- Category Finance

- Version4.68.0

- Downloads 5.00M

- Content Rating Everyone

Green Dot - Mobile Banking: Your Modern Financial Companion

Green Dot's Mobile Banking app offers an approachable yet comprehensive platform designed to simplify financial management, blending innovative security features with a user-friendly interface. Developed by Green Dot Corporation, a pioneer in fintech solutions, this app aims to deliver a seamless banking experience for everyday users eager for convenience and security.

Key Features That Make a Difference

At its core, Green Dot's app stands out with its emphasis on security, ease of use, and versatile banking functionalities. It excels in providing real-time transaction alerts, instant card management, and a straightforward interface that caters to both tech-savvy users and newcomers alike. Additionally, the app integrates budgeting tools and offers prepaid card services, making it a versatile financial hub for a diverse user base.

A Closer Look: What Makes Green Dot Stand Out

1. Robust Account and Fund Security

Security is the foundation of any banking app, and Green Dot prioritizes this through layered protection mechanisms. The app employs multi-factor authentication, biometric login options like fingerprint and facial recognition, and real-time fraud alerts. These features act like a vigilant security guard, constantly watching over your funds and personal information. What sets Green Dot apart is its emphasis on proactive security measures—users are immediately notified of any suspicious activity, empowering them to act swiftly.

2. Hassle-Free Transaction Experience

Imagine running errands where each payment feels as smooth as sliding a credit card; that's the transaction experience Green Dot aims to recreate. The app offers instant fund transfers, peer-to-peer payments, and quick bill payments—all with just a few taps. Its intuitive design ensures that even first-time users can navigate their way through transactions effortlessly, avoiding the maze of complicated menus typical of some financial apps. The real-time notifications and transaction histories serve as a detailed, digital cash register, keeping users informed at every step.

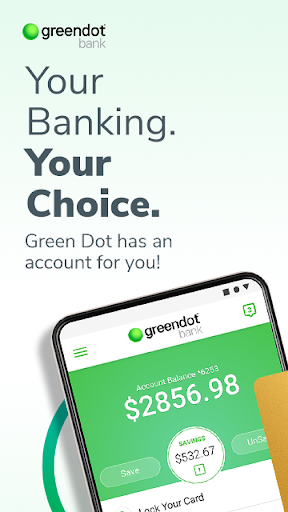

3. Engaging and User-Centric Interface

The app's interface resembles a well-organized workspace—clean, colorful, and easy to navigate. The home screen provides a snapshot of your account balance, recent transactions, and quick access to card controls. The learning curve is gentle, with onboarding that guides new users through essential features without overwhelming them. Animations and icons are thoughtfully designed to be both functional and visually appealing, making financial management feel less like a chore and more like a well-organized hobby.

Unique Selling Points and Comparative Edge

When stacked against similar fintech or banking apps, Green Dot shines particularly through its combination of quick card control features and superior security protocols. Unlike some competitors that rely on standard encryption, Green Dot incorporates biometric security at every turn, giving users peace of mind that their assets are well-guarded. Its transaction experience also feels more immediate—transactions are processed swiftly, and the interface ensures users can resolve any issues without frustration. Furthermore, the integrated prepaid card services streamline cash management for users who need flexible, accessible banking solutions without the traditional complexities.

Is Green Dot Worth a Try? Recommendations for Use

Overall, Green Dot's Mobile Banking app is a solid choice for individuals seeking a secure, straightforward, and efficient way to handle their finances. It suits busy professionals, students, and anyone interested in prepaid cards and quick banking features. For those prioritizing security alongside ease of use, Green Dot offers a reassuring environment that doesn't compromise either aspect.

While it may lack some advanced investment tools found in more comprehensive banking apps, its core features are more than sufficient for everyday banking needs. Users unfamiliar with digital banking might need a brief learning period, but the app's intuitive design helps flatten that curve quickly.

If you're searching for a reliable companion that balances strong security, usability, and versatility, Green Dot's Mobile Banking app is worth considering. It's like having a trustworthy financial assistant in your pocket—ready to help you navigate your money smoothly and safely.

Similar to This App

Pros

User-friendly interface

The app's clean layout makes navigating between features intuitive for new users.

Robust security measures

Green Dot employs multi-factor authentication and encryption to protect user data, ensuring safety.

Instant fund transfers

Users can send and receive money quickly with real-time processing, enhancing convenience.

Comprehensive account management

The app provides detailed transaction histories and budgeting tools for better financial tracking.

Limited fee structure

Many standard banking features come with low or no transaction fees, offering good value.

Cons

Limited ATM network (impact: medium)

There are fewer partnered ATMs, which may require users to pay withdrawal fees at other machines.

Occasional app crashes (impact: low)

Some users experience crashes during peak usage times; restarting the app often resolves this temporarily.

Basic customer support options (impact: low)

Support is mainly via email or FAQ, with limited live chat options; official improvements are expected soon.

Limited international features (impact: medium)

Currently, the app primarily caters to US users, which may restrict international transactions; future updates may expand this.

No biometric login for all devices (impact: low)

Biometric authentication is available only on certain devices, but official updates aim to broaden compatibility.

Frequently Asked Questions

How do I register and activate my Green Dot mobile banking account?

Download the app from App Store or Google Play, open it, and follow the on-screen instructions to register, verify your identity, and activate your account.

What are the basic features I can access after setting up my account?

You can view your balance, transaction history, lock/unlock your account, deposit checks, and set up alerts through the app's main menu.

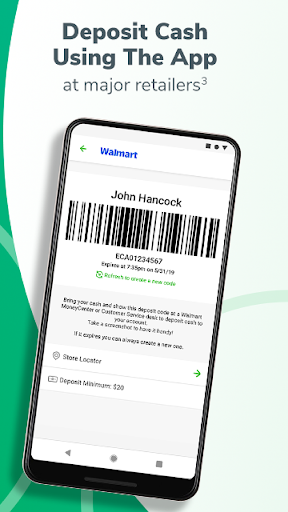

How can I add money to my Green Dot account via the app?

Use the 'Deposit' feature in the app to deposit checks by taking a photo or deposit cash at a retail location, with a $4.95 fee applicable.

How do I set up early direct deposit to get paid or benefits earlier?

Go to Settings > Direct Deposit, enter your employer or benefits provider info, and ensure your account is active for early deposit eligibility.

How can I turn on overdraft protection and what are the limits?

Navigate to Settings > Overdraft Protection, opt-in, and ensure eligible direct deposits are set up; protection covers up to $200 after fees.

How do I enable and use cashback rewards on purchases?

Use your Green Dot Cash Back Visa Debit Card for eligible online or mobile purchases; cashback is credited annually while your account is in good standing.

How can I set up and access the Green Dot High-Yield Savings Account?

Tap 'Savings' in the app, follow prompts to open the account, and deposit funds to earn 2.00% APY on up to $10,000.

How do I find and use free ATMs via the app?

Go to the 'ATM Network' section in the app to locate free ATM locations and learn about withdrawal limits and potential fees.

What should I do if I forget my login password?

On the login screen, click 'Forgot Password,' follow the prompts to verify your identity, and reset your password securely.

Are there any costs for using the app or specific features?

Most features are free, but cash deposits cost $4.95, and some ATM withdrawals outside the network may incur fees. Check the app for detailed fee info.