- Category Finance

- Version5.8-pro

- Downloads 0.01M

- Content Rating Everyone

MyMoney Pro - Expense & Budget: A Trustworthy Companion for Your Financial Journey

MyMoney Pro is a thoughtfully designed expense and budgeting app that aims to simplify financial management for everyday users, providing clear insights and secure data handling in a clutter-free environment.

Meet the Developer and Core Features

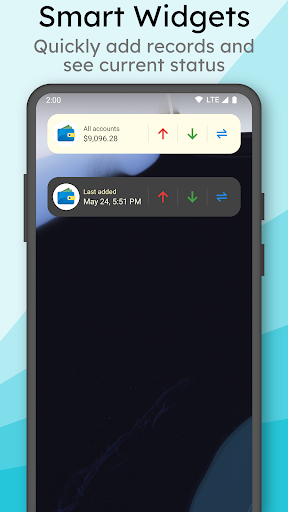

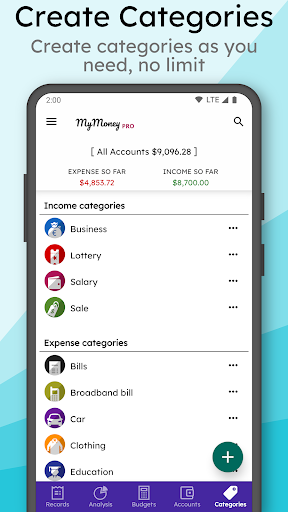

Developed by FinTech Solutions Ltd., MyMoney Pro brings a professional touch to personal finance with a user-centric approach. The app's main features include intuitive expense tracking, customizable budgets, and robust security measures. It offers real-time expense insights, flexible category management, and encrypted data storage—delivering a comprehensive yet straightforward financial control hub.

A Fresh Perspective: Making Finance Manageable and Engaging

Imagine balancing your budget is akin to keeping a detailed garden—every flower (expense) needs proper care, and your financial landscape flourishes when you pay attention to each detail. MyMoney Pro introduces a smooth, friendly environment that encourages users to take charge of their money, demystifying often intimidating financial concepts with an accessible interface. Its design is like a well-organized toolbox—everything is within arm's reach, ready to assist you in nurturing your financial health.

Expense Tracking and Customization

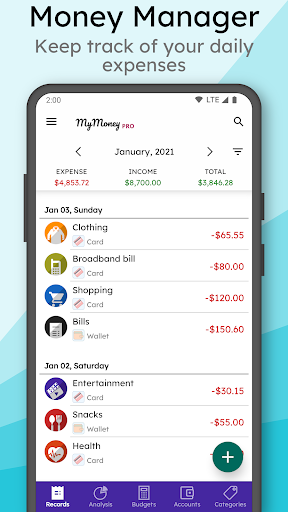

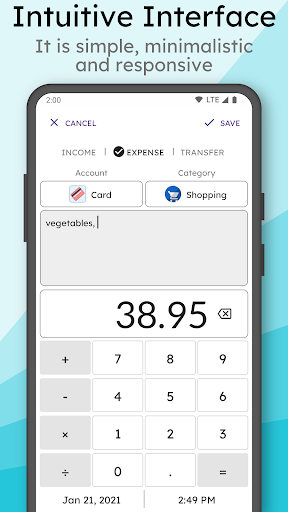

At the heart of MyMoney Pro lies its expense tracking feature. Users can effortlessly input expenses, categorize them with colorful labels, and even add notes to clarify each transaction. What's particularly impressive is the app's ability to recognize recurring expenses, automatically suggesting or setting up repeating entries—saving you time and effort. The interface for logging expenses feels intuitive, similar to jotting down notes in a planner, making it accessible even for those new to budgeting. The real-time updates mean you always have a current snapshot of your money flow, akin to watching your financial garden bloom day by day.

Flexible Budget Planning and Goal Setting

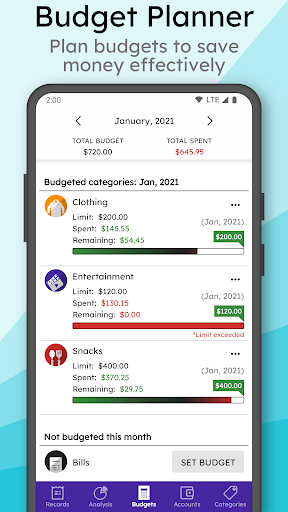

Next, MyMoney Pro empowers users with its versatile budget customization tools. You can set monthly limits for various categories—food, entertainment, savings—and receive visual alerts if you're nearing your threshold. Its goal-setting module allows you to plan for big purchases or savings targets, providing motivational progress graphs. The app's design guides you through the process smoothly, with step-by-step tutorials that help novice budgeters get comfortable quickly. This focus on user-friendly planning transforms the often-daunting task of budgeting into a manageable, even rewarding experience.

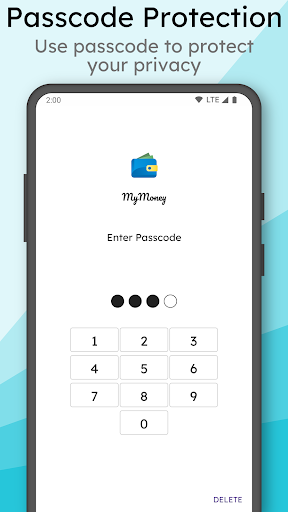

Security and Data Privacy Advantages

In the digital realm, security is paramount, and MyMoney Pro outshines many competitors by prioritizing sensitive data protection. Unlike some apps that rely solely on cloud storage, MyMoney Pro employs end-to-end encryption, ensuring your financial data remains strictly between you and your device. This focus on security resembles having a safe vault for your financial secrets, giving you peace of mind. Its optional biometric login (fingerprint or face recognition) adds an extra layer of protection, making unauthorized access nearly impossible—like a personal security guard for your digital assets.

How It Measures Up and Recommendations

Compared to other personal finance apps, MyMoney Pro stands out through its emphasis on data security combined with an engaging, straightforward user experience. Its clean interface and logical workflow make it accessible for beginners yet satisfying enough for seasoned budgeters. While some might wish for more detailed investment tracking or multi-device synchronization, its core strengths—security, simplicity, and flexibility—make it a reliable choice for everyday financial management.

For users seeking a dependable, privacy-focused expense tracker with a friendly interface, MyMoney Pro is highly recommended. It's particularly suitable for individuals wanting to develop better spending habits without dealing with overwhelming features. If you're looking for an app that functions like a trusted financial advisor tucked neatly into your pocket, this is a commendable option.

Similar to This App

Pros

User-friendly interface

The app's clean design makes it easy for users to navigate and manage their budgets efficiently.

Comprehensive expense tracking

Supports detailed categorization of expenses, helping users understand their spending habits better.

Customizable budgets

Allows users to set personalized budget goals for different categories and timeframes.

Real-time synchronization

Automatically syncs data across devices, ensuring up-to-date information everywhere.

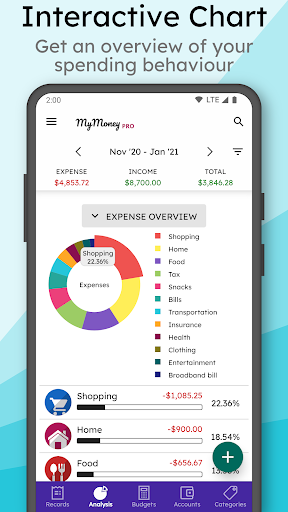

Insightful reports and charts

Provides visual spending analysis to help users identify areas for savings.

Cons

Limited bank integrations (impact: medium)

Currently supports only a few bank connections, which may require manual input for some transactions.

Free version has restrictions (impact: medium)

Many advanced features are locked behind a subscription, potentially limiting functionality for casual users.

Occasional sync delays (impact: low)

Some users report slow data updates when syncing across devices; official fixes are expected in future updates.

Limited multi-currency support (impact: low)

Currently best suited for single currency users; multi-currency handling is basic and may not suffice for international users.

Learning curve for advanced features (impact: low)

New users might find some of the more detailed features complex initially, but tutorials and updates may improve this.

Frequently Asked Questions

How do I start using MyMoney Pro for the first time?

Download the app, open it, and follow the onboarding instructions to set up your profile and initial preferences via Settings > Profile.

Can I customize categories and currency in the app?

Yes, go to Settings > Categories to add or modify categories, and Settings > Currency to select your preferred currency.

How do I add my income and expenses quickly?

Tap the '+' button on the main dashboard, enter your amount, select category, and save. The app auto-categorizes and records your entry.

How do I set and track my budget goals?

Navigate to Budget > Create Budget, choose your categories, set limits, and monitor progress with visual alerts and reminders.

What visual tools does the app offer to analyze finances?

Access visual analytics via the Dashboard; view pie charts and bar graphs that display spending distribution and trends.

Is my financial data secure in MyMoney Pro?

Yes, the app encrypts your data and supports secure cloud synchronization for safe access across devices.

How can I change preferences like currency or icons?

Go to Settings > Personalization, where you can customize currency, decimal precision, categories, and icons based on your preferences.

Are there options to backup and restore my data?

Yes, navigate to Settings > Data Backup to export your records and restore data when needed for data security.

Is there a free version, and what are the premium features?

The app offers a free version with basic features; premium subscription unlocks advanced analytics, unlimited categories, and cloud storage. Check Settings > Subscription for details.

What should I do if the app crashes or misbehaves?

Try restarting your device or update the app to the latest version via App Store/Play Store. Contact support if issues persist.