- Category Finance

- Version7.23.1

- Downloads 1.00M

- Content Rating Everyone

Greenlight Kids & Teen Banking: A Smart, Kid-Friendly Financial Companion

Greenlight Kids & Teen Banking offers a comprehensive, secure, and engaging platform designed to teach young users about managing money responsibly while providing parents with peace of mind. With a blend of intuitive design and innovative features, it stands out in the realm of youth financial apps.

Who's Behind the Curtain?

Developed by Greenlight Financial Technology, Inc., a company dedicated to transforming the way families handle finances, this app combines expert financial education with user-centric technology. Their mission is to empower children and teens to develop healthy money habits early on, preparing them for lifelong financial independence.

Major Highlights: What Makes It Shine?

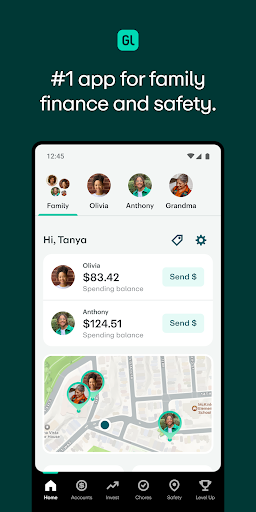

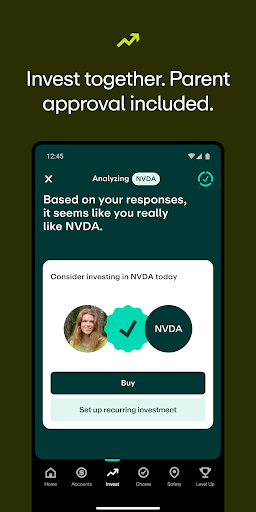

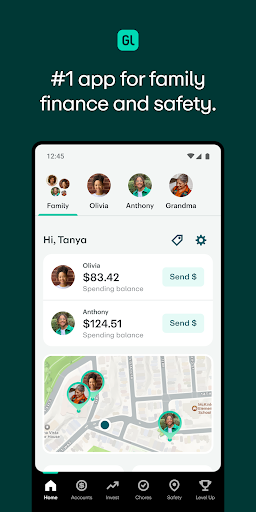

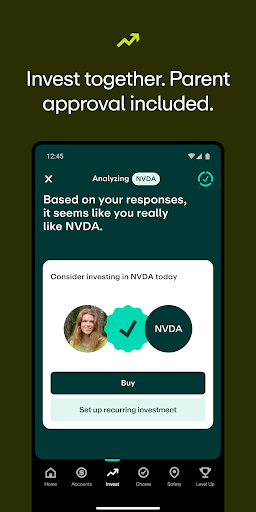

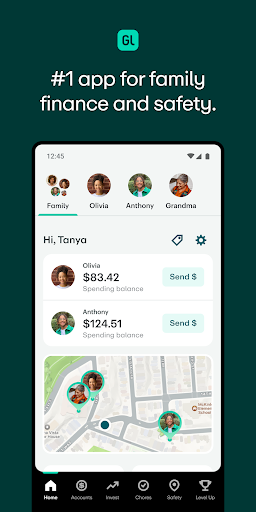

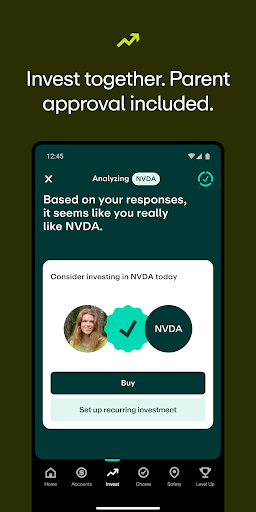

- Parent-Child Account Management: Seamless oversight allowing parents to create and monitor accounts, set allowances, and track spending.

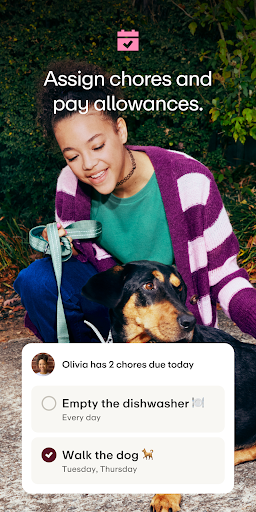

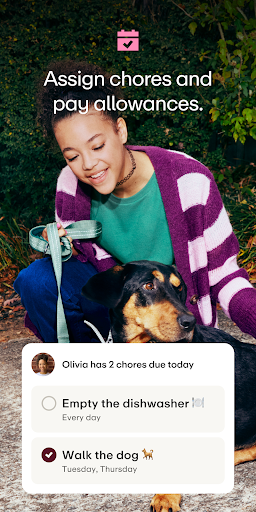

- Automated Allowances & Chore Tracking: Customizable recurring allowances tied to chores, making money management a real-world learning experience.

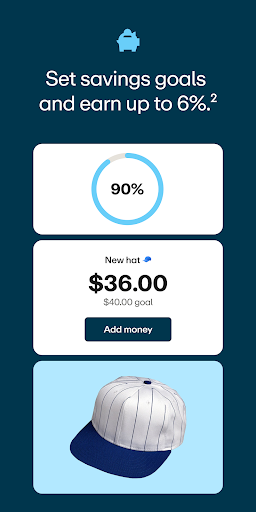

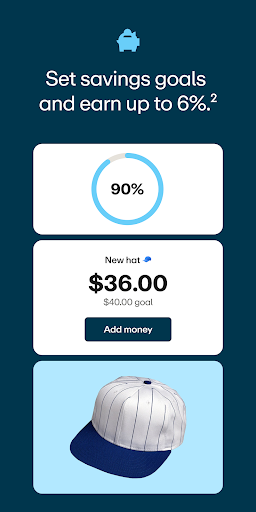

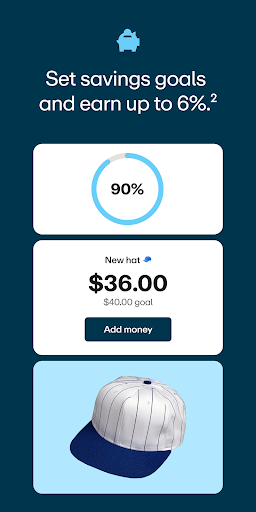

- Financial Literacy & Goal Setting: Engaging educational tools that encourage goal-oriented saving and smart spending habits.

- Secure & Private Transactions: Advanced security measures ensuring that young users' financial data remains protected.

A Closer Look: Navigating the Features

A User-Friendly Interface That Feels Like a Digital Wallet

The app's interface is colorful, inviting, and intuitive—almost like a digital wallet that children would love to carry around. Cartoon-inspired icons and straightforward navigation make it easy for young users to find what they need without frustration. The onboarding experience smoothly guides children and teens through deposit methods, spending limits, and educational modules, making the learning curve gentle yet engaging.

Streamlined Operations for Seamless Learning and Spending

Greenlight's transaction process mimics a real-world experience; children can view real-time updates of their spending and savings. Parents can set spending limits and approve transactions via instant notifications, providing control without creating bottlenecks. The app's smooth performance ensures actions—be it transferring funds or setting new savings goals—are quick and hassle-free, akin to flipping a switch and watching the magic happen. This fluidity helps foster a sense of trust and responsibility in young users.

Unique Security Features That Set It Apart

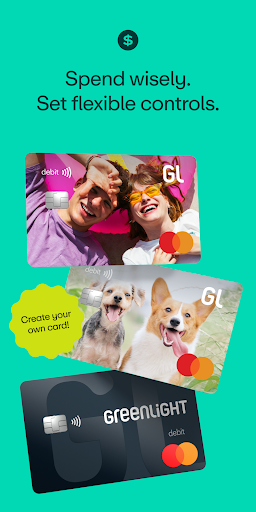

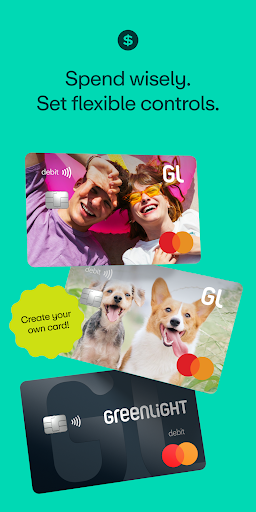

What really makes Greenlight stand out among youth-oriented finance apps is its layered security approach. Unlike simple prepaid cards or generic apps, Greenlight employs bank-level encryption, multi-factor authentication, and biometric options to keep accounts safe. Parents can restrict card usage by merchant category or time, almost like setting digital passcodes for a younger sibling's toy box, ensuring that control stays firmly in their hands. This robust security design reassures parents that their children's money is protected by the same standards used in professional banking environments.

What Sets Greenlight Apart? The Highlighted Difference

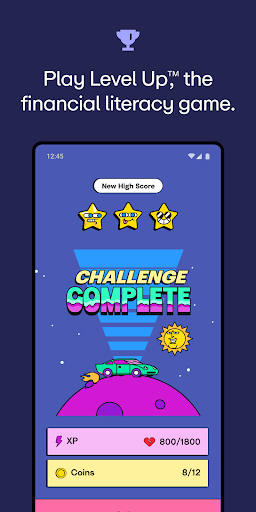

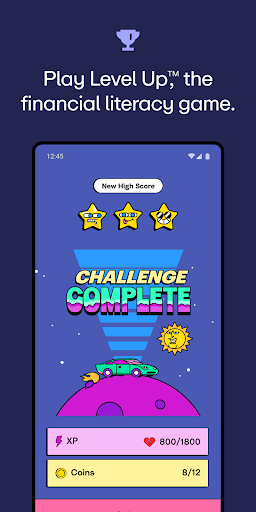

The app's standout feature lies in its blend of educational content with practical banking functions. Unlike traditional finance apps, Greenlight emphasizes learning by integrating quizzes, tips, and visual progress trackers that make understanding money concepts fun and accessible. Additionally, its **automatic allowance feature linked to chores** fosters responsibility while making allowance management effortless for parents. This tight coupling of education, security, and usability explains why many see Greenlight not just as a banking app but as a trusted financial coach for young learners.

My Verdict: Is It Worth It?

Considering its ease of use, safety measures, and educational approach, Greenlight Kids & Teen Banking is highly recommended for families seeking a reliable starting point for financial literacy. It's particularly suitable for children aged 6-18, adapting well to various maturity levels with customizable features. For parents eager to teach their kids about money without the constant oversight, this app acts like a patient, tech-savvy teacher who's always within arm's reach.

In essence, Greenlight isn't just about opening a bank account—it's about opening a door to financial independence and smart money habits. Whether your child is just starting to learn the value of coins or managing a teen-sized allowance, Greenlight provides the tools, security, and guidance needed to turn money lessons into lifelong skills. Think of it as planting the seeds for a financially confident future—practical, safe, and designed to grow alongside your child.

Similar to This App

Pros

User-friendly interface

The app is easy for kids and teens to navigate, encouraging independent financial management.

Parental controls

Parents can monitor transactions and set spending limits, promoting responsible habits.

Educational features

Includes financial literacy tools and lessons tailored for different age groups.

Secure environment

Uses robust encryption and PIN protection to safeguard users' funds and data.

Reward system

Offers rewards for saving goals, motivating kids to develop good saving habits.

Cons

Limited transaction categories (impact: medium)

Currently, the app only supports basic transactions, which might limit financial tracking detail.

In-app customer support (impact: low)

Support options are limited, often requiring email contact; live chat may be introduced in future updates.

Age-specific features (impact: low)

Some features are not fully customized for different age groups, but improvements are planned.

Offline access (impact: medium)

The app requires internet connectivity for most functions; offline mode could be enhanced.

Limited international availability (impact: medium)

Currently, the app is available only in select countries; broader rollout is expected soon.

Frequently Asked Questions

How do I set up Greenlight for my family?

Download the app, sign up as a parent, then create accounts for your children through the app's setup process in the main menu.

Can I monitor my child's spending activity?

Yes, parent controls allow you to view all transactions, set limits, and restrict where the debit card can be used via Settings > Parental Controls.

How do I assign chores and allowances to my kids?

Navigate to the family management section, then add chores and set automated allowances in the app's Family Management tab.

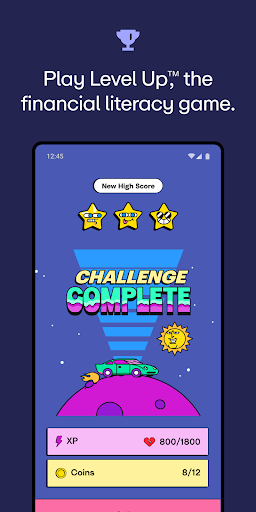

What educational tools does Greenlight offer for kids?

Greenlight provides the Greenlight Level UpTM game to teach saving, budgeting, and investing in an engaging way within the app's Learning section.

How secure are the transactions and family data on Greenlight?

Transactions are protected by encryption, and the app offers family safety features like real-time notifications, location sharing, and identity theft protection in Settings.

What are the differences between the subscription plans?

Core plan costs $5.99/month with basic features; Max is $10.98/month with cashback and protection; Infinity is $15.98/month with higher rewards; Family Shield is $24.98/month with extensive protections.

How do I upgrade or change my plan?

Go to Settings > Subscription, then select your desired plan and follow prompts to upgrade or modify your subscription in the app.

What should I do if the app is not working properly?

Try restarting your device or reinstalling the app. For further assistance, visit the help portal at https://help.greenlight.com.

Is there a free trial or demo available?

Greenlight does not specify a free trial; plans are billed monthly. Check the app store listing for any current promotions or demos.

How can I ensure my family's privacy and data security?

Greenlight complies with California Privacy Rights, with options to request data removal and manage privacy settings under Settings > Privacy in the app.