- Category Finance

- Version5.6.10

- Downloads 0.01B

- Content Rating Everyone

IRS2Go: Your Friendly Guide to Navigating U.S. Tax Payment and Refunds

Designed by the Internal Revenue Service, IRS2Go stands out as a user-centric mobile app that simplifies the complex world of tax payments and refunds, providing a seamless digital experience for taxpayers nationwide.

About the App: Quick Snapshot

IRS2Go is the official mobile application developed by the IRS, aimed at making the tax-related processes more accessible and manageable through smartphones. Its core functionalities include tracking refund statuses, making payments securely, and providing timely tax updates. It primarily targets individual taxpayers, tax professionals, and anyone needing quick access to IRS services on the go.

A Friendly Introduction: Navigating Taxes Made Less Taxing

Imagine tax season as a bustling city, with millions navigating the labyrinth of forms, deadlines, and payments. IRS2Go acts like a friendly local guide, whispering helpful tips, providing a clear route to your refund, and keeping you updated without the need to wrestle with bulky paper or confusing websites. It's designed to bring clarity and convenience into an often stressful process—turning what used to be a chore into a manageable, even pleasant, experience.

Reflecting Core Functionalities: What Makes IRS2Go Stand Out

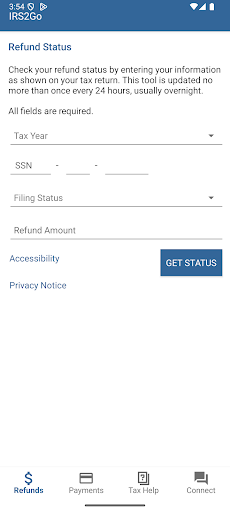

1. Refund Status Tracking: Your Refund's GPS

One of the standout features of IRS2Go is its ability to let users track their tax refunds in real-time. Upon submitting your tax return, you can open the app and see exactly where your refund is—whether it's being processed, approved, or sent out. It's like having a GPS for your money, providing reassuring updates and eliminating the need for repetitive calls or web check-ins. This feature embodies transparency and keeps taxpayers informed, reducing anxiety during the often-long wait.

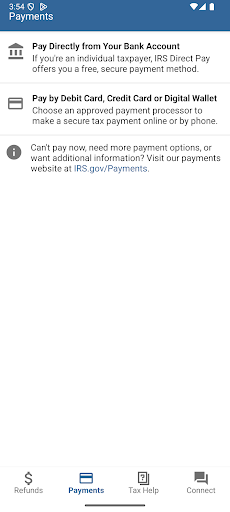

2. Secure and Convenient Payment Options

Paying taxes can feel like a daunting task, but IRS2Go simplifies it by offering a secure channel for payments directly from your mobile device. Whether you prefer electronic transfers or scheduling payments ahead of deadlines, the app ensures your sensitive information remains protected via encryption. Think of it as a virtual lockbox that facilitates smooth transactions, saving you trips to the bank or cumbersome online portals—especially helpful during busy tax seasons or when traveling.

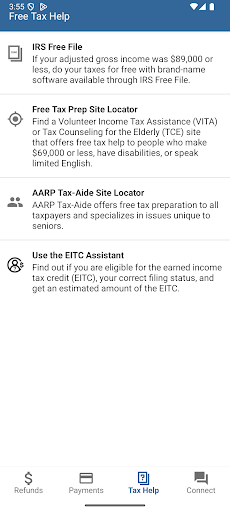

3. Timely Tax Tips and Updates—Your Personal Tax News Broadcast

IRS2Go keeps users in the loop with the latest tax tips, deadlines, and alerts. From reminders about upcoming submission dates to explanations of new tax laws, this feature transforms the app into a mini broadcast station dedicated to tax education. It's like having an experienced tax advisor in your pocket, guiding you through the year's financial landscape with friendly advice and timely notifications.

User Experience and Unique Selling Points

The interface design of IRS2Go is clean, intuitive, and straightforward—imagine navigating a well-organized city map with clear pathways and signage. The app's responsiveness is commendable; transitions between features are fluid, ensuring users don't experience lag or confusion. For newcomers, the learning curve is gentle—much like stepping into a familiar neighborhood that gradually reveals its conveniences.

Compared to other financial apps, IRS2Go emphasizes taxpayer security and convenience. Its focus on secure transactions and real-time refund tracking differentiates it from generic finance apps that often lack specialized features for tax management. Moreover, the app's emphasis on promptly delivering updates and tax tips makes it a reliable companion during the often hectic tax season, rather than just a static portal for data entry.

In terms of overall recommendation, IRS2Go is best suited for individual taxpayers seeking a streamlined, reliable way to stay on top of their tax payments and refunds. It's especially beneficial for those who prefer managing their finances on mobile and value peace of mind through real-time updates and secure transactions.

Final Verdict: A Trusted Ally in Your Tax Journey

While IRS2Go may not replace the need for professional tax advice, its targeted features provide genuine convenience and transparency—especially with its standout refund tracking and secure payment options. It's like having a trusted assistant that keeps a watchful eye on your tax affairs, offering clarity and confidence. For anyone aiming to demystify the tax process and handle their financial obligations with greater ease, IRS2Go deserves a spot on their mobile device. Consider it a practical, no-nonsense tool designed with the everyday taxpayer in mind—and that's a recommendation worth taking to heart.

Similar to This App

Pros

User-Friendly Interface

IRS2Go offers a clean and intuitive layout that makes navigation simple for users of all levels.

Quick Access to Refund Status

Users can easily check their refund status with just a few taps, saving time and effort.

Multiple Language Support

The app provides options in several languages, enhancing accessibility for diverse users.

Tax Payment Convenience

Allows secure online payments, including installment options for taxpayers.

Up-to-Date Tax Information

Regular updates ensure users have access to the latest IRS announcements and forms.

Cons

Limited Functionality Offline (impact: medium)

Many features require internet connectivity, which may inconvenience users in low-signal areas.

Occasional App Crashes (impact: medium)

Some users experience crashes during form submissions or when accessing certain tools; reinstalling or updating may help temporarily.

Delayed Updates for New Tax Laws (impact: low)

Updates on recent tax law changes may be delayed, but official online resources can serve as a supplement.

Limited Customer Support Options (impact: low)

Support is mostly via FAQs and email; upcoming features may include live chat for quicker assistance.

Navigation for Complex Tasks (impact: high)

Users handling complex tax situations might find the app inadequate; official IRS websites remain essential for detailed guidance.

Frequently Asked Questions

How do I get started with IRS2Go after downloading it?

Open the app, register or log in, then explore features like refund status or tax tips from the home screen to get started easily.

Is IRS2Go available for both Android and iOS devices?

Yes, IRS2Go is compatible with both Android and iOS devices, accessible via Google Play and the Apple App Store.

How can I check my tax refund status using IRS2Go?

Open IRS2Go, navigate to 'Check Refund Status,' then enter your SSN, filing status, and refund amount for real-time updates.

What features does IRS2Go offer for making tax payments?

You can make payments through the app via bank transfer, credit card, or IRS Direct Pay under the 'Make Payments' section.

How do I find nearby free tax assistance centers with IRS2Go?

Use the 'Locate Assistance' feature, enable location services, and the app will show nearby VITA and TCE sites.

Can I get tax tips to help prepare my return on IRS2Go?

Yes, access the 'Tax Tips' section to find regularly updated advice on deductions and tax strategies to optimize your return.

Are there any subscription or in-app purchase options in IRS2Go?

No, IRS2Go is free to download and use; there are no subscriptions or in-app purchases required.

Is my personal and payment information secure when using IRS2Go?

Yes, the app uses industry-standard security protocols to protect your data during transactions and interactions.

What should I do if the app crashes or I experience errors?

Try updating the app, restart your device, or reinstall IRS2Go to resolve issues. Contact support if problems persist.

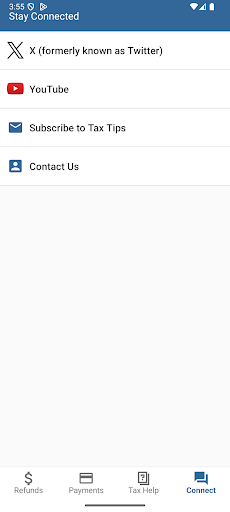

How can I stay updated with the latest IRS news through the app?

Navigate to the 'News' section within IRS2Go to read the latest updates, guidelines, and important tax deadlines.