- Category Finance

- Version7.143.1

- Downloads 5.00M

- Content Rating Everyone

Introducing MoneyLion: Bank & Earn Rewards – Your All-in-One Financial Companion

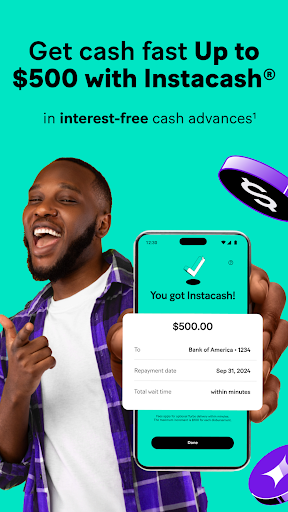

MoneyLion offers a streamlined platform that combines banking, investment, and rewards, aiming to empower users to manage their finances smarter and earn simultaneously. Developed by MoneyLion Inc., this app positions itself as a comprehensive financial solution for tech-savvy individuals seeking both convenience and financial growth opportunities.

Core Functionality Highlights

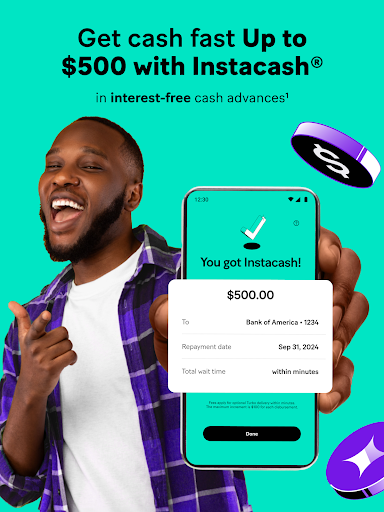

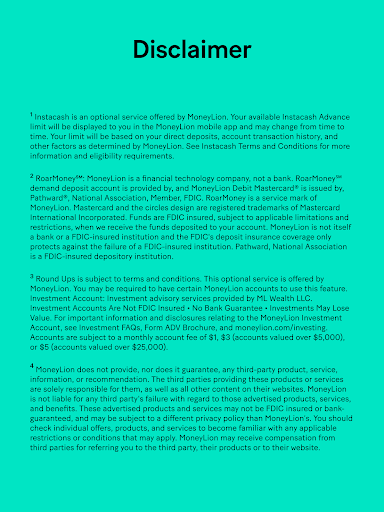

1. Integrated Banking & Savings Accounts: Users can access checking and savings accounts with competitive interest rates, integrated seamlessly within the app for easy money management.

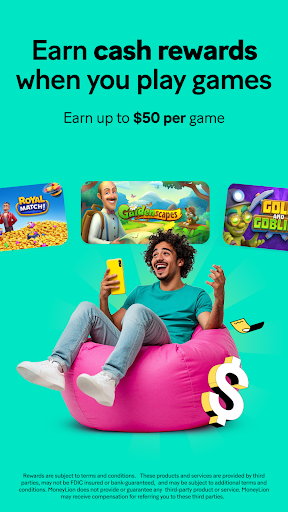

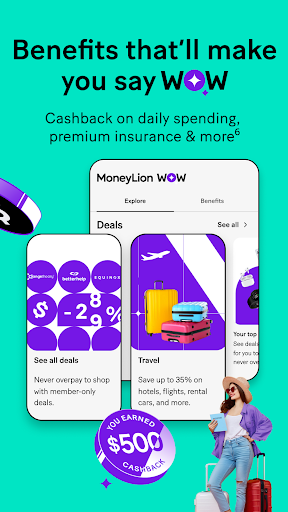

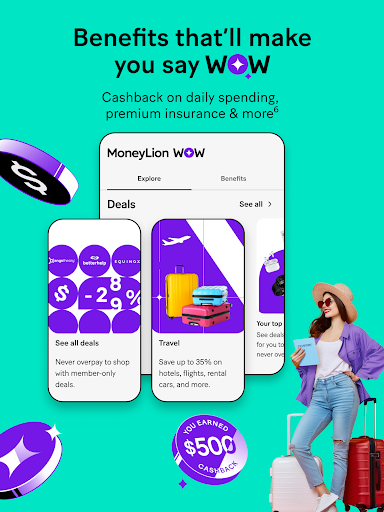

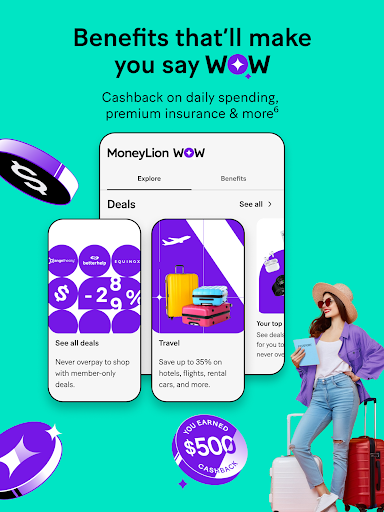

2. Earning Rewards & Cashback: The app incentivizes users through cashback offers, rewards on banking activities, and sign-up bonuses, turning everyday financial actions into earning opportunities.

3. Financial Insights & Budgeting Tools: Empowering users to understand their spending patterns through personalized analytics, helping craft smarter budget strategies.

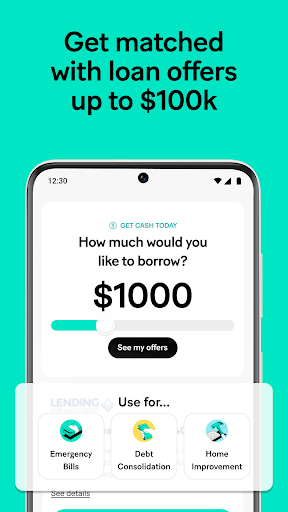

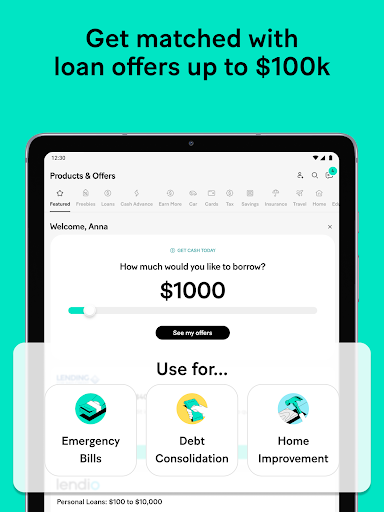

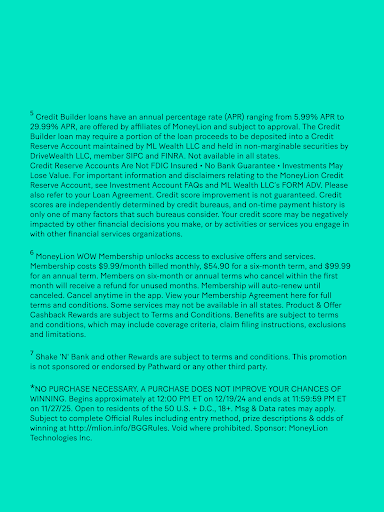

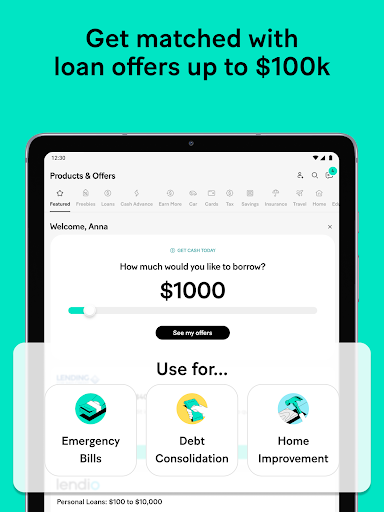

4. Investment Options & Credit Building: Including investment in stocks and access to credit builder loans, making financial growth accessible in one unified platform.

A Fun and Engaging Introduction: Why Users Are Talking About MoneyLion

Imagine your financial life as a garden—you want it to thrive, grow, and perhaps even bear some fruit. MoneyLion is like a friendly gardener, tending to your financial soil and helping you plant seeds that grow into real rewards. Its vibrant, intuitive interface makes navigating financial tasks feel less like a chore and more like a rewarding game—where every action can lead to greater gains. Whether you're just starting out or looking for an all-in-one platform to manage your money, MoneyLion promises a user-friendly journey, sprinkled with opportunities to earn as you grow.

Streamlined Banking and Savings Experience

One of MoneyLion's standout features is its integrated banking suite. Unlike traditional banks with separate apps, MoneyLion simplifies your financial life by combining banking and savings within a single, sleek interface. Setting up checking or savings accounts is straightforward, and the app offers competitive interest rates that make savings more appealing. The real charm lies in its automatic saving features—round-up transactions or scheduled transfers—helping users build savings effortlessly without feeling deprived. Additionally, the account security measures, including multi-factor authentication and encryption, provide peace of mind, which is crucial given the app's digital-first approach.

Rewards That Feel Like a Bonus for Every Step

The Rewards & Cashback feature is where MoneyLion truly shines. It turns routine banking activities into a game of earning. For instance, transactions made with their debit card can earn cashback, and special offers periodically pop up to maximize your earnings. This is akin to turning everyday spending into a magic trick—spending money, but getting some back in return. Moreover, the app offers sign-up bonuses and personalized cashback deals tailored to your habits, making the reward system feel like a personal thank-you from the platform. This distinctive focus on incentivization helps MoneyLion stand out among similar financial apps, emphasizing earning as a core benefit.

Personalized Financial Insights & Investment Opportunities

Beyond just banking, MoneyLion provides insightful analytics that help users understand where their money flows—like having a friendly financial coach by your side. The app tracks your transactions, categorizes expenses, and offers practical tips for boosting savings or reducing unnecessary costs. For those seeking investment options, MoneyLion extends its services to allow stock trading and access to credit-building loans. These features cater to users who want holistic financial growth, from everyday budgeting to long-term investments. The platform's user experience here is thoughtful, with visual tools and straightforward navigation making complex financial concepts approachable.

Unique Selling Points & User Experience

What sets MoneyLion apart from many of its peers is its unwavering focus on combining security with earning potential. The app employs robust security protocols like biometric login and real-time transaction alerts, ensuring peace of mind for users wary of digital fraud—important when handling sensitive financial data. Its transaction experience is smooth, with lightning-fast processing and seamless fund transfers that make navigation feel natural. The user interface is visually appealing, with intuitive icons and a clean layout that reduces learning curve—perfect for both beginners and experienced users.

Final Verdict and Recommendations

All things considered, MoneyLion is a well-rounded financial app that emphasizes earning through everyday banking activities, backed by solid security features. Its mindset of turning routine transactions into earning opportunities is its most distinctive trait, making it especially appealing to users looking for practical ways to grow their finances passively. For those comfortable managing multiple facets of their financial lives in one app, MoneyLion offers an engaging, trustworthy, and rewarding experience.

We recommend this app to young professionals, budget-conscious savers, or anyone eager to make their money work harder. Keep in mind, while it provides excellent tools and incentives, users should be aware of any fees associated with certain services and evaluate their individual financial needs before fully relying on the platform. Overall, MoneyLion is a friendly financial sidekick—smart, secure, and built to help you earn rewards along the way.

Similar to This App

Pros

User-friendly interface

The app offers a clean, intuitive layout that makes navigation simple for all users.

Effective rewards system

Earn rewards and cashback on everyday banking activities, incentivizing consistent use.

Integrated financial tools

Provides budgeting, saving, and credit monitoring features within one platform.

Fast approval process

Quickly opens new accounts or credit lines, reducing waiting time compared to traditional banks.

Educational resources

Offers useful tips on managing finances and improving credit health.

Cons

Limited customer support options (impact: medium)

Customer service mainly available via in-app chat, which may delay complex issues resolving.

High fees on certain transactions (impact: medium)

Some services, such as overdraft or cash deposits, may incur charges, which could be inconvenient.

Limited ATM network (impact: low)

Access to free ATMs is restricted, requiring users to find partnered machines to avoid fees.

Some features may require premium subscription (impact: low)

Certain benefits like higher rewards or enhanced tools are only available with paid plans.

Security concerns related to data sharing (impact: middle)

As with all fintech apps, users should be cautious about sharing sensitive information, though app security is generally robust.

Frequently Asked Questions

How do I open a new account with MoneyLion?

Download the app, tap Sign Up, enter your personal details, and follow the prompts to set up your RoarMoney account.

Is MoneyLion available for both Android and iOS devices?

Yes, MoneyLion is available on both Android and iOS platforms. Download it from Google Play or the App Store to get started.

How can I earn rewards or cashback using MoneyLion?

Use your linked debit card for purchases to earn cashback, or complete certain activities. Rewards are automatically credited; check the Rewards section in the app.

What features does the RoarMoney account include?

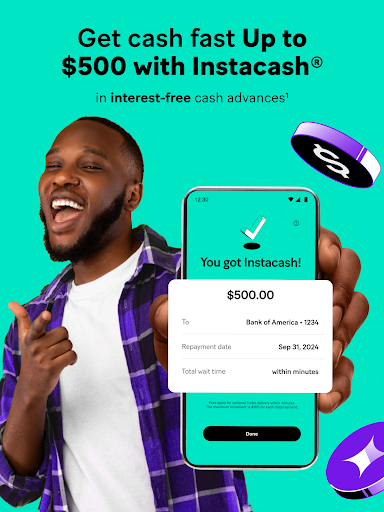

RoarMoney offers early direct deposit, cash advances up to $1000, Round Ups for savings, and a digital checking account—all accessible via the app.

How can I apply for a personal loan or credit builder loan?

Navigate to the Marketplace in the app, select Loan or Credit Builder options, and follow the application steps. You may need to provide some financial info.

Are there any fees or subscriptions to use MoneyLion?

Some features may have fees, such as certain loan products. The basic banking services are generally free; check the Fees section in the app for details.

How do I manage or cancel my subscription within the app?

Go to Settings > Account > Subscriptions, select your subscription, and follow the prompts to manage or cancel your plan.

What should I do if I have trouble logging into my account?

Tap 'Forgot Password' on the login screen, follow the instructions, or contact customer support through the Help section for assistance.

Does MoneyLion protect my personal and financial information?

Yes, it uses bank-level encryption and security measures to safeguard your data. Always keep your app updated for optimal security.

Can I link my existing bank accounts to MoneyLion?

Yes, during setup or in Settings > Bank Accounts, you can link your existing bank accounts for easy transfers and management.