- Category Finance

- Version25.50.1

- Downloads 0.05B

- Content Rating Everyone

Intuit Credit Karma: Your Personal Financial Health Companion

Intuit Credit Karma is a user-centric financial management app designed to empower individuals with clear insights into their credit health, personalized recommendations, and secure financial tools, all crafted by the experienced team at Intuit Inc.

Core Features That Make a Difference

At first glance, Credit Karma combines the comfort of a trusted financial buddy with the power of sophisticated financial analysis. Its standout features include free credit score monitoring, tailored loan and credit card offers, and a comprehensive financial dashboard—all aimed at helping users make smarter financial decisions.

Personalized Credit Monitoring and Alerts

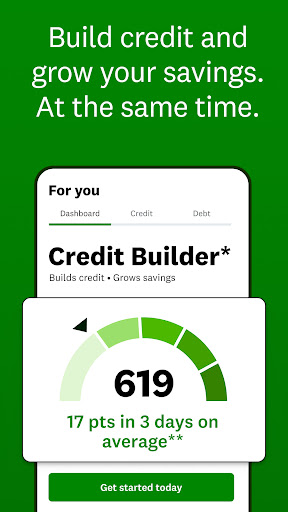

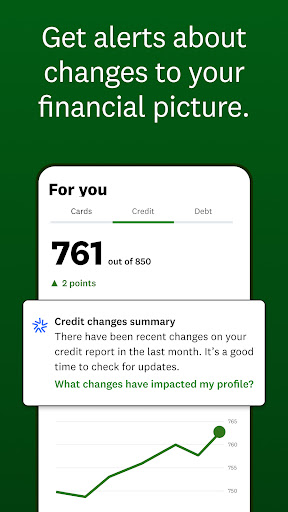

One of Credit Karma's crown jewels is its real-time credit monitoring service. Think of it as having a vigilant financial guardian by your side — constantly tracking your credit report for any changes. The app provides weekly updates on your credit scores from TransUnion and Equifax, the two major credit bureaus, allowing users to stay ahead of potential identity theft or unauthorized activities before they escalate. Customizable alerts notify you of significant changes, giving you peace of mind without the hassle or hidden fees typically associated with credit monitoring services.

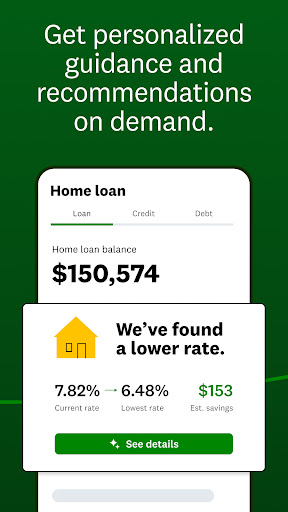

Smart Financial Product Recommendations

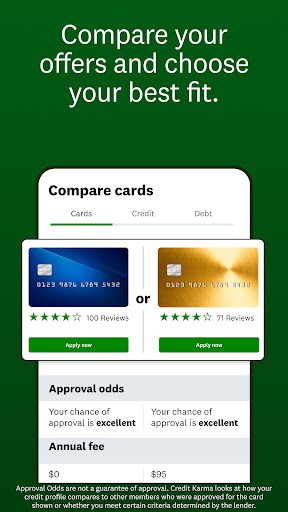

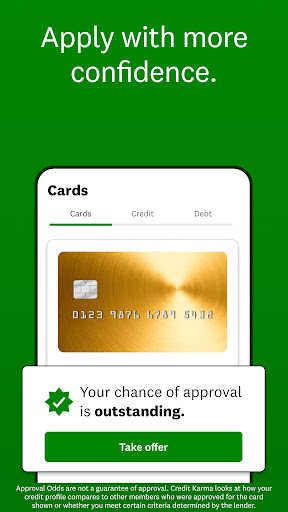

Imagine having a savvy financial advisor whispering in your ear, offering you tailored loan, credit card, and savings product suggestions based on your unique profile. Credit Karma leverages its data-driven algorithms to analyze your credit profile and suggest the best financing options that suit your needs. Whether you're planning to buy a new car, refinance a student loan, or find a credit card with rewards, the app helps you see your options clearly and choose the best fit—all transparent and free of junk fees or bias.

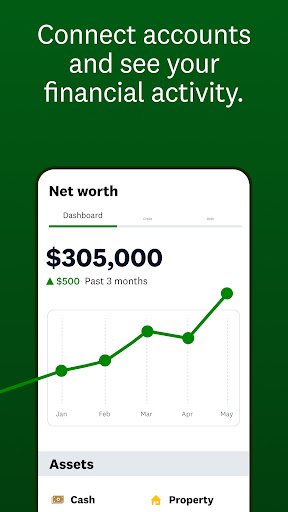

Comprehensive Financial Health Dashboard

The app's main interface resembles a well-organized control panel—intuitive and approachable. Users can view their credit scores, report summaries, and customized tips at a glance. The dashboard consolidates insights across different financial areas, including debt levels, account activity, and savings goals. This holistic view transforms complex data into straightforward, actionable advice, making financial management feel less like a chore and more like managing a personal mission. The user interface is clean and colorful, with smooth interactions that make navigation seamless, even for those unfamiliar with financial apps.

Exceptional User Experience and Unique Selling Points

Credit Karma's design maintains a friendly, approachable tone, akin to chatting with an informed friend. Its layout is uncluttered, with logical flows that gradually introduce more advanced features — a gentle learning curve that welcomes first-time users without overwhelming them. Transitioning from reading a credit score to exploring recommended loans feels like flipping through the pages of a well-illustrated guide—not a daunting task.

Compared to other financial apps, Credit Karma's most notable advantage lies in its combined emphasis on security and transparency. Unlike some apps that may hide their fee structures or use opaque algorithms, Credit Karma proudly offers free credit scores, reports, and personalized recommendations. It emphasizes the safety of user data through robust encryption and regular security audits, reassuring users that their information is protected. Its transaction experience shines through its simplicity—users can explore offers, compare terms, and apply directly within the app, all in a few taps, providing an efficient and worry-free process.

Should You Give It a Try?

If you're someone who wants to get a clear picture of your credit health without the sales pitches or hidden agendas, Credit Karma is worth installing. It's especially suitable for users at various stages of their financial journey—students building credit, young professionals managing loans, or families planning for future expenses. The app's tailored insights and alerts serve as a reliable compass, guiding you through the often-confusing maze of personal finance.

Overall, I'd recommend Credit Karma to anyone seeking an honest, transparent, and easy-to-use financial companion. While it may not replace comprehensive financial advisors for complex planning, it certainly lays a solid foundation for smarter money habits. Its most remarkable feature—free, real-time credit monitoring combined with personalized financial recommendations—sets it apart from many peers in the crowded finance app landscape. So, if you're ready to take charge of your financial health with confidence, Credit Karma is a friendly hand you'll want to hold onto.

Similar to This App

Pros

Free Credit Monitoring

Intuit Credit Karma offers free access to credit scores and reports, helping users track their financial health without extra charges.

Personalized Credit Tips

The app provides tailored advice to improve credit scores, such as paying down specific debt categories.

Financial Product Recommendations

Credit Karma suggests personalized loan and credit card options, streamlining the application process.

User-Friendly Interface

The app's clean and intuitive design makes navigating credit information simple for users.

Credit Score Updates

Scores are updated weekly, allowing users to monitor progress with recent changes.

Cons

Limited Credit Score Models (impact: Medium)

The app displays VantageScore instead of FICO, which is more widely used by lenders, possibly misrepresenting credit standing.

Ads and Recommendations (impact: Low)

Users may encounter frequent advertisements for financial products, which can be distracting; using premium features can reduce this.

Data Refresh Delays (impact: Low)

Credit score updates are weekly, so real-time changes may not be immediately reflected; users should wait for next update for latest info.

Limited Credit Details (impact: Medium)

The report provides an overview but lacks detailed insights into credit report items, which may require checking directly with credit bureaus.

Inconsistent Credit Recommendations (impact: Low)

Some suggested financial products might not suit all users' needs; users should verify options independently before applying.

Frequently Asked Questions

How do I sign up and get started with Credit Karma?

Download the app from your device's app store, open it, and follow the signup process by entering basic personal info. Navigate through the onboarding to connect your accounts easily.

Is Credit Karma free to use?

Yes, Credit Karma offers most features for free, including credit monitoring and loan comparisons. There are optional premium services available through in-app settings.

How can I check my credit score regularly?

Your credit score updates automatically within the app. To view it, go to the 'Credit' tab on your dashboard, and enable notifications for score change alerts.

What features help me understand what affects my credit score?

The 'Credit Report Card' provides a straightforward overview of factors affecting your score. Access it via the 'Credit' tab under 'Credit Report' section.

Can I connect my bank accounts to track my spending?

Yes, go to 'Settings' > 'Accounts' > 'Connect Accounts' to securely link your bank and credit card accounts for spending insights.

How do I explore loan options and personalized offers?

Navigate to the 'Offers' tab to view tailored loan, credit card, and insurance deals based on your financial profile.

Does Credit Karma provide alerts for credit score changes?

Yes, enable notifications in 'Settings' > 'Notifications' to receive instant alerts about credit score fluctuations and important updates.

Can I open a savings or checking account within the app?

Yes, go to 'Credit Karma Money' section to open FDIC-insured Spend and Save accounts directly within the app for easy banking.

How do I compare car insurance policies on Credit Karma?

Select 'Insurance' from the menu to view and compare various policies, helping you find the best rates and discounts suited to your needs.

What should I do if I experience technical issues with the app?

Try restarting your device or updating the app through the app store. If problems persist, contact Credit Karma support via 'Help' in the app settings.