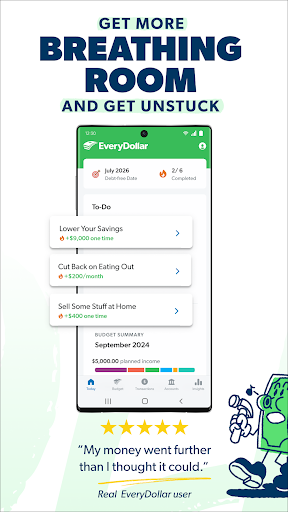

EveryDollar: Budget Planning is a thoughtfully designed budgeting app aimed at helping users take control of their finances with simplicity and clarity. Developed by Ramsey Solutions, this tool emphasizes straightforwardness and customization, allowing users to plan, track, and optimize their spending effortlessly. Its standout features include zero-based budgeting, seamless bank account integration, and personalized expense tracking—all crafted to serve a broad audience from young professionals to seasoned savers eager to tighten their financial grip.

Bright Ideas for Budgeting Made Easy

Imagine having a financial GPS that guides you through the winding roads of expenses, savings, and debt reduction—EveryDollar offers just that. Whether you're a novice just starting your financial journey or someone aiming to fine-tune an existing budget, this app presents itself as a friendly, approachable co-pilot that demystifies money management.

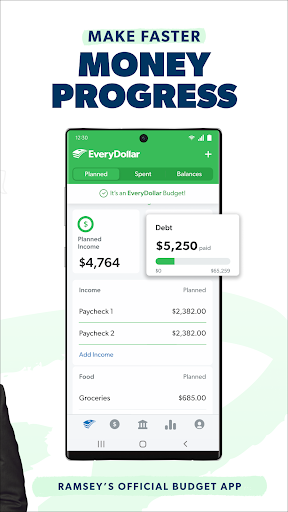

Zero-Based Budgeting — Every Dollar Has a Purpose

This core feature stands out as the backbone of the app. EveryDollar employs a zero-based budgeting method, meaning users assign every dollar a specific job—be it groceries, rent, savings, or investments—before the month begins. This approach ensures no money slips through the cracks, fostering a disciplined and intentional spending pattern. The interface simplifies this process by providing easy-to-navigate categories and real-time updates, making the complex seem manageable. It's akin to having a detailed map that shows you exactly where each penny should go, avoiding any financial dead ends.

Bank Account Syncing — Real-Time Financial Reflection

One of the app's most compelling features is its ability to securely connect with your bank accounts and credit cards. This synchronization updates your spending data automatically, removing the tedious task of manual entries. The process is smooth and responsive, giving users confidence that their financial snapshot is accurate and current. This real-time view makes it easier to adjust your budget mid-month—much like having a financial cockpit where you can instantly see your fuel levels and speed, allowing course correction on the fly.

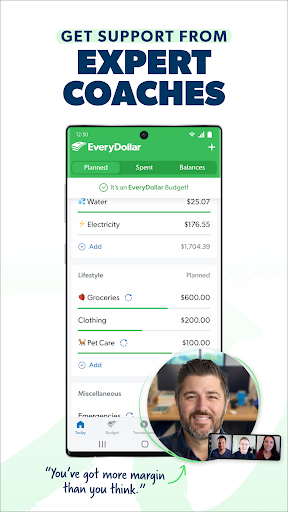

Personalized Expense Tracking — Insightful and Intuitive

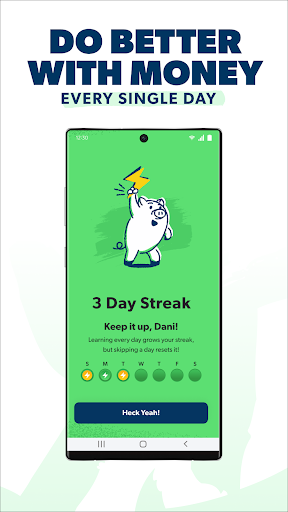

EveryDollar simplifies expense monitoring by categorizing spending and providing clear visualizations. Users can easily review where their money is going and identify patterns or overspending habits. It's like having a personal financial coach who not only points out the problem areas but suggests tips to optimize spending. This feature encourages mindful money habits and helps establish long-term financial stability by making data accessible and non-intimidating. The learning curve is gentle, thanks to welcoming interfaces and straightforward prompts, making ongoing budget management feel less like a chore and more like a productive habit.

User Experience: Smooth Sailing or Stormy Seas?

From the outset, EveryDollar impresses with its sleek, uncluttered design. The intuitive layout resembles a clean financial dashboard—everything you need is right where you expect it to be. Navigating between budget setup, expense categories, and reports is seamless, with responsive interactions that make adjustments quick and stress-free. The onboarding process is straightforward, offering helpful tips without overwhelming newcomers. Overall, the app delivers a polished experience that feels both professional and inviting.

Security and Transaction Experience — Your Data's Fortress

Security is paramount when dealing with sensitive financial data, and EveryDollar takes this seriously. Bank linkages are secured with industry-standard encryption, giving users peace of mind that their information is protected. Unlike some fintech apps that rely heavily on third-party integrations, EveryDollar emphasizes secure transactions and privacy, making users comfortable with its handling of personal data. Additionally, the transaction experience is frictionless—updates occur automatically, with clear, concise summaries that make it easy to understand your financial situation without endless digging through statements.

What Makes EveryDollar Special? The Two Pinnacle Features

While many budgeting apps share common ground, what truly sets EveryDollar apart are its focus on user simplicity and its strong emphasis on zero-based budgeting paired with seamless bank syncing. These two features combine to create a user experience where budgets not only start strong but stay current—like a boat that's always cruising, never drifting off course. This synergy ensures that users are not left winging their financial plans but have a reliable, always-updated system supporting their goals.

Recommendations and Final Thoughts

Considering its straightforward approach, robust core features, and secure infrastructure, EveryDollar is highly recommended for individuals who prefer a no-frills, effective budgeting experience. It's especially suited for those who want to adopt zero-based budgeting or need an easy way to sync bank data without juggling multiple apps. For seasoned budgeters seeking highly detailed analytics or investment tracking, it might be a bit too simplified, but for most everyday users, it hits the sweet spot.

In conclusion, if you're looking for a friendly yet powerful tool to help you build healthier financial habits—think of EveryDollar as your financial co-pilot—ready to steer you toward your money goals with clarity and confidence. It may not promise overnight riches, but it certainly offers a steady, reliable course for smarter money management.

Similar to This App

Pros

User-Friendly Interface

The app has an intuitive layout that makes budgeting straightforward for users of all experience levels.

Automatic Transaction Tracking

Integrates seamlessly with bank accounts to automatically track expenses, reducing manual entry time.

Customizable Budget Categories

Allows users to create personalized categories to better tailor their budget tracking.

Real-Time Budget Updates

Provides instant updates on spending, helping users stay aware of their financial status.

Goal Setting Features

Enables users to set savings goals and monitor progress effectively, encouraging financial discipline.

Cons

Limited Free Features (impact: medium)

Some advanced features require a paid subscription, which may be a barrier for casual users.

Mobile App Syncing Issues (impact: low)

Occasionally faces syncing delays between devices, but official updates are expected to improve stability.

Lack of Investment Tracking (impact: low)

Currently focuses on budgeting and expense management, lacking tools for investment monitoring.

Limited Export Options (impact: low)

Exporting budgets to other formats is somewhat restricted; users can request additional formats in feedback.

Learning Curve for Advanced Features (impact: low)

Some complex features may require a brief learning period, but tutorials are available within the app.

Frequently Asked Questions

How do I create my first budget in EveryDollar?

Open the app, tap 'Create Budget,' choose your budget type, and enter your income and expenses to set up your personalized plan.

Can I link my bank accounts to automatically track transactions?

Yes, go to Settings > Accounts > Connect Bank, and securely link your accounts for automatic transaction imports.

How do I set and track financial goals in the app?

Navigate to Goals > Add Goal, input your target amount and deadline, then monitor your progress through the goal dashboard.

How does EveryDollar help me stay on budget daily?

Use the expense tracker to log expenses regularly, review your remaining budget, and receive alerts for overspending to stay on track.

Can I categorize my expenses for better insight?

Yes, during expense entry, select categories like Food, Travel, or Bills to organize your spending and analyze patterns.

How do I manage subscriptions and recurring expenses?

Go to Expenses > Subscriptions, add recurring costs, and monitor or modify them easily to control ongoing expenses.

Are there premium features available, and how much do they cost?

EveryDollar offers premium features like account syncing; check Settings > Subscription for details and pricing options.

How do I upgrade to the paid version of EveryDollar?

Navigate to Settings > Subscription > Upgrade, select your plan, and follow prompts to complete the upgrade process.

What should I do if the app crashes or has syncing issues?

Try restarting your device, update the app, or reconnect your bank accounts via Settings > Accounts to resolve common issues.