- Category Finance

- Version4.89.0

- Downloads 1.00M

- Content Rating Everyone

Introducing Klover - Instant Cash Advance: Your Quick Financial Sidekick

Imagine having a financial safety net that's just a tap away — flexible, fast, and user-friendly. Klover is a sleek, modern app designed to provide instant cash advances directly into your bank account, helping you bridge the gap between paychecks without the hassle of traditional loans. Developed by the dedicated team at Klover Inc., this app aims to empower everyday users with accessible financial support when they need it most. Its standout features include real-time earnings tracking, seamless cash advances, and a commitment to security, making it a noteworthy option among personal finance tools. Whether you're a gig worker, a young professional, or anyone managing irregular income, Klover sets out to make short-term financial relief straightforward and trustworthy.

Fast, Rewarding Cash Advances—A New Way to Handle Emergencies

When unexpected expenses hit — a medical bill, car repair, or simply a need to cover a few days before payday — Klover's core proposition becomes crystal clear: instant access to funds without the ordeal of traditional loan processes. The app connects directly with your bank account and syncs with your income streams, providing a buffer zone that feels like having a trusted friend in your pocket. The user experience is designed to be as effortless as swiping a card, transforming what used to be a stressful, lengthy procedure into a quick, almost conversational process.

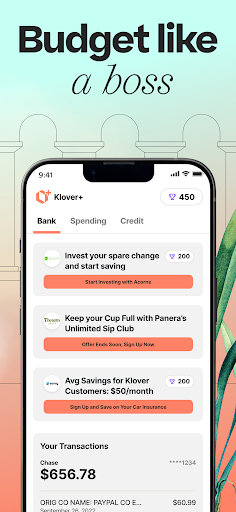

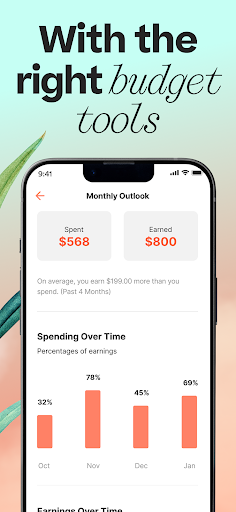

Core Function 1: Real-Time Income and Earnings Tracking

Klover stands out by prioritizing transparency through its earnings tracking feature. As soon as you connect your bank account or paycheck sources, the app offers a clear dashboard showing your incoming funds, expenses, and available cash advance amount. It feels like having your financial weather report, giving you a snapshot of your current fiscal climate. This feature helps users make informed decisions by providing real-time data, reducing the guesswork often associated with cash management. It's akin to having a financial co-pilot always looking over your shoulder, ensuring your cash flow is under control.

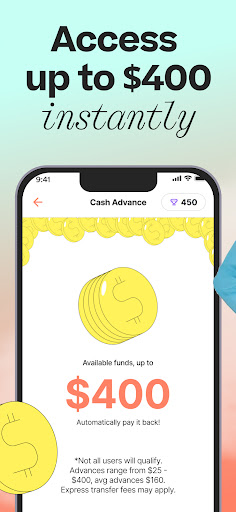

Core Function 2: Convenient and Secure Cash Advances

The heart of Klover's offering lies in its cash advance service. Requesting a short-term loan takes mere seconds — just a few taps to select the desired amount (usually up to a few hundred dollars) and confirmation. The app's backend employs robust security protocols, encrypting all transactions and sensitive data, ensuring your money and information are safeguarded. Unlike some competitors that may leave users feeling suspicious about security, Klover's transparent privacy policies and secure transaction architecture establish trust—making it feel like your funds are guarded by an invisible digital fortress.

Core Function 3: User Experience and Design — Friendly, Intuitive, and Streamlined

From the moment you open Klover, the clean, colorful interface invites exploration. Navigation is intuitive, with clear icons and straightforward language that make even first-time users feel comfortable. The app's design mirrors that of a well-organized wallet—accessible, uncluttered, and visually pleasing. Operation flow is smooth, mirroring the effortless glide of a bicycle on a well-paved road. Learning curve? Minimal. Most users will pick up how to use key features in moments, thanks to helpful prompts and an uncluttered layout. The seamless experience encourages trust and reduces apprehension during times of financial stress.

What Makes Klover Truly Unique?

One of Klover's most distinctive features is its focus on Account and Fund Security paired with a frictionless transaction experience. Unlike traditional cash advance apps that merely deliver funds but leave users uncertain about safety measures, Klover emphasizes protective protocols and transparent practices. Its integration of real-time income tracking ensures users only borrow what they can afford, minimizing debt risks—an important consideration in today's financial environment.

Additionally, Klover's approach to transaction experience emphasizes simplicity and confidence. The app's quick approval process, combined with encrypted transactions, offers an experience that feels both effortless and safe — a rare combination in the fintech space. This focus on security and ease of use sets it apart from many competitors that often prioritize either accessibility or security, but rarely both simultaneously.

Should You Give Klover a Shot?

Considering its professional design, emphasis on security, and user-centric features, I'd recommend Klover to anyone seeking a reliable, quick financial lifeline. It's particularly suitable for gig workers, those with irregular incomes, or anyone who wants a straightforward way to handle short-term cash needs without resorting to predatory lending or complicated bank loans.

However, as with any financial tool, it's essential to use the app responsibly. The app excels as a short-term solution rather than a long-term financial fix. For users comfortable with digital finance and seeking transparency, security, and simplicity, Klover proves to be a trustworthy companion — like a friendly financial assistant always ready to lend a hand when needed.

Similar to This App

Pros

User-friendly interface

Klover features a simple, easy-to-navigate design suitable for all users.

Instant cash access

Offers quick cash advances, enabling users to access funds within minutes.

No formal credit check

Allows users with poor or no credit history to obtain advances without impacting their credit score.

Fee transparency

Provides clear information about fees upfront, reducing hidden charges.

Additional benefits

Includes features like budgeting tools and financial tips to support users' financial health.

Cons

Limited funding amount (impact: medium)

The maximum cash advance is relatively low, which may not meet all users' needs.

Higher fees compared to traditional lenders (impact: high)

Fees can add up for frequent users, but internal promotions or future updates may reduce costs.

Dependence on smartphone availability (impact: low)

Requires a mobile device and internet connection, which may be a barrier for some users.

Limited to certain states (impact: low)

Availability varies by location, so some users may not access the service.

Potential for overspending (impact: medium)

Easy access to funds could lead to reliance on quick cash, but promoting responsible use could improve this.

Frequently Asked Questions

How do I sign up and start using Klover?

Download the app, fill in your basic details, link your bank account securely, and verify your information to start requesting cash advances quickly.

What information do I need to provide to use Klover?

You need to provide your name, email, phone number, and securely link your bank account to enable cash advance requests.

How can I request a cash advance through Klover?

Open Klover, set up your profile, navigate to the cash advance section, and select the amount up to $250 to request funds instantly.

What is the maximum cash advance I can get with Klover?

You can request up to $250 per advance, depending on your eligibility and account activity.

Are there any interest or hidden fees for using Klover?

No, Klover offers interest-free advances with no hidden charges; optional delivery fees apply only if you choose faster transfer options.

How do rewards and points work in Klover?

Participate in surveys and watch ads to earn points, which can be used for larger advances or entry into daily sweepstakes for cash prizes.

Where can I find budgeting tools in Klover?

Access budgeting features through Klover+ in the main menu to set goals, track expenses, and monitor your credit score for better financial management.

Do I need to undergo a credit check to use Klover?

No, Klover does not perform credit checks; eligibility is determined through data analysis based on your bank activity and history.

Can I subscribe to any premium features or plans?

Klover currently offers free cash advances and rewards; there are no subscription plans, but check app settings for available upgrades or features.

What should I do if my cash advance request is denied or delayed?

Ensure your bank account is linked correctly and your account activity qualifies, then try again later or contact Klover support for assistance.