- Category Finance

- Version9.10.1

- Downloads 0.10M

- Content Rating Everyone

My Budget Book: A Simple yet Powerful Financial Companion

My Budget Book is a straightforward yet versatile personal finance app designed to help users track, analyze, and manage their daily expenses with ease and confidence, making budgeting less of a chore and more of a habit.

Who Developed This App?

The app is crafted by WiseFinance Solutions, a dedicated team committed to simplifying financial management through user-friendly digital tools. Their focus lies in creating intuitive interfaces that cater to both finance beginners and seasoned budgeters alike.

Highlighting Key Features

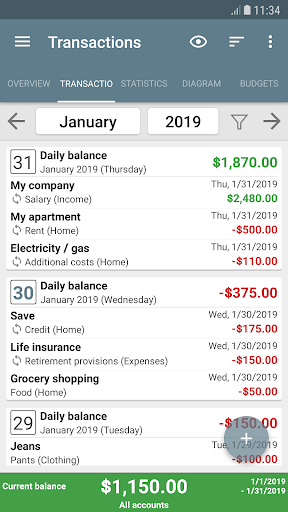

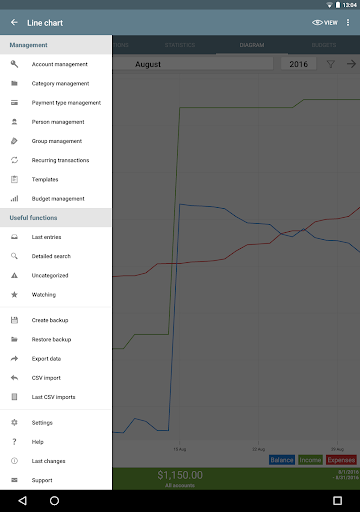

- Intuitive Expense Tracking: Easily log daily transactions with minimal effort, supported by customizable categories and recurring expense options.

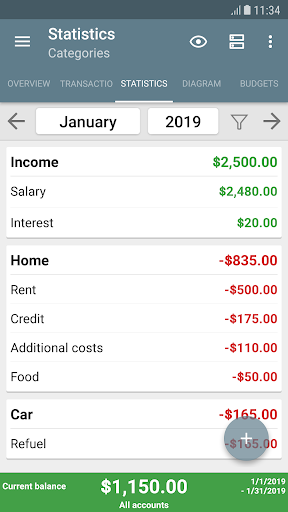

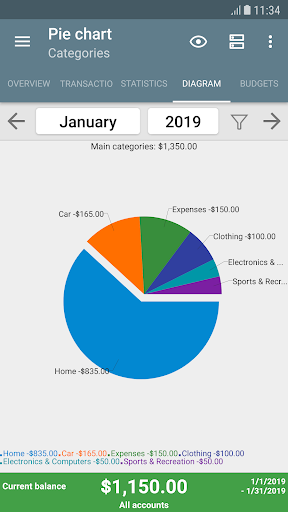

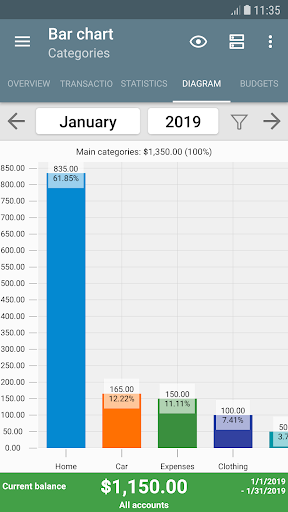

- Visualized Spending Insights: Gain clarity through colorful charts and reports that reveal spending patterns over different timeframes.

- Secure Data Management: Prioritizes user privacy with local data storage and robust encryption measures, ensuring your financial data remains protected.

- Multi-device Synchronization: Access your budget seamlessly across smartphones and tablets, keeping your financial snapshot up-to-date anytime, anywhere.

Engaging the User: A Look Into My Budget Book

Imagine you're standing at the end of each month, eyeing a clear map of where your money went—no more guesswork or blurry receipts. My Budget Book transforms the often-daunting task of budgeting into a manageable, even enjoyable experience. Its focus on simplicity doesn’t mean sacrificing functionality; instead, it invites users to take control of their financial journey with confidence and clarity.

Core Functionalities Deep Dive

Expense Logging and Categorization

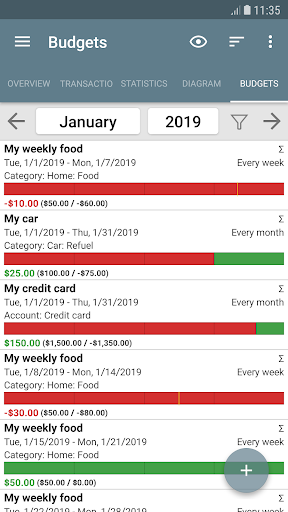

The heartbeat of the app lies in its effortless transaction recording system. Users can input expenses instantly, whether it's a coffee run or a big grocery haul. The app offers a flexible categorization system, allowing customization to fit personal spending styles. A standout feature here is the option for recurring expenses, which automatically record regular payments—saving time and reducing errors.

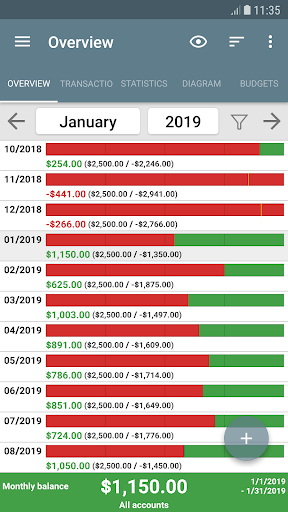

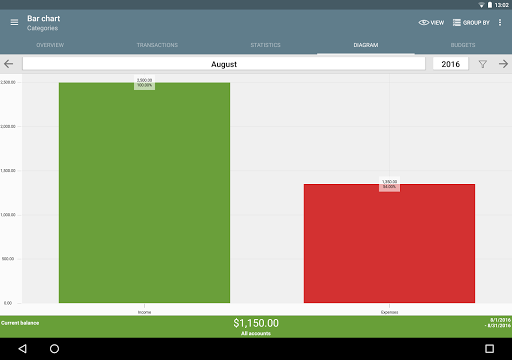

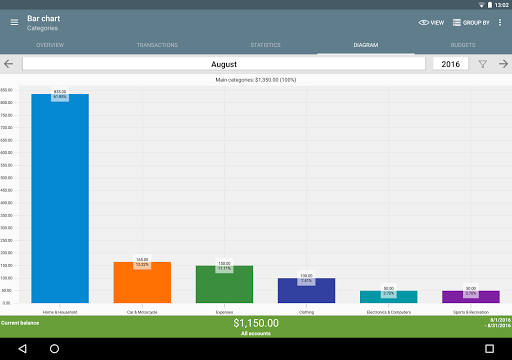

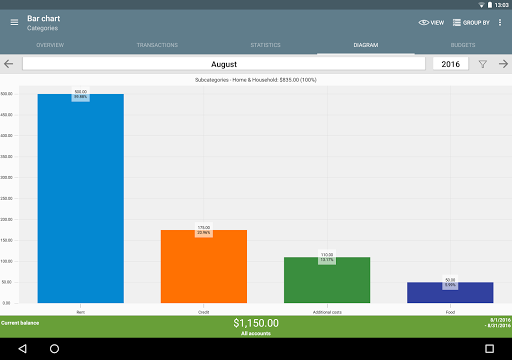

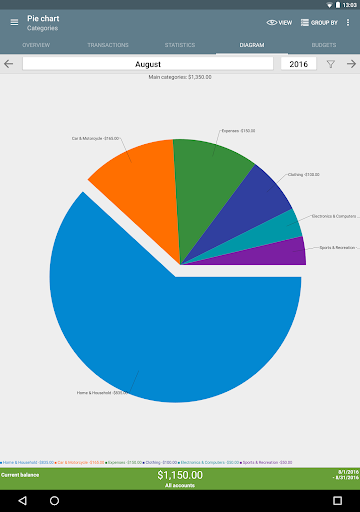

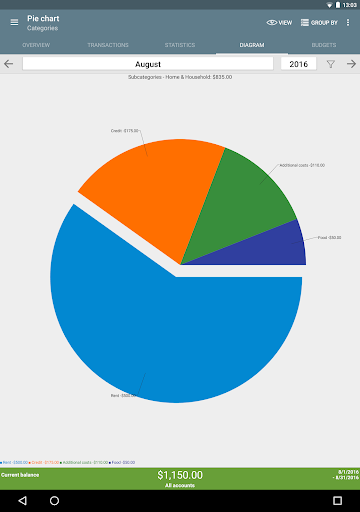

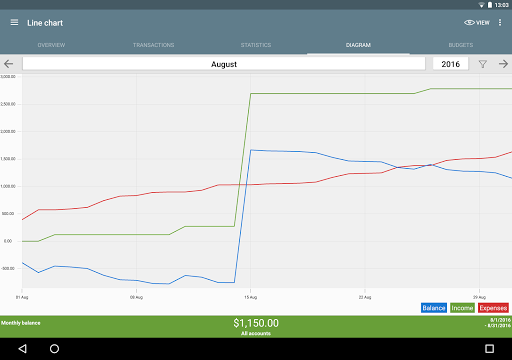

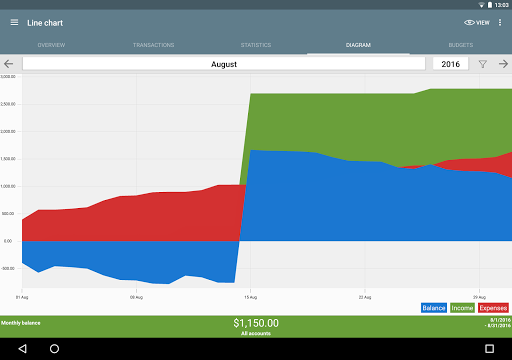

Insightful Visual Reports

Once your expenses are logged, visual analytics step in to paint a vivid picture of your financial habits. Pie charts, bar graphs, and line plots make it easy to identify spending peaks and savings opportunities. For example, your top spending categories might surprise you—transforming raw data into actionable insights. This layer of understanding helps you set realistic budgets and financial goals.

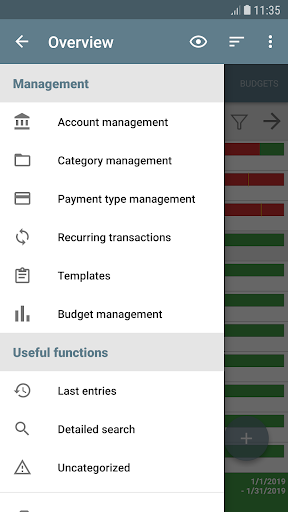

User Experience and Interface Design

The app boasts a clean, modern interface that feels more like browsing a well-organized digital notebook than navigating a complicated software. Navigation is smooth—swiping through different sections takes seconds, with responsive touch feedback enhancing the experience. The learning curve is gentle; even those new to budgeting apps will find onboarding straightforward. The minimalist design avoids clutter, focusing your attention on what matters most: your money.

What Sets My Budget Book Apart?

While many finance apps emphasize security or expense tracking individually, My Budget Book excels in integrating these aspects seamlessly while focusing on transaction experience. Its standout feature is how effortlessly it balances detailed security measures with an intuitive user journey—think of it as having a personal financial guardian that’s also your friendly guide. Unlike apps that overload users with countless complex features, it hones in on core functionalities, making the management process less intimidating and more engaging.

Final Thoughts: Would I Recommend It?

Overall, My Budget Book earns a solid recommendation for anyone seeking a reliable, straightforward personal finance tool. Its thoughtful design, combined with unique features like automatic recurring expense handling and visually rich reports, makes it suitable for users aiming to build a healthier financial habit without feeling overwhelmed. If you’re new to budgeting or looking for an app that respects your time and privacy, this could be the perfect digital companion to start or enhance your financial journey. Just remember, the key to success is consistent use—think of it as tending a financial garden that blooms over time.

Similar to This App

Pros

User-Friendly Interface

The app has an intuitive design, making it easy for users to navigate and manage their budgets efficiently.

Customizable Budget Categories

Users can create personalized spending categories to suit their specific financial goals.

Automatic Expense Tracking

The app can sync with bank accounts for automatic transaction imports, saving time and reducing manual entry.

Detailed Financial Reports

Provides clear, visual reports that help users analyze their spending habits over time.

Multi-Device Syncing

Supports synchronization across multiple devices, allowing seamless access to financial data anywhere.

Cons

Limited Export Options (impact: Low)

Currently only supports exporting data as CSV files; additional formats like PDF would be helpful.

Basic Budget Categories (impact: Medium)

Predefined categories may not cover all user-specific needs; custom categories require manual setup.

Occasional Syncing Delays (impact: Medium)

Synchronization with bank accounts can sometimes be delayed, but restarting the app often resolves the issue.

Limited Free Features (impact: Low)

Some advanced features are behind a premium subscription; users can still use core functions for free.

No Budget Sharing Option (impact: Low)

Currently, the app doesn't support sharing budgets with family or partners; future updates may include this feature.

Frequently Asked Questions

How do I start using My Budget Book for the first time?

Download the app, open it, and follow the onboarding guide to set up your categories, currency, and initial budget preferences for easy start.

Can I import my existing financial data into the app?

Yes, go to Settings > Data Import, then choose CSV, HTML, or Excel files to import your existing data seamlessly.

How do I create a new expense or income record?

Tap the '+' button on the main screen, select transaction type, enter details, categorize, and save for quick tracking.

How can I set a monthly budget limit?

Navigate to Budget Mode > Add Limit, choose your interval (monthly), set your cap, and save to monitor spending.

What features help me visualize my spending habits?

Access the Charts tab to view dynamic graphs and charts that illustrate your income and expenses over selected periods.

Are there options to customize the app's appearance?

Yes, go to Settings > Themes to choose dark mode, personalize categories, or change layouts for a tailored experience.

Is there a way to receive reminders for upcoming payments?

Yes, enable Reminders in Settings > Notifications to get alerts for pending transactions and due bills.

Does the app support multiple accounts and transferring funds between them?

Yes, you can add multiple accounts and transfer funds via Accounts > Transfer, ensuring a complete financial overview.

Is My Budget Book a paid app, and are there subscription options?

The app is a one-time purchase with optional one-month free trial; check Settings > Subscription for details and renewals.

What should I do if the app crashes or something doesn't work properly?

Try restarting the app, or contact support via email; ensure your app is updated for optimal performance.