- Category Finance

- Version10.0.0

- Downloads 1.00M

- Content Rating Everyone

Mission Lane: A Fresh Take on Financial Management

Imagine managing your financial life with ease, clarity, and a touch of innovation — that's the promise Mission Lane aims to deliver. Developed by a dedicated team committed to simplifying personal finance, this app offers a suite of features designed to empower users with smarter money management tools. Whether you're tracking spending, building credit, or planning for the future, Mission Lane positions itself as a user-friendly yet powerful companion in your financial journey.

A User-Centric Platform with Powerful Highlights

At its core, Mission Lane is built around core functionalities that stand out in the crowded landscape of finance apps. These include personalized credit insights, secure transaction processing, and an intuitive interface tailored for all levels of financial literacy. Its primary aim is to not only provide tools but also foster understanding and control over your financial life, making tough money decisions more approachable.

Innovative Credit Management & Insights

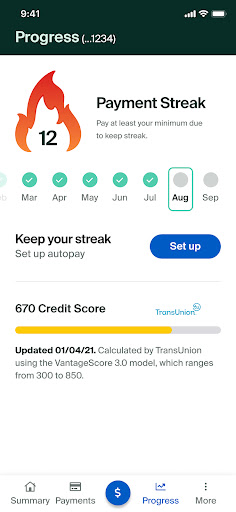

Unlike many finance apps that merely display numbers, Mission Lane offers individuals a clear window into their credit health. Users can view real-time credit scores, receive tailored advice for improvement, and access personalized reports that demystify the often complex credit scoring system. This feature aims to empower users to actively manage and enhance their credit standing, which is crucial for major financial milestones like loans or mortgages. The app's emphasis on transparency and education distinguishes it from competitors that often treat credit as a black box.

Secure Transactions & Account Security

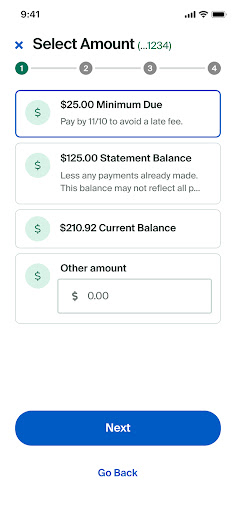

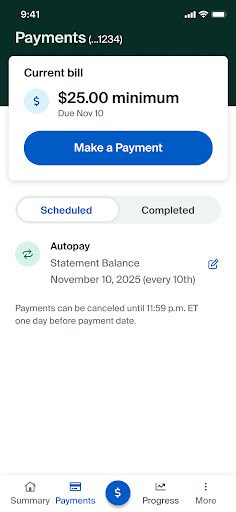

Security is paramount when handling sensitive financial data, and Mission Lane takes this seriously. Utilizing advanced encryption protocols, biometric authentication, and real-time fraud monitoring, the app ensures that user accounts are well-protected. The platform's design minimizes security concerns, allowing users to perform transactions—like paying bills, transferring funds, or updating account info—with confidence. This focus on authentication and data protection offers a peace of mind that's not always guaranteed in other similar apps.

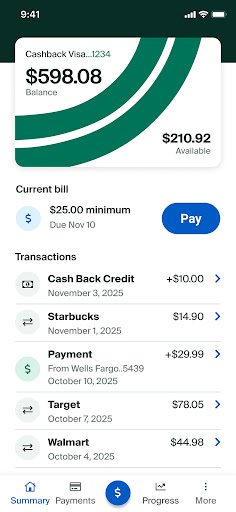

Streamlined User Experience & Interface Design

The app's interface resembles a dashboard of a high-tech cockpit—sleek, intuitive, and accessible. Navigation feels natural, whether you're setting up your profile or diving into detailed reports. The learning curve is gentle: even newcomers can quickly get the hang of managing their finances effectively. Smooth animations and thoughtful layout contribute to a fluid experience, reducing frustration and fostering continued engagement. It's like having a friendly financial mentor guiding you through your financial health in real-time.

Unpacking the Unique Strengths of Mission Lane

What sets Mission Lane apart from other personal finance applications? Its most distinctive features lie in its combination of personalized credit insights and a rigorous security framework. While many apps focus on budgeting or transaction tracking, Mission Lane zeroes in on understanding your credit profile—often the most complex and impactful facet of personal finance. Its proactive approach helps users make smarter financial choices, reducing anxiety around credit health. Additionally, the app's commitment to security creates a trustworthy environment that stands out amidst rising concerns over data breaches and cyber threats.

Final Recommendations: Who Should Use Mission Lane?

All in all, Mission Lane is highly recommended for individuals seeking a straightforward yet robust tool to monitor and improve their credit while maintaining high security standards. It's particularly suitable for those new to credit management or anyone eager to gain deeper insights into their financial health without getting overwhelmed. Given its user-friendly interface and focus on personalized insights, it functions as both an educational resource and a practical tool.

Similar to This App

Pros

User-friendly interface

The app is intuitive, making it easy for users to navigate through account management and repayment options.

Soft credit inquiry process

Mission Lane performs a soft pull on your credit, which doesn't negatively impact your credit score.

Flexible credit options

Offers personalized credit limits based on your financial profile, helping users find suitable borrowing amounts.

Clear fee structure

Transparent disclosure of interest rates and fees ensures users understand costs upfront.

Responsive customer support

Customer service is available via chat and email, frequently providing helpful and timely responses.

Cons

Limited credit reporting options (impact: Low)

Currently, Mission Lane mainly reports to major credit bureaus, with minimal options for alternative reporting.

No physical branch presence (impact: Medium)

Being a digital-only service may pose challenges for users who prefer in-person assistance, though online support is available.

Interest rates may be higher for some users (impact: High)

Depending on creditworthiness, some users might face higher interest rates; improving credit profiles can help reduce costs.

Limited financial tools (impact: Medium)

The app doesn't currently offer extensive budgeting or financial planning features, but future updates are anticipated.

Delayed updates for certain account issues (impact: Low)

Some users report slow responses to account discrepancies; contacting support through multiple channels might mitigate delays temporarily.

Frequently Asked Questions

How do I get started with Mission Lane app?

Download the app from your device store, create an account, and follow the onboarding process to link your financial information easily.

Is Mission Lane suitable for beginners in personal finance?

Yes, its user-friendly design and personalized advice make it ideal for users of all experience levels, including beginners.

How can I check my credit score on the app?

Open Mission Lane, go to the 'Credit' section from the menu, and view your real-time credit score update easily.

What features does the app offer for managing expenses?

The app provides detailed spending insights, trend analysis, and budget tips, accessible via the 'Expenses' tab for better money management.

How does Mission Lane help improve my credit score?

It offers real-time credit monitoring, personalized advice, and alerts, all accessible in the 'Credit' section to help you boost your score.

Can I get personalized financial advice in the app?

Yes, navigate to 'Advice' in the app to receive tailored recommendations based on your financial data and goals.

Are there any costs or subscriptions associated with Mission Lane?

Some features may require a subscription; check 'Settings > Subscription' for options and pricing details.

How do I manage or cancel my subscription?

Go to 'Settings > Account > Subscriptions' within the app to view or cancel your subscription conveniently.

What should I do if the app is lagging or not responding?

Try restarting your device, update the app to the latest version, or contact support via 'Help' > 'Contact Us' in the app.

Does Mission Lane offer notifications for bill payments or credit updates?

Yes, enable notifications in 'Settings > Notifications' to stay informed about payments and credit score changes.