- Category Finance

- Version2.0.4

- Downloads 0.50M

- Content Rating Everyone

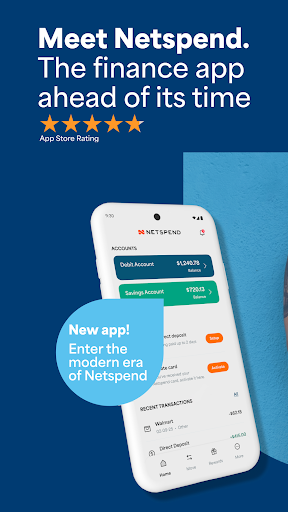

Netspend Wallet: A Secure and User-Friendly Prepaid Card Solution

Netspend Wallet is a versatile mobile application designed to streamline prepaid card management for everyday financial needs, blending convenience with robust security features.

Developed by a Trusted Pioneer in Financial Technology

Created by Netspend Corporation, a leader in prepaid payment solutions with decades of experience, the app aims to provide users with an accessible platform for managing funds effortlessly and securely.

Key Features that Stand Out

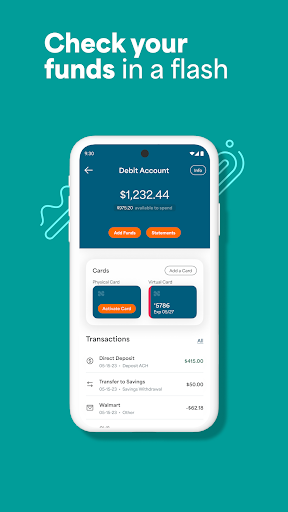

- Real-Time Transaction Tracking: Stay updated instantly on your spending, providing full control over your finances.

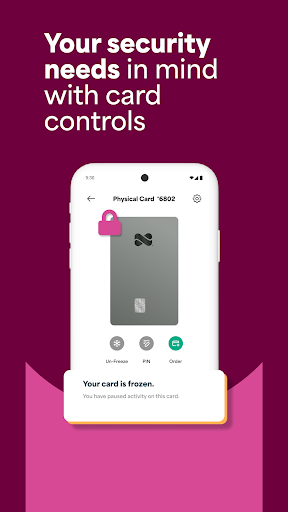

- Enhanced Security Measures: Includes advanced fraud detection, instant card freeze, and secure login options like biometrics.

- Fee Management and Card Controls: Transparent fee structure with customizable card controls, allowing users to lock/unlock features for added security.

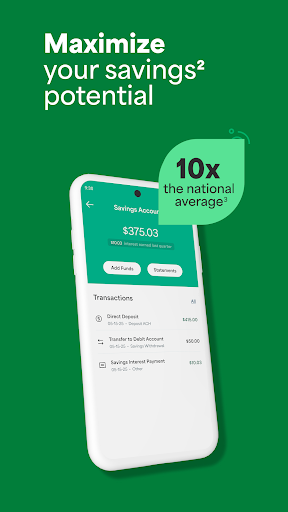

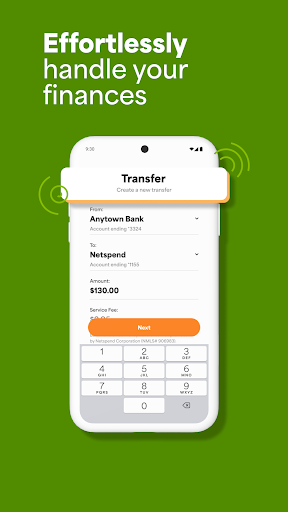

- Seamless Fund Loading: Supports multiple methods to load funds quickly, including direct deposit, bank transfers, and retail reloads.

Vivid Insights into Core Functionalities

Intuitive User Interface with Smooth Operations

From the moment you open the app, its clean, icon-rich interface feels like flipping through a well-organized financial dashboard. Navigation is logically structured, making it easy for both tech-savvy users and newcomers to find what they need. Tasks like checking balances, viewing transaction history, or loading funds are just a tap away, and the app maintains swift responsiveness without lag. This fluidity ensures a frictionless experience that feels as effortless as strolling through a well-paved financial park.

Unparalleled Security that Prioritizes Your Peace of Mind

Netspend Wallet's standout feature is its commitment to fund and account security. Unique to its offering is the instant card lock/unlock feature—think of it as flipping a switch to freeze your card if you suspect unauthorized activity, providing immediate peace of mind. Moreover, with biometric login options like fingerprint or facial recognition, the app ensures that only you can access your financial info. These layered security measures form a robust barrier against fraud and unauthorized access, making it more than just a digital wallet—it's a secure digital vault.

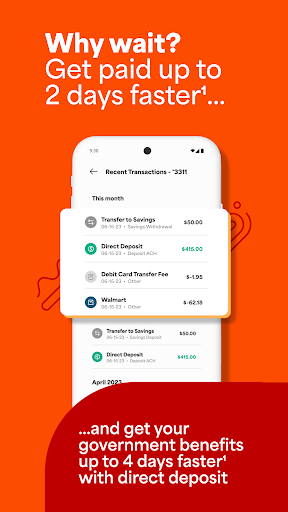

Transaction Experience and Load Flexibility

When it comes to spending and loading funds, Netspend Wallet excels at creating a seamless experience. Transactions process quickly, with real-time updates that feel akin to having a financial assistant right at your fingertips. Loading money into your wallet can be achieved through multiple channels—be it direct deposit, transfers from your bank account, or physical reloads at retail stores. This variety offers unmatched convenience, reminiscent of having a flexible, well-connected financial toolkit capable of adapting to your daily needs.

Comparative Strengths and Unique Selling Points

Unlike many traditional finance apps that focus solely on bank accounts or investments, Netspend Wallet emphasizes prepaid card management with a keen eye on security and ease of use. Its instant card freeze and unfreeze features stand out as particularly useful in today's fast-paced environment where security concerns are paramount. Additionally, the straightforward interface and transparent fees make it accessible for users wary of overly complex financial services. These features collectively differentiate it from competitors like PayPal or traditional bank apps, especially for users seeking a secure, easy-to-manage prepaid card experience.

Overall Recommendation and Usage Tips

For anyone looking for a prepaid card management app that doesn't compromise on security or ease of use, Netspend Wallet is a reliable and user-centric choice. It's particularly beneficial for those who frequently reload funds or need to swiftly react to potential security issues—think of it as your financial safety helmet with a user-friendly interface.

New users should start by exploring its transaction tracking and security features, ensuring they familiarize themselves with the app's controls. For regular prepaid card users or those with specific security concerns, this app provides peace of mind and operational ease that make it stand out in a crowded market.

In summary, Netspend Wallet strikes a commendable balance between simplicity, security, and flexibility, making it a valuable addition to anyone's mobile financial toolkit.

Similar to This App

Pros

User-friendly interface

The app has an intuitive layout that makes navigation simple for users of all ages.

Instant card loading and reloads

Funds can be added immediately through linked bank accounts or retail locations.

Wide acceptance for transactions

Netspend Wallet is accepted at numerous merchants and online stores, facilitating easy spending.

Robust security features

Includes PIN protection and fraud monitoring to safeguard user funds.

Free direct deposit

Users can receive paychecks directly into their wallet without additional fees.

Cons

Limited budgeting tools (impact: low)

The app lacks advanced expense tracking features; users might need third-party apps for comprehensive budgeting.

Customer support response times (impact: medium)

Support may sometimes be slow during peak hours, causing delays in issue resolution; official improvements are planned.

Fees for certain transactions (impact: low)

Some reload or ATM withdrawal options may incur charges; users can check fee details beforehand to avoid surprises.

Limited international usability (impact: medium)

The app primarily supports US currency; international transactions may be restricted or require additional steps.

Mobile app stability issues (impact: low)

Occasional crashes or bugs are reported, but updates are frequently released to improve stability.

Frequently Asked Questions

How do I create a new Netspend Wallet account?

Download the app, tap Sign Up, then follow the on-screen instructions to enter your details and verify your identity for quick account setup.

Can I link my existing bank account to Netspend Wallet?

Yes, go to Settings > Bank Accounts > Add Bank, then enter your bank details to link your account for transfers and payments.

What are the main features of the Netspend Wallet app?

The app offers real-time balance monitoring, bill payments, fund transfers, budgeting tools, and seamless integration with Google Pay and Apple Pay.

How does Netspend help me stay within my budget?

Use the budgeting feature in Settings > Budgeting to categorize expenses, track spending, and review transaction history for better financial control.

What security measures does Netspend Wallet provide?

Netspend uses encryption, real-time alerts, and the ability to suspend or freeze your card if lost or stolen, ensuring your funds are protected.

How can I load money into my Netspend Wallet?

You can load funds via direct deposit, bank transfer, or by visiting partner retail locations, with instructions in Settings > Load Funds.

Are there any fees for using the Netspend Wallet app?

Yes, but fees are transparent and upfront. Check Settings > Fees for details on transaction, reload, and maintenance charges.

Does Netspend Wallet offer any rewards or cashback programs?

Yes, the app provides cashback rewards with partner merchants, which you can view and redeem in the Rewards section of the app.

Is there a subscription fee for using Netspend Wallet's premium features?

Most features are free, but some premium services or upgrades may involve costs. Check Settings > Subscription for details and manage your plan.

What should I do if I encounter a problem with my Netspend Wallet?

Visit the Help Center in Settings, or contact customer support through the app for assistance with issues or troubleshooting.