- Category Finance

- Version4.2.6

- Downloads 0.01B

- Content Rating Everyone

Experian App: Your Personal Finance Companion

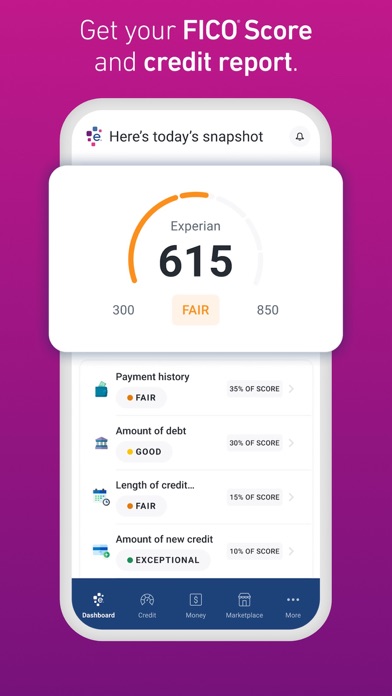

If you're looking for a robust yet user-friendly tool to keep tabs on your credit report, financial health, and tailored recommendations, Experian offers exactly that—a comprehensive platform designed to empower everyday users with insights and security. Developed by Experian Ltd., a global leader in credit bureau services, this app combines cutting-edge data analysis with straightforward usability, making financial management approachable for a broad audience.

Key Highlights of the App

- Real-Time Credit Monitoring: Stay informed with instant updates on your credit score and report changes, enabling proactive financial decisions.

- Personalized Financial Tips: Receive tailored suggestions and risk alerts based on your credit activity and profile, helping you improve your credit health.

- Enhanced Security Features: Multiple layers of security, including identity theft alerts and account monitoring, which safeguard your personal information.

- Seamless Transaction Insights: Gain detailed analysis of your financial transactions, empowering you to optimize spending and saving habits.

An Inviting Look into Experian's Interface and User Experience

Imagine opening an app that greets you like an attentive friend—welcoming, intuitive, and ready to assist. Experian's interface embodies a clean, modern aesthetic with easy navigation that guides users effortlessly through complex financial data. From the introductory dashboard, users can quickly view their credit score, recent changes, and security alerts, all presented through vivid visuals and simple language. This accessibility is especially beneficial for those new to credit management, as the learning curve is gentle—interactive tutorials and contextual tips help users understand each feature as they explore.

Core Features in Depth

Dynamic Credit Monitoring and Alerts

This feature stands out by providing real-time updates on your credit status, much like having a vigilant guardian watching over your financial reputation. When something notable happens—such as a new inquiry or a significant change in your score—you're notified instantaneously. Unlike traditional credit reports that refresh monthly, Experian's live monitoring offers peace of mind, especially during times of financial uncertainty. The app's alert system is customizable, allowing users to set thresholds that matter most to them, ensuring they stay in control and avoid surprises.

Personalized Recommendations and Risk Insights

Think of this feature as your financial GPS—guiding you towards better credit health. Based on your unique data, Experian suggests tailored actions like paying down balances, correcting errors, or applying for specific financial products. The app also provides alerts about potential risks, such as signs of identity theft or unusual activity, thereby acting like a security guard, constantly scanning for threats. These insights help make complex credit concepts understandable and actionable, transforming raw data into practical steps.

Transaction and Spending Analysis

Beyond credit scores, Experian provides an in-depth look at your transaction history. Visualizing spending patterns over time, it highlights where your money flows, akin to having a personal financial coach sitting beside you. This feature not only increases transparency but also aids in budget planning and debt reduction strategies. The clear, organized presentation demystifies complicated bank and credit card statements, making financial management less about guesswork and more about informed choices.

Assessing User Experience and Unique Differentiators

The app excels in offering a smooth, user-centric experience. Navigating through various features feels seamless thanks to intuitive design and responsive interactions. The onboarding process, complemented by helpful tutorials, ensures users quickly grasp the app's potential without feeling overwhelmed. Compared to peers, Experian's standout trait is its focus on account and fund security combined with actionable transaction insights—precisely those elements that turn raw data into meaningful, protective measures that users can trust and act upon.

Recommendation and Usage Advice

Overall, Experian is highly recommended for individuals eager to gain control over their credit and enhance financial literacy. Its comprehensive monitoring, security features, and tailored insights make it a solid choice whether you're just starting to build credit or seeking to optimize your existing profile. For users who prioritize security and want to stay ahead of potential identity theft while understanding their financial trajectory in real time, this app is a valuable companion. However, users comfortable with digital tools and seeking in-depth health reports may find some features standard compared to specialized financial management apps.

In essence, Experian's blend of real-time monitoring and security-focused insights positions it as a standout in the crowded field of personal finance apps. It's like having a vigilant financial assistant in your pocket—calm, reliable, and always ready to help you make smarter decisions. Whether you're a financial newbie or a seasoned pro, this app offers enough depth and simplicity to serve as your trusted guide through the complex world of credit and personal finance.

Similar to This App

Pros

Comprehensive Credit Monitoring

Provides real-time updates on your credit score and report, helping users stay informed.

User-Friendly Interface

The app features an intuitive layout that makes navigation simple even for first-time users.

Identity Theft Protection

Includes alerts for suspicious activity, enhancing personal security.

Credit Score Improvement Tips

Offers personalized advice to help users improve their credit health.

Additional Financial Tools

Provides access to tools like debt analysis and credit report explanations.

Cons

Slow Data Refresh Rate (impact: medium)

Credit data updates can sometimes lag, leading to outdated information; users can try refreshing manually or check back later for updated info.

Limited Free Reports (impact: low)

The free version provides only one report per month, which may be restrictive for some users; upgrading subscription offers more frequent updates.

Inconsistent App Performance (impact: low)

Some users report occasional bugs or crashes; ensuring app updates and restarting can mitigate issues.

Basic Security Features (impact: low)

While providing alerts, the app could benefit from additional security measures like biometric login; official updates are expected to improve this.

Customer Support Responsiveness (impact: low)

Customer service may be slow or unresponsive at times; users might find helpful FAQs or community forums as temporary solutions.

Frequently Asked Questions

How do I sign up and start using the Experian app?

Download the app from your device's app store, open it, and follow on-screen instructions to register with basic personal details for quick setup.

Is my credit information safe with Experian?

Yes, Experian uses advanced security protocols to protect your data. Ensure you enable all recommended security features during setup for added safety.

How often can I check my credit score for free?

You can check your FICO® Score and credit report for free once every 30 days through the app, without impacting your credit.

What are the main features of the Experian app?

Key features include free credit score checks, Experian Boost®, personalized insights, fraud alerts, and the Marketplace for comparing financial products.

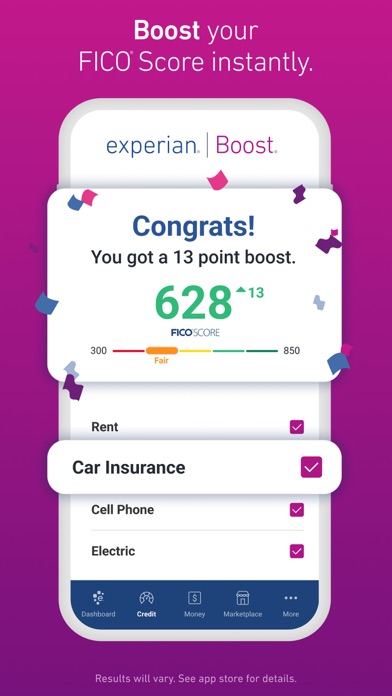

How does Experian Boost® work to improve my score?

It adds your on-time payments for bills like utilities and phone bills to your credit profile, potentially boosting your FICO® Score.

Can I use Experian to compare credit card and loan options?

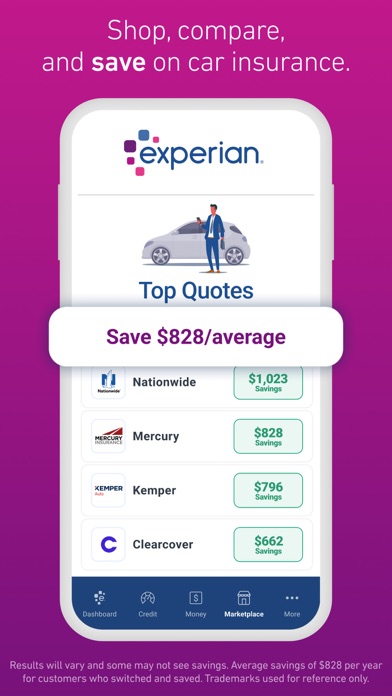

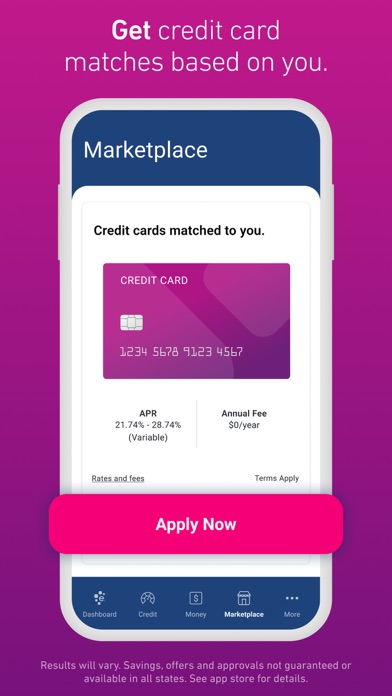

Yes, the Marketplace feature allows you to evaluate credit card, loan, and auto insurance quotes tailored to your credit profile.

Are there premium services available in the app?

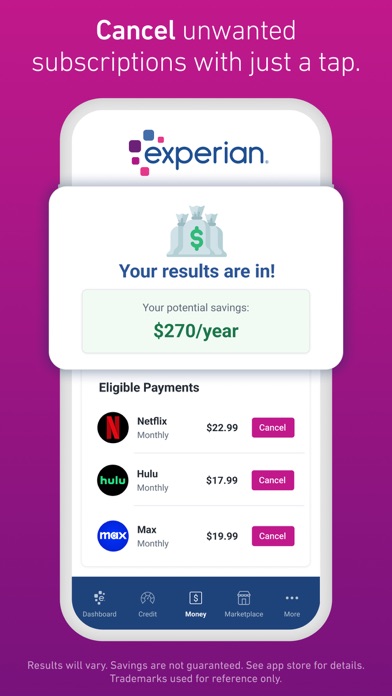

Yes, premium options include bill negotiation, subscription cancellation, and a digital checking account to help build credit without debt.

How do I subscribe to premium services?

Navigate to Settings > Subscription or Premium Services in the app, then follow the prompts to upgrade your plan.

What should I do if the app isn't updating my credit report correctly?

Try restarting the app, ensure your internet connection is stable, or reinstall the app. Contact customer support if issues persist.