- Category Finance

- Version3.0.0

- Downloads 5.00M

- Content Rating Everyone

GO2bank: Mobile Banking — A Fresh Spin on Digital Banking

If you're tired of the same old simple banking apps that just let you check balances and transfer funds, GO2bank brings a vibrant, user-friendly experience with features designed for everyday financial ease and security. Developed by Roadside Modules LLC, this mobile app aims to be your friendly financial partner, simplifying banking chores while offering innovative tools tailored to modern users.

Functions at a Glance: What Makes GO2bank Stand Out?

From seamless account management to unique security features, GO2bank emphasizes both convenience and safety. Its main highlights include a straightforward paycheck deposit system that speeds up fund access, an automatic savings feature that encourages smarter money habits, and robust security measures designed to keep your finances safe without fuss. It targets busy professionals, students, and anyone seeking a hassle-free digital banking experience.

Setting the Scene: An Engaging Digital Banking Companion

Imagine opening an app that feels less like a cold, corporate interface and more like chatting with a knowledgeable friend who knows your financial goals. GO2bank offers a lively, approachable design that makes managing money feel less like a chore and more like a daily routine—akin to having your personal financial assistant in your pocket. With its bright color palette, intuitive layout, and quick-loading screens, navigating the app is as effortless as scrolling through your favorite social feed. The learning curve is gentle, welcoming users of both tech-savvy and less experienced backgrounds, thanks to clear icons and guided workflows.

Account and Fund Security: Peace of Mind in Your Pocket

Security is often the unsung hero of banking apps, and GO2bank rises to the challenge with standout features that prioritize user protection. Besides standard encryption and fraud alerts, GO2bank incorporates instant transaction alerts and biometric login options. What sets it apart is its commitment to real-time security updates and biometric verification, which makes unauthorized access nearly impossible—think of it as a digital lock that's always engaged when you want it to be.

Transaction Experience: Banking with a Personal Touch

Transacting with GO2bank is like having a reliable, well-trained teller right in your pocket. Transfers are swift, with confirmation screens that keep you informed every step of the way, reducing uncertainties common in digital transactions. Moreover, the app's unique “Snapshot” feature offers a quick overview of recent transactions and spending patterns, making budgeting simpler and more visual. Unlike many competitors, GO2bank emphasizes transparency and ease, ensuring users spend less time figuring out where their money went and more time enjoying it.

Design, Usability, and Overall Experience

The user interface strikes a healthy balance—colorful without being overwhelming, icons that are intuitive, and menus logically arranged. Transition animations are smooth, giving the feeling of gliding through a well-designed digital space. The learning curve is mild; most features can be mastered within minutes, making it friendly to first-time digital banking users. The app's responsiveness is noteworthy, with quick load times even during peak hours, ensuring users aren't left waiting. Overall, GO2bank shines in delivering a modern, approachable user experience that feels trustworthy yet inviting.

The Special Spark: Most Notable Features

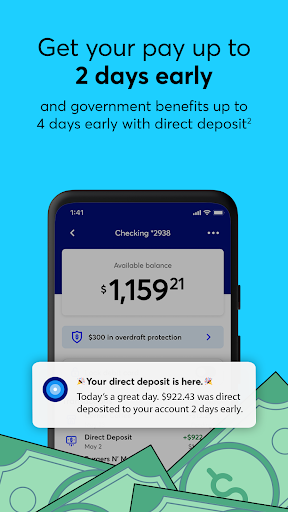

If I had to highlight what makes GO2bank truly shine, it's its rapid paycheck deposit capability and its automatic savings feature. The former means you can access your paycheck up to two days early—an absolute game-changer for managing cash flow when you need it most. The latter encourages smarter spending by rounding up everyday purchases into savings, almost like having a little financial coach nudging you towards your goals without feeling intrusive.

Final Verdict: Is GO2bank Worth Your Time?

For those seeking an app that combines clarity, security, and innovative features without overwhelming complexity, GO2bank is a compelling option. It's particularly suitable for users who value quick access to funds and proactive savings tools—think of it as a friendly financial sidekick that's always there to help. While it isn't packed with every advanced investment or credit feature, its core strengths lie in everyday banking with a thoughtful touch. I recommend giving it a try if you want a reliable, user-centric mobile banking experience that feels less like a chore and more like a partnership.

Similar to This App

Pros

User-friendly Interface

The app features an intuitive design that makes navigation easy for users of all ages.

No Monthly Fees

GO2bank offers free checking accounts with no monthly maintenance fees, saving users money.

Early Direct Deposit

Users can access their paycheck up to two days early with direct deposit setup.

Secure Mobile Banking

The app employs advanced security measures like encryption and fingerprint login to protect user data.

Cash Back Rewards

Cardholders can earn cash back on qualifying purchases directly through the app.

Cons

Limited Investment Options (impact: low)

Currently, GO2bank does not support investment services, which may be a drawback for users seeking comprehensive financial solutions.

Customer Service Accessibility (impact: medium)

Customer support has limited live chat hours, but improvements are anticipated in upcoming updates.

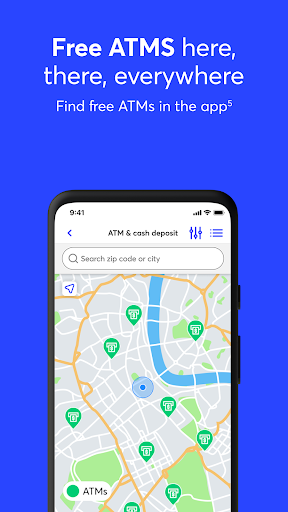

ATM Fee Limitations (impact: medium)

While many ATMs are fee-free, some users may encounter fees at non-network machines; planning ahead can help avoid this.

Minor App Glitches (impact: low)

Occasional app crashes or slow loading times have been reported, with official fixes expected in future updates.

Limited International Features (impact: low)

The app primarily supports US-based transactions and may have limited functionality abroad; official international plans are under consideration.

Frequently Asked Questions

How do I open a new account on GO2bank?

Download the app from your app store, then follow prompts for online registration, verify your mobile number via text, and complete identity verification with your SSN.

What do I need to start using GO2bank?

You need a mobile device, a valid mobile number, email address, and your SSN for identity verification. Completing these allows full access to all features.

How can I access my funds early with GO2bank?

Set up direct deposit via the app's settings. You can get paid up to 2 days early and government benefits up to 4 days early, depending on your payor's bank policies.

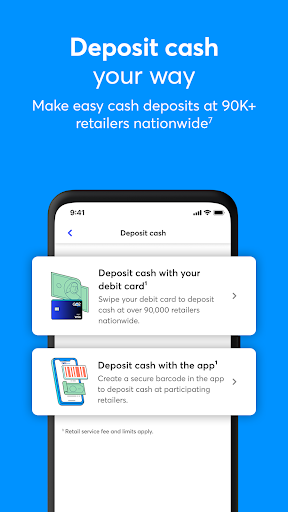

How do I deposit cash or withdraw money at ATMs?

Use the app to locate a participating ATM or retail deposit location. Withdraw cash for free at ATM networks; deposit cash at retail stores nationwide.

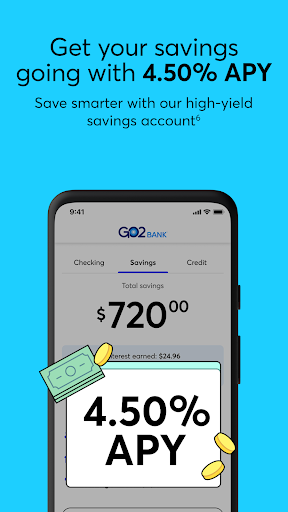

What is the interest rate on savings with GO2bank?

You earn 4.50% APY on your savings, paid quarterly. Simply transfer funds into your savings account within the app to start earning interest.

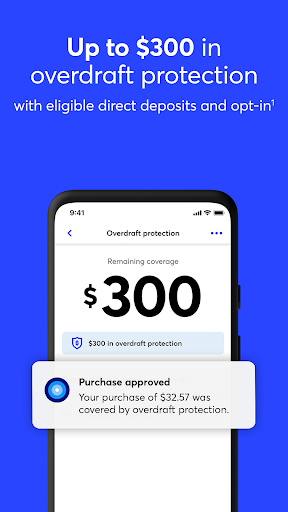

How does overdraft protection work?

Qualifying direct deposits enable you to get up to $300 overdraft protection. Enable this feature in the app under account settings for peace of mind.

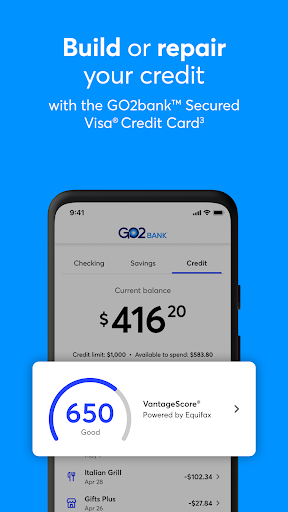

How can I build my credit using GO2bank?

Apply for the GO2bank Secured Visa® Credit Card via the app's credit section. No annual fee or credit check is required; use it to establish or improve your credit.

Is my money safe with GO2bank?

Yes, your funds are FDIC-insured up to the legal limits. You can also lock/unlock your card and receive fraud alerts for extra security through the app.

Are there any fees monthly or hidden charges I should know about?

If you have eligible direct deposit, there are no monthly fees. Otherwise, a $5 fee applies. Check detailed fee info in the app or visit GO2bank.com/daa.

What should I do if I encounter technical issues while using GO2bank?

Try closing and reopening the app, or reinstall it. For further help, contact GO2bank customer support through the app's help section or official website.