- Category Finance

- Version2.0.7

- Downloads 0.50M

- Content Rating Everyone

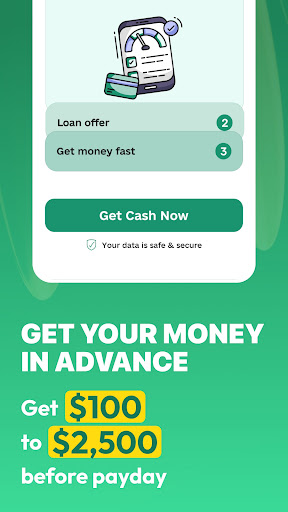

Instant Cash Advance Loan App: Your Quick Financial Helper

The Instant Cash Advance Loan App positions itself as a straightforward and reliable solution for those moments when you need immediate financial assistance without the hassle of traditional lending channels.

Developers and Key Features

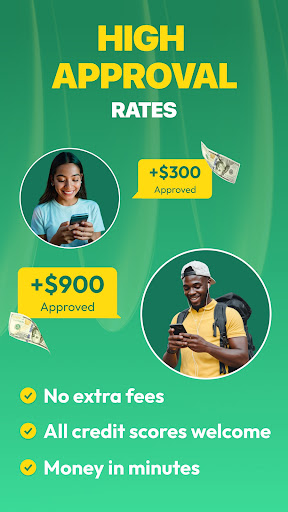

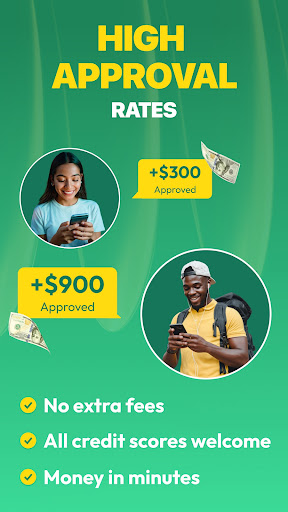

Developed by FinEase Technologies, a team dedicated to simplifying personal finance management, this app offers a suite of features designed to make small loans accessible and secure. Its main highlights include rapid loan approval within minutes, flexible repayment options tailored to user needs, and robust security measures ensuring transaction safety. Geared towards individuals seeking quick, small-scale financial relief, the app caters to students, gig workers, and anyone facing sudden expenses.

A Friendly Introduction: Lending Made Easy — With a Dash of Trust

Imagine a rainy day where your umbrella snaps just as the storm hits — suddenly, you need a quick fix to get you through. That's where the Instant Cash Advance Loan App steps in, like a helpful neighbor offering a small loan, right when you need it most. Its promise is simple: get approved fast, borrow effortlessly, and settle on your own schedule—all while feeling secure and in control. It's like having a financial safety net tucked into your pocket, ready to deploy at a moment's notice.

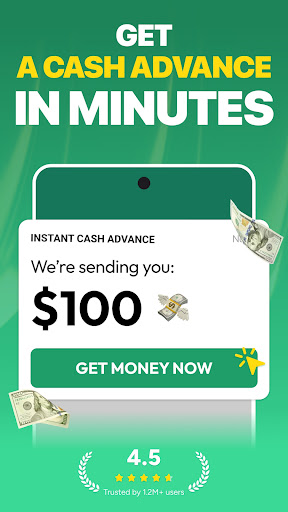

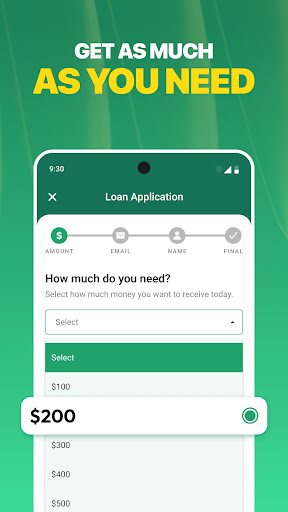

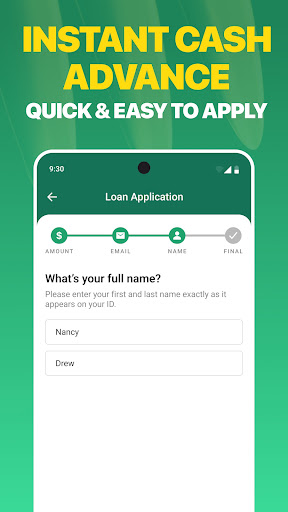

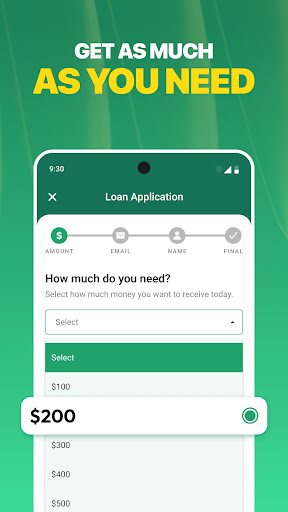

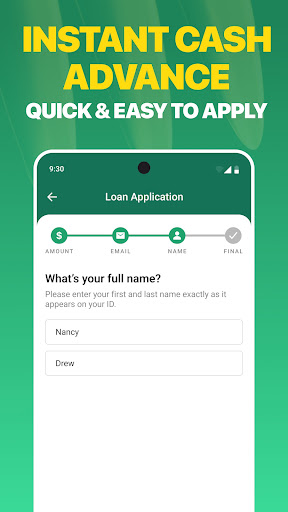

Swift and Seamless Loan Approvals — Your Financial Speed Dial

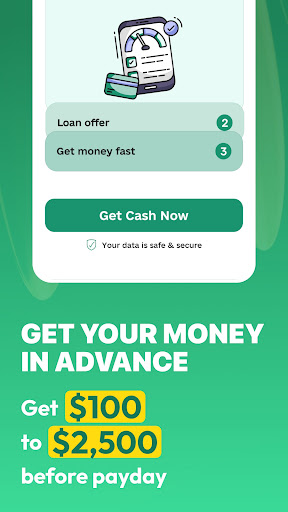

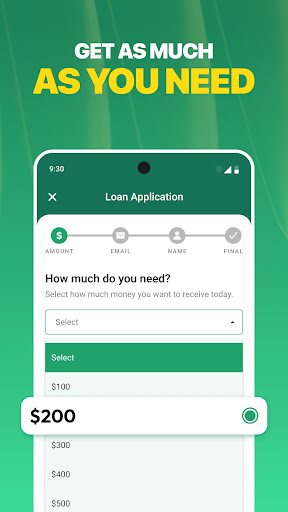

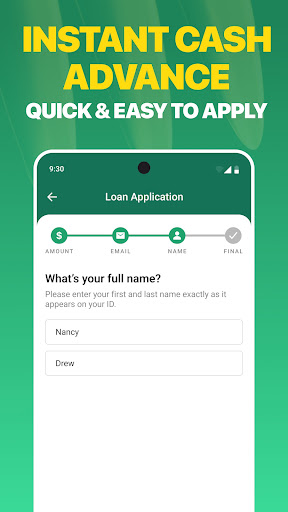

The core of this app's charm lies in its lightning-fast approval process. Thanks to streamlined algorithms and minimal paperwork, users can secure a loan within minutes. The process begins with a simple application form, where personal and employment details are entered. Using advanced AI models, the app swiftly assesses creditworthiness based on existing data, often approving small loans within a few taps. This immediacy is perfect for emergencies or unexpected expenses, transforming what used to be hours or days into mere moments. The interface guiding this process is intuitive, with clear prompts and progress indicators, making the user experience smooth even for first-time users.

Flexible Repayment Plans — Tailored to Your Rhythm

Beyond just quick access, the app shines with its flexible repayment options. Unlike traditional lenders that impose rigid schedules, this platform allows users to select repayment dates and amounts that align with their income flow. Whether you prefer weekly installments or a one-time payoff at the end of the month, the app accommodates your financial rhythm. Such customization reduces stress and enhances user trust, making it feel more like borrowing from a supportive friend rather than a faceless institution. The app also provides clear reminders and notifications, helping users stay on track without feeling overwhelmed.

Enhanced Security: Your Funds and Data, Fortress Protected

Security remains a top priority for the Instant Cash Advance Loan App. It incorporates military-grade encryption protocols, multi-factor authentication, and device-specific verifications, ensuring that your personal data and funds are shielded from any malicious threats. Unlike some other financial apps that might compromise user information, this platform emphasizes transparency and security — a trust-building feature that can't be overlooked. Users are also provided with detailed transaction histories and real-time alerts, giving them complete control and visibility over their borrowing activity.

What Sets It Apart? Security and User Experience at the Forefront

Many finance apps boast about their features, but the Instant Cash Advance Loan App distinguishes itself by seamlessly combining high security standards with a remarkably user-friendly transaction experience. Its security measures go beyond the basics, integrating biometric locks and encrypted data storage, making users feel confident that their funds and information are safe. Additionally, its intuitive design minimizes the learning curve, with a clean layout, straightforward navigation, and helpful prompts. These factors together make it not just a quick loan tool but a trustworthy financial partner.

Recommendation and Usage Tips

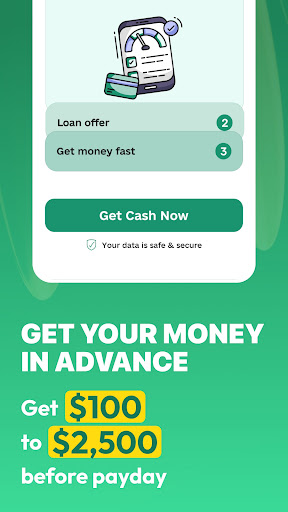

If you're often caught unprepared for unexpected expenses and appreciate quick, hassle-free borrowing, this app deserves a spot on your device. Its strengths lie in speed, flexibility, and security—key ingredients for a positive borrowing experience. However, always remember to assess your repayment capacity beforehand; loans should be used responsibly even when they're so conveniently accessible. For new users, starting with smaller amounts helps familiarize you with the flow, ensuring smooth future transactions. Overall, if timely financial aid is your priority, this app is a reliable and user-friendly choice.

Similar to This App

Pros

User-friendly interface

The app features a simple design that makes loan application straightforward for users of all experience levels.

Quick approval process

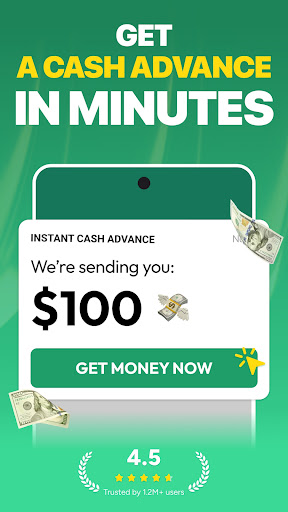

Loans are approved within minutes, providing fast financial assistance when needed most.

Low interest rates

Competitive interest rates compared to traditional payday loans help save users money.

Flexible repayment options

Multiple repayment plans allow users to choose based on their income schedules.

Minimal documentation required

The app simplifies the process by requiring only basic personal and financial information.

Cons

Limited loan amounts (impact: low)

The app offers relatively small loans, which might not meet larger financial needs.

Potential hidden fees (impact: medium)

Some users may encounter extra charges for late payments or extended repayment periods, but these are often clarified upfront.

Limited availability in certain regions (impact: medium)

The app may not be accessible in all geographic locations yet, but expansion plans are underway.

Strict credit score requirements (impact: high)

Applicants with poor credit may find it harder to qualify; however, the app is working to include alternative evaluation methods.

Risk of over-reliance on quick loans (impact: medium)

Users might become dependent on short-term borrowing; promoting financial literacy could mitigate this issue.

Frequently Asked Questions

How do I start using the Instant Cash Advance Loan App?

Download the app from your app store, create a profile, link your bank account, and complete the onboarding process to begin applying for cash advances.

Is it necessary to have good credit to use this app?

No, the app accommodates all credit types by evaluating income and employment, making it accessible even with poor credit scores.

How long does it take to get approved and receive funds?

Approval usually takes a few minutes after application, and funds are often transferred instantly once approved, providing quick access to cash.

What are the main features of this app?

The core features include quick application, no hard credit check, instant approval, fast fund transfer, and flexible repayment options.

How does the app determine my borrowing limit?

It analyzes your income, spending habits, and repayment history to set a borrowing limit, which can increase over time with positive use.

Are there any fees or interest rates I should be aware of?

Yes, the app displays APR rates ranging from 6.63% to 35.99% before you borrow, and fees depend on the loan amount and repayment terms.

Can I change or cancel a loan after applying?

Loan terms are fixed once approved; however, contact customer support promptly if you need to discuss modifications or cancellations.

How can I find my repayment schedule?

Navigate to 'Settings' > 'Payments' or 'Repayment Schedule' within the app to view your upcoming payments and due dates.

Are there any subscription or membership fees for using this app?

The app itself is free to download; fees are only applied when you take out a loan, based on the agreed interest and repayment plan.

What should I do if I'm experiencing technical issues with the app?

Try restarting your device, updating the app, or reinstalling it. If problems persist, contact customer support through the app's help section.