- Category Finance

- Version4.0.16.1

- Downloads 1.00M

- Content Rating Everyone

Introducing myFICO: Your Personal Credit Companion

myFICO: FICO Credit Check is a thoughtfully designed mobile application aimed at empowering users with detailed credit insights, making credit management simpler and more transparent. Developed by FICO, the company behind the iconic scoring model, this app brings professional-grade credit monitoring directly to your fingertips, catered to individuals who want to stay on top of their financial health without the complexity.

Key Features That Make Credit Management Look Easy

1. Real-Time FICO Score Monitoring

The heart of myFICO lies in its real-time FICO score tracking. Unlike many free credit apps that only provide generic scores, myFICO offers the actual FICO score — the one used by most lenders. This feature allows users to see their credit health fluctuate on a daily basis, enabling proactive measures before issues arise. It's like having a personal credit coach constantly watching over your shoulder, ready to alert you to important changes.

2. Deep Dive into Credit Reports

The app provides comprehensive access to your credit reports, including detailed breakdowns of your accounts, credit inquiries, balances, and payment history. The interface presents this data visually, with charts and graphs that transform intimidating financial data into an easily digestible story. This empowers users to identify problematic areas — be it a missed payment or high credit utilization — and take corrective actions efficiently.

3. Credit Score Simulation & Advisory Tools

One of myFICO's standout features is its credit simulation tool, which allows you to see how specific actions, like paying down debt or opening a new account, could impact your scores. Additionally, the app offers personalized tips based on your credit profile, guiding you on steps to improve your credit health. It's like having a financial advisor in your pocket, offering tailored advice based on your unique situation.

Intuitive Design and User Experience

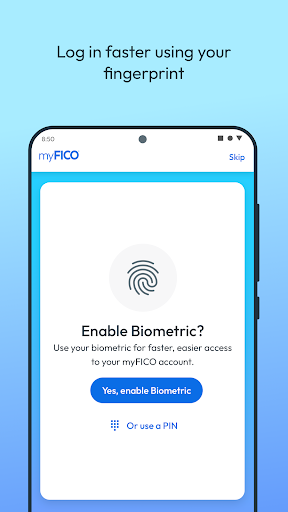

From the moment you launch myFICO, it feels like stepping into a well-organized, digital control center. The interface balances professional clarity with approachable aesthetics — a soothing palette combined with clear typography helps prevent overwhelm during complex data reviews. Navigation is smooth and intuitive; flipping between dashboard, reports, and simulation tools feels seamless, akin to browsing through a familiar magazine rather than deciphering cryptic menus. Moreover, the learning curve is gentle; even those new to credit monitoring can quickly get comfortable, as the app offers contextual help and explanations alongside each feature.

Distinctive Advantages: What Sets it Apart from Similar Apps?

Account and Fund Security: Built with FICO's Credibility

While many debt and credit apps dabble in data security, myFICO benefits from the robust infrastructure and credibility of FICO, a leader in credit scoring and analytics. This ensures that your sensitive data — from personal information to credit report details — is protected with top-tier security measures, providing peace of mind in a crowded digital landscape.

Transaction Experience and Data Integrity

The app's integration with official credit bureaus guarantees that all the information displayed is accurate and up-to-date, mimicking the transaction security you'd expect in a bank's online portal. Unlike some apps that generate approximate scores or partial reports, myFICO's data integrity ensures you see the real deal, which is essential for making informed financial decisions.

Focus on FICO Scores: Precision for Practical Use

Many financial apps tend to present generic credit scores—often VantageScore or other metrics—that aren't used by lenders. MyFICO's dedication to providing FICO scores makes it unique, offering a practical advantage—since these are the scores most creditors review. For consumers actively planning to buy a house, car, or seeking credit lines, this accuracy is akin to having insider information that's directly relevant to your future prospects.

Final Take: Is myFICO Worth Your Time?

For those who prioritize accuracy, security, and actionable insights in their credit journey, myFICO stands out as a reliable companion. It's not merely a monitoring tool but a comprehensive platform that demystifies your credit report, provides real-time updates, and guides you with clear, personalized recommendations. While the premium subscription may seem cautiously priced, the added features like credit score simulation and deep report analysis justify the investment, especially for credit-conscious individuals actively working towards financial goals.

In summary, if you're seeking an app that combines professional-grade credit insights with user-friendly design and unmatched data trustworthiness, myFICO is highly recommended. It's particularly suitable for those preparing for major financial moves or anyone wanting a clearer picture of their credit health. Just like having a seasoned navigator guiding you through the sometimes foggy seas of credit, myFICO ensures you're better equipped to steer your financial ship confidently.

Similar to This App

Pros

Comprehensive FICO score tracking

Provides users with regular updates on their FICO credit scores, helping them monitor credit health over time.

User-friendly interface

Easy navigation and clear layouts make it simple for even beginners to understand their credit reports.

Additional credit insights

Offers personalized tips and explanations to improve credit scores, adding value beyond just score viewing.

Secure data protection

Employs strong security measures to protect sensitive personal and financial information.

Free basic features

Allows users to access essential credit score updates without any cost, making it accessible to a wide audience.

Cons

Limited credit report details (impact: low)

The app provides only a summary of credit reports, lacking in-depth details available through official credit bureaus.

Occasional refresh delays (impact: medium)

Credit score updates may not happen immediately after credit activity, but users can refresh manually or wait for scheduled updates.

Premium features require subscription (impact: medium)

Advanced monitoring tools are locked behind a subscription paywall, which might deter some users. Official plans suggest upcoming free enhancements.

No credit freeze management (impact: low)

Currently lacks features for freezing or unfreezing credit, but future updates are planned to include such functionalities.

App occasional stability issues (impact: low)

Some users report app crashes or slow loading times, but these are often resolved with updates from developers.

Frequently Asked Questions

How do I start monitoring my FICO scores on myFICO app?

Download the app, create an account, and verify your identity. Navigate to 'Scores' to view and monitor your FICO scores from the dashboard.

Will checking my credit score through the app harm my credit?

No, checking your own FICO Score is a soft inquiry that does not impact your credit report or score.

How can I see my credit reports from all three bureaus?

In the app, go to 'Credit Reports' section; it provides instant access to Experian, TransUnion, and Equifax reports.

What features does the FICO Score Simulator include?

The simulator allows you to model how actions like new credit or payments might affect your FICO Score—access via 'Tools' > 'Score Simulator'.

How do I set up alerts for changes in my credit report?

Navigate to 'Settings' > 'Alerts' to enable notifications for changes, suspicious activities, or new inquiries.

Can I see my FICO Scores for different types of loans?

Yes, the app displays scores for mortgage, auto, and credit card borrowing, helping you understand your credit standing in various areas.

What educational content is provided within the app?

You can access videos and articles in the 'Learn' section that explain credit concepts and tips to improve your score.

Is there a subscription fee for advanced features?

Yes, some features, such as detailed reports and insights, require a paid myFICO subscription, accessible via 'Settings' > 'Subscription.'

How can I upgrade or cancel my subscription?

Go to 'Settings' > 'Account' > 'Subscription' to manage your plan—upgrade or cancel as needed.

What should I do if I encounter login issues?

Try resetting your password using the 'Forgot Password' option or contact support through 'Help' > 'Contact Us' for assistance.