- Category Finance

- Version26.1.22

- Downloads 5.00M

- Content Rating Everyone

Bringing the World Closer: An In-Depth Look at MoneyGram® Money Transfers App

In an increasingly interconnected world, seamless and secure cross-border money transfers are vital for individuals and businesses alike. MoneyGram® Money Transfers App positions itself as a dependable digital tool designed to make international remittances effortless, swift, and trustworthy. Developed by the globally recognized MoneyGram International, the app aims to bridge distances with just a few taps on your smartphone.

Core Features That Stand Out

With a focus on user convenience and security, the app's key highlights include:

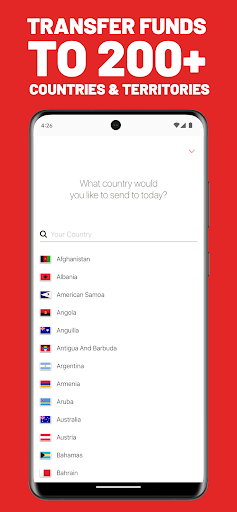

- Extensive Global Reach: Supports transfers to over 200 countries and territories, ensuring users can reach almost anywhere.

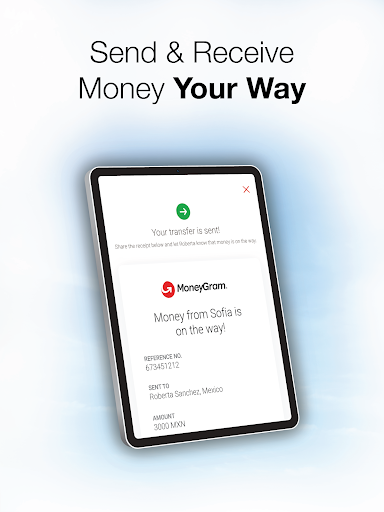

- Multiple Transfer Options: Offers various ways to send money—via bank accounts, mobile wallets, cash pickups—all within a unified interface.

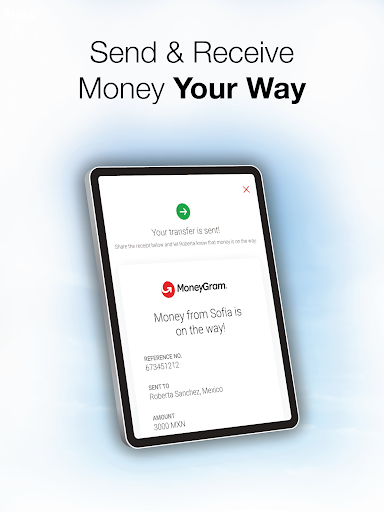

- Real-Time Tracking & Notifications: Keeps users updated at every step, providing peace of mind with transfer status alerts.

- Enhanced Security Protocols: Utilizes advanced encryption and security measures to safeguard user data and fund transactions.

User Experience: More Than Just a Functional App

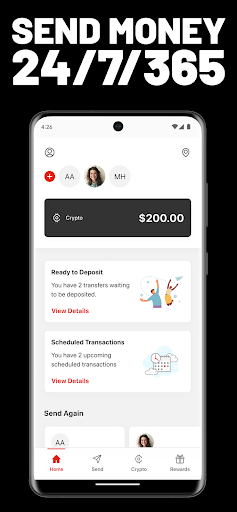

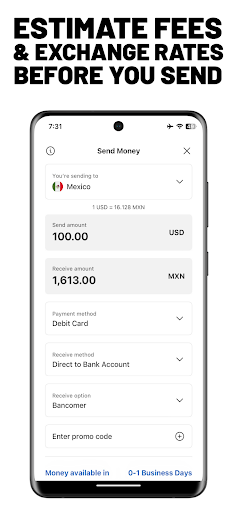

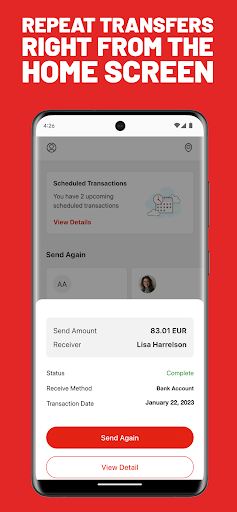

From the moment you open the MoneyGram app, it's clear that user experience was a priority. The interface is clean yet inviting, resembling a well-organized digital wallet where every feature is a few taps away. Navigating through the app feels intuitive, akin to flipping through a familiar booklet rather than deciphering a complex manual. Transferring money is straightforward: select your recipient, choose your transfer method, enter the amount, and confirm — all within moments. It's designed for convenience, whether you're a tech-savvy millennial or someone less accustomed to digital banking.

Design & Usability Dynamics

The interface boasts a modern aesthetic with a calm color palette and clearly labeled icons, making it easy to identify options quickly. The app's操作流畅度 (smooth operation) is impressive; animations are fluid, and transitions seamless, which reduces any user frustration. Learning curve? Minimal. Most users will find the app familiar after a single session, thanks to its logical layout and straightforward process flow.

Security & Transaction Experience: Setting It Apart

In the finicky realm of financial apps, security isn't just a feature; it's the foundation. MoneyGram® app's deliverance of ‘Account and Fund Security' is particularly noteworthy — employing end-to-end encryption and multi-factor authentication, it offers a digital fortress to host your sensitive information. Unlike some competitors that may overlook robust identity verification, MoneyGram's layered security measures help prevent fraud and unauthorized access effectively.

Furthermore, its transaction experience shines with options like instant transfers or scheduled remittances, giving users flexible control. The real-time tracking system functions as a digital ‘guardian,' providing continuous updates and reducing uncertainty during the transfer process, which is particularly appreciated in cross-border contexts prone to delays.

Final Verdict: Recommended for Its Trustworthy Simplicity

If you're seeking an app that combines comprehensive global coverage with security and ease of use, MoneyGram® Money Transfers App makes a compelling case. While it may not boast as many bells and whistles as some newer fintech offerings, its core strengths lie in reliability and clarity, making it particularly suitable for users who prioritize trust and straightforward service.

For those who frequently send remittances or are new to digital money transfer services, this app offers a smooth onboarding experience backed by a reputable brand. However, keep an eye on fee transparency and exchange rates—always compare a few options if cost-efficiency is a top concern.

Overall, I'd recommend giving it a try — especially if secure, quick, and globally accessible transfers are on your checklist. It's like having a dependable local bank branch in your pocket, ready to bridge distances with just a few taps.

Similar to This App

Pros

User-Friendly Interface

The app features an intuitive design that makes sending money quick and easy for users of all ages.

Fast Transaction Processing

Funds are typically transferred within minutes, ensuring timely delivery for urgent needs.

Wide Global Reach

Supports transfers to over 200 countries, providing extensive international coverage.

Multiple Payment Options

Allows users to fund transfers via bank accounts, debit/credit cards, and cash pickups.

Competitive Exchange Rates and Fees

Offers favorable rates and transparent fee structures, saving users money compared to some competitors.

Cons

Occasional App Crashes (impact: medium)

Some users experience crashes during high-traffic periods, but updates are expected to improve stability.

Limited Customer Support Options (impact: low)

Customer service is primarily through chat and email, with limited phone support; official improvements are underway.

Verification Process Can Be Lengthy (impact: medium)

The identity verification may take some time for new users; users are advised to prepare required documents in advance.

Inconsistent Transaction Tracking (impact: low)

Some users report delays in receiving transfer status updates, which may be improved in future app updates.

Limited Features on Web Version (impact: low)

The mobile app offers more functionalities than the web version; users can use the app for full features while waiting for web improvements.

Frequently Asked Questions

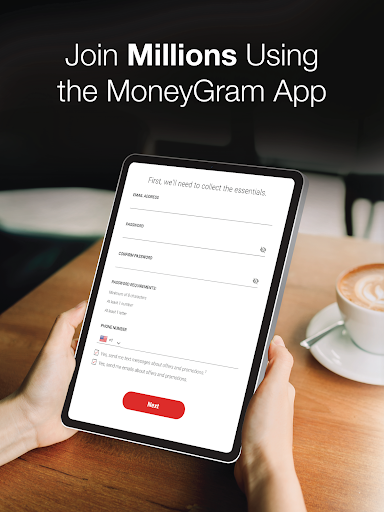

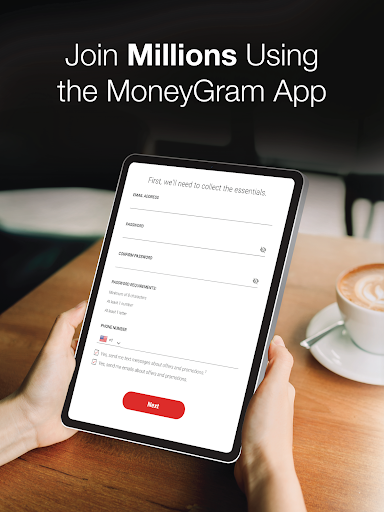

How do I set up my account for the first time?

Download the app, open it, tap 'Sign Up,' and follow the prompts to create your profile with personal details and secure password.

Can I send money internationally with this app?

Yes, select 'Send Money,' choose the destination country, enter the amount, and follow instructions to complete your international transfer easily.

How do I send money within the United States?

Choose 'Send Money,' select 'U.S. domestic,' enter recipient details, and specify transfer amount to send funds locally quickly.

How can I pay my bills using the app?

Go to 'Bill Payment,' select your biller from the list of 13,000 partners, enter payment details, and confirm to pay securely.

What is the MoneyGram Plus Rewards program and how do I join?

The program is free; just create an account. You'll automatically earn discounts like 20% off your second transfer; join via 'Profile > Rewards' to see details.

How can I set up automatic or recurring transfers?

Navigate to 'Transfers,' select 'Scheduled Transfer,' choose your recipient, set frequency (weekly/monthly), and save to automate payments.

How do I track my transfer status and receive notifications?

Go to 'Transaction History' or enable notifications in 'Settings > Notifications' to receive real-time updates and track your transfers easily.

What security measures does the app have to protect my data?

The app uses advanced encryption and continuous activity monitoring; enable biometric login for added security in 'Settings > Privacy & Security.'

Are there any fees for using the app, and how are they calculated?

Fees vary based on destination, amount, and payment method; details are shown before confirming transactions. Always compare rates for best value.

What should I do if my transfer fails or I encounter an error?

Check your internet connection, verify payment details, or contact customer support through 'Help > Contact Us' for assistance.