- Category Finance

- Version5.8.4

- Downloads 0.01B

- Content Rating Everyone

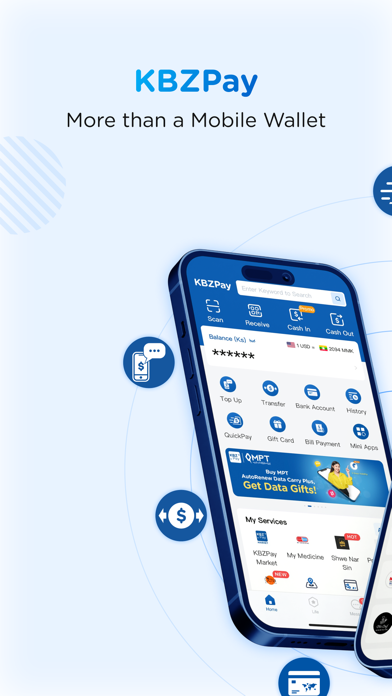

Introducing KBZPay: A Seamless Digital Wallet Experience

KBZPay is a versatile mobile financial application designed to simplify everyday transactions with a focus on security and user convenience, positioning itself as an essential tool for modern digital payments.

Developed by KBZ Bank's Tech Innovation Team

Created by the dedicated technology team behind KBZ Bank—one of the leading financial institutions in Myanmar—this app embodies the bank's commitment to digital transformation and customer-centric solutions.

Key Features That Shine

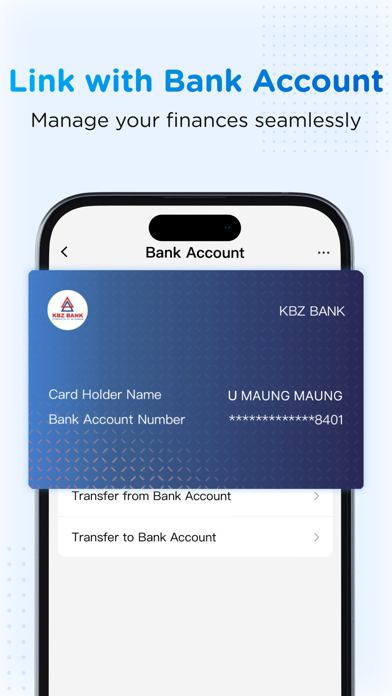

- Seamless Payments & Money Transfers: Send and receive money instantly within Myanmar and abroad with a few taps.

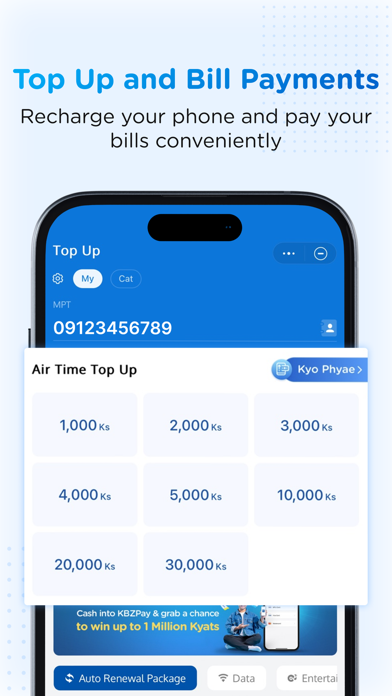

- Bill Payments & Top-Ups: Pay utility bills, mobile airtime, and internet subscriptions effortlessly, making daily financial chores a breeze.

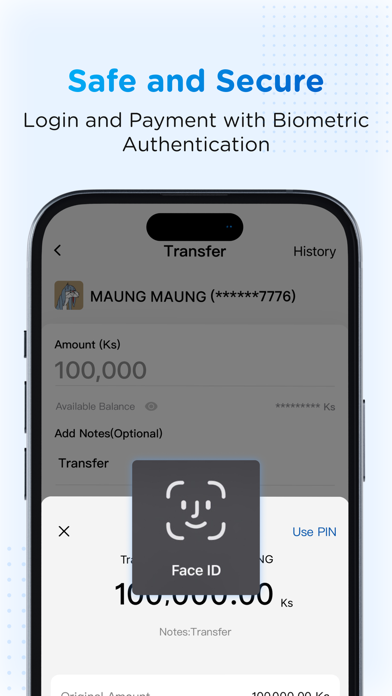

- Robust Security Measures: Advanced encryption, biometric authentication, and transaction alerts ensure your funds are always protected.

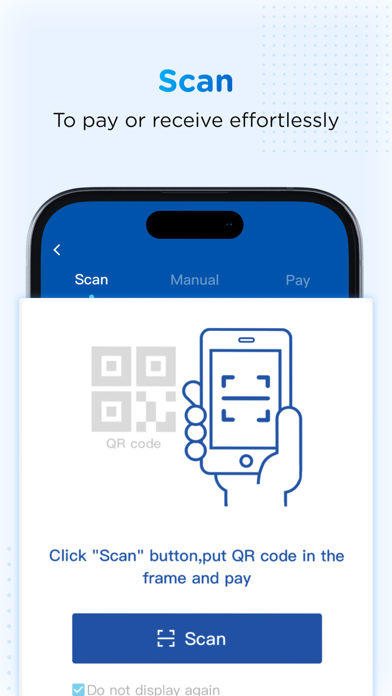

- Merchant & QR Code Payments: Simplified checkout experiences at partner stores via QR code scanning, turning your phone into a handy digital wallet.

The app primarily targets Myanmar's tech-savvy middle class, urban professionals, small business owners, and anyone looking to ditch cash for digital convenience while prioritizing security and ease of use.

A Fresh Take on Digital Payments: Welcome to the KBZPay Experience

Imagine a world where making a payment or splitting a bill feels as natural as sharing a laugh with friends—this is what KBZPay strives to deliver. With its smooth interface and intuitive features, navigating the world of digital finance becomes less like a chore and more like a friendly chat. Whether you're sending money across town or paying your electricity bill, KBZPay aims to be your reliable financial assistant, seamlessly fitting into your daily hustle.

Main Functionalities: Powering Your Financial Life

Effortless Fund Transfers and Payments

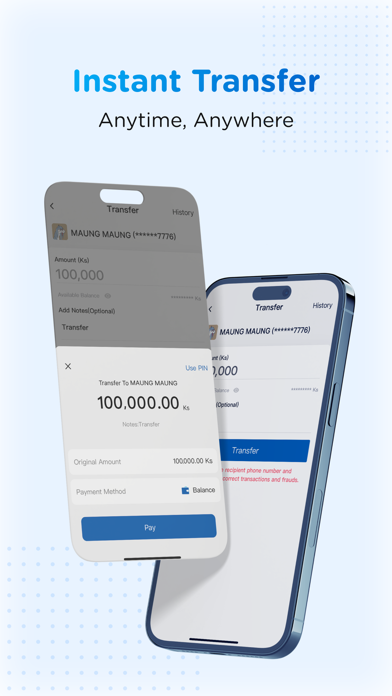

At the heart of KBZPay is its core strength—making money movement straightforward. The app supports instant peer-to-peer transfers, which feel akin to passing a note to a friend instead of dealing with cumbersome forms. For larger transactions, the app ensures swift processing backed by secure encryption, helping users feel safe as they send or receive funds. The international remittance feature also broadens horizons, allowing users to send money abroad with transparency about fees and exchange rates, reducing the uncertainty often associated with cross-border transactions.

Streamlined Bill and Service Payments

Paying utility bills or topping up mobile credits often feels like a tedious chore—except with KBZPay, it transforms into a quick, almost satisfying task. The app's interface displays a clean list of bill types and services, making navigation intuitive for first-time users. One standout advantage lies in its automation features—scheduled payments can be set up in advance, ensuring your dues are never missed, and the system provides notifications to confirm successful transactions, turning bill-paying from a necessity into a seamless habit.

Enhanced Security & User Experience

Security is a pillar that KBZPay takes seriously. The app employs multiple layers of protection—biometric authentication (fingerprint or facial recognition), encrypted data transmission, and real-time transaction alerts—to ensure your funds are safe from unauthorized access. The design choices foster a smooth user experience: minimalist layouts, clear icons, and logical flow make the app approachable even for non-tech-savvy individuals. It's akin to having a friendly guide walking you through digital finance, making the learning curve gentle and approachable.

Differentiation and Unique Selling Points

While countless digital wallets flood the market, KBZPay distinguishes itself mainly through its focus on security and transaction reliability. Its biometric authentication isn't just a fancy feature—it's a critical security barrier, giving users peace of mind akin to locking your front door before sleep. The app's transaction experience emphasizes speed and simplicity, with instant confirmation messages that make every payment feel solid and trustworthy.

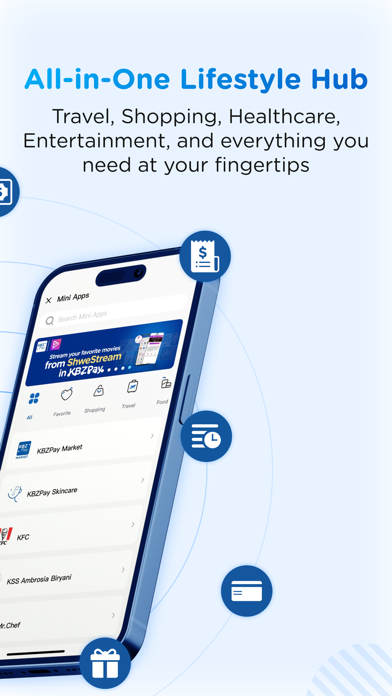

Moreover, KBZPay's partnerships with local merchants and integration with QR code-based payments foster a widespread ecosystem, making everyday shopping at supermarkets, markets, and restaurants remarkably convenient—transforming your mobile phone into a universal, quick-pay tool. This level of integration, combined with a security-first approach, sets KBZPay apart in a marketplace cluttered with similar applications that often prioritize features over safety and user trust.

Final Verdict: A Solid Choice for Digital Payments in Myanmar

If you're searching for a reliable, secure, and user-friendly digital wallet to handle daily transactions, KBZPay ranks highly in its class. Its core strengths—robust security, seamless transaction experience, and widespread acceptance—make it a smart companion for those embracing cashless lifestyles. While it may have a slight learning curve for complete beginners, the intuitive design quickly wins over users, turning complex transactions into simple gestures.

Recommended for: Myanmar residents seeking a trustworthy way to digitize their finances, from everyday payments to small business operations. Whether you're a busy professional, a shop owner, or someone aiming to reduce cash dependency, KBZPay offers a compelling, reliable solution—think of it as having a trusted financial partner right in your pocket.

Similar to This App

Pros

User-Friendly Interface

KBZPay has a clean and intuitive design that makes user navigation simple for all age groups.

Wide Range of Services

The app supports various functions including money transfer, bill payments, and mobile top-ups.

Fast Transaction Processing

Payments and transfers are processed quickly, often in real-time, enhancing user convenience.

Strong Security Measures

Features like PIN protection and biometric authentication ensure user data safety.

Offline Payment Options

Some services can be used offline through QR code scanning, useful in areas with poor network coverage.

Cons

Limited Merchant Acceptance (impact: medium)

Not all local merchants accept KBZPay, restricting its usage for some daily transactions.

Occasional App Freezes (impact: medium)

Users have reported occasional app crashes or freezes; updates are expected to improve stability.

Limited International Compatibility (impact: low)

KBZPay primarily supports domestic transactions; international remittances may require alternative methods.

Customer Support Response Time (impact: low)

Response times for customer queries can be slow; official improvements are underway to enhance support efficiency.

Occasional Transaction Delays (impact: medium)

Some transactions experience delays during peak times, but these generally resolve quickly; infrastructure upgrades are ongoing.

Frequently Asked Questions

How do I initially register and set up KBZPay on my phone?

Download KBZPay from App Store or Play Store, register with your phone number, verify with OTP, and follow the prompts to complete setup.

Can I use KBZPay without a bank account on KBZ Bank?

No, you need a registered KBZ Bank account linked to your phone number to use KBZPay functionalities.

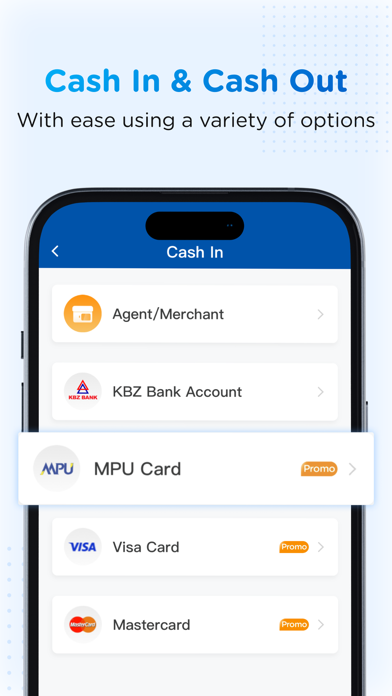

How do I add money to my KBZPay wallet?

Link your bank account or visit a participating KBZBank branch, then follow the app's instructions in the Wallet section to top up.

How do I pay at merchants using KBZPay?

Open KBZPay, select 'Scan & Pay', scan the merchant's QR code, enter the amount, and confirm to complete the payment.

What are the main features of KBZPay I should know about?

Key features include QR code payments, money transfers, mobile top-ups, bill payments, and booking travel tickets within the app.

How can I transfer money to friends or family via KBZPay?

Open the app, select 'Send Money', enter the recipient's phone number or QR code, specify the amount, and confirm.

Is there a subscription fee for using KBZPay?

KBZPay is generally free to download and use; some transactions like bill payments may incur small service charges, check within the app for details.

Are there any charges for transferring money or making payments?

Most transactions are free or have minimal fees; specific charges are detailed within the app during each transaction process.

What should I do if I encounter errors or the app crashes?

Try restarting the app, ensure your internet connection is stable, or reinstall. Contact KBZPay support if issues persist.

Can I access KBZPay from multiple devices simultaneously?

For security reasons, use the device registered during setup; multiple logins are not recommended without proper security measures.