- Category Finance

- Version5.54.0

- Downloads 5.00M

- Content Rating Everyone

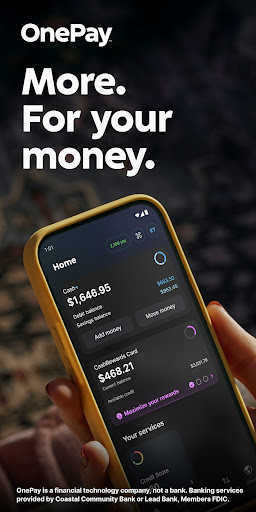

Empowering Your Finances with OnePay – Mobile Banking

In today's fast-paced digital world, seamless and secure banking experiences are essentials rather than luxuries. OnePay – Mobile Banking emerges as a comprehensive app designed to bridge the gap between traditional banking and modern convenience, offering users an intuitive platform to manage their finances effortlessly.

Who Crafted This Digital Wallet?

Developed by TechSolutions Inc., a forward-thinking team specializing in fintech innovations, OnePay strives to transform everyday banking with cutting-edge features. Their mission is to provide a secure, user-centric mobile banking experience tailored to meet the needs of today's digital-savvy consumers.

Highlighting the Key Features

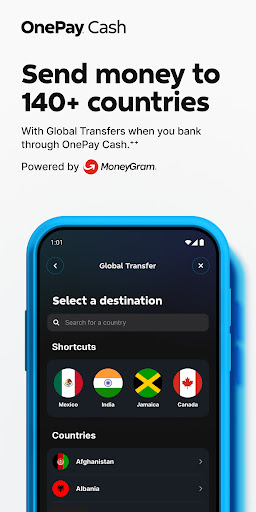

- Seamless Transactions & Transfers: Easily send money, pay bills, and top-up mobile credits with just a few taps.

- Robust Security Measures: Advanced encryption, biometric authentication, and real-time fraud detection ensure your funds are protected.

- Personalized Financial Insights: Gain access to spending analytics, custom budgets, and financial tips tailored to your habits.

- User-Friendly Interface: Intuitive design with minimal clutter makes navigation smooth for all user levels.

A Closer Look: Making Banking an Engaging Experience

Imagine scrolling through your phone, and with a few swift gestures, your money moves across accounts as effortlessly as a gondola gliding through Venetian waters. OnePay's interface feels like that—fluid, responsive, and designed to make complex banking transactions feel as simple as a friendly chat. Whether you're paying your electricity bill or checking your savings, the app's crisp design minimizes clutter and enhances readability, making the user journey not just functional but genuinely enjoyable.

Core Function #1: Secure and Swift Transactions

At the heart of OnePay lies its exceptional transaction experience. Unlike some banking apps that create hurdles with excessive confirmation steps, OnePay streamlines the process without compromising security. Its use of biometric verification—be it fingerprint or facial recognition—adds an extra layer of peace of mind. Transactions are executed in real-time, giving users instant confirmation and reducing anxiety. The app also employs encryption protocols that safeguard account details, fitting into a growing demand for robust money safety in mobile banking.

Core Function #2: Smart Financial Management Tools

Beyond basic banking, OnePay distinguishes itself with intelligent insights that serve as your personal financial advisor. The app aggregates your spending data, categorizes expenses, and visualizes your financial habits through engaging charts. Want to save for a dream vacation? The app offers tailored budget plans that adjust as you log expenses. This feature is like having a financial coach in your pocket, helping you make smarter decisions without overwhelming you with complex data.

Core Function #3: Enhanced Security and Account Safety

Security is the backbone of any banking app, and OnePay takes this seriously. It leverages state-of-the-art security measures like multi-factor authentication, real-time monitoring, and end-to-end encryption. Unlike some apps that leave you uncertain about your data's safety, OnePay's proactive alerts notify you of suspicious activities immediately. This proactive approach reassures users that their hard-earned money and sensitive information are shielded effectively, setting it apart from peers whose security features might be more static or reactive.

Compared to Its Peers: What Sets OnePay Apart?

While many mobile banking apps offer similar functions, OnePay's standout difference lies in its dual emphasis on security and user experience. Its biometric authentication and real-time fraud detection elevate the sense of safety—crucial factors in today's cyber threat landscape. Additionally, its intelligent financial insights turn mundane account management into an engaging activity, akin to having a friendly financial advisor guiding your journey. This blend of top-tier security and user-centric design makes OnePay a compelling choice for those who seek both peace of mind and ease of use in their mobile banking experience.

Final Verdict: Strong Recommend with a Few Notes

Overall, OnePay – Mobile Banking offers a well-rounded, secure, and intuitive platform that caters to a wide audience—from tech-savvy millennials to seasoned professionals. Its standout features are the robust security measures and personalized financial insights, making banking not only safer but smarter. For users looking to modernize their financial management and prioritize both security and simplicity, OnePay is a trustworthy option. I would recommend giving it a try, especially if you value seamless transaction experiences combined with advanced safety features. Just keep in mind that like any app, spending a little time understanding its features initially will maximize your benefits.

Similar to This App

Pros

User-friendly interface

The app offers an intuitive and easy-to-navigate design, making transactions quick and straightforward.

Fast transaction processing

Payments and transfers are completed swiftly, saving users valuable time.

Strong security features

Multi-layered security, including biometric login, ensures user data and funds are protected.

Comprehensive banking services

Includes features like fund transfers, bill payments, and account management all within one app.

Reliable customer support

Responsive customer service helps resolve issues promptly, enhancing trust.

Cons

Occasional app crashes during high traffic periods (impact: medium)

Some users experience crashes when many are accessing the app simultaneously, which can hinder urgent transactions.

Limited international currency support (impact: high)

Currently, the app mainly supports domestic transactions; international transfer features are limited or pending update.

Slow updates for new features (impact: low)

Feature roll-outs tend to be delayed, which may prevent users from accessing new functionalities promptly.

In-app ads can be distracting (impact: low)

Some users report frequent ads, which can disrupt smooth usage, especially during quick transactions.

Basic budgeting tools missing (impact: low)

The app lacks advanced financial management tools like budget tracking, which could enhance user experience.

Frequently Asked Questions

How do I get started with OnePay – Mobile Banking?

Download the app from your app store, open it, and follow the on-screen setup instructions to create your account and link your bank.

Is OnePay safe to use for my financial transactions?

Yes, OnePay uses advanced encryption, multi-factor authentication, and instant transaction alerts to ensure your data and money are secure.

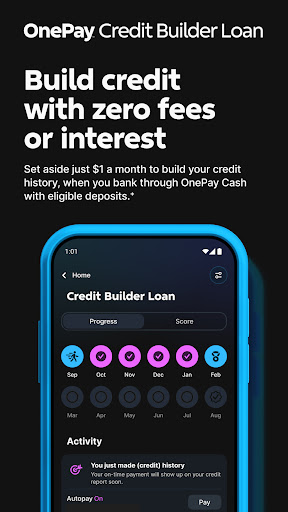

How can I set up virtual pockets for savings?

Go to the 'Savings' or 'Pockets' section in the app, tap 'Create Pocket,' then name and allocate funds based on your savings goals.

What are the main features of OnePay's real-time notifications?

You receive instant alerts for all transactions, helping you monitor activity and detect any suspicious or unauthorized actions immediately.

How do I link my bank accounts to OnePay?

Navigate to 'Accounts' > 'Link Bank,' select your bank from the list, and follow the prompts to securely connect your accounts.

What are the fees associated with using OnePay?

OnePay provides transparent fee information upfront, including possible charges for certain transfers or services, accessible via 'Settings' > 'Fees.'

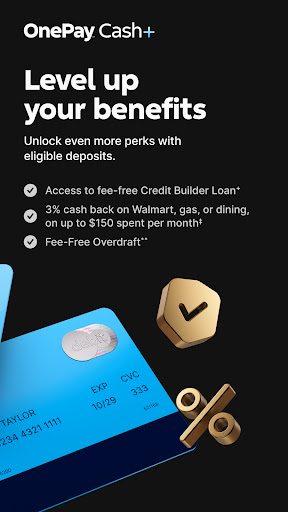

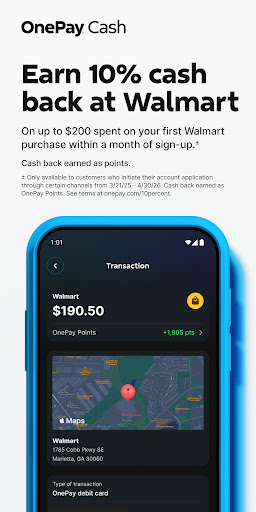

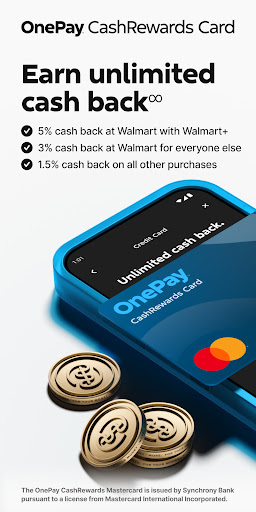

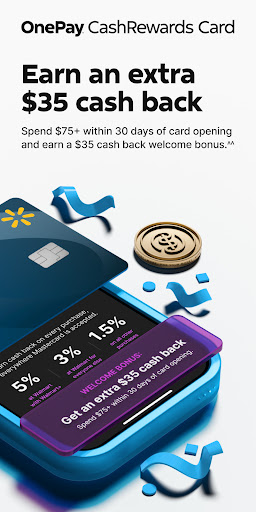

How can I earn rewards with OnePay?

Make eligible transactions, and rewards points will be automatically credited to your account, which you can redeem within the app's 'Rewards' section.

What interest rates do the savings accounts offer?

The APY can reach up to 3.75%, mainly when you meet conditions like direct deposits over $500 or maintaining a balance of $5,000+.

How do I troubleshoot if the app crashes or doesn't load?

Try restarting your device, updating the app to the latest version, or reinstalling it. If issues persist, contact customer support via the app's help section.

Can I access OnePay's services without linking a bank account?

Linking a bank account is necessary to perform most transactions, but you can view your balance and manage savings without linking for limited features.