- Category Finance

- Version10.110.0

- Downloads 1.00M

- Content Rating Everyone

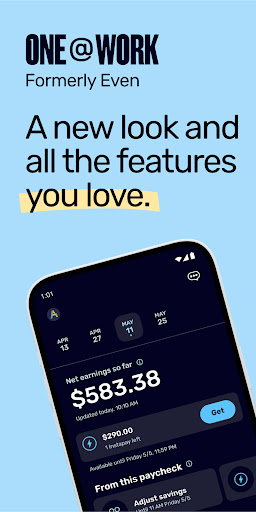

ONE@Work: A Fresh Take on Business Expense Management

Think of ONE@Work as your reliable financial companion, seamlessly bridging the gap between simplicity and security in business expense tracking and reimbursements. Developed by a dedicated team focused on streamlined user experiences, it's designed to serve small to medium enterprises, freelancers, and finance teams seeking efficiency without sacrificing control.

Rapid Introduction: Why Should You Care?

Imagine this: You're juggling multiple projects, receipts are piling up, and the last thing you want is a headache over expense reports. Enter ONE@Work—this app promises to turn the chaos of financial management into a smooth, almost enjoyable process. Its intuitive design and robust features aim to save your time and elevate your expense workflows, making finance tasks no longer a chore but a well-oiled process. Whether you're on the go or in the office, ONE@Work offers a touch of order amid the financial whirlwind—efficient, safe, and user-friendly.

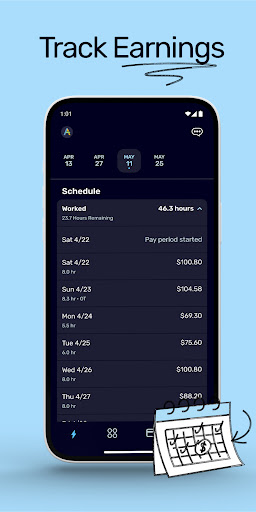

Core Functionality 1: Effortless Expense Tracking & Submission

ONE@Work's hallmark feature is its ability to turn receipts into digital data with a single snap. Users can quickly photograph physical receipts or upload digital ones, which the app then classifies and organizes automatically using smart OCR technology. This efficiency means no more tedious manual entry—just a photo, a few taps, and your expense is logged accurately. The app also supports categorization (travel, meals, office supplies), customizable tags, and GPS tagging for location-specific expenses, making future audits and reports straightforward. Its cloud synchronization ensures all expense data is instantly available across devices, fostering seamless collaboration between team members and managers.

Core Functionality 2: Secure Reimbursement & Fund Management

Beyond simple expense logging, ONE@Work excels at providing a secure platform for reimbursement processes. The app features encrypted data transmission and role-based access controls, ensuring sensitive information remains protected. Employees can submit their expense reports directly within the app, which managers can review and approve via an intuitive dashboard. The perk here? The integrated fund disbursement system allows businesses to authorize payments seamlessly—reducing delays and minimizing errors common in traditional reimbursement workflows. This tight integration of expense management and fund transfer sets ONE@Work apart from many competitors, offering an end-to-end solution rather than just a tracking tool.

User Experience: Navigating with Ease and Confidence

ONE@Work's interface resembles a well-organized workspace—clean, minimalistic, yet packed with intuitive shortcuts. The onboarding process is straightforward, with guided tutorials helping first-time users get up to speed within minutes. The app's operation flows smoothly; transitions between functions are buttery-smooth, with no lags or confusing menus to bog down your day. The learning curve is gentle—just enough to make users feel accomplished quickly but not overwhelmed by complex features. Its clear visual hierarchy and thoughtful design elements make the app a pleasure to navigate, whether you're a tech-savvy finance pro or someone new to expense management.

Unique Selling Points: What Sets ONE@Work Apart?

While many finance apps focus on just tracking or reporting, ONE@Work stands out with its combined emphasis on security and transaction efficiency. Its advanced data encryption and role-based access controls are particularly valuable for companies handling sensitive financial information. Moreover, the integrated fund disbursement feature simplifies the reimbursement process, reducing admin overhead and accelerating cash flow. This seamless link from expense recording to fund transfer not only augments user confidence but also promotes transparency and accountability—key elements in professional financial management.

Final Verdict and Recommendations

Having explored ONE@Work in depth, it's clear this app is a mature, thoughtfully designed solution for those looking to simplify business expense management. It's particularly well-suited for SMBs and freelance professionals who want security and efficiency without the complexity of traditional financial software. I recommend it to teams seeking a comprehensive, yet easy-to-use platform that can handle everything from expense logging to fund transfers securely. For organizations prioritizing data privacy and streamlined reimbursement workflows, ONE@Work deserves serious consideration. It's not just another expense app—it's a reliable partner in your financial journey.

Similar to This App

Pros

Intuitive User Interface

The app features a clean and easy-to-navigate design, enhancing user experience for busy professionals.

Seamless Collaboration Tools

Built-in messaging and file sharing facilitate efficient team communication and document management.

Strong Security Measures

End-to-end encryption ensures that sensitive work data remains protected.

Cross-Platform Compatibility

Available on both mobile and desktop, allowing users to stay connected across devices.

Customizable Templates

Provides a variety of templates to streamline document creation and task planning.

Cons

Limited Offline Functionality (impact: Medium)

Some features are disabled without internet access, which could hinder productivity during connectivity issues.

Occasional Sync Delays (impact: Low)

Real-time data synchronization may sometimes experience slight delays, especially with large files.

Learning Curve for Advanced Features (impact: Low)

New users might require time to fully utilize advanced functionalities like integrations.

Limited Customization Options for Notifications (impact: Low)

Users cannot extensively personalize notification settings, which might lead to notification fatigue.

Reported Occasional App Crashes (impact: Medium)

Some users have experienced sporadic app crashes, but official updates are expected to address this.

Frequently Asked Questions

How do I sign up and set up my account on ONE@Work?

Download the app, open it, and follow on-screen instructions to create your account with your employer's details. It's quick and straightforward.

Is there a fee to use ONE@Work for basic features?

Most core features, including early wage access and expense tracking, are free. Check your employer's specific benefits for any additional costs.

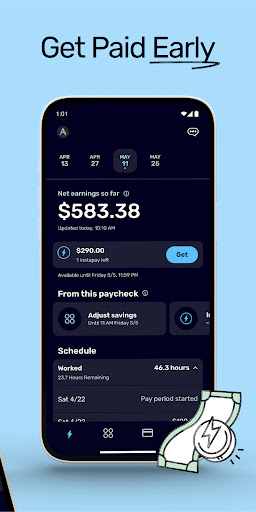

How can I access my earnings early through the app?

Navigate to the 'Instapay' feature within the app's main menu and follow prompts to request early pay, which is usually free for most users.

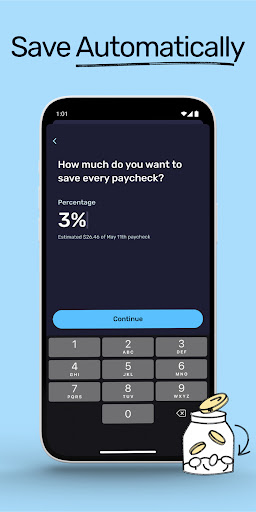

How does automatic savings work in ONE@Work?

Go to 'Settings' > 'Savings' to set a percentage of your paycheck to be automatically deducted and saved each pay period.

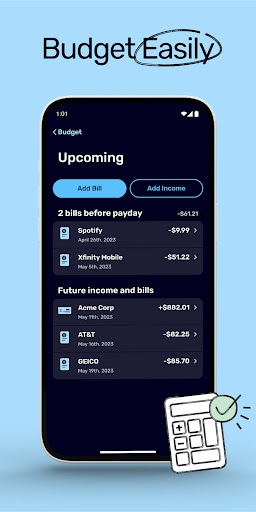

Can I create a budget with ONE@Work?

Yes, connect your bank account in 'Budget' section, then input your details. The app will analyze your spending and suggest a personalized budget.

How do I set savings goals in the app?

Open 'Savings Goals' in the app menu, then specify your target amount and deadline to start saving towards your goal.

Are there any subscription fees or premium features I need to pay for?

Basic features are free; check the app settings under 'Account' > 'Subscriptions' to see if you opt for any premium services, which may have fees.

Can I use ONE@Work if I change jobs or employers?

Typically, the app is linked to your current employer benefit. If you change jobs, you might need to set up a new account with your new employer.

What should I do if the app crashes or I can't access my account?

Try restarting your device or reinstalling the app. If issues persist, contact customer support via the app's help section for assistance.

Does ONE@Work provide security for my financial data?

Yes, the app is powered by FDIC-member banks like Cross River Bank and Coastal Community Bank, ensuring data security and protection.