- Category Finance

- Version1.155.2445

- Downloads 1.00M

- Content Rating Everyone

Unveiling the Power of Rapid Credit Building with Kikoff

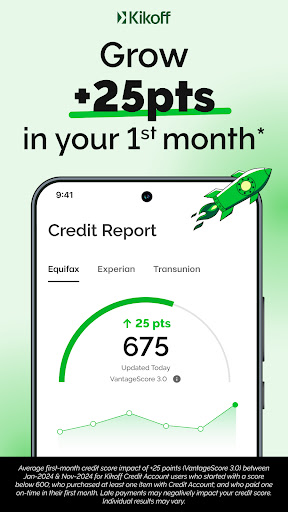

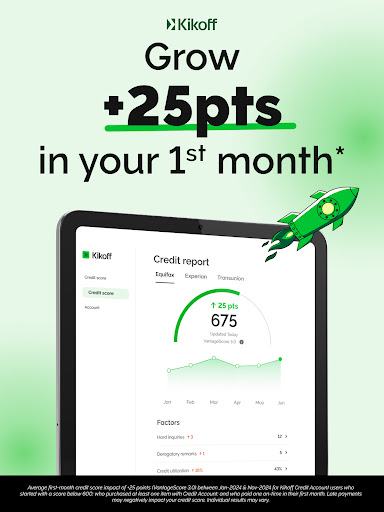

If you're looking for a straightforward way to bolster your credit score without the fuss of traditional financial institutions, Kikoff is designed to be your friendly companion on this journey. Developed by Kikoff LLC, this app aims to help users build credit quickly through innovative yet simple methods, making it an appealing tool for those new to credit building or anyone seeking a smoother experience. With its focus on accessible financial growth, Kikoff stands out among the crowded landscape of finance apps.

Key Highlights: Setting the Stage for Financial Growth

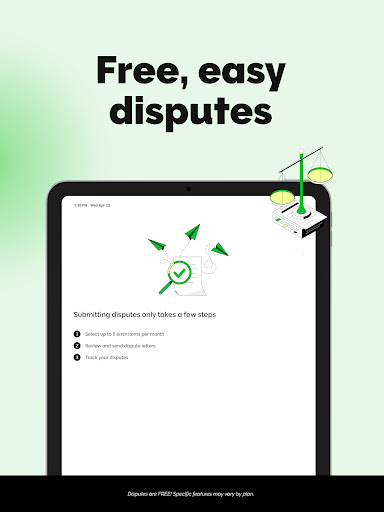

At its core, Kikoff offers features centered around credit education and building credit history. Its primary strengths include quick credit account setup, manageable credit line management, and transparent credit reporting. The app's user-centric approach aims to eliminate confusion, providing a hassle-free experience for users eager to establish or improve their credit profiles. Targeted at young adults, recent graduates, or anyone seeking to improve credit scores without hefty fees or complicated procedures, Kikoff opens a door to financial independence.

A Friendly Guide to Building Credit: An Introduction

Imagine you're planting a small seed—tender, new, needing just the right nourishment and care to grow into a sturdy tree. That's exactly what Kikoff offers: a gentle yet effective way to nurture your credit profile. As an app that demystifies credit building, it acts like a trusted friend guiding you through the often confusing financial landscape, making the journey both educational and empowering.

Simplified Credit Line Management: Your First Step

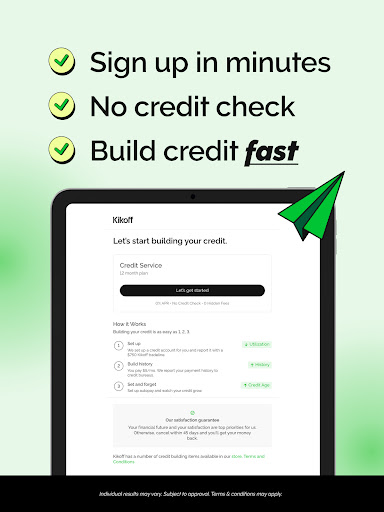

One of Kikoff's standout features is its ability to quickly open a credit account that appears on your credit report, helping to establish a history where none existed before. Unlike traditional credit cards or loans requiring hefty deposits or credit checks, Kikoff extends small, manageable credit lines that are easy to handle. This feature ensures that users can demonstrate responsible borrowing behavior—like making timely payments without the stress of high debt loads—which directly impacts their credit score positively over time.

The app's interface is refreshingly uncluttered, with a simplified dashboard that guides you through each step and clearly displays your credit activity. The operation feels seamless; tapping through menus and updating payment info is smooth, with minimal learning curve. For newcomers to credit systems, Kikoff's straightforward flow acts like a gentle slope rather than a steep climb, easing the path toward building a solid credit history.

Transparent and Responsible Credit Reporting: Building Trust

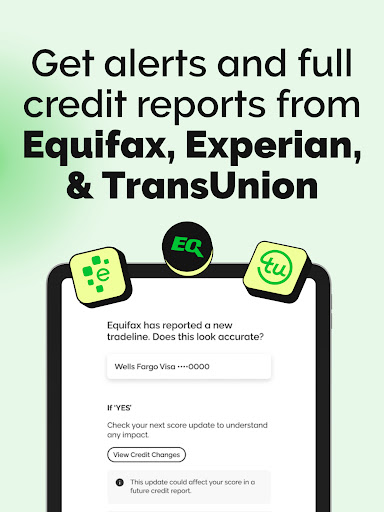

What truly sets Kikoff apart from many competitors is its focus on transparency and security. The app reports on-time payments directly to major credit bureaus, which is a crucial factor for credit growth. It's like having a reliable friend who always keeps their word—your responsible paybacks are faithfully recorded, boosting your credit profile authentically.

Furthermore, Kikoff employs bank-grade security measures to safeguard user data, distinguishing itself from some apps that fall short on security fronts. Customers can feel reassured that their financial information is protected, adding an extra layer of confidence to their credit-building journey.

Additionally, the app does not push unnecessary credit demands or hidden fees, focusing instead on gradual, responsible credit growth. This ethical approach fosters trust and makes the app suitable for those cautious about financial security and transaction integrity.

Beyond the Basics: User Experience & Differentiating Factors

Using Kikoff feels akin to navigating a well-designed city map—everything is where you expect it to be, intuitive, and designed with the user in mind. The interface is clean and inviting, encouraging users to check their progress regularly without feeling overwhelmed. The app's minimalistic design minimizes cognitive overload, making learning about credit as effortless as flicking through a friendly magazine.

Compared to other finance apps that often bundle complex investment features or aggressive marketing, Kikoff's simplicity is its strength. Its exclusive focus on building credit, combined with its commitment to security, sets it apart. Its direct reporting to credit bureaus and emphasis on responsible borrowing make it uniquely trustworthy. Moreover, the absence of cryptic fees and its focus on small, manageable credit lines make it accessible for users who might be wary of risky financial products.

Final Thoughts: Is Kikoff Worth a Try?

For those seeking an unobtrusive, educational, and trustworthy tool to enhance their credit profile, Kikoff is a solid choice. The app's core features—fast credit account setup and secure, responsible reporting—work together like a well-oiled machine, fostering confidence and momentum in your credit journey. While it might not offer the extensive financial tools found in broader apps, its laser focus on building credit quickly and safely makes it an excellent companion for beginners or anyone eager to see tangible progress without unnecessary complication.

Overall, I recommend giving Kikoff a try if you're motivated to build credit steadily and responsibly. It's like having a friendly guide by your side, helping you plant the seeds today for a stronger financial tomorrow. Just remember, consistent, on-time payments are key—think of this app as an empowering nudge, not a miracle worker. With patience and discipline, Kikoff can be a pivotal part of your credit-building toolkit.

Similar to This App

Pros

Effective credit-building features

Kikoff provides personalized credit education and reporting tools that help users understand and improve their credit scores quickly.

No credit check application

The app allows users to sign up without a traditional credit check, making it accessible to those with limited credit history.

Low-cost credit building

With minimal fees, Kikoff offers an affordable way to start building or rebuilding credit without high upfront costs.

Clear progress tracking

Users can easily monitor their credit score changes and see the impact of their activities through intuitive dashboards.

Educational content

The app includes helpful tips and resources to educate users on credit management and responsible borrowing.

Cons

Limited credit reporting partners (impact: medium)

Currently, Kikoff's credit reporting is restricted to certain bureaus, which may limit score improvements for some users.

Small credit building limit (impact: low)

The credit line offered is relatively low, which might slow down substantial credit growth; users can contact support for higher limits in some cases.

App features are somewhat basic (impact: low)

Compared to more comprehensive credit apps, Kikoff offers fewer features, but future updates are expected to add more tools.

Limited integration with other financial accounts (impact: low)

Currently, the app doesn't allow seamless linking with bank accounts for holistic financial management, but this may improve in future updates.

Customer support response times vary (impact: medium)

Some users report delays in customer support; maintaining updated contact options may help mitigate frustration.

Frequently Asked Questions

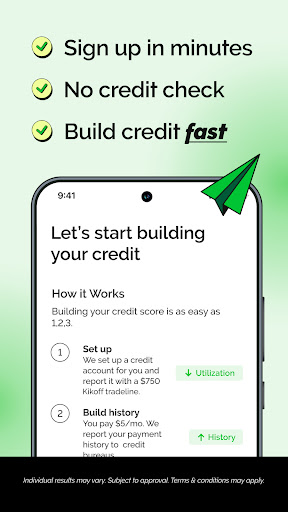

How do I sign up and start using Kikoff for credit building?

Download the app, create an account with your personal info, choose a plan, and receive a credit line. No credit check needed, and setup takes just a few minutes.

Do I need a good credit score to use Kikoff?

No, Kikoff is designed for those with low or no credit. It helps build your credit from scratch without requiring a credit check.

What features does Kikoff offer to help me improve my credit?

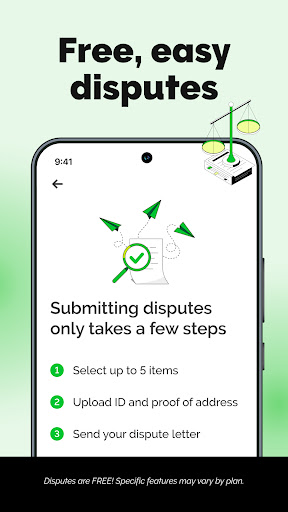

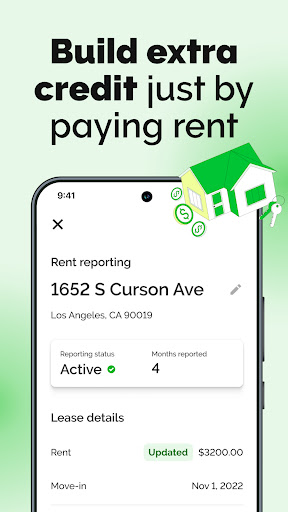

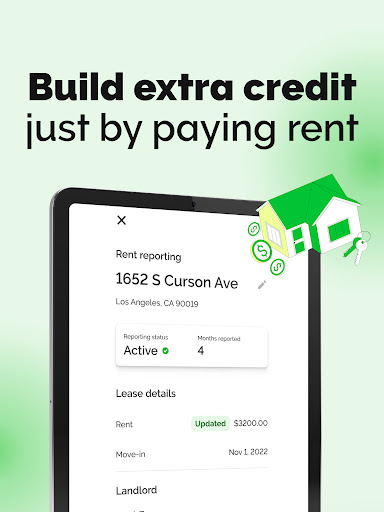

Kikoff provides a credit line, tracks your progress, reports payments to credit bureaus, and allows rent reporting with a premium plan.

How does making small purchases and paying them back improve my credit?

Using the credit line for small purchases and paying on time establishes a positive payment history, which boosts your credit score over time.

Can I set up automatic payments for my Kikoff credit line?

Yes, you can enable AutoPay in the app's settings under Payment > AutoPay to make payments automatically each month.

What is the difference between the Basic and Premium plans?

The Basic plan costs $5/month and offers standard credit building; the Premium plan costs $20/month and includes additional features like rent reporting.

How do I change my subscription plan or cancel it?

Go to Settings > Account > Subscriptions to upgrade, downgrade, or cancel your Kikoff plan easily.

Are there any hidden fees or interest charges?

No, Kikoff has no hidden fees or interest. You only pay the monthly fee and just repay your purchases on time.

What should I do if I encounter an error or issue with my account?

Contact Kikoff customer support through the app's Help section or Settings > Support for assistance with errors or problems.

Is my credit information safe with Kikoff?

Yes, Kikoff uses secure encryption to protect your data and reports payments accurately to major credit bureaus.