- Category Finance

- Version5.1.1

- Downloads 1.00M

- Content Rating Everyone

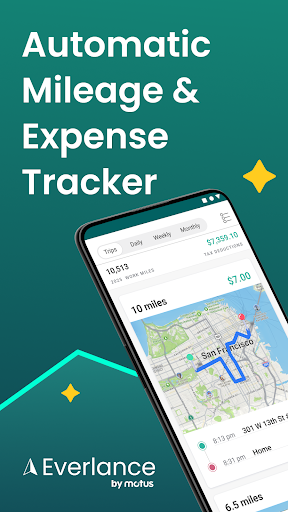

Introducing Mileage Tracker by Everlance: Your Trusted Driving Companion

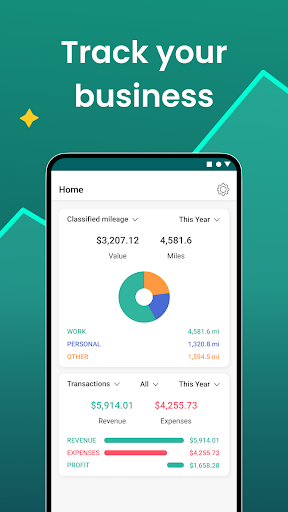

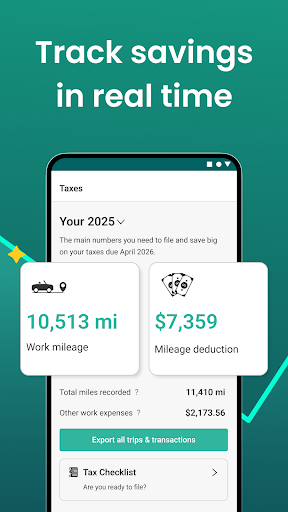

Designed to effortlessly log and manage your business miles, Mileage Tracker by Everlance stands out as a reliable solution for professionals seeking accurate mileage tracking and expense management. Developed by the experienced Everlance team, this app combines simplicity with robust features, making tax season less stressful and reimbursements more straightforward. Its main highlights include automatic mileage logging, expense categorization, and secure data handling, targeting freelancers, small business owners, and anyone needing precise mileage records.

Effortless and Accurate Mileage Logging: Your Driving Diary Gets Smarter

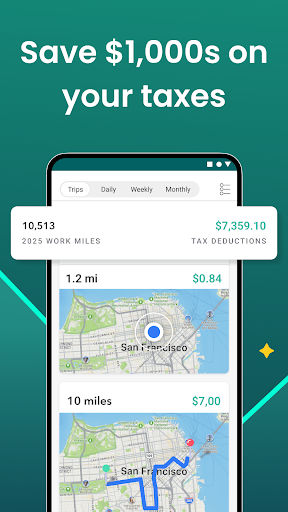

Imagine having an attentive co-pilot recording every mile you drive, so you never miss a reimbursable journey—Mileage Tracker makes this a reality. The app employs GPS technology to automatically detect when you start and end a trip, providing seamless, hands-free mileage logging. Whether you're commuting to client sites or making deliveries, it captures your routes with precision, eliminating the need for manual entries and reducing errors. Plus, you can manually edit or add trips post-drive, giving you control over your records without fuss.

Automatic Detection and Smart Logging

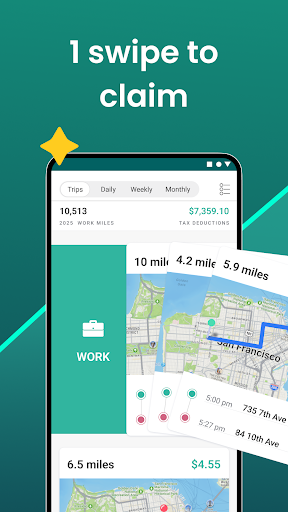

This feature is akin to having a diligent assistant noting each relevant trip behind your back. The app senses movement and begins tracking automatically, so you can focus on your work instead of battling with apps or paper logs. It differentiates between personal and business drives, helping you categorize expenses accurately—a critical aspect for tax deductions.

Trip Details and Customization

Beyond basic mileage, you can annotate trips with labels, receipts, and notes, transforming raw data into organized, audit-ready records. This makes reimbursements smoother and tax filing more straightforward—think of it as your digital mileage diary that speaks your language.

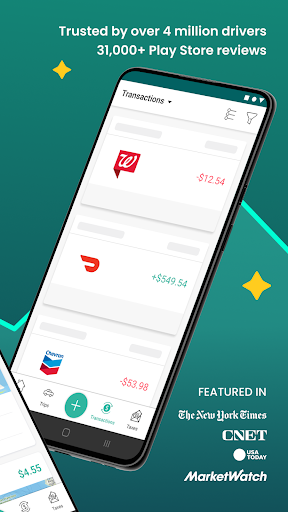

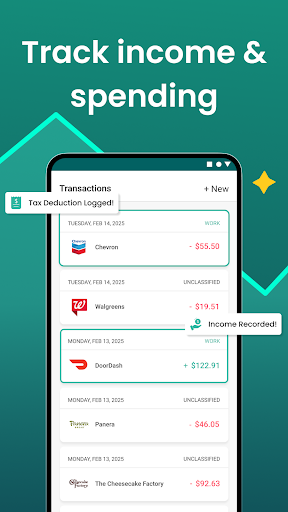

Expenses at Your Fingertips: Simplify and Streamline

Managing travel expenses can often resemble juggling flaming torches—dangerous and stressful. Everlance's expense feature aims to make it as easy as snapping photos of receipts and assigning them to specific trips or categories. This allows a comprehensive overview of your spending, making tax deductions and expense reports hassle-free.

Receipt Capture and Categorization

Snap a picture of your receipts directly within the app, and Mileage Tracker intelligently extracts key details like amount and date. Assigning expenses to trips ensures all related costs stay bundled together, giving you clear visibility into your travel spendings. The process is intuitive: a few taps, and you're done.

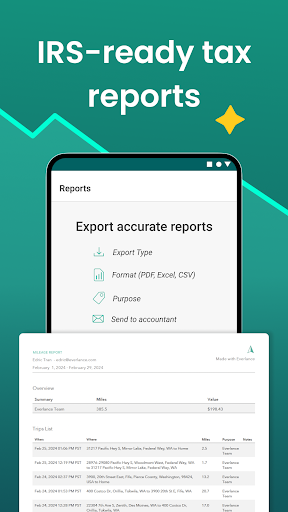

Integrated Expense Reports

The app generates ready-to-submit expense reports, which can be exported in formats compatible with accounting software or shared directly with your accountant. This streamlines your bookkeeping—think of it as having a financial assistant that not only tallies your miles but also compiles your expenses into tidy reports.

User Experience: Friendly Interface, Smooth Sailing

From the moment you launch Mileage Tracker, you're greeted with a clean, intuitive interface reminiscent of a well-organized dashboard—nothing confusing or cluttered. Navigating through trip logs, expense entries, or settings feels natural, akin to flipping through pages of a familiar notebook. The app's responsiveness is commendable, with quick loading times and fluid transitions that make daily tracking feel effortless.

Design and Usability

The visual layout emphasizes clarity, with easy-to-understand icons and concise menus. The auto-logging feature works invisibly in the background, letting users focus on driving while trusting the app's precision. Even those new to mileage tracking will find the learning curve gentle—as simple as setting up your profile and letting the app do the heavy lifting.

Reliability and Security

Security is paramount, especially when sensitive data like location and expenses are involved. Everlance employs encryption protocols and secure cloud storage, ensuring your information stays private and protected. Users can thus enjoy peace of mind, knowing their driving data and financial details are safe.

What Sets Everlance Apart in the FinTech Crowd?

While many mileage and expense apps struggle with the twin challenges of data security and transaction experience, Everlance excels with its seamless combination of these aspects. Its automatic trip detection minimizes manual inputs, reducing errors and saving time—much like having a meticulous assistant who never forgets a trip. Unlike some competitors that demand manual start/stop, Everlance's GPS-based detection ensures your journeys are captured accurately without intrusive prompts.

In terms of transaction and data security, Everlance leverages end-to-end encryption and regular compliance checks, providing a level of trust that's critical for users handling sensitive financial information. Moreover, the app's ability to generate professional expense reports and link with tax software offers a clear competitive edge, making it not just a mileage tracker but a comprehensive financial partner.

Final Verdict: A Practical Tool with Notable Strengths

Overall, Mileage Tracker by Everlance earns a solid recommendation for individuals who need reliable, hassle-free mileage and expense tracking. Its automatic detection and secure data management are the standout features, making it a particularly attractive choice for busy professionals and freelancers seeking efficiency without sacrificing security. While it may have a slight learning curve for complete beginners, the app's design ensures quick mastery and steady daily use.

If your goal is to automate mileage logging while maintaining high data security standards and simplifying your expense management, Everlance's Mileage Tracker is definitely worth trying out. It's like having a dedicated, trustworthy assistant who works quietly behind the scenes, letting you focus on what you do best—driving your business forward.

Similar to This App

Pros

Automatic mileage tracking

Everlance tracks your drives effortlessly in the background, saving time and reducing manual input.

Accurate and detailed reports

Provides comprehensive trip details and export options suitable for tax deductions or reimbursements.

User-friendly interface

Simple and intuitive design makes it easy for users to start and manage tracking without technical difficulties.

Multiple vehicle and trip management

Supports tracking for different vehicles, useful for freelancers or multiple-company users.

Reliable cloud synchronization

Data syncs across devices, ensuring access to trip logs anytime, anywhere.

Cons

Limited free features (impact: medium)

Most useful features require a subscription; temporary workaround is to use the free trial before committing.

Occasional GPS inaccuracies (impact: low)

GPS may misplace trips in dense urban areas; users can manually adjust trips if needed.

Battery consumption (impact: medium)

Background tracking can drain device batteries faster; users can optimize settings or charge devices regularly.

Limited customization options (impact: low)

Customization for trip categories is basic; future updates may include more options as per user feedback.

Language and regional support (impact: low)

Primarily tailored for US users; expanded regional support and language options may improve usability globally in upcoming updates.

Frequently Asked Questions

How do I start using Mileage Tracker by Everlance for the first time?

Download the app from your store, create an account, and follow the onboarding guide to set up automatic or manual trip tracking options tailored to your needs.

Can I manually log trips if I prefer not to use GPS?

Yes, in the app, go to 'Trips' > 'Add Trip' to manually record your mileage if you choose not to rely on automatic GPS detection.

How does the app automatically detect my trips?

The app uses GPS in the background to detect movement and automatically logs trips once it recognizes driving patterns, ensuring accurate mileage recording without manual input.

How can I categorize my trips as business or personal?

After trips are logged, tap on each trip and select the appropriate category (business, personal, charity) or set up rules for automatic classification in Settings > Trip Management.

Can the app generate tax reports for me?

Yes, in the Reports section, you can generate detailed tax and expense reports that are organized and exportable via email for tax filing or reimbursement.

What are the differences between the free and paid plans?

The free plan offers manual trip logging, while paid plans add automatic tracking, expense management, tax filing, and audit protection, accessible via Settings > Subscription.

How do I upgrade or change my subscription plan?

Open the app, go to Settings > Account > Subscription, and select the plan you want to upgrade to or modify. Follow prompts to confirm your purchase.

Is there a trial period for the paid plans?

Yes, the Professional plan often includes a free trial period. Check the app's subscription page in the app store or Settings for current trial offerings.

What should I do if the app isn't recording trips automatically?

Ensure GPS permissions are enabled in device settings, and check your internet connection. Restart the app or reinstall it if the issue persists through Settings > Troubleshooting.