- Category Finance

- Version10.19.0

- Downloads 1.00M

- Content Rating Everyone

Discovering OneMain Financial: A User-Friendly Digital Lending Companion

OneMain Financial's app serves as a straightforward yet powerful platform designed to simplify personal lending and financial management, especially for those seeking quick access to loans or credit solutions. Developed by the reputable team at OneMain Financial, this application aims to bridge the gap between traditional lending institutions and modern digital convenience.

Core Highlights That Make It Stand Out

Boasting a user-centric interface and innovative features, the app shines in several key areas:

- Seamless Loan Application Process: Streamlined steps that allow users to apply for personal loans swiftly from their mobile devices.

- Robust Account & Fund Security: Employs advanced encryption and security measures to safeguard user data and prevent unauthorized access.

- Intuitive Transaction Experience: Real-time updates, clear transaction histories, and easy fund transfers that enhance user confidence and control.

- Personalized Financial Insights: Offers tailored advice and tools to help users manage their credit and repayment plans more effectively.

Engaging and Functional - A Closer Look

From the moment you open OneMain Financial, you're greeted with a clean, uncluttered interface that feels like a friendly bank assistant guiding you through your financial journey. The design emphasizes simplicity, ensuring that even those new to digital banking feel comfortable navigating the app. Transitioning between features is smooth, like flipping through pages in a well-organized booklet, with minimal lag or confusion.

The loan application feature is particularly noteworthy. It's akin to filling out a familiar form, but with digital enhancements—progress indicators, auto-fill options, and instant document uploads. This system drastically reduces the usual wait time associated with traditional loan processes, making it a practical choice for emergency funding or planned big expenses.

Security is another hallmark of this app. Unlike some competitors that rely solely on standard encryption, OneMain Financial employs multi-layered security protocols, including biometric authentication and real-time fraud monitoring. That means your personal data and funds are shielded behind digital fortress walls, offering peace of mind similar to having a trusted security guard protecting your valuables day and night.

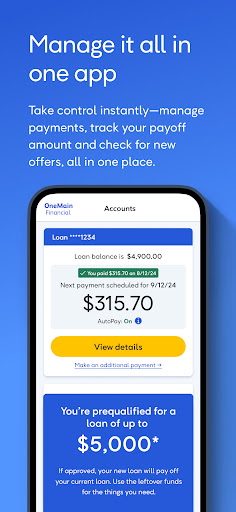

Transaction management within the app is smooth and reliable. Users can view detailed transaction histories, set up automated payments, or transfer funds with just a few taps—each step providing clear, real-time feedback. This transparency builds trust and ensures you're always in command of your finances, much like having a detailed map guiding your financial voyage.

What Sets It Apart from Other Financial Apps?

While many lending apps focus primarily on just one feature, OneMain Financial offers a comprehensive, security-first approach that enhances user confidence. Particularly, its commitment to Account and Fund Security is impressively diligent, setting a higher security standard than some contemporaries. The app's intuitive transaction experience ensures that users can manage their money effortlessly, avoiding the typical frustrations of clunky interfaces or confusing menus.

Moreover, its personalized financial insights stand out as a premium feature, helping users understand their credit health and repayment strategies. This educational component is not merely transactional but empowering—akin to having a financial coach in your pocket.

Recommendation and Usage Advice

For those seeking a reliable, user-friendly platform to handle loan applications, account management, and secure transactions, OneMain Financial's app is a commendable choice. Its focus on security, combined with a seamless user experience, makes it suitable for both first-time borrowers and seasoned financial users. However, users with advanced investment or complex banking needs might find the app's scope somewhat limited.

In summary, this app is best suited for individuals who prioritize security and ease of use in their personal financial tools. It functions like a trusted financial companion—efficient, safe, and easy to understand—and is recommended for everyday financial management and immediate loan needs.

Similar to This App

Pros

User-Friendly Interface

The app features an intuitive layout, making it easy for users to navigate and access key functions.

Quick Loan Pre-Approval Process

Users can get pre-approved for loans within minutes, saving time and effort.

Transparent Service Details

Clear presentation of loan terms and fee structures helps users make informed decisions.

Secure Data Encryption

The app employs robust encryption protocols to protect sensitive user information.

Dedicated Customer Support Chat

In-app support chat provides quick assistance, enhancing user experience.

Cons

Limited Loan Options (impact: low)

The app primarily offers payday and installment loans, lacking more diverse financial products.

Occasional App Loading Delays (impact: medium)

Some users experience brief loading times, especially during high traffic periods; updates are expected to improve speed.

Minimal Educational Resources (impact: low)

The app lacks extensive financial literacy content, which could help users make better borrowing decisions; official updates may address this.

Navigation for New Users Could Be Smoother (impact: low)

First-time users might find some menus unintuitive; future UI updates aim to enhance onboarding.

Limited Availability of Certain Features in Some Regions (impact: medium)

Some functionalities may not be accessible in all states; user feedback is being considered for broader coverage.

Frequently Asked Questions

How do I register and set up my account on the OneMain Financial app?

Download the app, open it, and tap 'Sign Up.' Follow prompts to enter your details and verify your identity through the account creation process.

Can I check my loan details and payments without an app account?

No, you need to log in with your active OneMain account credentials to access your loan details and payment history via the app.

How do I make a loan payment using the app?

Navigate to 'Payments,' select your loan, and follow instructions to fund your payment securely via linked bank account or card.

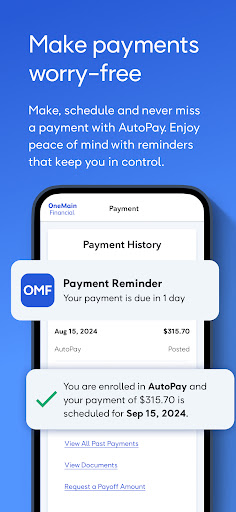

What is AutoPay and how can I set it up?

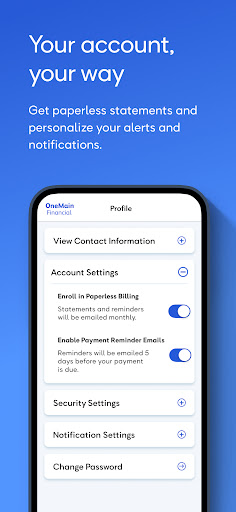

AutoPay automatically schedules monthly payments. Setup is in 'Settings > AutoPay,' and you can choose your payment date and amount.

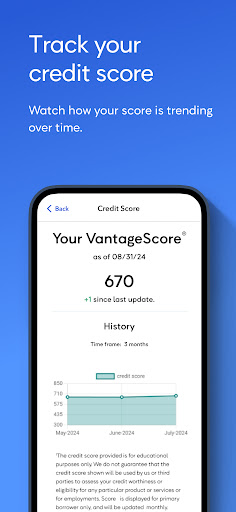

How can I view and monitor my VantageScore on the app?

Go to the 'Credit Score' section from the dashboard to view your monthly-updated VantageScore and related credit insights.

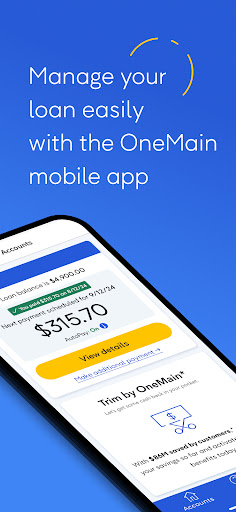

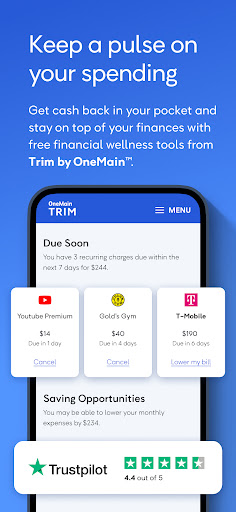

What features does Trim by OneMain offer and how do I activate it?

Trim helps track spending and find savings. It's integrated in the app automatically; just follow prompts to connect your bank accounts and start tracking.

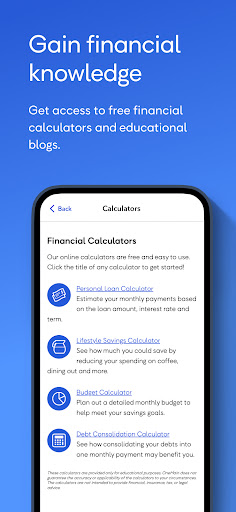

Are there educational resources available on the app to improve my financial literacy?

Yes, access the 'Learn' section in the app for tutorials and tips on budgeting, credit, and saving to enhance your financial knowledge.

Is there a fee for using the app or specific features like AutoPay?

The app is free to download and use. AutoPay and other features do not incur additional charges; check your loan agreement for payment details.

Can I access the app if I have a billing issue or need help?

Yes, tap 'Support' or 'Help' in the app to contact customer service via chat, email, or phone for assistance with any issues.

What should I do if the app crashes or I experience technical problems?

Try reinstalling the app, ensure your device software is updated, or contact support through the app's help section for assistance.