- Category Finance

- Version1.21

- Downloads 0.01M

- Content Rating Everyone

MyCard - Contactless Payment: Revolutionizing How We Tap and Go

In a world increasingly dependent on seamless transactions, MyCard offers a fresh take on contactless payments, blending security, speed, and user-centric design into a package that aims to make your daily purchases effortless and safe.

Who's Behind MyCard?

Developed by the innovative team at SecurePay Tech, MyCard is the culmination of years of experience in fintech and secure transaction environments. Their mission is straightforward: to craft a payment solution that's not only quick and convenient but also prioritized on security and user trust.

Key Features That Make MyCard Stand Out

- Enhanced Security Protocols: Incorporates multi-factor authentication and tokenization to safeguard user data during transactions.

- Fast and Reliable NFC Payments: Enables swift tap-to-pay capabilities compatible with most contactless terminals worldwide.

- Intuitive User Interface: Designed for ease of use, even for those new to digital wallets, with a streamlined setup process.

- Smart Transaction Management: Features transaction history, spending analytics, and customizable alerts to keep users informed and in control.

Getting Into the Payment Groove: Setting, Using, and Enjoying MyCard

Imagine walking into your favorite cafe, greeting the cashier with a simple tap of your phone or smartwatch—no fumbling, no PIN entry, just pure convenience. From setting up your account to making your first contactless payment, MyCard's onboarding feels like a friendly guide leading you through a familiar, trusted path.

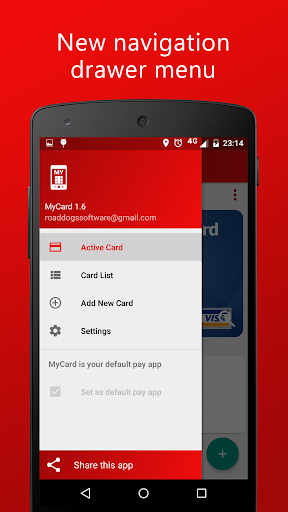

Design and User Experience: Clear, Clean, Friendly

MyCard's interface resembles a well-organized digital wallet—minimalist yet informative. The home screen displays your linked cards and recent transactions in a digestible format, much like a neatly arranged desk. Navigation is intuitive; icons are thoughtfully placed, and prompts gently guide you through setup, reloading funds, or viewing your transaction history. Transition animations are smooth, giving a sense of fluidity without overwhelming the user. The learning curve is gentle; even newcomers to digital payments can pick up the app within minutes.

Core Functionality: Powering Payments and Securing Data

Contactless Payments: The core appeal of MyCard lies in its NFC payment capability. Tap your device or smartwatch at any compatible terminal, and voilà—payment completed within seconds. For frequent travelers or busy shoppers, this reduces wait times and streamlines shopping trips into a few effortless gestures.

Security Measures and Account Safety: Unlike some apps that merely encrypt transaction data, MyCard employs multi-layered security, including biometric verification and dynamic tokenization that renders transaction data useless even if intercepted. The app also allows users to enable remote freeze or wipe functions, providing peace of mind should the device be lost or stolen.

Transaction Management & Analytics: Beyond basic payments, MyCard offers rich insights into your spending habits, customizable alerts for transaction limits, and easy dispute resolution features. It transforms your wallet from a simple payment tool into a personal financial assistant.

MyCard vs. Competition: What Sets It Apart?

Many contactless payment apps focus solely on speed—yet MyCard elevates this by emphasizing security with multi-factor authentication and tokenization, making your transactions safer than many counterparts. Its user-centric design ensures that even those unfamiliar with digital wallets find it accessible, a stark contrast to some complex apps that overwhelm new users with unnecessary features. Additionally, its transaction analytics help users understand their spending patterns more clearly, akin to having a financial coach in your pocket.

Final Thoughts: Is MyCard Wallet Worth Your Trust?

For anyone seeking a reliable, secure, and user-friendly contactless payment app, MyCard certainly warrants consideration. Its standout features—the focus on multi-layered security and intelligent transaction management—address core concerns many consumers have when embracing digital wallets. While it's designed to be simple enough for novices, its robust security features also appeal to cautious users who prioritize data protection.

Considering the seamless experience, security guarantees, and thoughtful design, I would recommend MyCard especially to those who want a straightforward yet secure payment solution integrated into their daily routines. For tech-savvy users or frequent travelers, its swift NFC capabilities combined with strong security protocols make it a practical choice that can enhance your payment experience without fuss.

Similar to This App

Pros

User-friendly interface

The app features an intuitive design that makes it easy for users to navigate and make transactions quickly.

Fast contactless payments

Allows instant transactions by simply tapping your device, enhancing convenience and reducing checkout time.

Wide acceptance

Compatible with numerous retail outlets and online platforms, increasing usability across various merchants.

Robust security features

Implements encryption and tokenization to protect user data during transactions, enhancing trust.

Supports multiple card types

Enables users to add and manage multiple credit or debit cards within a single app for convenience.

Cons

Limited offline functionality (impact: Medium)

The app requires an internet connection for most features, which may inconvenience users in areas with poor network coverage.

Initial setup complexity (impact: Low)

Some users report difficulty in verifying their cards during the setup process; official updates are expected to streamline this.

Battery consumption (impact: Low)

Using contactless mode frequently can drain device battery faster; reducing screen brightness or closing background apps may help temporarily.

Limited geographic coverage (impact: High)

Certain regions or merchants do not support MyCard, which could limit its usefulness; official partnerships may expand this in the future.

Occasional app crashes (impact: Medium)

Some users experience app stability issues; reinstalling or updating the app is recommended until a fix is released.

Frequently Asked Questions

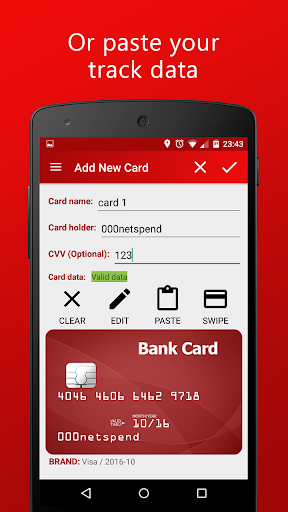

How do I add my credit or debit card to MyCard?

Use a USB magnetic stripe reader or an audio jack card reader to capture track2 data, then follow the app's instructions to input and save your card securely.

Is MyCard compatible with my smartphone?

Yes, MyCard works on Android devices with version 4.4 or higher and NFC capability. For iOS, check the latest updates for compatibility.

Can I use MyCard without an internet connection?

Absolutely, all your stored cards function offline; the app does not require internet for payment transactions, ensuring security.

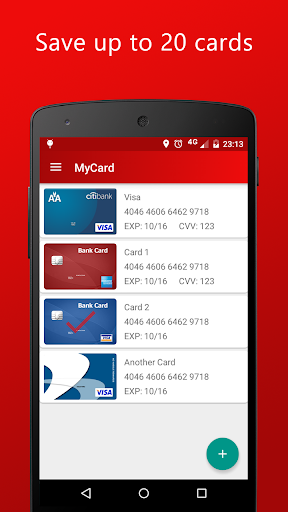

How many cards can I store in MyCard?

You can securely store up to 20 cards on your device, allowing quick access and payment with a tap.

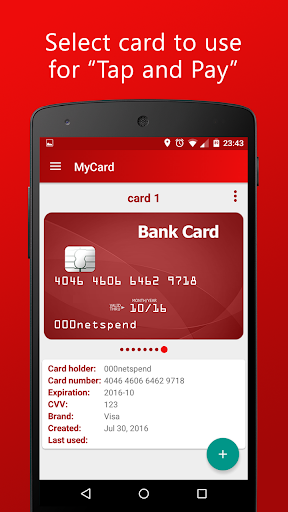

How do I make a contactless payment with MyCard?

Unlock your phone, open MyCard, select the desired card, and tap your device on a contactless reader; ensure NFC is enabled.

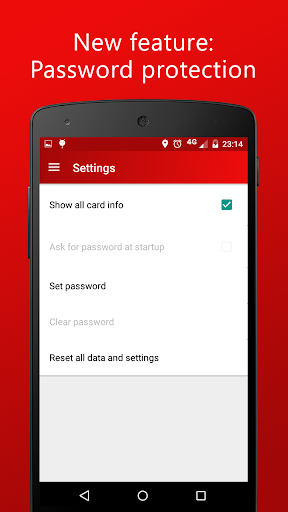

Does MyCard support biometric authentication?

Yes, you can enable fingerprint or face recognition in the app settings to enhance transaction security.

Are there any subscription or in-app purchase costs for MyCard?

Basic features are free. For premium options, go to Settings > Account > Subscription to view available plans and pricing.

How do I update or manage my subscription within the app?

Navigate to Settings > Account > Subscription to view, renew, or cancel your subscription directly.

What should I do if MyCard isn't working correctly?

Ensure NFC is enabled, your device is unlocked, and the app is up-to-date. Restart your device if issues persist.