- Category Finance

- Version5.18.0

- Downloads 1.00M

- Content Rating Everyone

Fifth Third: 53 Mobile Banking — A Solid Companion for Your Financial Journey

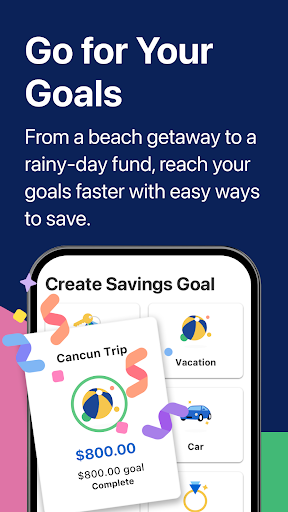

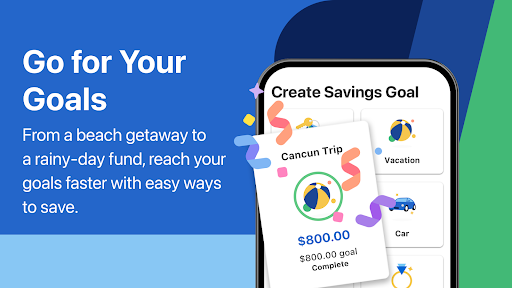

Fifth Third's 53 Mobile Banking app strives to bring banking at your fingertips with a focus on security, ease of use, and comprehensive features tailored for everyday financial management.

Introducing the App: Banking Made Simple and Secure

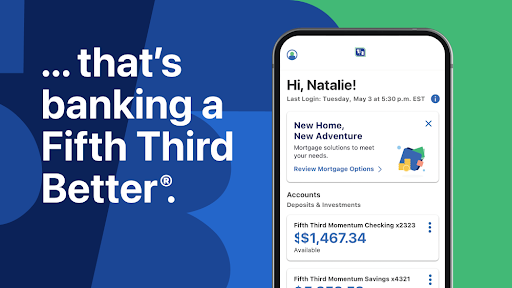

Fifth Third: 53 Mobile Banking is a mobile application developed by Fifth Third Bank, one of the prominent regional banks in the United States. The app positions itself as a reliable and user-friendly digital banking platform, designed to cater to the varied needs of modern banking customers. Whether you're managing personal expenses, transferring funds, or securing your account, this app aims to streamline financial tasks with a few taps.

The app's key highlights include:

- Robust Security Measures: Advanced authentication and encryption to safeguard your funds and data.

- Intuitive User Interface: A clean, organized layout that makes navigation effortless—even for first-time users.

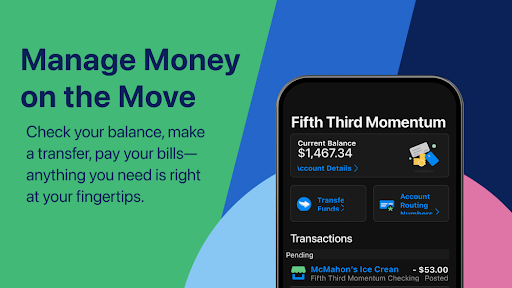

- Comprehensive Account Monitoring: Real-time updates on balances, transactions, and account activities.

- Personalized Alerts and Controls: Customizable notifications to keep you informed about account activity or set up security controls.

Its primary target audience encompasses existing Fifth Third Bank customers seeking a seamless mobile banking experience, as well as tech-savvy users who prefer managing their finances via smartphone, especially those focusing on security and convenience.

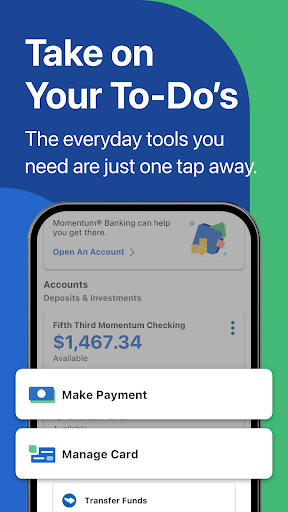

Engaging and User-Friendly Interface

From the moment you open the app, Fifth Third's design greets you with a modern, approachable look—like stepping into a well-organized digital banker's desk. The intuitive navigation bar at the bottom makes it feel like browsing through your personal money assistant. The color palette is calming yet professional, which helps reduce any banking anxiety that might arise with complex apps.

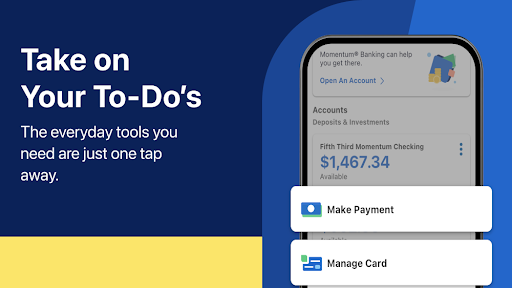

Operation smoothness is notable; transitions between different sections are swift, with minimal loading times. Whether you're checking your latest transaction or adjusting account settings, the app responds promptly, reinforcing a sense of reliability. For users unfamiliar with mobile banking, the learning curve is gentle—most functions are self-explanatory with clear icons and straightforward menus.

Key Functionalities That Stand Out

1. Enhanced Account and Fund Security

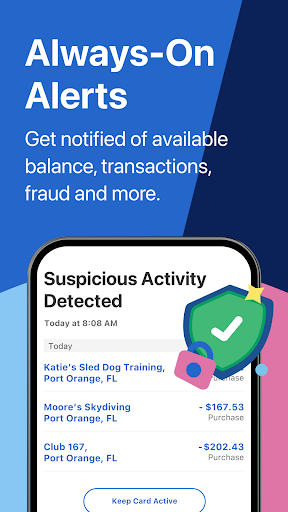

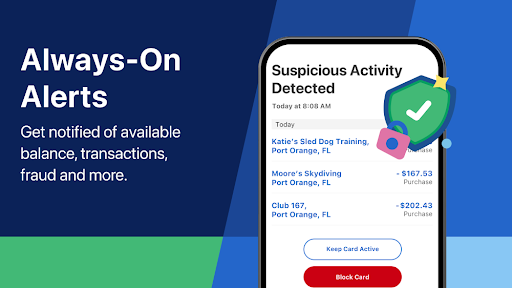

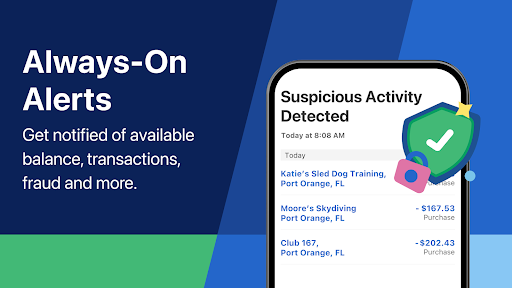

One of the app's standout features is its layered security framework. Beyond basic login credentials, Fifth Third employs multi-factor authentication (MFA), biometric login options like fingerprint or facial recognition, and real-time alerts for suspicious activity. Imagine having a vigilant guard watching over your digital funds 24/7—this focus on security makes users feel more confident when managing finances remotely. The app also allows you to lock/unlock your debit card instantly, offering peace of mind if you misplace it or suspect fraud.

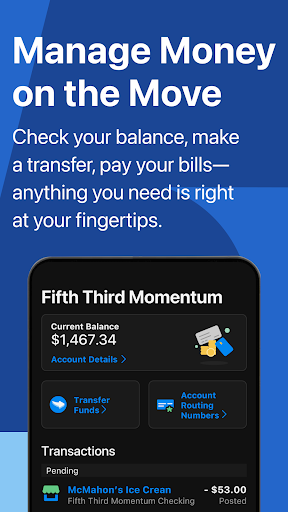

2. Seamless Transaction Experience

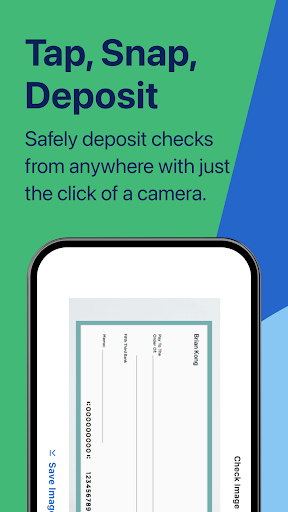

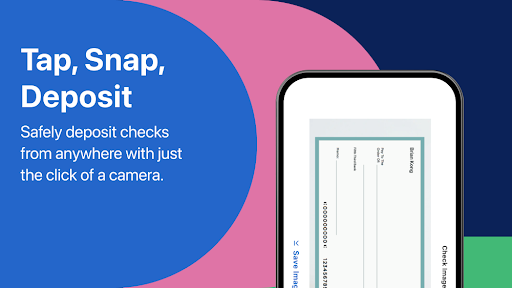

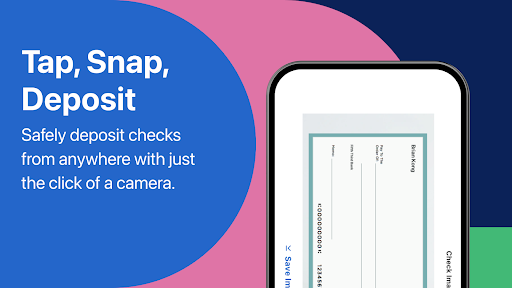

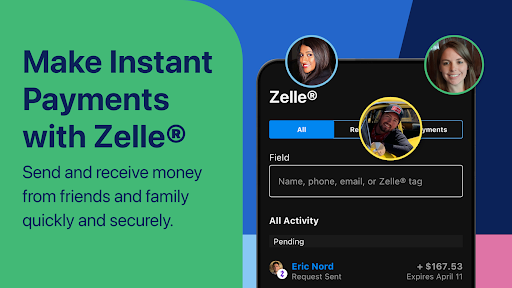

Fifth Third's app streamlines the process of transferring funds, paying bills, or depositing checks with a user-friendly workflow. The camera-based check deposit feature is particularly smooth—aligning the check in the app prompts a quick capture, auto-cropping, and validation, making deposits almost as easy as clicking a picture. Transfers between your accounts or to third parties happen in real-time, with clear confirmation dialogs that reduce chances of errors. The consistency and speed of these transactions make it a trustworthy tool for managing your daily finances.

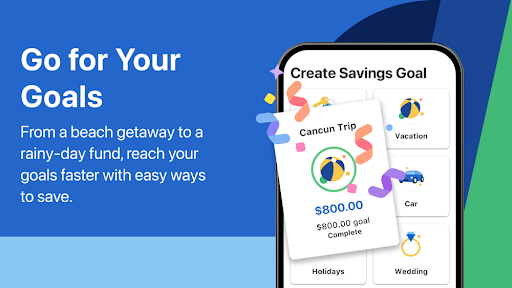

3. Personalized Alerts and Controls

This feature acts as your financial guardian angel. With customizable notifications, you can get immediate alerts for large transactions, low balances, and suspicious activities. It's like having a personal assistant reminding you to stay on top of your financial health. Moreover, controls such as temporary card freezes or setting spending limits empower you to exert greater control over your accounts without needing to call customer service. This level of personalization encourages proactive management rather than reactive fixes.

Comparative Edge: What Makes it Unique?

While many financial apps offer similar core features, Fifth Third's 53 Mobile Banking app distinguishes itself through its unwavering emphasis on security integrated seamlessly into everyday banking tasks. Unlike some competitors that bolt security features on as an afterthought, this app embeds multi-layered safeguards directly into its user flows. Additionally, its transaction experience stands out for the speed and simplicity of deposits and transfers—making it a pleasant "digital handshake" each time you interact.

Another subtle but important advantage is the app's ability to provide real-time updates and personalized alerts, which together create a sense of being in control without feeling overwhelmed. For users concerned about security, the combination of biometric login and instant card controls offers a reassuring safety net not always present in generic finance apps.

Final Verdict & Recommendations

If you're already a Fifth Third Bank customer or someone seeking a dependable, secure, and intuitive mobile banking platform, this app deserves a solid recommendation. Its most distinctive feature—layered security coupled with a user-centric transaction flow—makes it particularly suitable for users who prioritize safety without sacrificing convenience. For tech-savvy users or those new to digital banking, the clean interface and helpful features ease onboarding and daily use.

While it may not have the flashy features of some global banking apps, its strength lies in delivering a reliable, secure, and straightforward experience that feels trustworthy and personal. I would suggest giving this app a try if you value secure banking that blends professionalism with user-friendly design. For those who need robust security and seamless transaction handling, Fifth Third's 53 Mobile Banking is a dependable companion on your financial journey.

Similar to This App

Pros

User-Friendly Interface

The app features an intuitive layout making navigation easy for users of all levels.

Secure Authentication Methods

Supports multi-factor authentication, enhancing account security.

Fast Transaction Processing

Transfers and deposits are processed swiftly, saving users time.

Customizable Alerts

Users can set up personalized notifications for account activity.

Comprehensive Account Management

Allows quick access to balances, transaction history, and bill pay features.

Cons

Occasional App Crashes (impact: medium)

Some users experience crashes during high traffic periods, which may disrupt banking activities.

Limited International Transaction Support (impact: high)

Currently, international users face restrictions on certain transactions; official updates are anticipated to improve this.

Slow Customer Service Response (impact: medium)

Support response times can be lengthy, especially during peak hours; temporary solutions include using the in-app messaging feature.

Minor Bugs in Check Deposit Feature (impact: low)

Check deposit scans sometimes fail; updating the app or restarting may resolve the issue temporarily.

Inconsistent Push Notification Delivery (impact: low)

Some notifications are delayed or not received; users can try reinstalling the app or adjusting notification settings.

Frequently Asked Questions

How do I set up my Fifth Third mobile banking app for the first time?

Download the app, open it, and follow the on-screen registration prompts. You may need your account number and personal details to complete setup.

Can I access my account information on the app without visiting the bank?

Yes, you can securely log in to view account details, transactions, statements, and manage account settings directly from the app.

How do I deposit checks using the mobile app?

Select 'Deposit Checks,' take clear photos of both sides of your check, enter the amount, and submit before 8 PM ET for same-day processing.

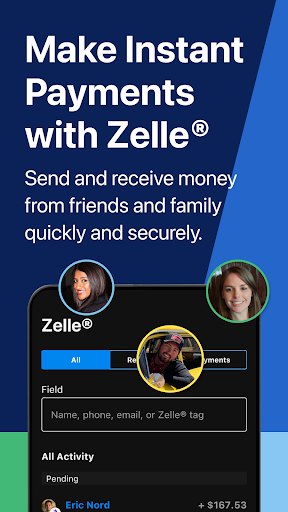

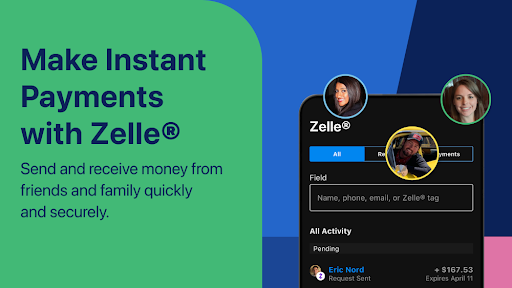

How can I quickly transfer money to friends or family?

Use ZELLE® within the app by selecting 'Send Money,' choosing or adding a recipient, entering the amount, and confirming the transfer.

What are the steps to pay my bills through the app?

Navigate to 'Bill Pay,' add payees if needed, select bills, enter amounts, and schedule payments directly from your account.

How do I enable or customize account alerts on the app?

Go to 'Alerts,' select 'Fifth Third Alerts®,' and set your preferences for transaction notifications via phone or email.

Is there a way to update my account information without calling customer support?

Yes, via the app go to 'Settings,' then 'Account Management' to update details like contact info, PIN, or card activation.

How do I find nearby ATMs or branches using the app?

Open the 'Locations' feature, allow location access, and view nearby branches and ATMs with operational hours and contact details.

Are there any security features to protect my account in the app?

Yes, the app encrypts data, uses multi-factor authentication, and allows you to lock/unlock your cards instantly for added security.

What should I do if I encounter an error or the app crashes?

Try updating the app, restarting your device, or reinstalling. If the issue persists, contact Fifth Third support through the app's help feature.